Ripple Vs SEC: XRP News And The Growing Likelihood Of A US ETF

Table of Contents

The Ripple vs SEC Lawsuit: A Deep Dive

The core of the SEC lawsuit against Ripple centers on whether XRP, Ripple's native cryptocurrency, is a security. The SEC argues that Ripple conducted unregistered securities offerings, violating federal securities laws. This legal battle, filled with complex legal arguments and procedural maneuvers, has significantly impacted XRP's price and the broader cryptocurrency market. Key events, like the recent summary judgment, have sent shockwaves through the industry.

-

The SEC's Definition of a Security: The SEC relies on the Howey Test, a decades-old legal standard, to determine whether an asset qualifies as a security. This test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues XRP meets these criteria.

-

Ripple's Defense Strategy: Ripple counters that XRP is a decentralized digital asset, similar to Bitcoin or Ethereum, and therefore not a security. Their defense emphasizes the decentralized nature of XRP's distribution and trading, arguing it operates independently of Ripple's efforts. They also highlight the significant number of XRP holders who are not involved in any investment contract with Ripple.

-

Key Court Decisions and their Impact on XRP Price: Court decisions, including the partial summary judgment, have created significant price volatility for XRP. Positive developments tend to boost XRP's price, while negative developments lead to declines. This highlights the market's sensitivity to the outcome of the lawsuit.

-

Potential Outcomes of the Case: The potential outcomes range from a complete SEC victory to a complete dismissal of the case, with various possibilities in between. A ruling in favor of Ripple could significantly boost XRP's price and potentially create a precedent for other cryptocurrencies. Conversely, a ruling against Ripple could have a chilling effect on the entire crypto industry.

XRP Price Volatility and Market Sentiment

The Ripple vs SEC case has directly influenced XRP's price volatility. Periods of uncertainty have often resulted in significant price swings. Market sentiment plays a crucial role, with positive news leading to buying pressure and negative news causing sell-offs.

-

Historical Price Correlation with Lawsuit Events: Analyzing XRP's price history reveals a strong correlation with key developments in the lawsuit. Positive court rulings or announcements have often been followed by price increases, while negative news has resulted in price drops.

-

Investor Sentiment and Trading Volume: Investor sentiment surrounding XRP is highly correlated with the lawsuit's progress. Positive sentiment drives trading volume and price appreciation, while negative sentiment leads to decreased volume and price declines.

-

Predictions from Market Analysts: Market analysts offer diverse price predictions for XRP, depending on their assessment of the lawsuit's outcome and broader market conditions. These predictions range from optimistic scenarios, with XRP reaching new highs, to pessimistic scenarios, with XRP experiencing further price declines.

-

Impact of a Positive or Negative Ruling: A positive ruling for Ripple could send XRP's price soaring, potentially boosting investor confidence in the cryptocurrency market. A negative ruling, however, could severely damage XRP's price and potentially negatively affect other cryptocurrencies.

The Connection Between Ripple's Case and US Crypto ETFs

A favorable ruling for Ripple could significantly impact the SEC's approach to approving crypto ETFs. The SEC's hesitancy to approve crypto ETFs stems largely from regulatory uncertainty regarding the classification of cryptocurrencies as securities. A clear ruling on XRP's status could provide the necessary regulatory clarity to facilitate ETF approvals.

-

Current Regulatory Landscape for Crypto ETFs in the US: Currently, the US lacks a clearly defined regulatory framework for crypto ETFs, leading to delays and rejections of applications.

-

Influence of the Ripple Case on SEC Decisions: The SEC’s decision in the Ripple case will set a significant precedent for how it will regulate other cryptocurrencies, directly influencing its approach to approving crypto ETFs. A favorable ruling for Ripple could signal a more open approach to crypto ETF applications.

-

Potential Impact on the Broader Cryptocurrency Market: The approval of crypto ETFs in the US could bring significant institutional investment into the cryptocurrency market, increasing liquidity and potentially boosting the prices of various cryptocurrencies.

-

Potential Domino Effect: A clear legal framework established by the Ripple case could encourage other cryptocurrency projects to seek similar legal clarity, potentially leading to more transparent and regulated markets.

Potential Impact on Other Cryptocurrencies

The Ripple vs SEC case has broader implications for the cryptocurrency market. Other cryptocurrencies facing regulatory uncertainty might experience increased scrutiny or, conversely, increased clarity depending on the outcome of the Ripple case. The precedent set by this case could significantly influence how regulators approach other digital assets, potentially impacting Bitcoin, Ethereum, and numerous altcoins. Regulatory clarity, regardless of the outcome, is vital for the healthy growth of the crypto market.

Conclusion

The Ripple vs SEC lawsuit is a pivotal moment for the cryptocurrency industry. The outcome will not only determine the fate of XRP but will likely influence the SEC's approach to crypto ETFs and the regulatory landscape for cryptocurrencies as a whole. The case highlights the inherent volatility associated with crypto investments and the importance of understanding the legal and regulatory risks involved. A clear ruling could pave the way for increased institutional investment and market stability.

Call to Action: Stay informed about the ongoing Ripple vs SEC lawsuit and its implications for XRP and the broader cryptocurrency market. Follow the latest XRP news and analysis to make informed investment decisions. Continue to research the potential implications of the Ripple vs SEC case on your crypto portfolio, and stay updated on the evolving landscape of crypto ETFs. Understanding the complexities of the Ripple vs SEC case is crucial for navigating the ever-changing world of cryptocurrencies.

Featured Posts

-

Dragons Den Scheduling Error Shows Old Irrelevant Episode

May 01, 2025

Dragons Den Scheduling Error Shows Old Irrelevant Episode

May 01, 2025 -

Will A Minority Government Weaken The Canadian Dollar Expert Analysis

May 01, 2025

Will A Minority Government Weaken The Canadian Dollar Expert Analysis

May 01, 2025 -

Update On Louisville Mail Delivery Delays Union Leaders Statement

May 01, 2025

Update On Louisville Mail Delivery Delays Union Leaders Statement

May 01, 2025 -

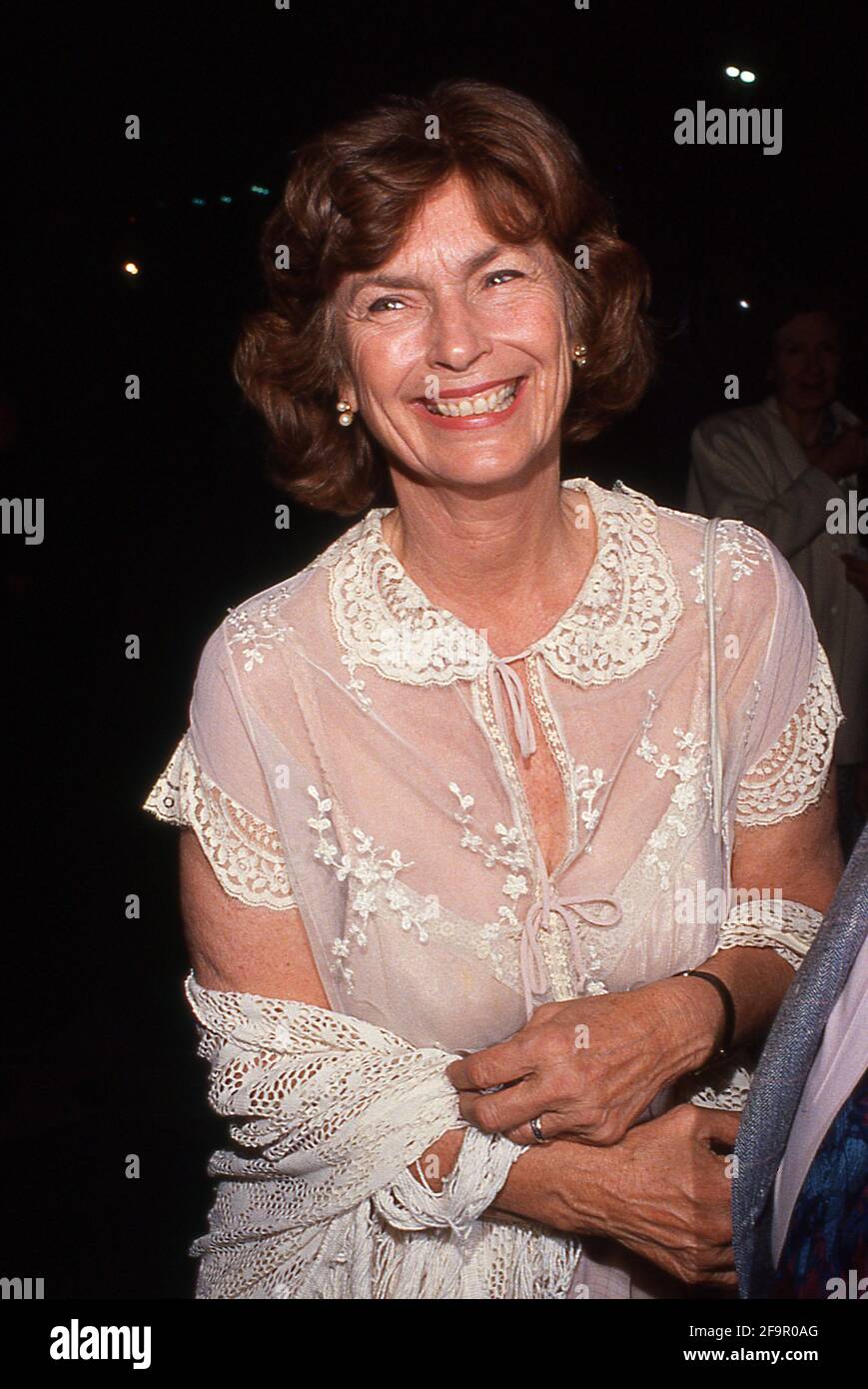

Death Of Actress Priscilla Pointer At 100

May 01, 2025

Death Of Actress Priscilla Pointer At 100

May 01, 2025 -

Gia Dinh Chon Tam Hop Cung Cap Nuoc Chien Thang Truoc 6 Doi Thu Khac

May 01, 2025

Gia Dinh Chon Tam Hop Cung Cap Nuoc Chien Thang Truoc 6 Doi Thu Khac

May 01, 2025