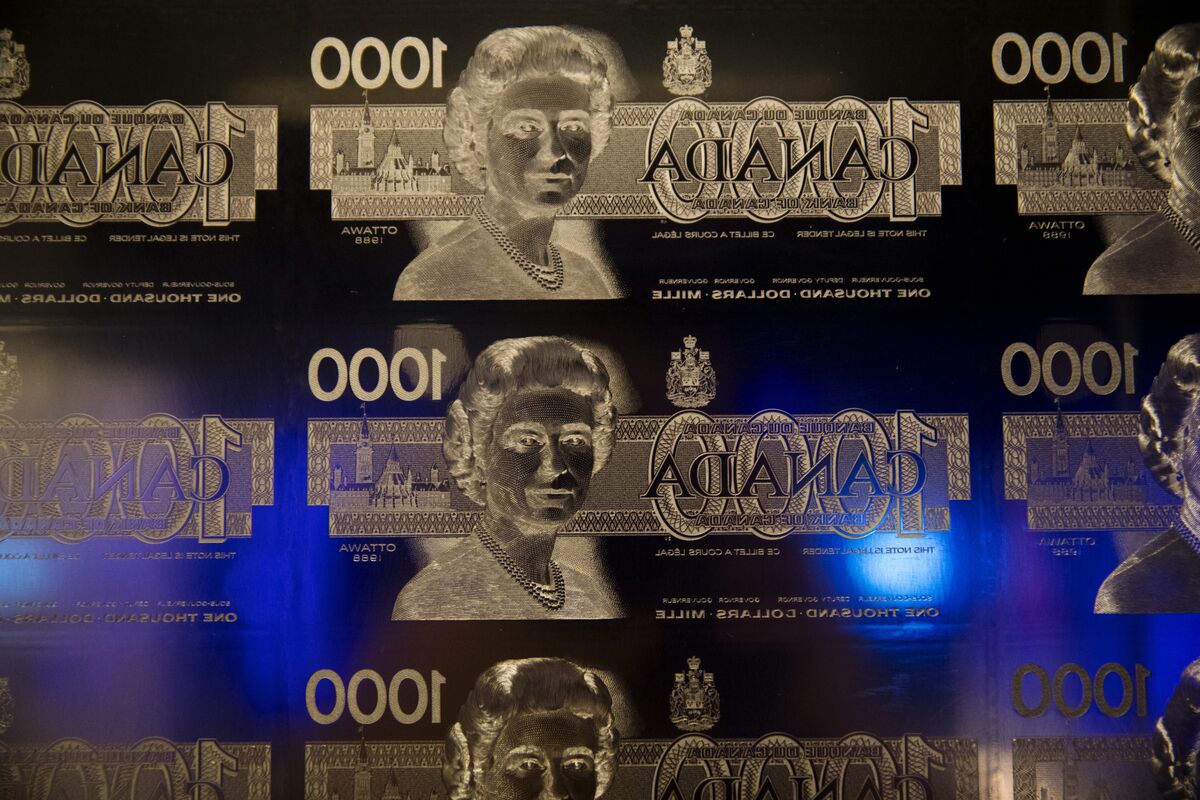

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistakes

Table of Contents

Rosenberg's Key Criticisms of the Bank of Canada's Approach

Rosenberg's central argument revolves around the Bank of Canada's aggressive interest rate hikes and quantitative tightening measures implemented in response to rising inflation. He contends that these actions were both premature and excessively forceful, ultimately jeopardizing economic stability.

-

Specific examples of policy decisions Rosenberg criticizes: Rosenberg points to the rapid succession of interest rate increases in 2022 and the speed at which quantitative tightening was implemented as key examples of flawed policy. He argues that these moves failed to adequately account for the complex interplay of global economic factors and the unique characteristics of the Canadian economy.

-

Economic indicators Rosenberg points to as evidence of policy errors: Rosenberg highlights the persistent strength of the Canadian dollar, despite the aggressive rate hikes, as evidence that the Bank of Canada overestimated the impact of its actions on inflation. He also cites concerns about rising unemployment and a potential housing market crash as indicators of an overly restrictive monetary policy.

-

Rosenberg's predicted consequences of the Bank's actions: Rosenberg predicts that the Bank of Canada's actions will lead to a significant economic slowdown, potentially tipping the Canadian economy into a recession. He further warns of rising job losses and increased financial instability as a result of these policy missteps. He believes a softer approach, acknowledging the lagging nature of monetary policy, would have been more effective.

Analysis of the Bank of Canada's Response (or Lack Thereof)

The Bank of Canada has, to date, largely maintained its position on the necessity of its aggressive monetary policy. While acknowledging the challenges faced by the Canadian economy, they have emphasized the paramount importance of controlling inflation.

-

Quotes from Bank of Canada officials addressing the issues raised by Rosenberg: While no direct response to Rosenberg's specific criticisms has been publicly issued, the Bank's Governor and other officials have reiterated their commitment to achieving the 2% inflation target and have defended the necessity of the measures taken.

-

Analysis of the Bank's justification for its policy decisions: The Bank has consistently cited elevated inflation rates and concerns about inflation expectations as the primary justifications for their actions. They argue that swift and decisive action was necessary to prevent inflation from becoming entrenched.

-

Comparison of the Bank's statements with independent economic analyses: Independent economic analyses are varied, with some supporting the Bank's aggressive approach, others questioning its effectiveness, and still others echoing Rosenberg's concerns about the potential for economic harm. This divergence of opinions highlights the complexity of the situation and the inherent uncertainties involved in monetary policy decision-making.

Alternative Perspectives and Expert Opinions on Canadian Monetary Policy

The debate surrounding the Bank of Canada's monetary policy is far from one-sided. Many economists believe the Bank’s actions were necessary given the unprecedented inflationary pressures.

-

Opinions supporting the Bank of Canada's approach: Supporters of the Bank's stance emphasize the importance of maintaining credibility and preventing a wage-price spiral, arguing that the potential short-term pain is outweighed by the long-term benefits of stable prices.

-

Opinions that partially agree or disagree with Rosenberg's assessment: Some economists agree with Rosenberg's concerns about the potential for economic damage, while also acknowledging the need for decisive action to combat inflation. These analysts often advocate for a more nuanced approach, potentially involving a slower pace of tightening or a greater focus on targeted measures.

-

Discussion of different economic models and their implications: The varying perspectives often stem from differences in underlying economic models and assumptions about the responsiveness of the economy to monetary policy changes. Different models yield different predictions about the likely impact of interest rate hikes and quantitative tightening.

The Impact on the Canadian Economy – Short and Long Term

The potential consequences of the Bank of Canada's monetary policy decisions extend across various sectors of the Canadian economy.

-

Impact on inflation and consumer prices: While inflation has begun to moderate, it remains a significant concern. The Bank of Canada's actions are expected to further curb inflation, albeit at a cost.

-

Impact on employment and the job market: The tighter monetary policy may lead to increased unemployment as businesses cut back on investment and hiring in response to higher borrowing costs.

-

Impact on the housing market and overall economic growth: The housing market, already showing signs of weakness, is particularly vulnerable to rising interest rates. A significant slowdown in housing activity could have ripple effects throughout the economy.

Conclusion

David Rosenberg's critique of the Bank of Canada's monetary policy raises serious questions about the effectiveness and potential consequences of the Bank's recent decisions. While the Bank maintains its position, significant disagreements persist amongst economists, highlighting the complexities and inherent uncertainties in managing monetary policy. The potential for economic slowdown, job losses, and a housing market correction are real possibilities. Understanding the potential short and long-term effects of these alleged Bank of Canada monetary policy mistakes is crucial.

To form your own informed opinion, we encourage you to delve deeper. Research the Bank of Canada's official statements [link to Bank of Canada website], read analyses from reputable financial news outlets [link to relevant news sources], and engage in critical thinking around the different perspectives presented. Understanding the complexities of the Bank of Canada’s monetary policy and the ongoing debate surrounding potential mistakes is crucial for every Canadian citizen.

Featured Posts

-

Quinoas New Rival Discover The Latest It Crop

Apr 29, 2025

Quinoas New Rival Discover The Latest It Crop

Apr 29, 2025 -

Increased Data Center Capacity In Negeri Sembilan Malaysia

Apr 29, 2025

Increased Data Center Capacity In Negeri Sembilan Malaysia

Apr 29, 2025 -

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025

Seven Tech Titans A 2 5 Trillion Market Value Plunge In 2024

Apr 29, 2025 -

Alberto Ardila Olivares Estrategia Para La Garantia De Gol

Apr 29, 2025

Alberto Ardila Olivares Estrategia Para La Garantia De Gol

Apr 29, 2025 -

Is Kevin Bacon Returning For Tremor 2 On Netflix Exploring The Rumors

Apr 29, 2025

Is Kevin Bacon Returning For Tremor 2 On Netflix Exploring The Rumors

Apr 29, 2025

Latest Posts

-

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025 -

Family Appeals For Information On Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025

Family Appeals For Information On Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025 -

Concern Grows For Missing British Paralympian In Las Vegas

Apr 29, 2025

Concern Grows For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian

Apr 29, 2025 -

Appeal For Information British Paralympian Sam Ruddock Missing In Las Vegas

Apr 29, 2025

Appeal For Information British Paralympian Sam Ruddock Missing In Las Vegas

Apr 29, 2025