Ripple Lawsuit: SEC Considers XRP As A Commodity In Settlement Negotiations

Table of Contents

The SEC's Initial Claim and Ripple's Defense

The SEC's initial claim against Ripple alleged the unregistered sale of securities, specifically XRP, arguing that it functioned as an investment contract under the Howey Test. This test, a cornerstone of securities law, examines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. Ripple vehemently denies this, asserting that XRP is a decentralized digital asset, more akin to a commodity like gold or Bitcoin, and therefore not subject to the same regulatory framework.

- Key arguments presented by the SEC: XRP sales constituted an unregistered securities offering; Ripple executives benefited from XRP sales; XRP lacked sufficient decentralization.

- Key arguments presented by Ripple: XRP is a decentralized, freely tradable digital asset; XRP sales were not investment contracts; the SEC's definition of a security is overly broad and harms innovation.

- Significant legal precedents cited: Both sides have cited various cases related to the Howey Test and the definition of securities, creating a complex legal landscape.

Recent Developments and Settlement Talks

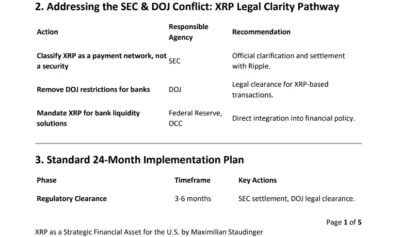

Recent filings and reports hint at a potential turning point in the Ripple Lawsuit. While neither party has officially confirmed a settlement, rumors suggest the SEC is showing a willingness to compromise, potentially acknowledging XRP as a commodity in certain contexts to facilitate a resolution. This would represent a significant shift from the SEC's initial stance.

- Specific details about potential settlement terms: Details remain scarce, but speculation includes potential limitations on XRP sales, future regulatory compliance measures by Ripple, and a financial settlement.

- Analysis of the implications of classifying XRP as a commodity: Classifying XRP as a commodity would significantly reduce regulatory oversight, potentially boosting investor confidence and the price of XRP.

- Statements by SEC officials or Ripple representatives: While neither side has publicly confirmed settlement talks, indirect statements and actions fuel speculation within the crypto community.

Implications for XRP Investors and the Crypto Market

The outcome of the Ripple lawsuit will undoubtedly impact XRP investors. A favorable ruling for Ripple, or a settlement recognizing XRP as a commodity, could lead to a surge in XRP's price and renewed investor confidence. Conversely, an unfavorable ruling could result in significant price drops and a chilling effect on other cryptocurrency projects.

- Potential price fluctuations of XRP: The price of XRP is highly sensitive to news related to the lawsuit. A positive outcome could trigger a significant price increase, while a negative outcome could lead to a substantial drop.

- Effects on other cryptocurrencies and overall market sentiment: The Ripple lawsuit sets a precedent for the broader cryptocurrency market. A clear legal framework for digital assets could stabilize the market and attract institutional investors.

- Impact on future regulatory actions concerning cryptocurrencies: The outcome will greatly influence how future regulatory actions regarding cryptocurrencies are implemented, impacting innovation and market development.

Legal Analysis and Expert Opinions

Legal experts offer diverse opinions on the likelihood of a settlement and its potential terms. Some believe a settlement is likely, given the complexities and costs of continuing litigation. Others predict a protracted legal battle, citing the strong positions of both parties.

- Quotes from legal experts: Numerous legal analysts have weighed in, offering perspectives on the strengths and weaknesses of each side's arguments.

- Different interpretations of legal precedents: The application of existing legal precedents to the unique characteristics of XRP remains a point of contention among legal experts.

- Predictions regarding the future of the case: Predictions range from a swift settlement to a lengthy appeal process, depending on the outcome of current negotiations.

Conclusion

The Ripple lawsuit and the SEC's potential consideration of XRP as a commodity represent a pivotal moment for the cryptocurrency industry. The outcome will significantly shape the regulatory landscape for digital assets and have a profound impact on XRP's price and investor confidence. The "Ripple Lawsuit" remains a critical case, demonstrating the ongoing struggle to define and regulate the rapidly evolving cryptocurrency market. Stay updated on the latest developments in the Ripple lawsuit, and continue following news related to XRP and its classification. Share your thoughts and analysis in the comments below! For deeper dives into the legal intricacies, further research into securities law and relevant case precedents is recommended.

Featured Posts

-

Rugby Pacific Tongas Upset Victory Against Si

May 01, 2025

Rugby Pacific Tongas Upset Victory Against Si

May 01, 2025 -

Coronation Street Actors Departure And Exciting New Opportunity Abroad

May 01, 2025

Coronation Street Actors Departure And Exciting New Opportunity Abroad

May 01, 2025 -

Episima I Pari Stin Euroleague Kai Tin Epomeni Sezon

May 01, 2025

Episima I Pari Stin Euroleague Kai Tin Epomeni Sezon

May 01, 2025 -

Increased Profits At China Life The Role Of Strategic Investments

May 01, 2025

Increased Profits At China Life The Role Of Strategic Investments

May 01, 2025 -

Significant Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Significant Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025