Ripple's Dubai License & XRP Price: A $10 Target Realistic?

Table of Contents

Ripple's Dubai Virtual Asset License: A Game Changer?

The issuance of a virtual asset license in Dubai marks a pivotal moment for Ripple. This isn't just another license; it signifies a significant step towards regulatory clarity and legitimacy within a major global financial hub. Dubai's proactive approach to embracing blockchain technology and cryptocurrencies positions it as a leader in the space, attracting significant investment and fostering innovation. Securing this license provides Ripple with:

- Increased legitimacy and trust: Operating under a regulated framework in a prominent jurisdiction like Dubai significantly enhances Ripple's credibility and attracts institutional investors hesitant to engage with unregulated entities. This boosts confidence in Ripple and, consequently, XRP.

- Access to new markets: The Dubai license opens doors to a vast network of investors and partners across the Middle East and beyond. This expansion significantly increases Ripple's potential market reach.

- Strategic partnerships: The license facilitates collaborations with established financial institutions based in Dubai, potentially accelerating the adoption of Ripple's technology for cross-border payments.

- Positive regulatory implications globally: This success in Dubai could influence regulatory decisions in other jurisdictions, potentially paving the way for broader acceptance of Ripple and XRP globally. This positive regulatory environment is crucial for a sustained price increase.

Analyzing the Current XRP Market Sentiment and Price Action

Currently, XRP's price fluctuates based on various factors beyond just the Dubai license. While the license provides positive momentum, several other influences impact the Ripple price prediction. These include the overall crypto market's performance, updates on the ongoing SEC lawsuit, and technical indicators. Let's examine these elements:

- Recent Trading Volume and Market Capitalization: Analyzing recent trading data helps gauge current market interest and overall investor sentiment towards XRP.

- Price Fluctuations: Significant price swings indicate market volatility, influenced by news, market trends, and investor behavior.

- Support and Resistance Levels: Technical analysis of support and resistance levels can provide insights into potential price movements. Breaking through key resistance levels could signal a bullish trend.

- Ongoing Developments: News regarding Ripple's partnerships, technological advancements, and regulatory updates significantly influences XRP's price.

Factors Supporting a Potential $10 XRP Price Target

The possibility of XRP reaching $10 hinges on several bullish factors, including broader adoption of Ripple's technology and a positive shift in the overall cryptocurrency landscape. Here are some key contributors to a potential rise in the Ripple price prediction:

- Increased Institutional Adoption: Growing acceptance of XRP by financial institutions for cross-border payments would substantially increase demand.

- Growing Demand for Efficient Payments: The need for faster, cheaper, and more efficient international payment solutions fuels the demand for Ripple's technology.

- Positive Global Regulatory Developments: Favorable regulatory decisions in key markets beyond Dubai could further propel XRP's growth.

- Expanded Utility and Use Cases: The more applications XRP finds beyond just payments, the more valuable it becomes, potentially driving up its price.

Challenges and Risks Hindering a $10 XRP Price Target

Despite the positive aspects, several challenges could impede XRP's journey to $10. These include regulatory uncertainty and competitive pressures within the cryptocurrency market.

- SEC Lawsuit Uncertainty: The ongoing SEC lawsuit against Ripple creates significant uncertainty. A favorable outcome is crucial for a sustained price increase.

- Competition: The cryptocurrency market is highly competitive. Other cryptocurrencies offering similar services pose a challenge to XRP's dominance.

- Market Volatility: The cryptocurrency market is inherently volatile, susceptible to bear markets and sudden price crashes.

- Regulatory Hurdles: Facing regulatory challenges in other jurisdictions could slow down XRP's global adoption.

Conclusion: Ripple's Dubai License and the $10 XRP Target – A Realistic Outlook?

The Dubai license is undoubtedly a significant development for Ripple, injecting a dose of optimism into the XRP price prediction. However, reaching a $10 price target depends on several factors, both positive and negative. While the license enhances Ripple's legitimacy and access to new markets, the SEC lawsuit and market volatility remain significant hurdles. A balanced perspective acknowledges the potential for substantial growth alongside inherent risks. To reach $10, XRP needs sustained institutional adoption, positive regulatory developments globally, and a bullish overall crypto market. Stay tuned for further updates on Ripple, XRP price predictions, and the ongoing impact of its Dubai license. Conduct thorough research and understand the implications before making any investment decisions related to Ripple and XRP.

Featured Posts

-

School Suspensions Do The Cons Outweigh The Pros

May 02, 2025

School Suspensions Do The Cons Outweigh The Pros

May 02, 2025 -

End Of School Desegregation Order Implications For Education

May 02, 2025

End Of School Desegregation Order Implications For Education

May 02, 2025 -

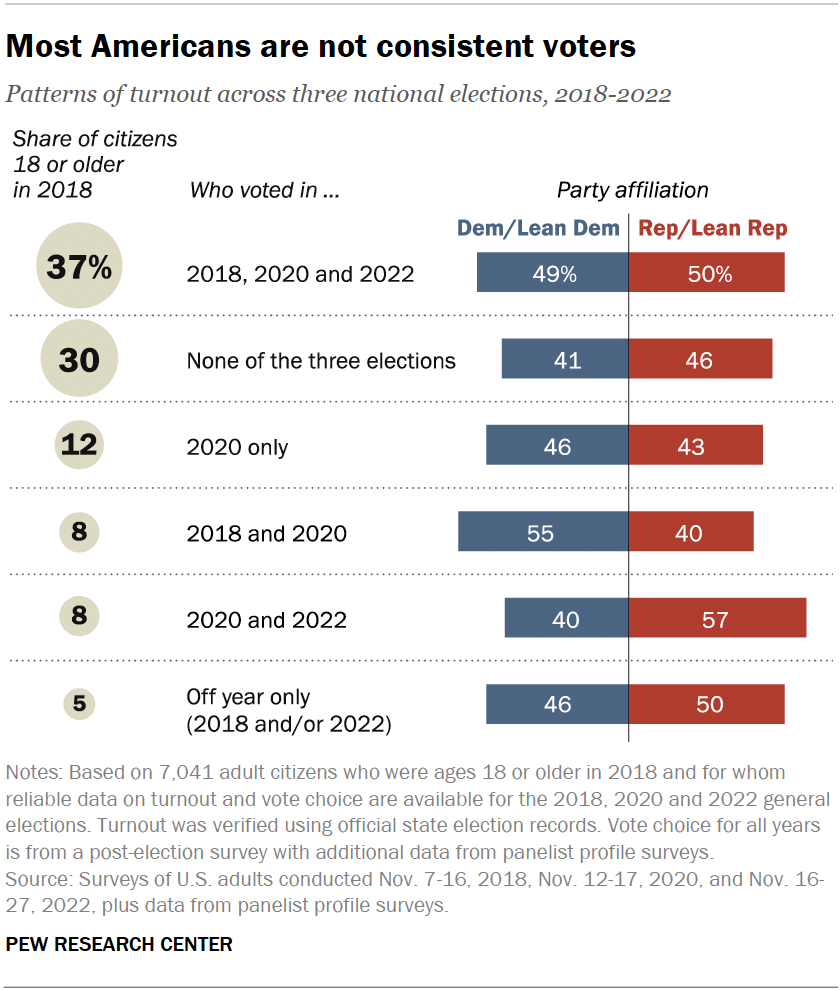

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Political Climate

May 02, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Political Climate

May 02, 2025 -

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 02, 2025

Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Revealed

May 02, 2025 -

Fortnite Rare Skins You Might Never See Again

May 02, 2025

Fortnite Rare Skins You Might Never See Again

May 02, 2025