Ripple, XRP, And The SEC: Analyzing The Impact Of Recent Developments And ETF Potential

Table of Contents

The Ripple-SEC Lawsuit: A Deep Dive into the Ruling and its Implications

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleged that Ripple had conducted an unregistered securities offering through the sale of XRP. The core of the SEC's argument centered on whether XRP should be classified as a security under the Howey Test, a legal framework used to determine whether an investment contract exists. This classification has massive implications for the trading and regulation of XRP.

The court's partial ruling in July 2023 delivered a mixed verdict. While the judge determined that programmatic sales of XRP on exchanges did not constitute the sale of unregistered securities, it ruled that certain institutional sales did qualify as securities offerings. This nuanced decision created a complex situation, leaving many questions unanswered.

This ruling significantly impacted institutional investors and exchanges. Many exchanges delisted XRP immediately following the initial announcement, reflecting the ongoing regulatory uncertainty. However, some have since re-listed it. The ripple effects (pun intended) are still being felt across the cryptocurrency markets.

- Key arguments: The SEC argued that XRP's distribution and functionality aligned with the characteristics of a security. Ripple countered that XRP is a decentralized, utility token operating independently of Ripple’s actions.

- Judge's reasoning: The judge focused on the different contexts of XRP sales, distinguishing between programmatic sales (considered not securities) and direct sales to institutional investors (considered securities).

- Future legal challenges: Both the SEC and Ripple could appeal aspects of the ruling, prolonging the legal battle and creating sustained uncertainty.

- Impact on XRP price volatility: The ruling caused significant price volatility, initially dropping but later recovering somewhat depending on the interpretation of the ruling and market sentiment.

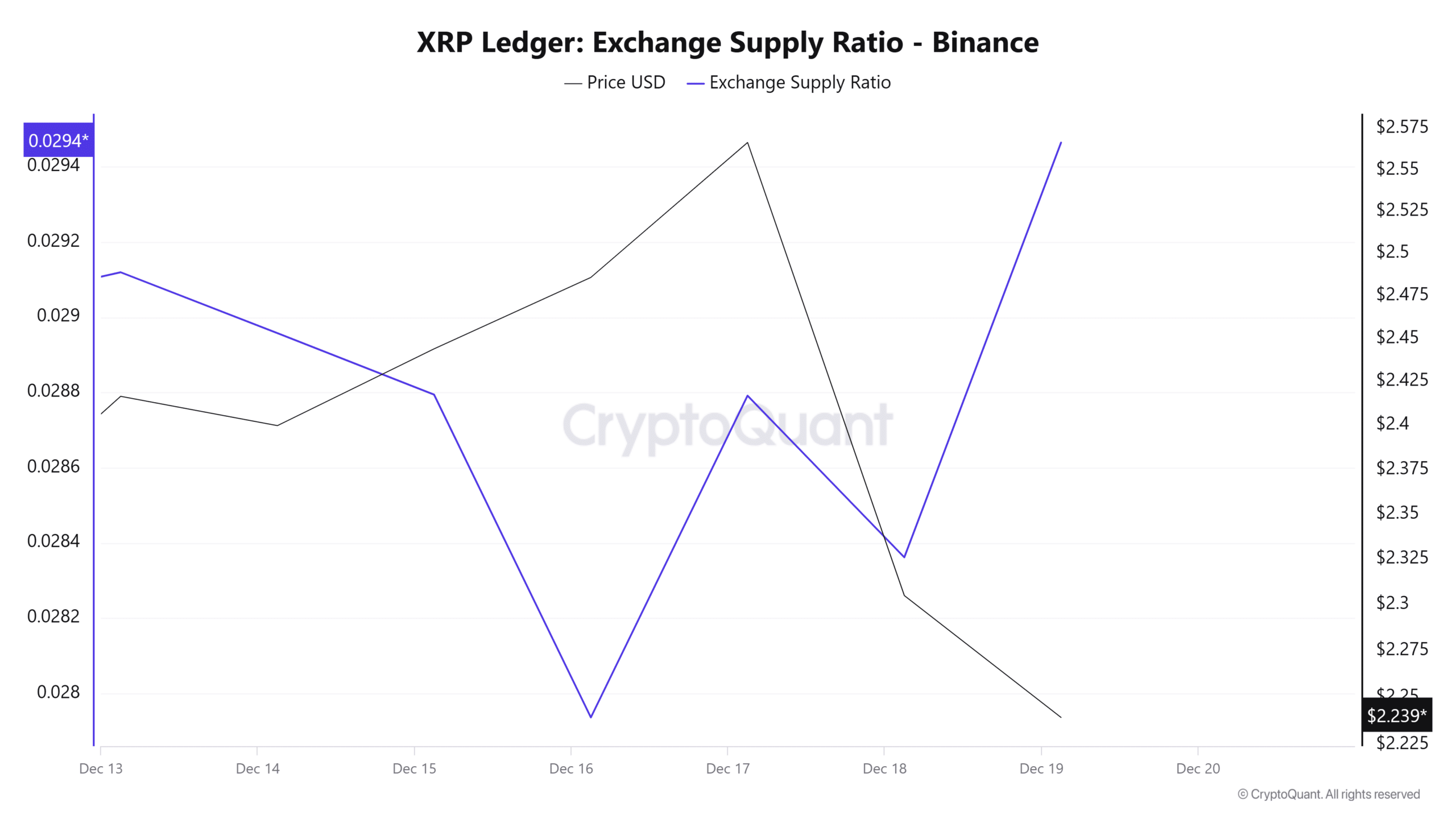

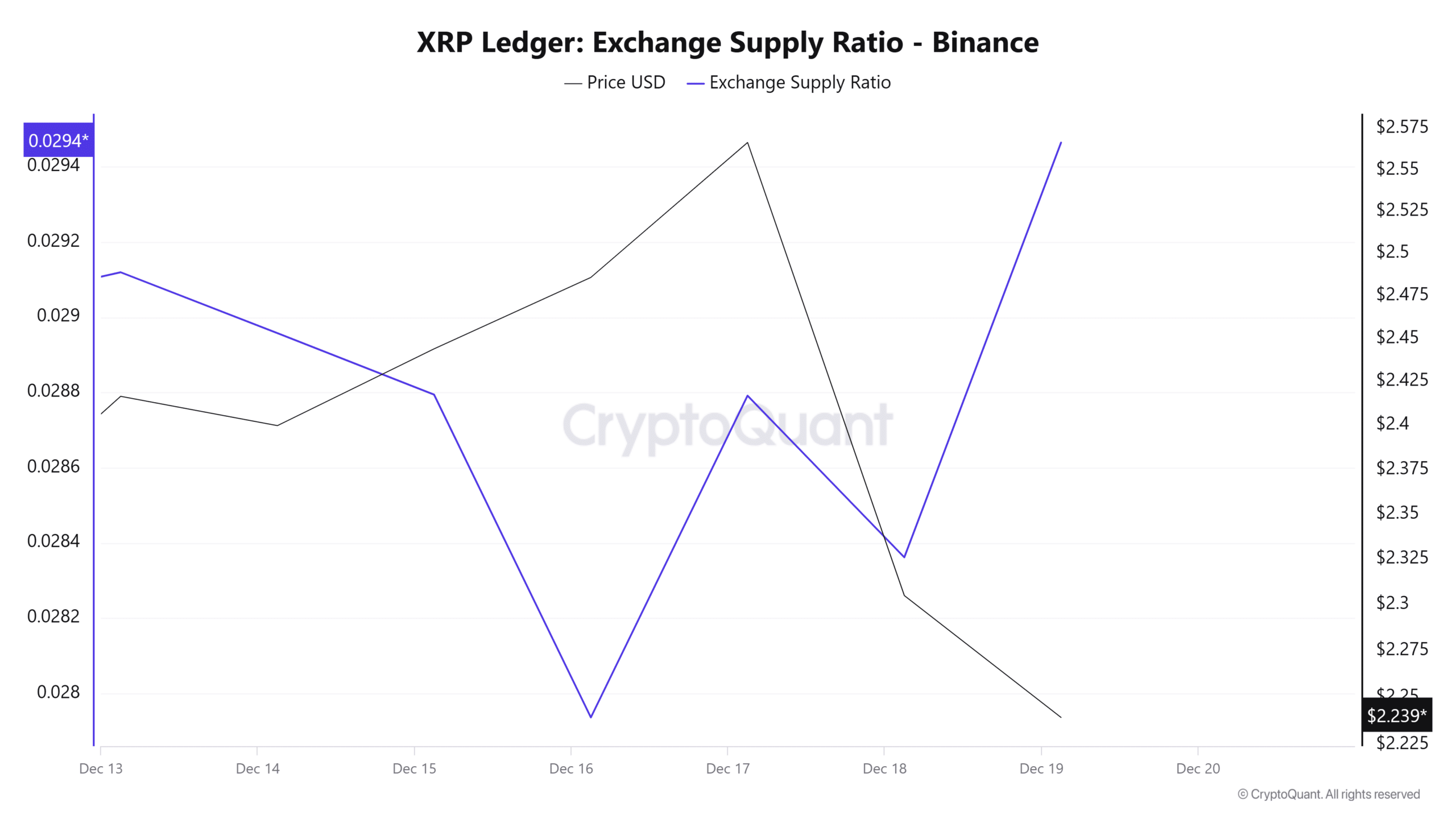

XRP's Market Performance and Future Price Predictions Post-Ruling

XRP's price has experienced dramatic swings since the SEC lawsuit commenced. Initially, the price plummeted. Following the July 2023 ruling, it showed a mixed response with initial volatility before a period of relative stability, reflecting the complex and nuanced nature of the court's decision.

Several factors influence XRP's price, including regulatory uncertainty, the ongoing adoption of XRP for cross-border payments, and overall market sentiment towards cryptocurrencies. The level of institutional investment, driven by the ruling's implications, is another significant factor to consider. Expert opinions and price predictions vary widely, with some analysts expressing cautious optimism while others remain skeptical.

- Price charts: Analyzing XRP's price action over time reveals periods of sharp increases and declines tied to news related to the lawsuit.

- Comparison with other cryptocurrencies: Comparing XRP's price performance with other major cryptocurrencies, such as Bitcoin and Ethereum, helps to gauge its relative strength and volatility.

- Technical analysis: Technical indicators, like moving averages and relative strength index (RSI), can provide insights into short-term price trends.

- Investor confidence: News related to the lawsuit and the overall regulatory environment heavily influences investor confidence, impacting trading volumes and price.

The Potential for an XRP ETF and its Market Impact

An Exchange-Traded Fund (ETF) is an investment fund traded on stock exchanges, providing investors with diversified exposure to a specific asset class. The approval of an XRP ETF would significantly increase its accessibility and liquidity, potentially attracting a broader range of investors.

Given the recent court ruling's complexities, the likelihood of an XRP ETF approval remains uncertain. The SEC will weigh several factors before making a decision. The clarity (or lack thereof) surrounding XRP's regulatory status will play a crucial role. The potential benefits include increased liquidity and mainstream adoption, while the challenges include regulatory hurdles and the risk of market manipulation.

- SEC approval factors: The SEC will consider XRP's regulatory classification, market manipulation risks, and the ETF's overall structure and compliance with securities laws.

- Comparison with other crypto ETFs: Comparing a potential XRP ETF with existing Bitcoin and Ethereum ETFs will highlight its potential advantages and disadvantages.

- Investor benefits: An XRP ETF offers easier access to XRP for investors who may lack the technical expertise to directly invest in cryptocurrencies.

- Challenges and risks: Regulatory uncertainty, market manipulation concerns, and potential for price volatility are significant obstacles to overcome.

Regulatory Landscape and Global Adoption of XRP

The regulatory landscape surrounding cryptocurrencies varies significantly across different jurisdictions. Some countries have embraced a more progressive approach, while others remain highly cautious. These differing regulatory approaches directly affect XRP's adoption and use cases. Ripple Labs has actively worked to foster global acceptance of XRP, partnering with financial institutions worldwide.

- Regulatory comparisons: A comparison of the regulatory frameworks in the US, EU, and Asia reveals varying degrees of clarity and acceptance of cryptocurrencies.

- Ripple's global initiatives: Ripple's efforts in forging partnerships and collaborations with banks and payment processors are crucial for promoting XRP adoption.

- Impact of regulatory clarity: Clearer regulations could stimulate XRP's growth, while uncertainty could hinder its progress.

- Adoption in different sectors: The use of XRP in cross-border payments and remittances is a key driver of its adoption.

Conclusion: The Future of Ripple, XRP, and the SEC: A Call to Action

The Ripple-SEC lawsuit has profoundly impacted the cryptocurrency market, particularly XRP. The partial ruling provides some clarity but also leaves significant uncertainty. The potential for an XRP ETF remains a significant factor shaping its future. The global regulatory landscape will continue to play a crucial role in determining XRP's long-term prospects.

The future of "Ripple, XRP, and the SEC" remains intertwined and uncertain. Staying informed about ongoing legal developments, regulatory changes, and market trends is crucial for making informed investment decisions. Continue researching the complexities of this evolving situation through reputable financial news sources and dedicated cryptocurrency analysis platforms. Understanding the nuances of this ongoing saga will be vital in navigating the ever-changing world of cryptocurrencies.

Featured Posts

-

Naujas Hario Poterio Parkas Sanchajuje Atidarymo Data 2027 Metai

May 02, 2025

Naujas Hario Poterio Parkas Sanchajuje Atidarymo Data 2027 Metai

May 02, 2025 -

Texas Techs Road Win Over Kansas A Game Recap 78 73

May 02, 2025

Texas Techs Road Win Over Kansas A Game Recap 78 73

May 02, 2025 -

Wyjatkowe Wyroznienia Sakiewicz O Solidarnosci I Republice

May 02, 2025

Wyjatkowe Wyroznienia Sakiewicz O Solidarnosci I Republice

May 02, 2025 -

Ponant Agent Program 1 500 Flight Credit For Paul Gauguin Cruise Bookings

May 02, 2025

Ponant Agent Program 1 500 Flight Credit For Paul Gauguin Cruise Bookings

May 02, 2025 -

Kshmyrywn Ke Lye Ansaf Jnwby Ayshyae Ke Mstqbl Ke Lye Klydy Ensr

May 02, 2025

Kshmyrywn Ke Lye Ansaf Jnwby Ayshyae Ke Mstqbl Ke Lye Klydy Ensr

May 02, 2025