Ripple Vs. SEC: Understanding The $50M Settlement And Its Impact On XRP

Table of Contents

The Core of the Ripple vs. SEC Dispute

The SEC's lawsuit against Ripple alleged that the company conducted an unregistered securities offering through the sale of XRP. The SEC's central argument rested on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. The SEC argued that XRP met the criteria of the Howey Test, implying investors purchased XRP with the expectation of profit generated by Ripple's efforts.

Ripple, however, vehemently denied these allegations. Their counterarguments focused on the decentralized nature of XRP and its use in various functionalities beyond investment. They emphasized XRP's utility as a payment mechanism and its widespread adoption across various exchanges and platforms.

Key Arguments:

- SEC: XRP sales constituted an unregistered securities offering; investors expected profits based on Ripple's efforts; the Howey Test applied to XRP.

- Ripple: XRP is a decentralized digital asset; it functions as a currency, not a security; the SEC's interpretation is overly broad and harms innovation.

Breakdown of the $50 Million Settlement

The $50 million settlement marked a significant turning point in the case. While Ripple didn't explicitly admit to wrongdoing, the settlement avoided a lengthy and costly trial. The terms included a payment of $50 million, but crucially, it avoided classifying XRP as a security nationwide. This nuanced outcome presents both opportunities and challenges for Ripple and the XRP ecosystem.

Key Concessions:

- Ripple: Paid $50 million; agreed to certain stipulations regarding future sales and distribution of XRP.

- SEC: Did not formally declare XRP a security nationwide. The settlement was more of a compromise than a defeat, opening opportunities for Ripple to rebuild trust and continue operations.

Impact of the Settlement on XRP Price and Market Sentiment

The immediate aftermath of the settlement saw a surge in XRP's price, reflecting a wave of positive investor sentiment. However, the longer-term implications remain complex. While some consider the settlement a victory, the absence of clear regulatory clarity introduces uncertainty. The settlement didn't establish a decisive legal precedent, leaving room for future regulatory challenges.

Impact on XRP Metrics:

- XRP Price After Settlement: Initially experienced a significant increase, followed by some consolidation.

- XRP Market Cap: Fluctuated alongside the price changes.

- XRP Trading Volume: Saw increased activity around the announcement.

- XRP Investor Sentiment: Shifted from cautious pessimism to cautious optimism. [Include chart illustrating price fluctuations here]

Future of XRP and Ripple in Light of the Settlement

The Ripple vs. SEC case has undeniably influenced the regulatory landscape surrounding cryptocurrencies. The settlement, while not offering complete clarity, could pave the way for more nuanced regulations in the future. Ripple's future plans likely involve increased focus on partnerships, technological advancements, and addressing potential regulatory concerns.

Future Outlook for XRP:

- XRP Regulatory Implications: The settlement leaves room for varying interpretations, potentially impacting future XRP operations in different jurisdictions.

- XRP Adoption Rate: Will likely continue to grow, especially within payment solutions, depending on evolving regulatory environments.

- Ripple Future Plans: Include continued innovation and exploration of practical applications for XRP.

Conclusion: Navigating the Aftermath of Ripple vs. SEC: The Future of XRP

The $50 million Ripple-SEC settlement represents a significant development in the cryptocurrency industry. It’s crucial to understand its implications not only for Ripple and XRP but also for the broader regulatory landscape surrounding digital assets. The future of XRP remains intertwined with ongoing regulatory discussions. While the settlement offers a degree of stability, the long-term impact depends on the evolution of cryptocurrency regulations and the ongoing efforts by Ripple to cultivate XRP's adoption and utility. Continue to research XRP, stay updated on the Ripple SEC developments, and learn more about the implications of the Ripple settlement on XRP investing to navigate this dynamic market effectively.

Featured Posts

-

Frances Rugby Triumph Duponts Masterclass Against Italy

May 01, 2025

Frances Rugby Triumph Duponts Masterclass Against Italy

May 01, 2025 -

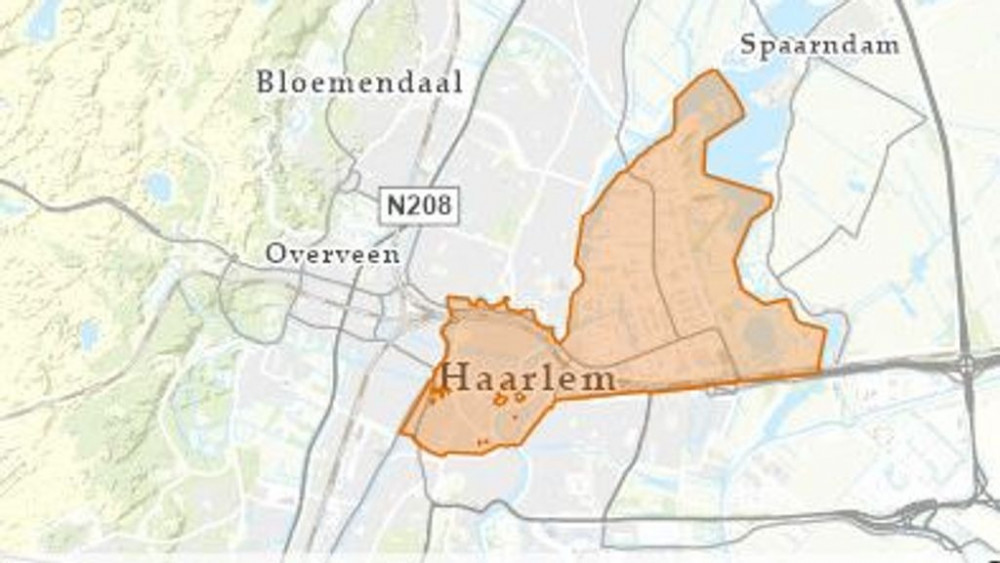

Van Mesdagkliniek Groningen Steekpartij Met Verdachte Malek F

May 01, 2025

Van Mesdagkliniek Groningen Steekpartij Met Verdachte Malek F

May 01, 2025 -

000 Zonder Stroom Grote Stroomstoring Ramt Breda

May 01, 2025

000 Zonder Stroom Grote Stroomstoring Ramt Breda

May 01, 2025 -

Processo Becciu Appello 22 Settembre Innocenza Proclamata

May 01, 2025

Processo Becciu Appello 22 Settembre Innocenza Proclamata

May 01, 2025 -

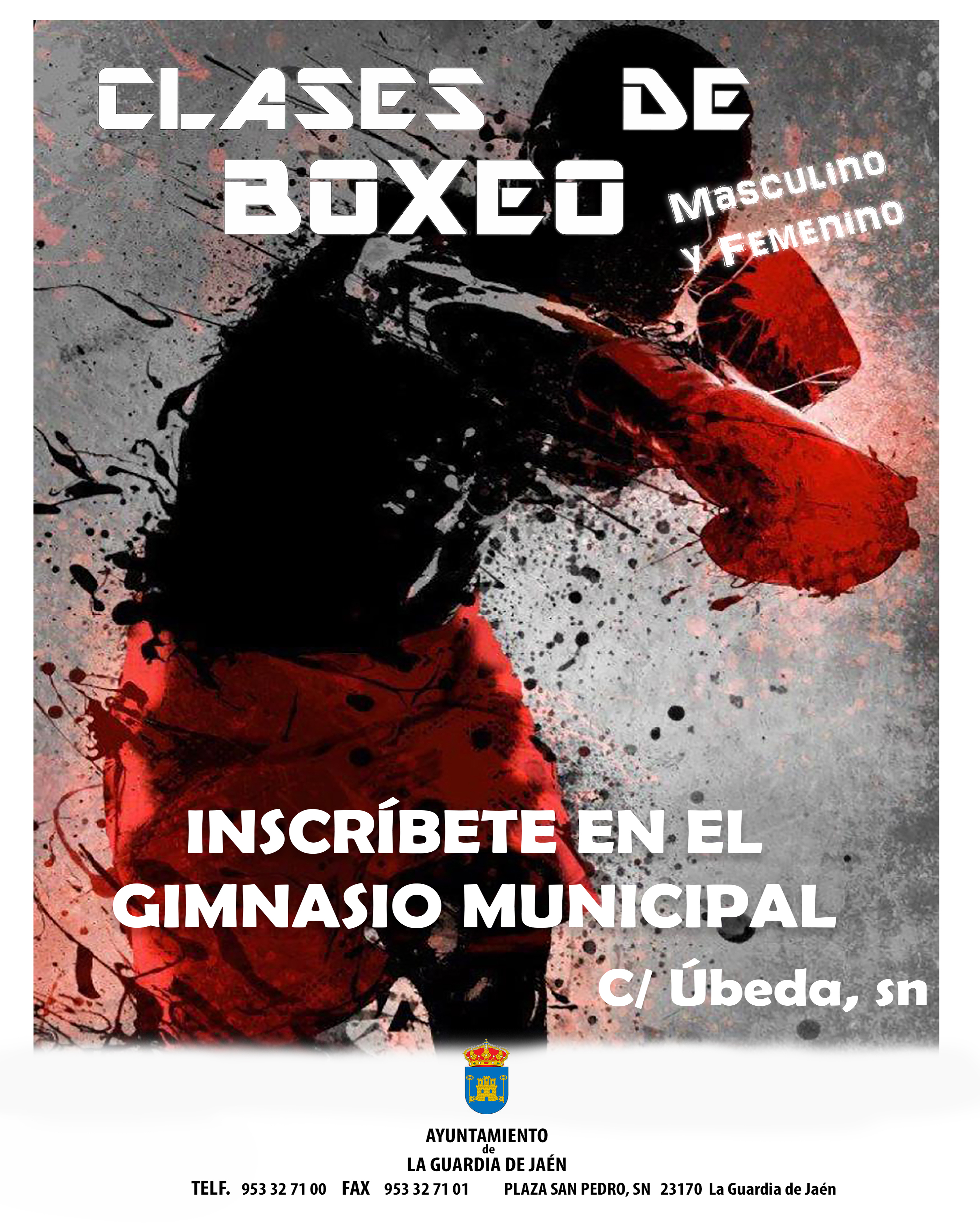

Clases De Boxeo En Edomex Inscribete En 3 Dias

May 01, 2025

Clases De Boxeo En Edomex Inscribete En 3 Dias

May 01, 2025