Ryanair: Tariff Wars Pose Biggest Threat To Growth, Announces Share Buyback

Table of Contents

Tariff Wars: The Looming Threat to Ryanair's Profitability

Fuel Costs and Price Volatility

The direct impact of fluctuating fuel prices on Ryanair's operational costs and profitability is undeniable. Tariff disputes significantly affect global oil prices, directly impacting jet fuel costs. Recent price spikes have already squeezed Ryanair's profit margins.

- Example 1: The recent increase in oil prices due to geopolitical instability resulted in a X% increase in jet fuel costs for Ryanair in Q[Quarter] [Year].

- Example 2: A similar situation occurred in [Year] leading to a Y% decrease in profit margins.

- Ryanair employs hedging strategies to mitigate some of this risk, but these strategies are not foolproof and cannot completely eliminate the volatility inherent in global oil markets. Effective hedging requires accurate forecasting, which is challenging in the current geopolitical climate.

Potential Impact on Passenger Numbers

Tariffs can indirectly impact Ryanair's passenger numbers. Higher fuel costs, resulting from tariff wars, inevitably lead to increased airfares. This can negatively affect consumer confidence and reduce the number of passengers willing to fly.

- Increased airfares may deter price-sensitive leisure travelers, impacting tourism.

- Business travel may also be affected, as companies seek to reduce expenses in times of economic uncertainty.

- Consumers might shift to alternative transport methods such as trains or buses, especially for shorter distances, if airfares become significantly higher.

Ryanair's Strategic Response: The Share Buyback

Details of the Buyback Program

Ryanair recently announced a €[Amount] share buyback program. This program is scheduled to run for [Duration] and aims to repurchase [Number] of its own shares. The rationale behind the buyback is twofold: returning value to shareholders and signaling confidence in the company's long-term prospects.

- The total amount allocated to the share buyback represents a significant investment in shareholder returns.

- The duration of the program suggests Ryanair's commitment to this strategy, regardless of short-term market fluctuations.

- The buyback is intended to boost investor confidence and potentially increase the company's share price.

Assessing the Effectiveness of the Buyback

The effectiveness of the share buyback as a countermeasure to the challenges posed by tariff wars is debatable. While returning value to shareholders is positive, it doesn't directly address the underlying issue of volatile fuel prices and potentially reduced passenger numbers.

- The share buyback alone may not be sufficient to counteract the negative impact of sustained high fuel costs.

- Alternative strategies, such as exploring alternative fuels, negotiating better fuel contracts, or implementing aggressive cost-cutting measures, might have been considered alongside the buyback.

- The long-term implications of the buyback on Ryanair's financial health depend on the overall market conditions and the airline's ability to mitigate the risks associated with tariff wars.

Future Outlook for Ryanair: Navigating Uncertainty

Analyzing the Risk Factors

Beyond tariff wars, Ryanair faces several other significant risk factors. Brexit continues to present uncertainties regarding trade and travel regulations. Economic downturns can significantly reduce travel demand. Intense competition from other low-cost and full-service airlines puts pressure on pricing and market share. Furthermore, potential pilot strikes can cause considerable operational disruption.

- Brexit's lingering effects on air travel regulations pose significant uncertainties.

- An economic downturn could severely impact Ryanair's passenger numbers, especially its price-sensitive customer base.

- Competition from established players and new entrants in the low-cost airline market is fierce.

- Pilot strikes can lead to significant flight cancellations, damaging the airline's reputation and causing financial losses.

Predictions and Potential Mitigation Strategies

Predicting the future for Ryanair is challenging, but several scenarios are possible. A prolonged period of high fuel prices could squeeze profit margins significantly. Conversely, a resolution to global trade tensions could alleviate some of the pressure. Ryanair's response will depend on its ability to adapt to the changing market conditions.

- Route diversification can spread risk and tap into new markets less susceptible to economic downturns.

- Fleet optimization, such as investing in more fuel-efficient aircraft, can significantly reduce operational costs.

- Aggressive cost-cutting measures may be necessary to maintain profitability in a challenging environment.

Conclusion

Ryanair's significant growth is threatened by tariff wars impacting fuel costs and potentially passenger numbers. The airline's share buyback program is a strategic response, but its long-term effectiveness against these external pressures remains to be seen. Future prospects depend on navigating various economic and geopolitical risks. Stay informed about the evolving impact of tariff wars on Ryanair and other airlines. Follow our updates for further analysis of the Ryanair situation and its implications for the future of low-cost air travel. Continue reading about the latest developments concerning Ryanair and its response to the current challenges.

Featured Posts

-

Breaking Israel Lifts Food Blockade On Gaza

May 21, 2025

Breaking Israel Lifts Food Blockade On Gaza

May 21, 2025 -

Detroit Tigers 8 6 Victory Over Rockies A Closer Look

May 21, 2025

Detroit Tigers 8 6 Victory Over Rockies A Closer Look

May 21, 2025 -

Bmw And Porsche In China Market Difficulties And Future Outlook

May 21, 2025

Bmw And Porsche In China Market Difficulties And Future Outlook

May 21, 2025 -

The Goldbergs Behind The Scenes Look At The Hit Tv Show

May 21, 2025

The Goldbergs Behind The Scenes Look At The Hit Tv Show

May 21, 2025 -

Arne Slot On Liverpools Luck Luis Enriques Alisson Assessment

May 21, 2025

Arne Slot On Liverpools Luck Luis Enriques Alisson Assessment

May 21, 2025

Latest Posts

-

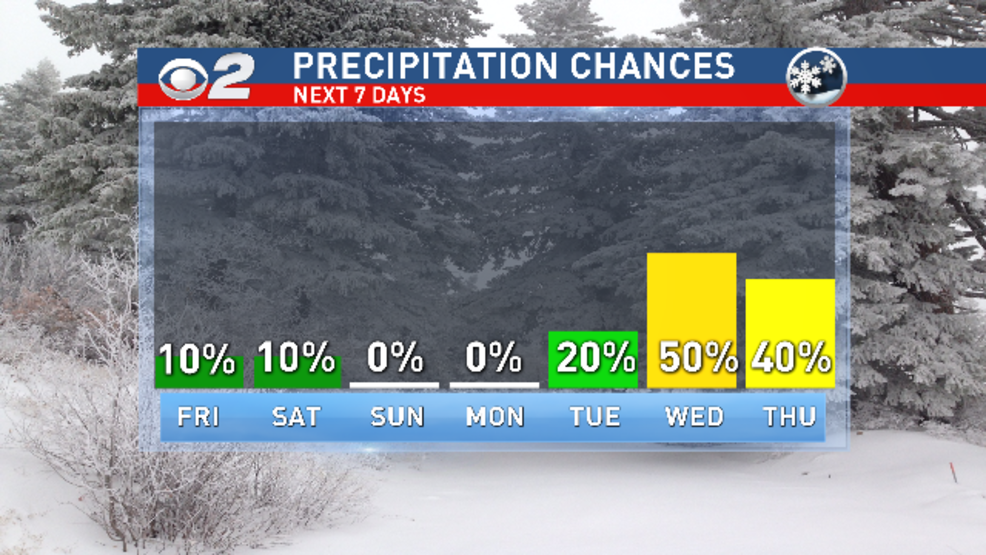

Drier Weather Ahead Tips For Conservation And Safety

May 21, 2025

Drier Weather Ahead Tips For Conservation And Safety

May 21, 2025 -

Understanding And Preparing For A Wintry Mix Of Precipitation

May 21, 2025

Understanding And Preparing For A Wintry Mix Of Precipitation

May 21, 2025 -

Preparing Your Home And Garden For Drier Weather

May 21, 2025

Preparing Your Home And Garden For Drier Weather

May 21, 2025 -

Preparing For A Wintry Mix Of Rain And Snow

May 21, 2025

Preparing For A Wintry Mix Of Rain And Snow

May 21, 2025 -

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025