Ryanair's Growth Threatened By Tariff Wars; Company Announces Buyback Plan

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The ongoing global trade disputes are having a tangible and detrimental effect on Ryanair's operational efficiency and profitability. Increased costs across several key areas are squeezing margins and forcing the company to re-evaluate its strategies.

Increased Fuel Costs

Tariffs on imported aviation fuel are significantly increasing Ryanair's operational expenses. This is a major blow, considering fuel represents a substantial portion of an airline's operating costs.

- Quantifiable Impact: While precise figures are not always publicly released immediately, industry analysts suggest that fuel costs for airlines have risen by X% (cite source if available, e.g., IATA report, specific news article) due to tariffs. This translates to a substantial increase in Ryanair's overall operational expenditure, directly impacting profitability margins.

- Effect on Profitability: The increased fuel prices directly reduce Ryanair's profit margins. This necessitates a careful examination of cost-cutting measures and potential pricing strategies to offset these added expenses and maintain profitability.

- Keywords: Fuel prices, aviation fuel, import tariffs, operational costs, profitability, Ryanair fuel costs.

Rising Costs of Aircraft Parts and Maintenance

The impact of tariff wars extends beyond fuel. Tariffs on imported aircraft parts and components are also driving up maintenance costs for Ryanair.

- Parts Affected: Tariffs are affecting a range of essential parts, including engines, landing gear components, and avionics systems. This broad impact affects various aspects of aircraft maintenance.

- Supply Chain Disruptions: The tariffs can lead to supply chain disruptions, potentially resulting in delays in maintenance or repairs. This could impact fleet availability and scheduling, potentially affecting Ryanair's ability to maintain its flight schedules and passenger capacity.

- Keywords: Aircraft maintenance, spare parts, supply chain disruptions, aircraft components, maintenance costs, Ryanair maintenance.

Impact on Passenger Numbers and Ticket Prices

The increased operational costs stemming from tariff wars inevitably put pressure on Ryanair's pricing strategies and potentially its passenger numbers.

- Potential Price Increases: Ryanair may need to consider increasing ticket prices to offset the increased costs. However, this strategy could negatively impact passenger numbers, especially given the competitive nature of the budget airline market.

- Demand Elasticity: The extent to which passenger numbers are affected will depend on the elasticity of demand for budget air travel. If consumers are highly price-sensitive, higher fares could lead to a substantial drop in demand.

- Market Competition: The competitive landscape will also play a significant role. If Ryanair's competitors are less affected by tariff wars, they might gain a competitive edge.

- Keywords: Passenger numbers, airfares, ticket prices, market competition, demand elasticity, Ryanair passengers.

Ryanair's Share Buyback Plan: A Response to the Challenges

In response to these challenges, Ryanair has announced a share buyback program. This strategic move aims to address the negative impacts of tariff wars and boost investor confidence.

Details of the Buyback Program

Ryanair's share buyback program involves repurchasing a significant number of its own shares (specify the number of shares if available, cite source). The timeframe for the buyback (specify timeframe if available, cite source) indicates the company's commitment to this strategy.

- Rationale: The rationale behind this decision is likely twofold: to return value to shareholders and to potentially increase the company's share price by reducing the number of outstanding shares. (Include relevant quotes from company executives if available).

- Keywords: Share buyback, stock repurchase, investor confidence, company strategy, financial performance, Ryanair stock.

Investor Reaction and Market Analysis

The market's response to Ryanair's buyback announcement will be crucial in assessing its effectiveness.

- Stock Price Movements: Following the announcement, Ryanair's stock price (mention any observed changes). This reflects investor sentiment regarding the company's ability to navigate these challenges.

- Analyst Comments: Financial analysts' opinions on the buyback's impact and their predictions for Ryanair's future performance will provide valuable insights. (Include any relevant analyst comments if available).

- Keywords: Stock market, investor sentiment, stock price, market reaction, financial analysts, Ryanair stock price.

Long-Term Implications for Ryanair

The long-term consequences of both the tariff wars and the buyback program remain to be seen.

- Growth Strategy: The challenges posed by tariff wars could necessitate adjustments to Ryanair's growth strategy, potentially impacting its expansion plans.

- Competitive Advantage: Ryanair's ability to maintain its competitive advantage in the budget airline market will depend on its ability to mitigate the negative impacts of tariff wars and capitalize on opportunities.

- Keywords: Long-term growth, business strategy, competitive advantage, market share, future outlook, Ryanair future.

Conclusion: Navigating the Headwinds – Ryanair's Future Amidst Tariff Wars

Ryanair is facing significant headwinds due to escalating tariff wars, which are driving up fuel and aircraft maintenance costs. In response, the company has implemented a share buyback plan, a move aimed at boosting investor confidence and returning value to shareholders. The long-term impact of these tariff wars on Ryanair's operations and the success of its buyback program remain to be seen. However, the company's proactive response demonstrates its commitment to navigating these challenges and maintaining its position in the competitive airline industry. Stay tuned for further updates on how Ryanair navigates these challenges and continues to adapt its strategies in the face of evolving global tariff wars and their impact on Ryanair's growth.

Featured Posts

-

Improved Wireless Headphones A Review Of Top Models

May 21, 2025

Improved Wireless Headphones A Review Of Top Models

May 21, 2025 -

Klopps Anfield Return Liverpool Awaits Manager Before Final Match

May 21, 2025

Klopps Anfield Return Liverpool Awaits Manager Before Final Match

May 21, 2025 -

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025

Unpacking Trumps Aerospace Deals An Analysis Of Promises And Outcomes

May 21, 2025 -

Nj Transit And Engineers Union Reach Tentative Agreement

May 21, 2025

Nj Transit And Engineers Union Reach Tentative Agreement

May 21, 2025 -

Manchester Citys Next Manager An Arsenal Legend

May 21, 2025

Manchester Citys Next Manager An Arsenal Legend

May 21, 2025

Latest Posts

-

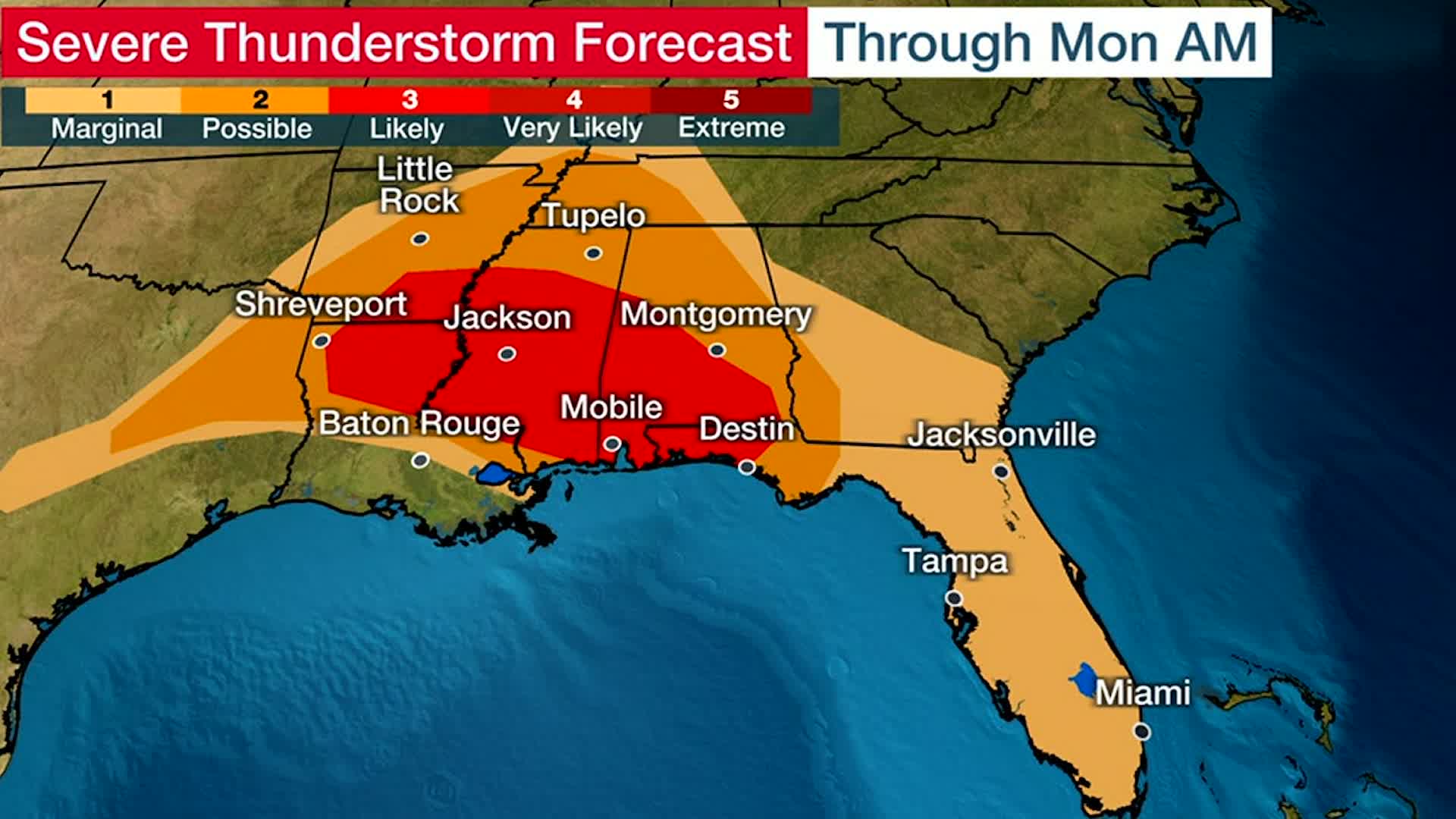

Overnight Storm Chances And Mondays Severe Weather Outlook

May 21, 2025

Overnight Storm Chances And Mondays Severe Weather Outlook

May 21, 2025 -

10 Minnesota Twins Games Coming To Kcrg Tv 9

May 21, 2025

10 Minnesota Twins Games Coming To Kcrg Tv 9

May 21, 2025 -

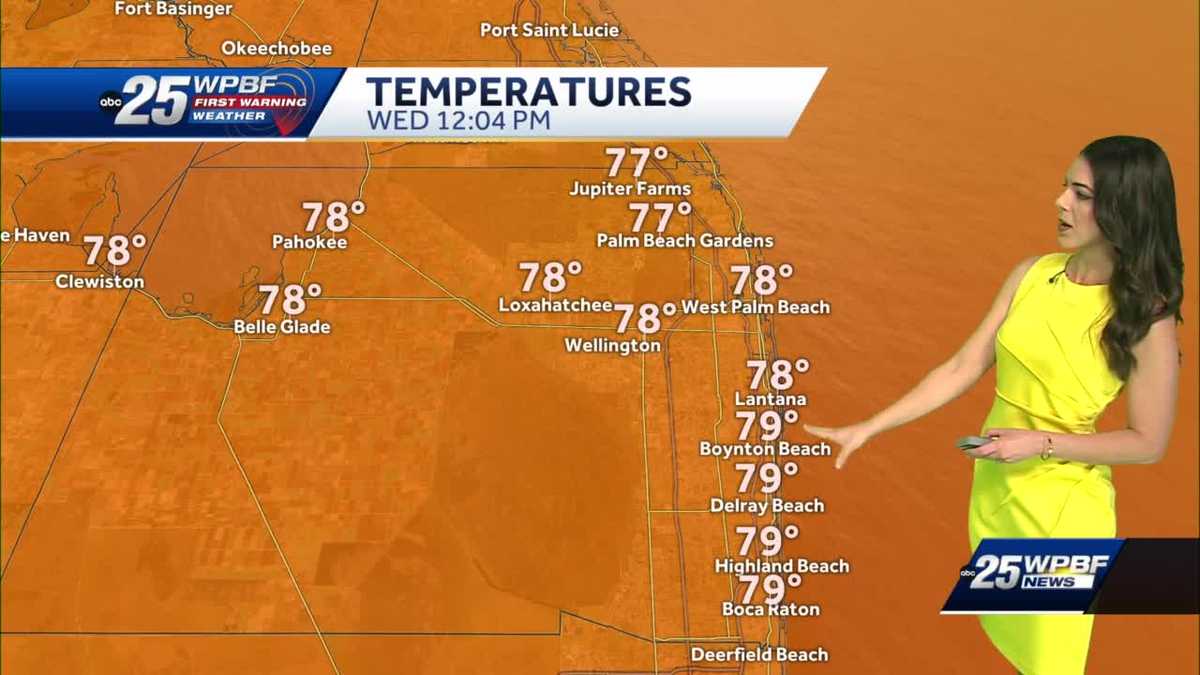

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 21, 2025

Finding The Perfect Breezy And Mild Climate For Your Next Vacation

May 21, 2025 -

Kcrg Tv 9 Announces Broadcast Of 10 Minnesota Twins Regular Season Games

May 21, 2025

Kcrg Tv 9 Announces Broadcast Of 10 Minnesota Twins Regular Season Games

May 21, 2025 -

Breezy And Mild Weather Your Guide To Comfort

May 21, 2025

Breezy And Mild Weather Your Guide To Comfort

May 21, 2025