Ripple Settlement Talks: Will The SEC Classify XRP As A Commodity?

Table of Contents

Understanding the SEC's Case Against Ripple

The SEC's core argument centers on classifying XRP as an unregistered security. They allege that Ripple conducted an unregistered securities offering, violating federal securities laws. This argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security. The SEC claims that XRP sales, particularly those made through programmatic sales to institutional investors, involved an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

The key allegations in the SEC's complaint against Ripple include:

- Unregistered securities offering: The SEC argues that Ripple's sales of XRP constituted an unregistered public offering of securities.

- Violation of federal securities laws: Ripple is accused of violating Section 5 of the Securities Act of 1933, which requires registration of securities offerings.

- Ripple executives' alleged involvement: The SEC alleges that Ripple executives actively participated in and benefited from the unregistered sales of XRP.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's accusations, arguing that XRP is a digital asset, a commodity or utility token, not a security. Their defense strategy centers on highlighting XRP's decentralized nature and its utility within the RippleNet payment network. They contend that the programmatic sales were not investment contracts and that XRP holders did not rely on Ripple's efforts for profit.

Key points in Ripple's defense include:

- Decentralization of XRP: Ripple emphasizes the decentralized nature of XRP's network and its independent functionality outside of Ripple's direct control.

- Programmatic sales versus direct investment contracts: Ripple argues that the programmatic sales of XRP did not create the expectation of profits derived from Ripple's efforts, a crucial element of the Howey Test.

- Focus on XRP's utility in the RippleNet network: Ripple highlights XRP's functional utility in facilitating cross-border payments through its RippleNet network, arguing against its classification as an investment contract.

Potential Outcomes of the Settlement Talks

The Ripple settlement talks could yield several outcomes, each with significant implications for XRP:

- SEC classifying XRP as a security: This would likely result in a significant drop in XRP's price, restrict its trading on major exchanges, and potentially lead to legal action against XRP investors.

- SEC classifying XRP as a commodity: This would be a victory for Ripple, boosting XRP's price and fostering greater market acceptance. It could also pave the way for clearer regulatory frameworks for cryptocurrencies.

- A negotiated settlement with specific conditions: This could involve limitations on XRP sales or other compliance measures. The outcome would depend on the specifics of the settlement.

- Dismissal of the case: A dismissal would be highly positive for Ripple and XRP, signaling a significant win for the cryptocurrency.

The Impact of XRP Classification on the Crypto Market

The SEC's decision regarding XRP will have far-reaching consequences for the cryptocurrency market as a whole. The classification of XRP could serve as a precedent for how other cryptocurrencies are regulated, potentially influencing regulatory approaches to other digital assets.

- Impact on investor confidence: A clear ruling, regardless of its direction, could help restore investor confidence. However, prolonged uncertainty could continue to negatively affect the market.

- Effect on cryptocurrency exchanges and trading platforms: The outcome will significantly impact how exchanges list and trade XRP, potentially leading to delistings or stricter compliance measures.

- Potential for regulatory clarity or increased uncertainty: The decision could either establish clearer regulatory guidelines for the crypto industry or create further uncertainty and regulatory fragmentation.

The Role of Judge Analisa Torres' Ruling

Judge Analisa Torres' previous rulings in the case, particularly her partial summary judgment in favor of Ripple regarding institutional sales, significantly influenced the ongoing Ripple settlement talks. Her legal interpretations of the Howey Test and her analysis of XRP's different sales channels will likely play a crucial role in shaping any settlement agreement or final judgment. Her perspective on the decentralization of XRP and its functional use within RippleNet will likely be pivotal in the resolution of the case.

Conclusion: Ripple Settlement Talks and the Future of XRP

The Ripple settlement talks represent a crucial juncture in the ongoing legal battle between Ripple and the SEC. The SEC's decision regarding XRP's classification – whether as a security, commodity, or something else – will significantly impact not only XRP's future but also the broader cryptocurrency market and investor confidence. Understanding the arguments, potential outcomes, and broader implications of this case is essential for navigating the evolving landscape of crypto regulation. Stay informed about the ongoing Ripple's legal battle, the XRP classification, and the developments in the SEC vs. Ripple case by following reputable news sources and engaging with ongoing discussions within the cryptocurrency community. Staying informed about the future of XRP is crucial for all investors.

Featured Posts

-

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025

Analysis Duponts Performance In Frances Win Over Italy

May 01, 2025 -

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

May 01, 2025

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

May 01, 2025 -

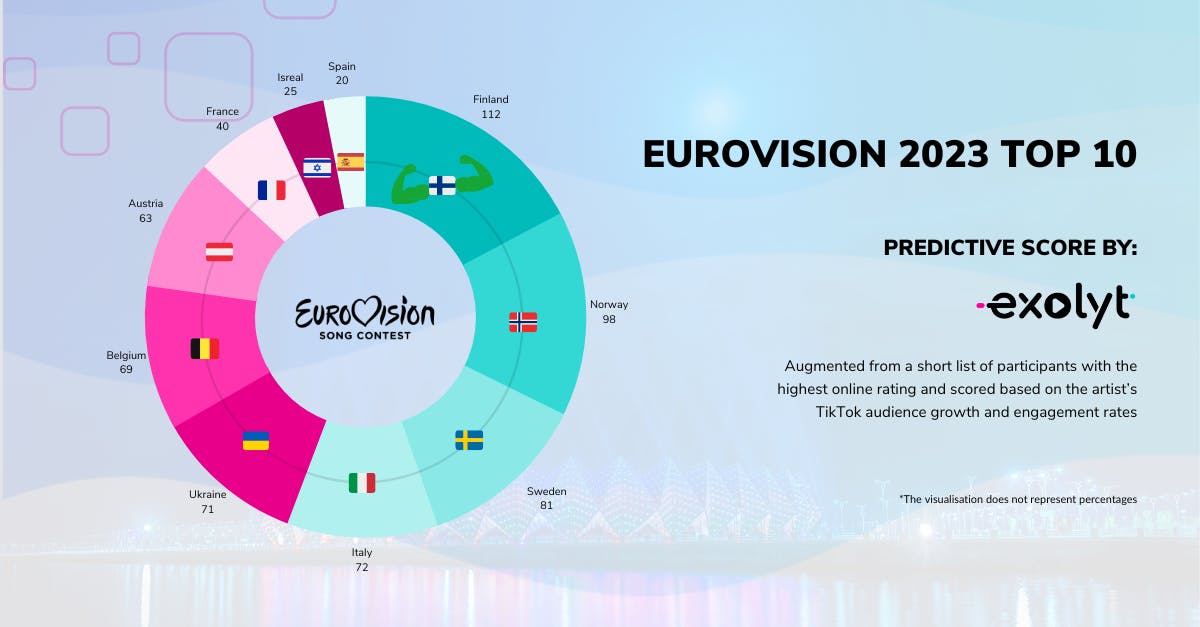

Predicting The Eurovision 2025 Winner Early Contenders

May 01, 2025

Predicting The Eurovision 2025 Winner Early Contenders

May 01, 2025 -

Sec Vs Ripple Xrps Future As A Commodity Hangs In The Balance

May 01, 2025

Sec Vs Ripple Xrps Future As A Commodity Hangs In The Balance

May 01, 2025 -

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025