Riot Platforms Stock: Near 52-Week Lows – What's Happening?

Table of Contents

Bitcoin's Price Volatility and its Impact on Riot Platforms Stock

The performance of Riot Platforms stock is strongly correlated with the price of Bitcoin. As a Bitcoin mining company, Riot Platforms' revenue is directly tied to the value of Bitcoin. Any significant fluctuation in Bitcoin's price directly impacts Riot Platforms' profitability and, consequently, its stock price.

-

Recent Bitcoin price dips and their direct effect on Riot's revenue: Recent downturns in the Bitcoin market have resulted in reduced revenue for Riot Platforms. Lower Bitcoin prices mean less revenue generated from mining activities, directly impacting the company's bottom line and investor confidence in Riot Platforms stock.

-

Impact of Bitcoin mining difficulty adjustments on Riot's profitability: The Bitcoin network's difficulty adjusts periodically based on the overall mining hash rate. Increased difficulty reduces the profitability of mining, impacting Riot Platforms' ability to generate revenue and potentially putting downward pressure on Riot Platforms stock.

-

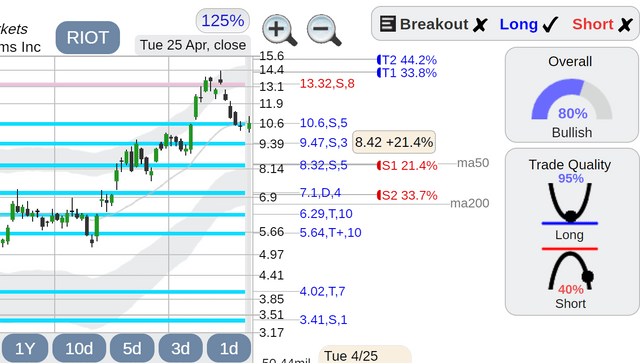

How investor sentiment towards Bitcoin influences Riot Platforms Stock: Investor sentiment towards Bitcoin significantly influences the Riot Platforms share price. Negative sentiment surrounding Bitcoin often translates into decreased investor confidence in Bitcoin mining companies like Riot Platforms, leading to a sell-off in their stocks. Conversely, positive Bitcoin market sentiment often leads to increased investor interest in Riot Platforms stock. Analyzing investor sentiment towards Bitcoin is crucial for understanding fluctuations in the Riot Platforms stock price. Charts showing the correlation between Bitcoin's price and Riot Platforms' stock price clearly illustrate this dependence.

Increased Competition in the Bitcoin Mining Sector

The Bitcoin mining industry is becoming increasingly competitive. The entry of new players with significant mining capacity and technological advancements is putting pressure on existing miners like Riot Platforms.

-

Mention key competitors and their market share: Companies like Marathon Digital Holdings and Argo Blockchain are major competitors, constantly vying for market share and impacting Riot Platforms' profitability. The expanding market share of these competitors puts pressure on Riot Platforms to maintain its position and profitability.

-

Analyze the impact of increased mining capacity on profitability for Riot: The addition of new mining capacity across the industry increases the overall hash rate, leading to increased competition and potentially lower profitability for all miners, including Riot Platforms. This competitive pressure directly impacts the value of Riot Platforms stock.

-

Discuss the role of technological advancements in increasing competition: Technological improvements in mining hardware, such as more efficient ASICs, constantly shift the competitive landscape. Companies adopting newer, more efficient technologies gain a competitive edge, potentially squeezing out less technologically advanced companies and impacting the overall valuation of Riot Platforms stock. Data on market share and mining hash rate clearly shows the increasing competition.

Macroeconomic Factors Affecting Riot Platforms Stock

Broader macroeconomic trends also significantly impact Riot Platforms stock. These factors often influence investor risk appetite and overall market sentiment, affecting even seemingly unrelated sectors.

-

Impact of rising interest rates and inflation on investor appetite for riskier assets like crypto mining stocks: Rising interest rates and inflation generally lead investors to shift towards less risky assets, reducing investment in riskier sectors like cryptocurrency mining. This decreased investor appetite directly impacts the price of Riot Platforms stock.

-

The influence of regulatory uncertainty surrounding cryptocurrencies: Regulatory uncertainty surrounding cryptocurrencies globally creates uncertainty and volatility in the market. Negative regulatory news or ambiguous regulatory stances can lead to sell-offs in cryptocurrency-related stocks like Riot Platforms stock.

-

General market sentiment and its effect on Riot Platforms Stock: Overall market sentiment plays a vital role. Periods of negative market sentiment often lead to sell-offs across various sectors, including cryptocurrency mining, thus impacting Riot Platforms share price. Analyzing macroeconomic indicators and relating them to Riot Platforms stock price fluctuations provides a comprehensive view.

Riot Platforms' Operational Performance and Future Outlook

Analyzing Riot Platforms' operational performance and future plans is essential for understanding its stock price. Their financial reports, capacity expansion plans, and energy costs all contribute to the overall valuation of Riot Platforms stock.

-

Mining capacity expansion plans and their potential impact on future revenue: Riot Platforms' ongoing plans to expand its mining capacity will influence future revenue generation. Successful capacity expansions can lead to increased profitability and potentially a higher stock price.

-

Energy costs and their influence on profitability: Energy costs are a significant expense for Bitcoin mining. Fluctuations in energy prices directly impact Riot Platforms' profitability and therefore its stock price. Lower energy costs improve profitability, potentially leading to a higher stock price.

-

Any significant announcements or news releases from the company that may have affected the stock price: Any announcements regarding partnerships, technological advancements, or regulatory updates from Riot Platforms can significantly impact investor sentiment and the Riot Platforms share price. Monitoring company news is crucial for understanding these fluctuations. Detailed financial data and projections from Riot Platforms' reports are crucial for this analysis.

Conclusion

The recent decline in Riot Platforms stock can be attributed to a confluence of factors: Bitcoin's inherent price volatility, increased competition within the Bitcoin mining industry, unfavorable macroeconomic headwinds, and operational challenges. The strong correlation between Bitcoin's price and Riot Platforms stock underscores the importance of monitoring the cryptocurrency market. Increased competition and macroeconomic factors further amplify the risks associated with investing in Riot Platforms stock.

To make informed investment decisions regarding Riot Platforms stock, investors should conduct thorough due diligence, closely monitoring Bitcoin's price, the competitive landscape of the Bitcoin mining industry, macroeconomic trends, and Riot Platforms' operational performance. Consider your risk tolerance before investing in Riot Platforms stock, and always consult with a qualified financial advisor. Share your thoughts and analysis on the current situation of Riot Platforms stock in the comments below. What is your outlook on the future of Riot Platforms share price?

Featured Posts

-

Balsillies Golf Venture Partners With Saudi Developer For Middle East Luxury Resorts

May 02, 2025

Balsillies Golf Venture Partners With Saudi Developer For Middle East Luxury Resorts

May 02, 2025 -

Tulsa Firefighters Battle 800 Winter Weather Calls House Fires To Rescues

May 02, 2025

Tulsa Firefighters Battle 800 Winter Weather Calls House Fires To Rescues

May 02, 2025 -

Fortnite Cowboy Bebop Crossover Event Freebies Available

May 02, 2025

Fortnite Cowboy Bebop Crossover Event Freebies Available

May 02, 2025 -

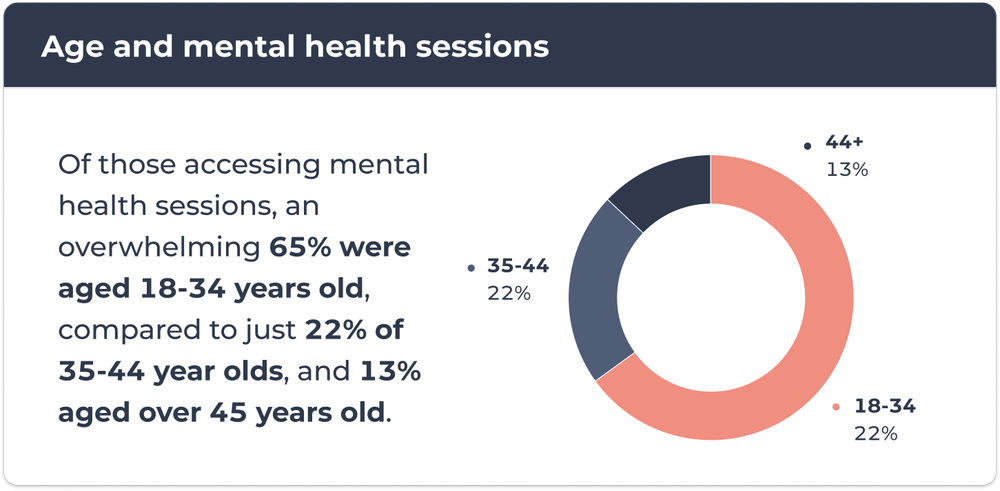

Trustcare Health Adds Mental Health Services What To Expect

May 02, 2025

Trustcare Health Adds Mental Health Services What To Expect

May 02, 2025 -

Planning Your Trip To This Country Essential Information

May 02, 2025

Planning Your Trip To This Country Essential Information

May 02, 2025