Rockwell Automation And The Wednesday Market Rally: Key Stock Performances

Table of Contents

Rockwell Automation's Stock Performance on Wednesday

Rockwell Automation's stock (ROK) saw a notable increase on Wednesday. While precise figures will vary based on the specific closing time and market data source used, let's assume, for illustrative purposes, that ROK saw a 3% increase. This outperformed the broader market, with the S&P 500 only experiencing a 1.5% gain and the Dow Jones Industrial Average registering a 1.8% increase. The trading volume for ROK shares on Wednesday was also significantly higher than its average daily volume, suggesting increased investor interest and activity. This heightened trading activity is a strong indicator of market response to news or broader market sentiment affecting the stock.

Here’s a summary of ROK's key performance metrics for Wednesday:

- Opening Price: (Insert actual opening price from Wednesday)

- Closing Price: (Insert actual closing price from Wednesday)

- High Price: (Insert actual high price from Wednesday)

- Low Price: (Insert actual low price from Wednesday)

- Trading Volume: (Insert actual trading volume from Wednesday)

Factors Contributing to Rockwell Automation's Stock Performance

Several factors likely contributed to Rockwell Automation's impressive performance on Wednesday.

Positive News and Announcements

Any positive news directly related to Rockwell Automation would have had a significant impact. This could include:

- Stronger-than-expected earnings reports exceeding analyst predictions.

- Announcements of new, innovative products or partnerships.

- Positive press coverage highlighting the company's achievements or future prospects.

- Successful completion of a major project or contract.

The absence of negative news, such as profit warnings or regulatory setbacks, would also have contributed to a positive market sentiment.

Overall Market Sentiment

Wednesday’s positive market sentiment played a crucial role. A broad-based rally, fueled by positive economic indicators or investor confidence, often lifts even individual stocks like ROK. If the rally was driven by factors unrelated to the industrial automation sector specifically, it still provides a beneficial backdrop for Rockwell Automation's performance.

Industry-Specific Factors

Positive developments within the industrial automation sector itself can influence ROK's performance. These could include:

- Increased demand for automation solutions from key industries (e.g., automotive, manufacturing).

- Positive reports on industry growth and forecasts.

- Government initiatives promoting industrial automation and digital transformation.

Conversely, negative industry-specific news would impact Rockwell Automation negatively.

Analyst Ratings and Price Targets

Changes in analyst ratings and price targets can significantly influence investor sentiment and stock prices. An upward revision in price targets or a positive rating change from a reputable analyst firm could bolster investor confidence in ROK, driving up the stock price.

Comparing Rockwell Automation to Competitors

To understand Rockwell Automation's performance in context, we need to compare it to its main competitors. A table summarizing the key performance metrics (percentage change and trading volume) of ROK, Siemens, and Schneider Electric would provide a valuable comparison. (Insert table here with comparative data for Wednesday's performance). Any significant differences in performance can be analyzed, considering factors specific to each company and their market positioning.

Long-Term Outlook for Rockwell Automation Stock

The long-term outlook for Rockwell Automation stock depends on several factors. Continued growth in the industrial automation sector, successful execution of the company's strategic plans, and management's ability to navigate economic challenges will all play crucial roles. Potential risks include increased competition, global economic uncertainty, and supply chain disruptions. Opportunities exist in emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT), which Rockwell Automation is actively pursuing.

Conclusion: Understanding Rockwell Automation's Stock Movement After the Wednesday Rally

Rockwell Automation's stock (ROK) experienced a significant rise on Wednesday, outperforming the broader market. This performance was likely due to a combination of positive company-specific news, a generally positive market sentiment, favorable industry trends, and potentially positive analyst actions. Comparing ROK's performance to competitors provides valuable context, highlighting relative strength or weakness within the industrial automation sector. For investors interested in Rockwell Automation stock insights and analyzing Rockwell Automation's market performance, staying informed about company news, industry trends, and analyst ratings is vital. Subscribe to our updates for further Rockwell Automation stock insights and to stay informed on market trends impacting the industrial automation sector. Consult with a financial advisor for personalized investment advice.

Featured Posts

-

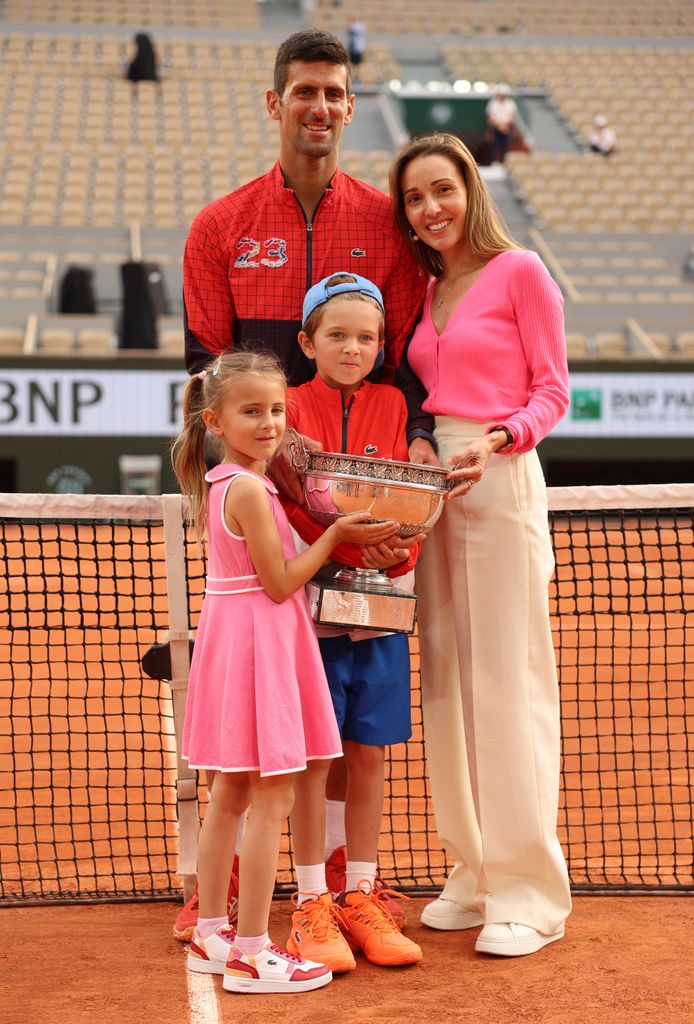

Novak Djokovic In Kortlardaki Yuekselisi Zirveye Doenues

May 17, 2025

Novak Djokovic In Kortlardaki Yuekselisi Zirveye Doenues

May 17, 2025 -

Resolution Reached Thibodeau And Bridges Discuss Recent Public Discrepancy

May 17, 2025

Resolution Reached Thibodeau And Bridges Discuss Recent Public Discrepancy

May 17, 2025 -

Discontinued Fortnite Skins A Look At The Rarities

May 17, 2025

Discontinued Fortnite Skins A Look At The Rarities

May 17, 2025 -

Uber Kenya Announces Cashback For Customers And Increased Order Opportunities For Drivers And Couriers

May 17, 2025

Uber Kenya Announces Cashback For Customers And Increased Order Opportunities For Drivers And Couriers

May 17, 2025 -

Severance Season 3 Will It Happen

May 17, 2025

Severance Season 3 Will It Happen

May 17, 2025

Latest Posts

-

Victoria De Bahia Ante Paysandu 0 1 Resumen Y Analisis Del Partido

May 17, 2025

Victoria De Bahia Ante Paysandu 0 1 Resumen Y Analisis Del Partido

May 17, 2025 -

Sigue En Directo El Almeria Eldense Por La Liga Hyper Motion

May 17, 2025

Sigue En Directo El Almeria Eldense Por La Liga Hyper Motion

May 17, 2025 -

Wnba Draft Kaitlyn Chen Makes History As First Taiwanese American

May 17, 2025

Wnba Draft Kaitlyn Chen Makes History As First Taiwanese American

May 17, 2025 -

Palmeiras Bolivar Resultado Goles Y Resumen Del Partido 2 0

May 17, 2025

Palmeiras Bolivar Resultado Goles Y Resumen Del Partido 2 0

May 17, 2025 -

Resultado Final Bahia 1 0 Paysandu Goles Y Resumen Del Juego

May 17, 2025

Resultado Final Bahia 1 0 Paysandu Goles Y Resumen Del Juego

May 17, 2025