Ripple Vs. SEC: Analyzing The $50M Settlement Impact On XRP

Table of Contents

The Ripple-SEC lawsuit has been a protracted and highly publicized battle within the cryptocurrency world. The recent $50 million settlement marks a significant turning point, but its ramifications for XRP, its price, and the broader cryptocurrency landscape remain complex and require careful analysis. This article will dissect the settlement's implications, exploring its impact on XRP's price, future regulations, and the overall market sentiment. We'll delve into the details of the agreement, examine the ripple effects (pun intended!), and discuss what this means for the future of XRP and the cryptocurrency ecosystem.

The Settlement's Key Terms and Conditions

What did Ripple agree to?

The Ripple-SEC settlement concluded with Ripple agreeing to pay a $50 million penalty without admitting guilt or acknowledging that XRP is a security. This is a crucial detail; it avoids a legal precedent that could negatively impact other cryptocurrencies.

- No admission of guilt: This is a significant victory for Ripple, protecting their reputation and avoiding a potentially crippling blow to their future operations.

- $50 million payment: This covers the alleged unregistered securities sales. The absence of an admission of guilt, however, mitigates the severity of the penalty.

- No injunction: Ripple avoided a court order that would have severely restricted their operations, a major win in the context of this long-standing battle.

Financial Penalties and Their Significance

The $50 million penalty, while substantial, pales in comparison to Ripple's overall market capitalization. This suggests a relatively small financial impact on the company itself. However, the cost-benefit analysis is complex. Avoiding a protracted legal battle and the potential for far more substantial fines in the event of a loss likely influenced Ripple's decision. It's also important to note that future violations could lead to further penalties, highlighting the importance of compliance going forward.

Impact on XRP Price and Market Sentiment

Short-term price volatility

The immediate reaction to the settlement news was a significant surge in XRP's price, reflecting relief within the market. However, this volatility is not unexpected, indicative of the intense speculation surrounding the case and the emotional reactions of investors. [Insert chart or graph illustrating price fluctuations]. Investor sentiment played a crucial role: hope for a positive outcome fueled short-term price increases.

Long-term price predictions

Predicting XRP's long-term price remains challenging. While the settlement removes a significant overhang of uncertainty, other factors will influence the price.

- Increased adoption: The settlement could lead to increased adoption of XRP if the legal uncertainty surrounding its classification diminishes.

- Regulatory clarity (or lack thereof): Future regulatory pronouncements, both in the US and globally, will heavily influence XRP's price.

- Market competition: The competitive landscape within the cryptocurrency market will also play a decisive role in XRP's price performance.

Implications for the Broader Crypto Landscape

Ripple's influence on other crypto projects

The Ripple-SEC case has set a precedent, although not necessarily a universally applicable one. Other crypto projects facing similar regulatory scrutiny will carefully examine the settlement's terms. This could lead to:

- Increased regulatory compliance efforts: Projects might proactively increase their regulatory compliance to minimize future legal risks.

- Adjustments to business models: Some projects might adjust their token distribution or business models to distance themselves from potential securities classifications.

Regulatory Clarity and Future of Crypto Regulation

The settlement's impact on broader crypto regulation remains debatable. The SEC's approach to regulating cryptocurrencies remains unclear.

- Future enforcement actions: The SEC's future enforcement actions will significantly shape the cryptocurrency regulatory environment.

- Evolving regulatory frameworks: This case highlights the need for clearer and more comprehensive regulatory frameworks for cryptocurrencies.

- Self-regulation: The crypto industry may need to accelerate efforts toward self-regulation to demonstrate responsible behavior and foster a more stable market.

Conclusion

The Ripple-SEC settlement, while settling the immediate case, leaves many long-term questions unanswered about XRP and the broader crypto landscape. The $50 million settlement has had a clear, although volatile, impact on XRP's price. The lack of a definitive ruling on XRP's status as a security leaves regulatory uncertainty. However, the impact on the broader crypto space is mostly in increased discussion about legal compliance and regulatory clarity. The future of XRP and similar cryptocurrencies depends heavily on future regulatory decisions and market dynamics.

Call to Action: The Ripple vs. SEC settlement brings significant changes to the XRP landscape, making it vital to stay informed about future developments. Continue researching XRP and the evolving cryptocurrency regulatory environment to make well-informed investment decisions. Understanding the evolving legal implications surrounding XRP is crucial for all investors.

Featured Posts

-

Is Doctor Who Ending Showrunners Comments Spark Cancellation Concerns

May 02, 2025

Is Doctor Who Ending Showrunners Comments Spark Cancellation Concerns

May 02, 2025 -

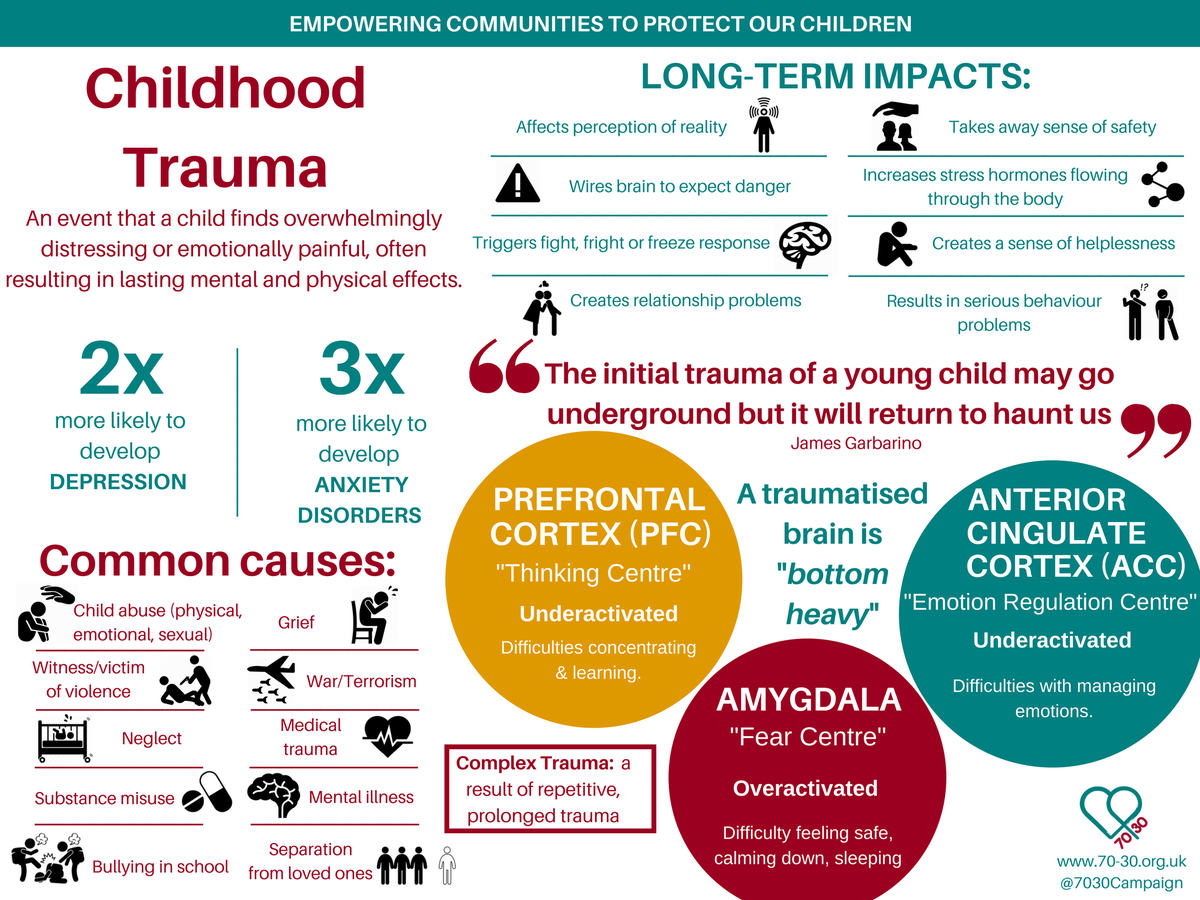

A Generations Well Being The Critical Need To Invest In Childhood Mental Health

May 02, 2025

A Generations Well Being The Critical Need To Invest In Childhood Mental Health

May 02, 2025 -

Christina Aguileras Photoshopped Images Fans React To Unrecognizable Photoshoot

May 02, 2025

Christina Aguileras Photoshopped Images Fans React To Unrecognizable Photoshoot

May 02, 2025 -

Fortnite Update 34 20 Server Downtime New Features And Bug Fixes

May 02, 2025

Fortnite Update 34 20 Server Downtime New Features And Bug Fixes

May 02, 2025 -

Xrp Price Prediction Will Xrp Reach 5 After Sec Lawsuit Dismissal

May 02, 2025

Xrp Price Prediction Will Xrp Reach 5 After Sec Lawsuit Dismissal

May 02, 2025