Robust Retail Sales Data Pushes Back Against Bank Of Canada Rate Cut Speculation

Table of Contents

Strong Retail Sales Figures: A Detailed Analysis

The latest retail sales data paints a picture of surprising strength in the Canadian economy. Figures released [insert date and source of data] showed a [insert percentage]% increase in retail sales compared to [previous period – month or year]. This significant surge surpasses analyst expectations and signals robust consumer spending despite inflationary pressures. This positive growth is a key economic indicator suggesting a healthier-than-anticipated economic climate.

- Specific examples of strong performing retail sectors: The increase wasn't uniform across all sectors. Durable goods sales saw particularly strong growth at [insert percentage]%, indicating increased consumer confidence in larger purchases. Non-durable goods also experienced a healthy rise of [insert percentage]%, suggesting sustained demand for essential and discretionary items.

- Geographical variations in sales data: While nationwide figures are encouraging, regional variations may exist. [Insert data on regional variations if available, e.g., stronger sales in Ontario compared to weaker performance in Atlantic Canada].

- Comparison to previous periods: The [insert percentage]% growth represents a significant improvement compared to the [insert percentage]% growth recorded in [previous period]. This month-over-month and year-over-year growth reflects a consistent upward trend in consumer spending.

This strong performance underscores the resilience of the Canadian consumer and fuels optimism regarding the overall health of the retail sector. The robust sales growth directly impacts key economic indicators, suggesting sustained economic expansion.

Impact on Bank of Canada's Monetary Policy Decisions

The Bank of Canada's primary mandate is to maintain price stability and full employment. Strong retail sales data directly influences their assessment of the current economic climate and its alignment with these objectives. The robust consumer spending suggests a resilient economy less susceptible to immediate downturns, lessening the urgency for a rate cut.

- Explanation of how inflation and retail sales data are interconnected: While high inflation remains a concern, strong retail sales, in the context of stable employment, could indicate that the economy can handle higher interest rates without significant negative consequences. The BoC will closely examine whether robust sales are driving further inflationary pressures.

- Discussion of the Bank of Canada's inflation targets: The BoC's inflation target is [insert target percentage]%. The current rate of inflation is [insert current rate]. Strong retail sales, if not accompanied by wage growth and further inflationary pressures, could bring inflation closer to the target range.

- Analysis of any statements made by the Bank of Canada officials regarding retail sales data: [Insert any relevant statements made by BoC officials regarding their assessment of retail sales and its implications for monetary policy].

Considering the current data, scenarios of maintaining the current interest rate, or even potential future hikes, become more plausible than an imminent rate cut. The strong retail sales figures provide the BoC with room to maneuver, potentially delaying any rate cut decisions.

Counteracting Rate Cut Speculation: Market Reactions

The release of the unexpectedly strong retail sales data sent ripples through the financial markets. The initial market response was largely positive, reflecting improved investor sentiment and a reassessment of the economic outlook.

- Specific examples of market reactions: The Canadian dollar strengthened slightly against other major currencies following the data release. Bond yields also showed a modest increase, reflecting a reduced expectation of rate cuts.

- Quotes from financial analysts about the impact of retail sales data: [Insert quotes from relevant financial analysts and economists discussing the impact of strong retail sales on rate cut expectations].

- Mention of any revisions to economic forecasts by reputable institutions: Many financial institutions have revised their economic forecasts upwards in response to the strong retail sales data, further diminishing the likelihood of an immediate rate cut.

This shift in market sentiment underscores the significant influence of robust retail sales data on investor expectations and the broader economic outlook. The data has effectively countered the prevailing narrative of imminent rate cuts, pushing back the timeline for any potential easing of monetary policy.

Conclusion: Retail Sales Data and the Future of Interest Rates

The unexpectedly strong retail sales figures have significantly altered the landscape of Bank of Canada interest rate speculation. The robust data suggests a resilient Canadian economy capable of withstanding current interest rates, weakening the case for an imminent rate cut. Market reactions have mirrored this shift, reflecting a more optimistic outlook. The strong performance of the retail sector serves as a crucial economic indicator, offering valuable insights into the health and resilience of the Canadian economy.

The robust retail sales data indicates a more complex picture than previously anticipated. While inflation remains a concern, the strength of consumer spending suggests the economy possesses considerable resilience. To understand the future trajectory of Canadian interest rates, it's crucial to remain informed about upcoming retail sales data and the Bank of Canada's subsequent announcements. Keeping a close eye on robust retail sales data and Bank of Canada interest rates will be vital for navigating the evolving economic landscape and making informed financial decisions.

Featured Posts

-

Fin De La Semaine Des 5 Heures La Rtbf Precise Sa Decision

May 26, 2025

Fin De La Semaine Des 5 Heures La Rtbf Precise Sa Decision

May 26, 2025 -

L Affaire Qui A Change Le Destin De Marine Le Pen

May 26, 2025

L Affaire Qui A Change Le Destin De Marine Le Pen

May 26, 2025 -

Ex Israeli Soldiers Plea Free Gaza Captives

May 26, 2025

Ex Israeli Soldiers Plea Free Gaza Captives

May 26, 2025 -

Top Nike Running Shoes 2025 Reviews And Buying Guide

May 26, 2025

Top Nike Running Shoes 2025 Reviews And Buying Guide

May 26, 2025 -

The 40 F1 Driver A Retrospective On Careers Extended

May 26, 2025

The 40 F1 Driver A Retrospective On Careers Extended

May 26, 2025

Latest Posts

-

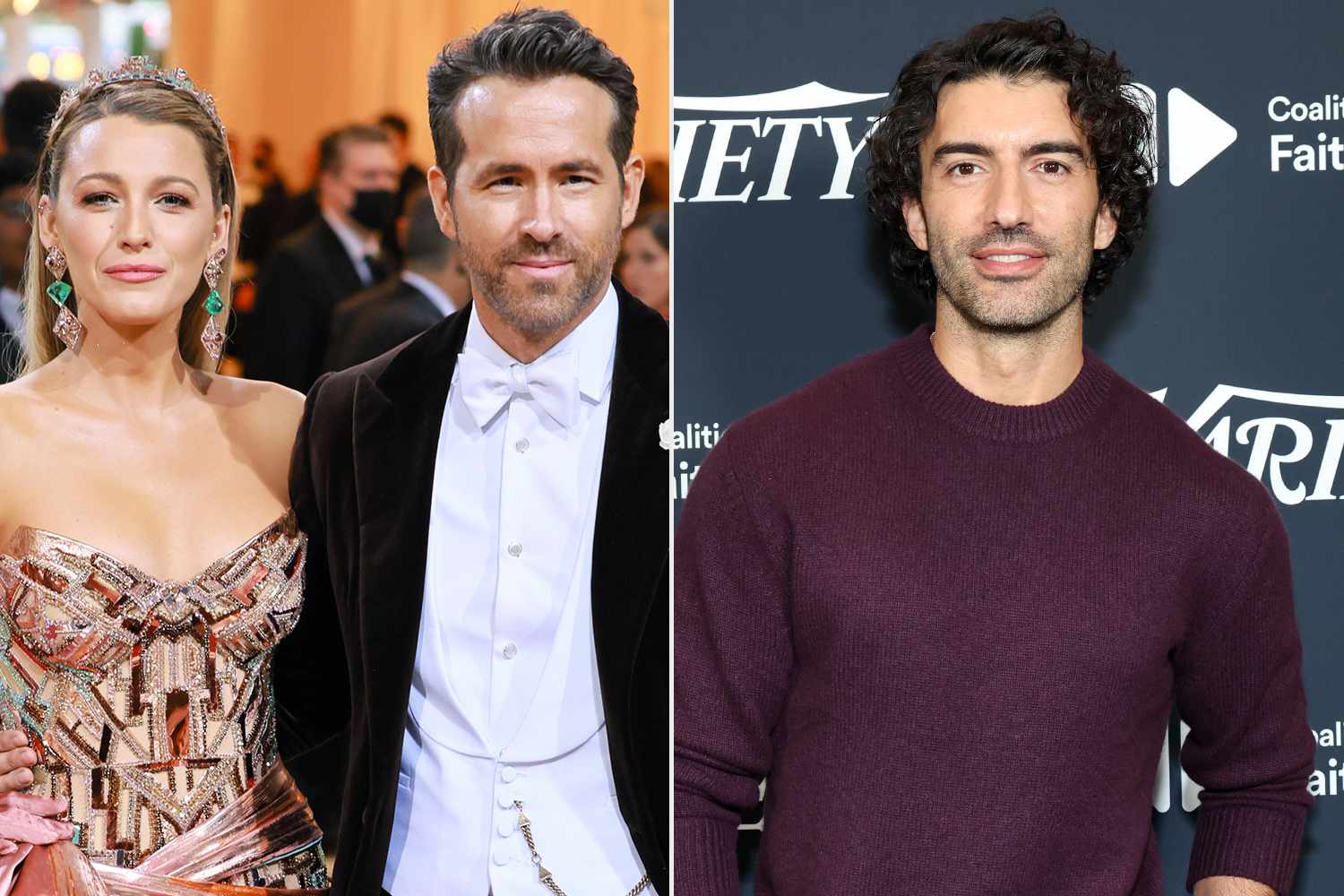

Legal Battle Blake Livelys Response To Reynolds And Swift Subpoena

May 28, 2025

Legal Battle Blake Livelys Response To Reynolds And Swift Subpoena

May 28, 2025 -

Blake Livelys Legal Team Challenges Subpoena From Ryan Reynolds And Taylor Swift

May 28, 2025

Blake Livelys Legal Team Challenges Subpoena From Ryan Reynolds And Taylor Swift

May 28, 2025 -

Blake Livelys Lawyer Responds To Ryan Reynolds And Taylor Swift Subpoena

May 28, 2025

Blake Livelys Lawyer Responds To Ryan Reynolds And Taylor Swift Subpoena

May 28, 2025 -

Time100 Gala Blake Lively And Ryan Reynolds Pose Together Despite Lawsuit

May 28, 2025

Time100 Gala Blake Lively And Ryan Reynolds Pose Together Despite Lawsuit

May 28, 2025 -

Ryan Reynolds And Blake Livelys Joint Time100 Gala Appearance Amid Legal Battle

May 28, 2025

Ryan Reynolds And Blake Livelys Joint Time100 Gala Appearance Amid Legal Battle

May 28, 2025