Ripple XRP: Can It Overcome Resistance And Hit $3.40?

Table of Contents

Current Market Conditions and XRP's Price Action

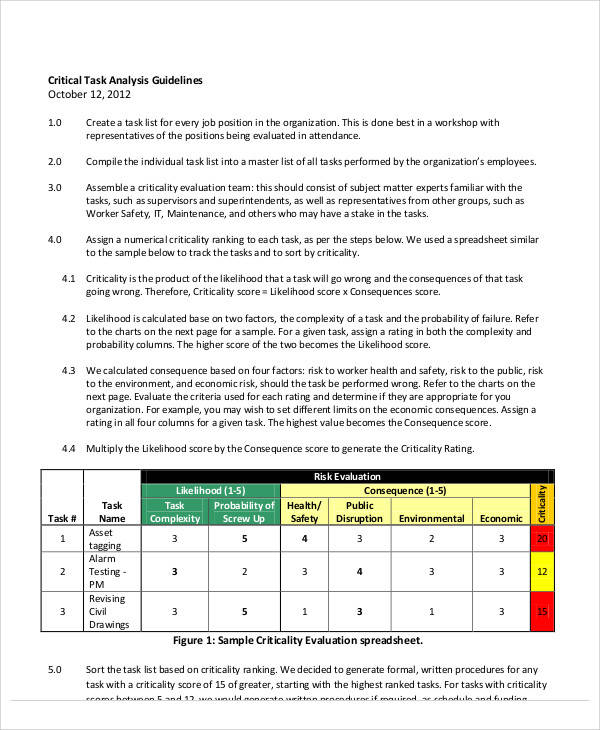

Analyzing XRP's current price and its recent performance is crucial for understanding its potential trajectory. Key support and resistance levels, identified through technical analysis, provide valuable insights. Tools like moving averages (e.g., 50-day, 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) help predict future price movements.

-

XRP Price and Performance: As of [insert current date], XRP is trading at [insert current price]. Recent performance has shown [describe recent price trends – e.g., a period of consolidation, a bullish breakout, a bearish downturn]. This trend needs to be considered in context with broader market movements.

-

Support and Resistance Levels: Technical analysis reveals key support levels around [insert support levels] and resistance levels near [insert resistance levels]. A successful break above the resistance level at [specific resistance level] could signal a significant bullish move. Conversely, failure to break through resistance and a fall below support could signal further price decline.

-

Trading Volume: Observing trading volume is essential. High volume during price increases indicates strong buying pressure and potentially sustainable upward momentum. Conversely, low volume during price increases might suggest weak buying pressure and a potential price reversal. Currently, XRP’s trading volume is [insert current volume data] which suggests [interpret volume in relation to price action].

-

Chart Analysis: [Include a relevant chart showing XRP's price action, support/resistance levels, and relevant indicators like moving averages and RSI. Clearly label the chart and its components.]

Ripple's Legal Battle and its Impact on XRP

The ongoing SEC lawsuit against Ripple is a significant factor influencing XRP's price. The outcome of this legal battle will likely have a profound impact on investor sentiment and the overall price of XRP.

-

SEC Lawsuit and Potential Outcomes: The SEC alleges that XRP is an unregistered security. A favorable ruling for Ripple could lead to increased regulatory clarity, potentially boosting investor confidence and driving up the price. Conversely, an unfavorable ruling could negatively impact XRP's price and market position.

-

Impact of Legal Uncertainty: The ongoing legal uncertainty creates volatility in the XRP market. Investors are hesitant to commit significant capital until the lawsuit's outcome is known. This uncertainty suppresses price appreciation.

-

Regulatory Clarity's Potential Influence: A clear regulatory framework for cryptocurrencies, particularly a positive outcome in the Ripple vs. SEC case, would likely increase institutional investment and broader adoption of XRP.

-

Court Ruling Implications: The court ruling is expected to have a significant impact on the cryptocurrency market as a whole, influencing how other cryptocurrencies are regulated. A positive ruling for Ripple could set a precedent for other similar cases.

Factors that Could Drive XRP to $3.40

Several factors could propel XRP's price towards $3.40. Increased adoption, strategic partnerships, and technological advancements are all potential catalysts.

-

Adoption and Partnerships: Wider adoption by businesses and institutions is essential for significant price appreciation. New partnerships and integrations with payment platforms and financial institutions would increase XRP’s utility and demand.

-

Institutional Investment: Increased institutional investment in XRP would significantly impact its price. Large-scale investments from hedge funds, investment banks, and other financial institutions demonstrate confidence in XRP's long-term potential.

-

Technological Advancements: Improvements to the XRP Ledger, such as enhanced scalability and security features, would make it a more attractive option for businesses and individuals seeking efficient and cost-effective transactions.

-

Positive Market Sentiment: Broader positive sentiment in the cryptocurrency market, along with overall market growth, would likely boost XRP’s price. Positive news within the crypto sector can have a ripple effect.

Obstacles Preventing XRP from Reaching $3.40

Despite the potential for growth, several obstacles could prevent XRP from reaching $3.40. These include regulatory hurdles, market volatility, and competition from other cryptocurrencies.

-

Regulatory Hurdles: Unfavorable regulatory decisions or ongoing uncertainty regarding XRP's regulatory status could stifle its growth and limit price appreciation. Different jurisdictions have varying stances on cryptocurrencies, further complicating things.

-

Market Volatility: The inherent volatility of the cryptocurrency market poses a significant challenge. Sudden market downturns could significantly impact XRP’s price, regardless of underlying fundamentals.

-

Competition: XRP faces stiff competition from other cryptocurrencies vying for market share. The innovation and adoption rates of rival cryptocurrencies influence XRP’s position in the market.

-

Macroeconomic Factors: Broader macroeconomic factors, such as inflation, recessionary fears, or geopolitical instability, could negatively impact investor sentiment and reduce demand for XRP.

Conclusion

This article explored the factors influencing Ripple XRP's price trajectory, examining both its potential to reach $3.40 and the obstacles it faces. The analysis considered market conditions, Ripple's legal battles, potential catalysts, and bearish factors. While reaching $3.40 presents significant challenges, positive developments in the legal sphere, increased adoption, and technological advancements could substantially impact the price. The future price of XRP remains uncertain.

Call to Action: The cryptocurrency market is inherently risky. Before investing in Ripple XRP or any other cryptocurrency, conduct thorough research, diversify your portfolio, and manage your risk effectively. Stay informed about the latest developments regarding Ripple and XRP to make informed decisions about your investment strategy. Continue your research on Ripple XRP and its potential.

Featured Posts

-

The Importance Of Trustworthy Crypto News Sources

May 08, 2025

The Importance Of Trustworthy Crypto News Sources

May 08, 2025 -

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025

Why Middle Managers Matter A Critical Analysis Of Their Impact On Companies And Employees

May 08, 2025 -

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025

Rusya Merkez Bankasi Ndan Kripto Para Uyarisi Yatirimcilar Icin Riskler Neler

May 08, 2025 -

Xrp Rally Analyzing The Impact Of The Presidents Trump Ripple Article

May 08, 2025

Xrp Rally Analyzing The Impact Of The Presidents Trump Ripple Article

May 08, 2025 -

Strengthening Crime Control Urgent Directives And Effective Strategies

May 08, 2025

Strengthening Crime Control Urgent Directives And Effective Strategies

May 08, 2025