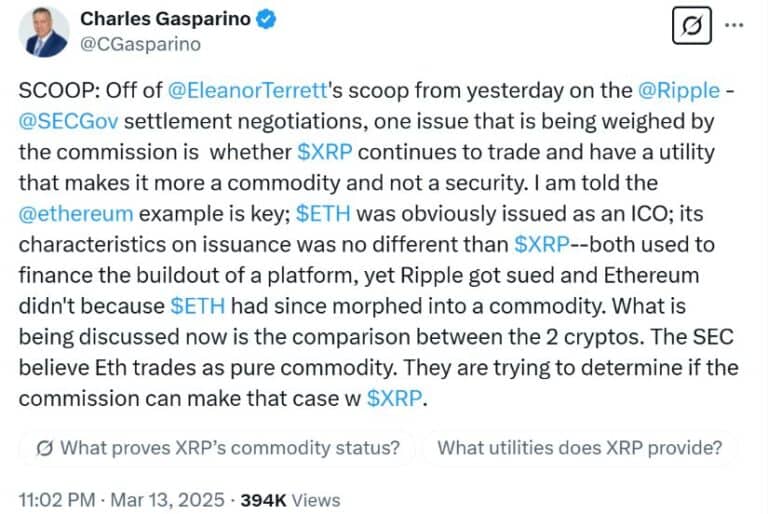

Ripple Lawsuit: SEC's Potential XRP Commodity Classification In Settlement Talks

Table of Contents

The SEC's Case Against Ripple and its Claim Regarding XRP

The SEC's lawsuit against Ripple alleges that the company conducted an unregistered securities offering through the sale of XRP. The core of the SEC's argument rests on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The SEC claims that XRP sales fulfilled the Howey Test criteria, implying investors purchased XRP with a reasonable expectation of profit based on Ripple's efforts.

Key allegations in the lawsuit include:

- Unregistered securities offering: The SEC contends that Ripple's distribution of XRP to institutional investors and the general public constituted an unregistered securities offering, violating federal securities laws.

- Violation of federal securities laws: Ripple is accused of violating Section 5 of the Securities Act of 1933, which requires registration of securities before public sale.

- Ripple's alleged distribution of XRP to raise capital: The SEC argues that Ripple used XRP sales to fund its operations and enrich its executives, furthering the claim of an unregistered securities offering.

- Impact on investors: The SEC asserts that investors were not adequately informed of the risks associated with purchasing XRP, leading to potential investor harm.

Potential for XRP Commodity Classification in a Settlement

A significant possibility within the Ripple lawsuit XRP settlement discussions revolves around the SEC agreeing to classify XRP as a commodity rather than a security. The crucial difference lies in the regulatory framework applied. Securities are subject to stringent registration and disclosure requirements under federal securities laws, while commodities are generally regulated by the Commodity Futures Trading Commission (CFTC) under a less stringent framework.

- How a commodity classification would impact future XRP sales: A commodity classification would significantly ease the regulatory burden on Ripple, allowing for freer sales and distribution of XRP.

- Potential implications for Ripple's business model: The classification would likely reshape Ripple's business model, allowing for more straightforward partnerships and transactions.

- Reduced regulatory burden for Ripple: This would eliminate the substantial compliance costs and legal challenges associated with operating under securities regulations.

- Impact on XRP price volatility: The outcome could potentially lead to increased price stability for XRP due to reduced regulatory uncertainty.

Arguments for and Against Commodity Classification of XRP

Arguments supporting the SEC classifying XRP as a commodity center on its functionality within the cryptocurrency market. Proponents highlight its use as a medium of exchange and its decentralized nature. Conversely, arguments against commodity classification point to potential future regulatory challenges and emphasize the role of Ripple in its initial distribution.

Arguments for Commodity Classification:

- How XRP functions in the market: XRP primarily operates as a medium of exchange, facilitating fast and low-cost cross-border payments.

- Decentralization aspects of XRP: While Ripple created XRP, its operation is increasingly decentralized, reducing Ripple's direct control.

- Use cases for XRP beyond fundraising: XRP's utility extends beyond a mere investment vehicle; it's used for real-world transactions.

Arguments against Commodity Classification:

- Ripple's initial distribution: The significant role Ripple played in the initial distribution of XRP could still be seen as problematic, even under a commodity classification.

- Potential for future regulatory challenges: Even if classified as a commodity, XRP could still face future regulatory scrutiny based on its specific use cases and market dynamics.

Implications of a Settlement on the Broader Cryptocurrency Market

The Ripple lawsuit and its potential Ripple lawsuit XRP settlement hold significant implications for the entire cryptocurrency market. Regardless of the final XRP classification, the settlement will set important precedents for regulatory clarity and investor confidence.

- Precedents set for future SEC actions against crypto projects: The outcome will heavily influence how the SEC approaches other cryptocurrency projects, particularly those with similar structures or distribution models.

- Influence on investor confidence in the crypto market: A clear resolution, whether it favors Ripple or the SEC, could improve or harm investor confidence in the cryptocurrency industry.

- Impact on the development and adoption of cryptocurrencies: Regulatory clarity could either accelerate or hinder the development and adoption of new cryptocurrencies and blockchain technologies.

- Potential for increased regulatory scrutiny across the industry: The case's outcome may trigger increased regulatory scrutiny of the entire cryptocurrency industry, potentially leading to more stringent regulations across the board.

Conclusion

The Ripple lawsuit and the potential for an XRP commodity classification in settlement talks have significant implications for the cryptocurrency industry. A settlement, regardless of how XRP is classified, could provide much-needed regulatory clarity, impacting investor confidence and the trajectory of the crypto market. The outcome will likely influence how regulators approach other cryptocurrencies and shape the future of digital asset regulation. Staying informed about the developments in the Ripple lawsuit XRP settlement is crucial for anyone invested in, or interested in, the future of cryptocurrency. Continue to monitor reputable sources for the latest updates on this landmark case and its effects on the wider crypto space.

Featured Posts

-

John Robertss Supreme Court Decisions A Threat To Church State Separation

May 02, 2025

John Robertss Supreme Court Decisions A Threat To Church State Separation

May 02, 2025 -

Kocaeli Nde 1 Mayis Kutlamalari Arbede Ve Sonrasi

May 02, 2025

Kocaeli Nde 1 Mayis Kutlamalari Arbede Ve Sonrasi

May 02, 2025 -

Dallas Icon Passes Away At 100

May 02, 2025

Dallas Icon Passes Away At 100

May 02, 2025 -

Tulsa Braces For Record Cold Extended Snowmelt

May 02, 2025

Tulsa Braces For Record Cold Extended Snowmelt

May 02, 2025 -

Boost Your Earnings 1 500 Flight Credit For Selling Paul Gauguin Cruises Via Ponant

May 02, 2025

Boost Your Earnings 1 500 Flight Credit For Selling Paul Gauguin Cruises Via Ponant

May 02, 2025