Ripple (XRP) Analysis: Potential For $3.40 Breakout?

Table of Contents

Technical Analysis of XRP Price Action

Chart Patterns

Analyzing XRP's price charts reveals intriguing patterns that may signal an upcoming breakout. We'll examine key chart patterns to determine if a move towards $3.40 is technically feasible. [Insert image of XRP chart with annotated potential head and shoulders pattern].

- Key Support and Resistance Levels: Current support seems to be holding around [insert price level], while significant resistance lies near [insert price level]. A decisive break above this resistance could trigger a substantial upward movement.

- Trading Volume Analysis: Observe increased trading volume around key support and resistance levels. High volume during a breakout confirms the strength of the move, increasing the likelihood of a sustained rally towards $3.40.

- Technical Indicators: The Relative Strength Index (RSI) is currently [insert RSI value], suggesting [overbought/oversold/neutral] conditions. The Moving Average Convergence Divergence (MACD) shows [insert MACD interpretation – bullish/bearish/neutral crossover], further supporting the [bullish/bearish/neutral] outlook.

On-Chain Metrics

On-chain data provides valuable insights into investor behavior and potential price movements. Examining metrics like transaction volume, active addresses, and the distribution of XRP among wallets can help us assess the strength of the market.

- Increased On-Chain Activity: A significant surge in daily active addresses and transaction volume suggests growing interest and potential upward pressure on the XRP price.

- Whale Wallet Influence: The actions of large XRP holders ("whales") can significantly impact price movements. Monitoring their activity is crucial for understanding potential shifts in the market. Analysis of whale wallet behavior suggests [insert interpretation based on observed data – e.g., accumulation, distribution].

- On-Chain Data Platforms: Platforms like [mention specific platforms, e.g., Santiment, Glassnode] provide valuable on-chain data for a comprehensive analysis. Their findings on XRP's on-chain activity suggest [Summarize findings from these platforms].

Ripple's Legal Battle and its Impact on XRP Price

SEC Lawsuit Update

The ongoing SEC lawsuit against Ripple Labs is a crucial factor impacting XRP's price. The outcome of this legal battle will significantly influence investor sentiment and future price movements.

- Potential Outcomes and Impact: A favorable ruling could trigger a substantial price increase, potentially leading to the $3.40 target. Conversely, an unfavorable ruling could cause a significant price drop.

- Expert Opinions and Predictions: Legal analysts and market experts offer varying predictions. Some anticipate a positive resolution that could propel XRP significantly higher, while others remain cautious. [Mention specific legal analysts and their views].

- Positive Developments: Positive developments in the case, such as favorable court decisions or settlements, could act as catalysts for a significant price rally.

Ripple's Partnerships and Developments

Ripple's strategic partnerships, technological advancements, and regulatory progress play a significant role in shaping XRP's future.

- Key Partnerships and Collaborations: Ripple's continued partnerships with financial institutions for cross-border payments and CBDC solutions demonstrate the growing adoption of its technology. [List key partnerships and collaborations].

- Technological Advancements: Innovations like xRapid, RippleNet, and its contributions to CBDC infrastructure enhance its utility and attract further adoption, potentially boosting XRP's price.

- Regulatory Progress: Favorable regulatory developments in various jurisdictions could remove uncertainties and foster wider XRP adoption, contributing to price appreciation.

Market Sentiment and Predictions

Social Media Sentiment

Analyzing social media sentiment towards XRP can offer insights into market psychology and potential price movements.

- Overall Sentiment: Social media sentiment towards XRP is currently [bullish/bearish/neutral], based on analysis of relevant keywords and hashtags like #XRP, #Ripple, and #crypto.

- Significant Events Driving Sentiment: Recent news events, such as [mention specific events], have significantly influenced social media sentiment.

- Social Media Analytics Tools: Tools such as [mention specific tools] provide valuable data on social media sentiment, helping gauge market expectations.

Expert Opinions and Price Predictions

Several cryptocurrency analysts have offered predictions regarding XRP's price potential. While predictions vary, it’s essential to consider them within the context of the overall market conditions.

- Expert Opinions: [Mention specific analysts and their predictions, quoting or paraphrasing their reasoning. Include links to their analysis whenever possible].

- Reasoning Behind Predictions: Analysts base their predictions on various factors, including technical analysis, market sentiment, and legal developments.

- Uncertainty in Price Predictions: It's crucial to remember that cryptocurrency price predictions are inherently uncertain and should not be considered financial advice.

Conclusion

This analysis suggests that a Ripple (XRP) price reaching $3.40 is a possibility, contingent on several factors. Favorable outcomes in the SEC lawsuit, increased adoption driven by Ripple’s partnerships and technological advancements, and sustained positive market sentiment could all contribute to a significant price surge. However, technical resistance levels, negative legal developments, or a shift in overall market sentiment could hinder this price target.

Disclaimer: Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment. The information provided in this article is for informational purposes only and does not constitute financial advice.

Call to Action: While a $3.40 XRP breakout remains a possibility, it's crucial to conduct thorough research before making any investment decisions. Stay updated on Ripple (XRP) news and analysis to make informed choices about your portfolio. Consider diversifying your investment strategy to mitigate risk.

Featured Posts

-

Analyzing The Feasibility Of Macrons European Netflix Initiative

May 07, 2025

Analyzing The Feasibility Of Macrons European Netflix Initiative

May 07, 2025 -

The Value Of Middle Managers Benefits For Companies And Employees

May 07, 2025

The Value Of Middle Managers Benefits For Companies And Employees

May 07, 2025 -

142 105 Rout Mitchell And Mobley Fuel Cavaliers Win Against Knicks

May 07, 2025

142 105 Rout Mitchell And Mobley Fuel Cavaliers Win Against Knicks

May 07, 2025 -

Simone Biles Bahamas Trip Black Bikini Photos And Fun In The Sun

May 07, 2025

Simone Biles Bahamas Trip Black Bikini Photos And Fun In The Sun

May 07, 2025 -

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025

Latest Posts

-

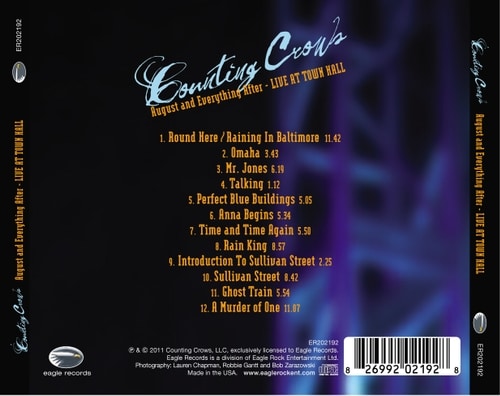

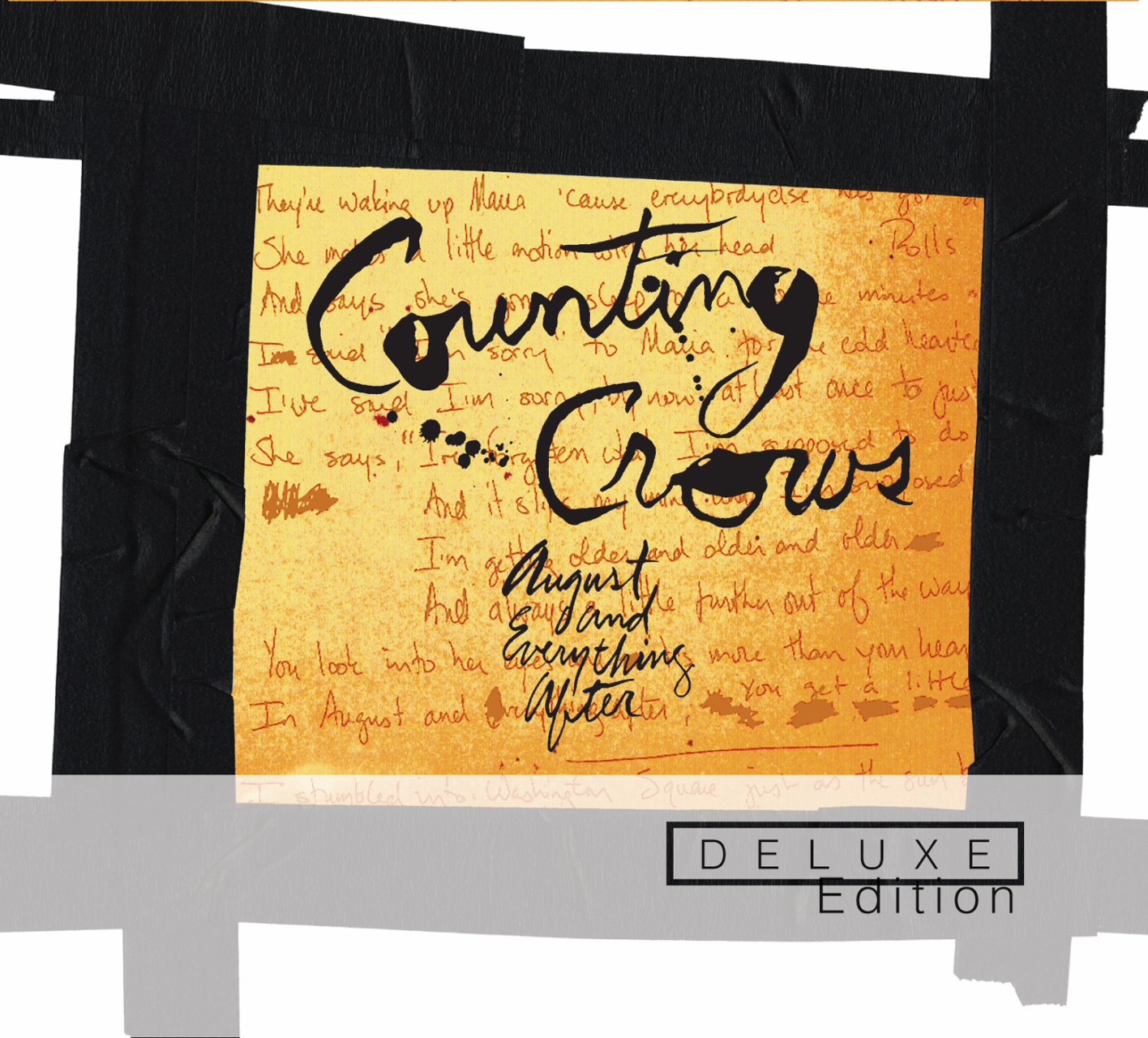

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025 -

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025 -

Counting Crows The Snl Effect And Its Lasting Influence

May 08, 2025

Counting Crows The Snl Effect And Its Lasting Influence

May 08, 2025