Ripple's Explosive Growth: A Look At XRP's 15,000% Increase And Investment Implications

Table of Contents

Factors Driving Ripple's Explosive Growth

Several key factors have contributed to Ripple's remarkable growth and the subsequent surge in XRP's value. These include the technological advantages of RippleNet, the increasing adoption by banks and financial institutions, and the evolving regulatory landscape.

Technological Advantages of RippleNet

RippleNet, Ripple's payment network, offers significant advantages over traditional cross-border payment systems. Its blockchain-based technology facilitates faster, cheaper, and more efficient transactions. Key benefits include:

- Speed: RippleNet significantly reduces transaction processing times, often settling payments in seconds compared to days with traditional methods.

- Cost-effectiveness: Lower transaction fees compared to SWIFT and other traditional systems make it a more attractive option for businesses.

- Scalability: The network can handle a high volume of transactions, making it suitable for large-scale global payments.

- Transparency: RippleNet provides greater transparency throughout the payment process, allowing participants to track transactions in real-time.

- Partnerships: Ripple has forged strategic partnerships with major financial institutions globally, accelerating its adoption and solidifying its position in the market. These partnerships demonstrate confidence in RippleNet's capabilities and reliability. Keywords like RippleNet, cross-border payments, blockchain technology, scalability, efficiency, financial institutions, and partnerships highlight the technological core of Ripple's success.

Increasing Adoption by Banks and Financial Institutions

The growing adoption of Ripple's technology by banks and financial institutions is a crucial factor driving XRP's price. Many institutions are turning to RippleNet as a superior alternative to traditional systems.

- Reduced Costs: Banks can significantly reduce their operational costs by using RippleNet's efficient and cost-effective payment solutions.

- Increased Speed: Faster payment processing times lead to improved customer satisfaction and enhanced operational efficiency.

- Improved Security: RippleNet's secure blockchain technology enhances the security of cross-border payments.

- Examples: Several prominent banks, including Santander, SBI Holdings, and many others, have already implemented Ripple's technology for their cross-border payments. This widespread adoption validates Ripple's technology and boosts investor confidence. Relevant keywords here are adoption, banks, financial institutions, partnerships, remittance solutions, and global payments.

Regulatory Developments and Their Impact

The regulatory landscape surrounding Ripple and XRP has significantly influenced its growth trajectory. The ongoing SEC lawsuit against Ripple has created uncertainty, but recent developments suggest a potential path towards clearer regulatory clarity.

- SEC Lawsuit: The SEC lawsuit, alleging that XRP is an unregistered security, impacted XRP's price and adoption.

- Court Decisions: Ongoing legal battles and court decisions directly impact investor sentiment and market behavior.

- Regulatory Clarity: Increased regulatory clarity, regardless of the outcome of the lawsuit, could potentially lead to a significant increase in adoption and price appreciation. Keywords such as SEC lawsuit, Ripple vs SEC, regulatory clarity, legal battles, compliance, and regulatory landscape are crucial for contextualizing this dynamic aspect of XRP's trajectory.

Investment Implications of XRP's Growth

Investing in XRP, like any cryptocurrency, involves substantial risks and potential rewards. Careful analysis is crucial before making any investment decisions.

Assessing the Risks and Rewards of Investing in XRP

XRP's price volatility is a significant risk factor. However, its potential for future growth based on market trends and technological advancements presents a compelling reward.

- Volatility: The cryptocurrency market is known for its volatility, and XRP is no exception. Prices can fluctuate dramatically in short periods.

- Growth Potential: The widespread adoption of RippleNet and potential future use cases for XRP could drive significant price appreciation.

- Risk Management: Investors should diversify their portfolios and only invest what they can afford to lose. Relevant keywords here are risk assessment, volatility, investment strategy, return on investment, portfolio diversification, and risk management.

Comparing XRP to Other Cryptocurrencies

Comparing XRP to other major cryptocurrencies like Bitcoin and Ethereum helps put its potential in perspective.

- Market Capitalization: XRP's market capitalization compared to Bitcoin and Ethereum provides a measure of its relative size and market standing.

- Trading Volume: High trading volume generally indicates higher liquidity and potentially lower price volatility.

- Unique Features: XRP's focus on cross-border payments differentiates it from other cryptocurrencies with broader aims. Keywords include market capitalization, trading volume, Bitcoin, Ethereum, cryptocurrency comparison, and altcoins.

Long-Term Outlook for XRP and Ripple

Ripple's technology has the potential to disrupt the global financial system by offering a more efficient and cost-effective alternative to traditional payment systems.

- Market Disruption: Ripple's long-term success hinges on its ability to gain wider adoption among financial institutions globally.

- Technological Advancements: Further technological advancements could enhance RippleNet's capabilities and expand its use cases beyond cross-border payments.

- Future Use Cases: Potential applications in supply chain management and other sectors could drive future growth. Keywords like future outlook, long-term investment, market disruption, technological innovation, and future use cases help paint a picture of XRP's future.

Conclusion: Investing in Ripple's Future – The XRP Opportunity

Ripple's explosive growth, driven by the technological advantages of RippleNet, increasing adoption by financial institutions, and the evolving regulatory landscape, presents a complex investment scenario. While the potential rewards are significant, the risks associated with cryptocurrency investments, including XRP's volatility, must be carefully considered. Thorough research is paramount before investing in XRP or any other cryptocurrency. Learn more about investing in XRP, explore the potential of Ripple's technology, and assess the investment implications of XRP, but always proceed with caution. Remember key search terms like XRP investment, Ripple investment, cryptocurrency investment, and blockchain investment when conducting your research.

Featured Posts

-

Tabung Baitulmal Sarawak Bantuan Asnaf Sehingga Mac 2025 Rm 36 45 Juta

May 02, 2025

Tabung Baitulmal Sarawak Bantuan Asnaf Sehingga Mac 2025 Rm 36 45 Juta

May 02, 2025 -

Is That Christina Aguilera Fans Question Singers Changed Appearance

May 02, 2025

Is That Christina Aguilera Fans Question Singers Changed Appearance

May 02, 2025 -

To Ypoyrgiko Symvoylio Enekrine Tin Ethniki Stratigiki P Syxikis Ygeias 2025 2028

May 02, 2025

To Ypoyrgiko Symvoylio Enekrine Tin Ethniki Stratigiki P Syxikis Ygeias 2025 2028

May 02, 2025 -

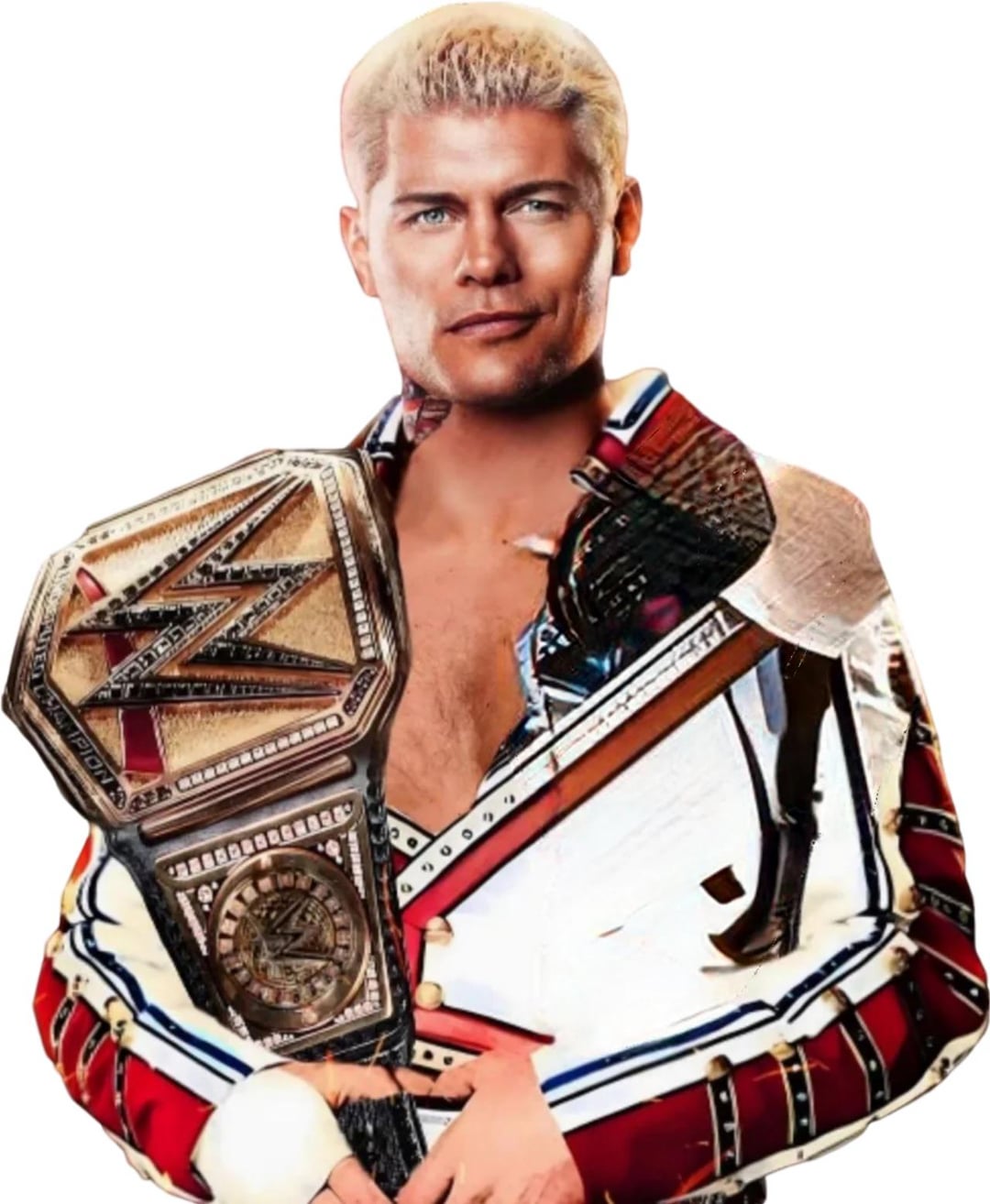

How To Get Wwe Skins In Fortnite Cody Rhodes And The Undertaker Guide

May 02, 2025

How To Get Wwe Skins In Fortnite Cody Rhodes And The Undertaker Guide

May 02, 2025 -

Nrc Health Achieves 1 Best In Klas For Healthcare Experience

May 02, 2025

Nrc Health Achieves 1 Best In Klas For Healthcare Experience

May 02, 2025