Ryanair's Growth Outlook Dampened By Tariff Disputes, Buyback To Offset

Table of Contents

Tariff Disputes: A Significant Headwind for Ryanair's Growth

The escalating costs associated with various tariff disputes pose a substantial threat to Ryanair's expansion plans and profitability. These disputes encompass a range of charges, including increased fuel surcharges, rising airport fees, and fluctuating air traffic control charges. These operational expenses significantly impact Ryanair's bottom line and its ability to maintain its competitive edge in the fiercely contested low-cost airline market.

The financial implications are considerable. While precise figures are difficult to pinpoint due to the ongoing nature of these disputes, analysts estimate that increased fuel costs alone could amount to hundreds of millions of euros annually. This directly affects Ryanair's ability to offer the ultra-low fares that have fueled its success. Other contributing factors like fluctuating airport charges and unpredictable air traffic control costs add further complexity to accurate financial forecasting.

- Impact on flight routes and frequency: Higher operational costs might necessitate route adjustments or a reduction in flight frequency on less profitable routes.

- Potential for increased ticket prices: To offset increased expenses, Ryanair might be forced to raise ticket prices, potentially impacting its appeal to price-sensitive customers.

- Effect on Ryanair's competitive advantage: Increased costs erode Ryanair's competitive advantage based on exceptionally low fares, leaving it vulnerable to competitors.

- Geographical areas most affected: Regions with particularly high airport charges or complex air traffic control regulations are most significantly impacted, potentially hindering expansion in these areas.

Ryanair's Response: A Share Buyback Program

In response to these challenges, Ryanair has announced a substantial share buyback program. This initiative involves repurchasing a significant number of its own shares, demonstrating a confidence in the company's long-term prospects despite the current headwinds. The rationale behind this move is multifaceted, aiming to both offset the negative impact of tariff disputes and bolster investor confidence. The buyback is seen as a strategic allocation of capital, returning value to shareholders while signaling a belief in the company’s ability to navigate these challenges.

Using keywords like "share repurchase," "capital allocation," and "investor confidence," it's important to analyze the strategic implications of this move. The buyback program could significantly influence the share price, attracting more investors.

- Positive signals sent to investors: The buyback signals confidence in the company's future performance and demonstrates a commitment to shareholder value.

- Potential impact on share price: Share buybacks typically increase the earnings per share (EPS), potentially leading to a higher share price.

- Alternative uses of the capital (e.g., fleet expansion, new routes): By choosing a share buyback, Ryanair prioritized returning capital to shareholders over potential investments like fleet expansion or new route development.

- Analyst opinions on the buyback strategy: Analysts hold varying views, with some praising the move as a prudent allocation of capital, while others suggest that investing in fleet modernization or route expansion might yield better long-term returns.

Assessing the Overall Impact on Ryanair's Future Growth

The combined effect of tariff disputes and the share buyback program on Ryanair's future growth is complex and multifaceted. While the share buyback offers a short-term boost to investor confidence and share price, the long-term impact hinges on the airline's ability to mitigate the rising operational costs associated with tariff disputes. The future prospects for Ryanair depend on several factors, including the resolution of these tariff disputes, the overall economic climate, and the airline's ability to adapt its strategies.

This analysis requires careful consideration of various potential scenarios, including fuel price volatility, potential government regulations, and the competitive landscape. Forecasts from leading industry analysts suggest a period of moderate growth, although the pace might be slower than initially projected before the tariff disputes intensified.

- Short-term vs. long-term growth outlook: The short-term outlook is likely to be impacted by rising costs, while the long-term growth depends on resolving the tariff issues and adapting to the changing market conditions.

- Impact on passenger numbers: Increased ticket prices could slightly reduce passenger numbers, although Ryanair's brand loyalty and operational efficiency might mitigate this.

- Potential for diversification strategies: Ryanair might consider diversification strategies, such as expanding into ancillary revenue streams or exploring new markets to lessen its reliance on specific routes.

- Comparison to competitors' strategies: Comparing Ryanair's strategies to those of its competitors will be crucial in assessing its future performance and market share.

Conclusion: Navigating the Headwinds: Ryanair's Future

In summary, Ryanair's growth outlook is currently facing headwinds due to escalating tariff disputes. While the strategic share buyback program aims to offset some of the negative impacts by boosting investor confidence and share price, the long-term consequences remain uncertain. The airline's ability to successfully navigate these challenges hinges on resolving the tariff issues, managing costs effectively, and potentially implementing diversification strategies. Staying informed about Ryanair’s performance, specifically regarding its response to tariff disputes and the ongoing impact of its share buyback program, is crucial for understanding its future trajectory. Follow Ryanair's financial news releases and industry publications to stay updated on developments related to Ryanair's growth outlook and its efforts to mitigate these challenges. The ongoing impact of these factors will be instrumental in shaping Ryanair's future success in the competitive European airline market.

Featured Posts

-

Jennifer Lawrences Growing Family Second Child Arrives

May 20, 2025

Jennifer Lawrences Growing Family Second Child Arrives

May 20, 2025 -

Jennifer Lawrences Breathtaking Backless Look First Public Appearance Since Second Babys Birth

May 20, 2025

Jennifer Lawrences Breathtaking Backless Look First Public Appearance Since Second Babys Birth

May 20, 2025 -

Technologies Spatiales En Afrique Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025

Technologies Spatiales En Afrique Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025 -

Biarritz Le Guide Complet Du Mercato Gastronomique Nouveaux Chefs Et Adresses

May 20, 2025

Biarritz Le Guide Complet Du Mercato Gastronomique Nouveaux Chefs Et Adresses

May 20, 2025 -

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Gp Sinden Diskalifiye

May 20, 2025

Ferrariye Koetue Haber Hamilton Ve Leclerc Cin Gp Sinden Diskalifiye

May 20, 2025

Latest Posts

-

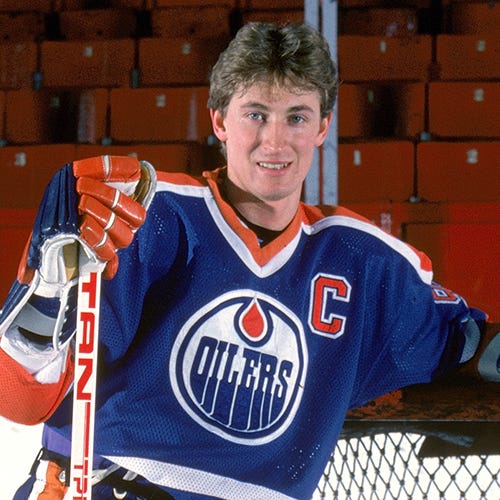

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025 -

The Trump Effect How Trade Policies And Statehood Rhetoric Impact Wayne Gretzkys Legacy

May 20, 2025

The Trump Effect How Trade Policies And Statehood Rhetoric Impact Wayne Gretzkys Legacy

May 20, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 20, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 20, 2025 -

Trumps Actions Fuel Debate Wayne Gretzky And The Question Of Canadian Patriotism

May 20, 2025

Trumps Actions Fuel Debate Wayne Gretzky And The Question Of Canadian Patriotism

May 20, 2025 -

Wayne Gretzkys Daughter Paulina Makes Rare Public Appearance With Husband

May 20, 2025

Wayne Gretzkys Daughter Paulina Makes Rare Public Appearance With Husband

May 20, 2025