Ripple (XRP) 15,000% Surge: Millionaire Maker Or Market Fluctuation?

Table of Contents

Analyzing the 15,000% XRP Price Increase

Understanding the Ripple (XRP) 15,000% surge requires examining its historical context. XRP's price has always been volatile, experiencing significant ups and downs throughout its history. However, this recent surge stands out due to its sheer magnitude. Several key factors contributed to this dramatic price increase:

- Positive Court Rulings Affecting XRP Price: The partial victory in the ongoing SEC lawsuit against Ripple significantly boosted investor confidence. The court's decision clarified some aspects of XRP's regulatory status, reducing uncertainty and attracting new investment.

- Increased Adoption Driving XRP's Value: Partnerships and integrations with various financial institutions around the globe have been driving adoption of RippleNet, Ripple's payment solution. This increased usage translates to higher demand and, consequently, price appreciation.

- Social Media and News Fueling the Hype: Positive news coverage and enthusiastic discussions on social media platforms amplified the surge. This created a feedback loop where positive sentiment further fueled price increases.

[Insert chart/graph illustrating XRP's price movement during the surge, clearly labeled and showing relevant dates.]

Analyzing the XRP price history, along with the XRP market cap, is crucial for gauging the sustainability of this dramatic increase. Furthermore, understanding the intricacies of the Ripple lawsuit remains crucial in any XRP price prediction.

The Ripple (XRP) Ecosystem and Its Future

Ripple's technology extends far beyond cryptocurrency trading. It offers a comprehensive solution for facilitating seamless cross-border payments through its RippleNet platform.

- RippleNet's Role in International Transactions: RippleNet enables banks and financial institutions to transfer money across borders more quickly and cost-effectively than traditional methods.

- Other Applications of XRP Technology: Beyond payments, XRP's technology has potential applications in various sectors, such as supply chain management and digital asset exchange.

- Competition in the Fintech Space: While Ripple is a leader in the cross-border payment space, it faces strong competition from other fintech companies and emerging blockchain technologies.

The future of XRP hinges on the continued adoption of RippleNet and the success of its expansion into new markets. The utility of XRP within the broader Ripple ecosystem is a significant factor in its long-term prospects.

Risks Associated with Investing in XRP After the Surge

While the Ripple (XRP) 15,000% surge is impressive, it's crucial to acknowledge the inherent risks associated with investing in cryptocurrencies:

- Cryptocurrency Volatility: The cryptocurrency market is notoriously volatile. Sharp price drops can occur rapidly, potentially leading to significant losses.

- Investment Based on Hype and Speculation: Investing solely based on hype and social media sentiment is extremely risky. Fundamental analysis is crucial for making informed investment decisions.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, with potential for future changes that could significantly impact XRP's price.

- Impact of Future Court Decisions: The outcome of the ongoing SEC lawsuit could still affect XRP's price, potentially leading to further volatility.

- Market Manipulation: The possibility of market manipulation, although difficult to prove, always exists in the volatile cryptocurrency market. Investors should be aware of this risk.

A comprehensive XRP risk assessment is necessary before committing significant capital. Understanding the complexities of crypto regulation is crucial for navigating this volatile market.

Is a 15,000% Ripple (XRP) Surge Sustainable? A Realistic Perspective

Whether the Ripple (XRP) 15,000% surge is sustainable is a complex question with no easy answer. While the positive court rulings and increased adoption are encouraging, several factors could influence its future trajectory.

- Fundamental Factors Affecting Long-Term Price Stability: Long-term price stability depends on factors like continued adoption, technological advancements, and overall market sentiment.

- Impact of Macroeconomic Factors: Global economic conditions and regulatory changes significantly impact the cryptocurrency market, including XRP's price.

- Realistic Price Predictions (with disclaimers): Predicting future prices with accuracy is impossible. Any prediction should be treated with caution and viewed as a potential outcome, not a guarantee.

An in-depth XRP price forecast should consider both optimistic and pessimistic scenarios, integrating a thorough analysis of current market conditions. The long-term XRP outlook depends on a multitude of intertwined factors.

Conclusion: Navigating the Ripple (XRP) 15,000% Surge – What's Next?

The Ripple (XRP) 15,000% surge represents a significant event in the cryptocurrency market. While it offers exciting potential, investors must approach it with caution, understanding both the upside and the considerable risks involved. This analysis highlighted the contributing factors to the surge, the potential of the XRP ecosystem, and the inherent volatility of the cryptocurrency market. Before making any investment decisions regarding the volatile world of Ripple (XRP), conduct thorough research and consult with a financial advisor. Understanding the potential of the Ripple (XRP) 15,000% surge requires careful consideration of market trends and potential risks.

Featured Posts

-

Kamala Harris Broadway Speech A Word Salad

May 01, 2025

Kamala Harris Broadway Speech A Word Salad

May 01, 2025 -

Wsoc Tv Michael Sheens Generosity Erases 1 Million In Debt

May 01, 2025

Wsoc Tv Michael Sheens Generosity Erases 1 Million In Debt

May 01, 2025 -

V Mware Pricing Controversy Broadcoms Proposed 1 050 Hike

May 01, 2025

V Mware Pricing Controversy Broadcoms Proposed 1 050 Hike

May 01, 2025 -

Priscilla Pointer Dalla A Century Of Life Celebrated Death Announced At 100

May 01, 2025

Priscilla Pointer Dalla A Century Of Life Celebrated Death Announced At 100

May 01, 2025 -

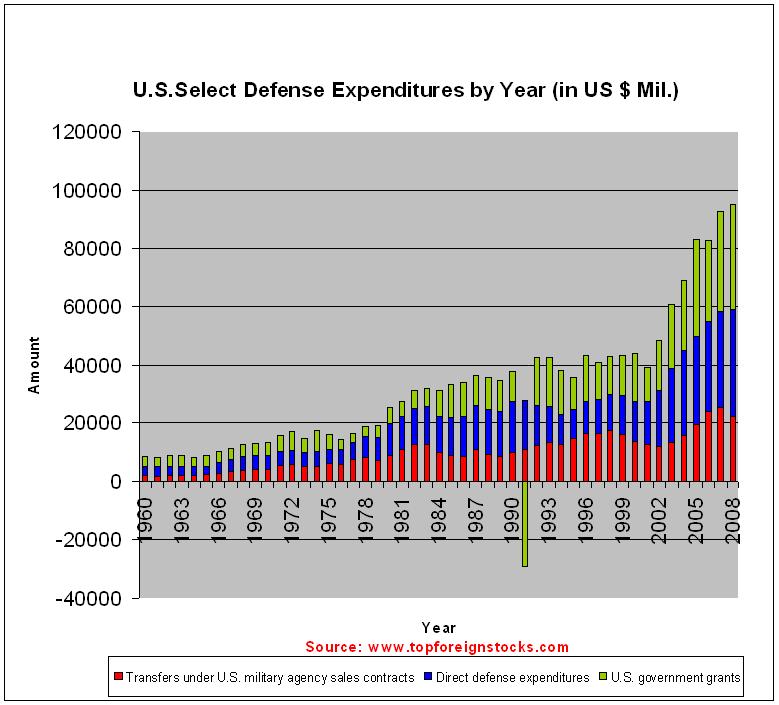

Rising Global Defense Spending A Focus On Europes Security Concerns

May 01, 2025

Rising Global Defense Spending A Focus On Europes Security Concerns

May 01, 2025