Ryanair's Share Buyback Amidst Growing Concerns Over Tariff Wars

Table of Contents

Ryanair, Europe's largest low-cost airline, recently announced a significant share buyback program, a bold move considering the escalating global tariff wars and their potential impact on the airline industry. This seemingly contradictory action – repurchasing shares amidst economic uncertainty – warrants a closer examination. This article analyzes Ryanair's strategy, exploring the rationale behind the buyback, the potential risks and rewards, and the broader implications for investors.

Ryanair's Share Buyback Program: Details and Rationale

H3: The Buyback Program's Size and Timeline:

Ryanair's share buyback program, announced on [Insert Date of Announcement], involves the repurchase of [Insert Number] shares, representing approximately [Insert Percentage]% of its outstanding stock. The buyback is expected to be completed by [Insert Completion Date]. The exact amount repurchased will depend on market conditions and share price fluctuations. This significant investment demonstrates Ryanair's confidence in its future performance.

H3: Ryanair's Justification for the Buyback:

Ryanair’s justification for this substantial share buyback hinges on several key factors:

-

Undervalued Shares: Ryanair believes its shares are currently undervalued in the market, presenting a compelling opportunity to repurchase them at a discounted price. This strategy aims to enhance shareholder value by reducing the number of outstanding shares.

-

Strengthening the Balance Sheet: While not explicitly stated as the primary reason, the buyback can indirectly improve Ryanair's balance sheet by reducing equity. This can improve certain financial ratios, particularly if coupled with debt reduction.

-

Returning Capital to Shareholders: The buyback represents a direct return of capital to existing shareholders, a key element of Ryanair's commitment to shareholder value creation. This is viewed as a more efficient use of capital than reinvestment in certain less profitable ventures.

-

Demonstrating Confidence: The substantial buyback signals a strong vote of confidence from Ryanair's management in the company’s future prospects, despite the external economic headwinds.

-

Quotes: "[Insert Quote from Ryanair CEO or CFO regarding the share buyback program and their rationale]. [Link to official press release]."

The Impact of Tariff Wars on the Airline Industry

H3: Increased Fuel Costs:

Tariff wars often lead to increased fuel costs for airlines. Tariffs on imported oil or related products can directly increase fuel prices, significantly impacting airline profitability. For example, [Insert Example of Tariff and its Impact on Fuel Prices]. This rise in fuel expenses directly affects Ryanair’s operating costs, potentially reducing profit margins.

H3: Supply Chain Disruptions:

Trade disputes and tariffs can disrupt global supply chains, affecting the availability and cost of aircraft parts, maintenance services, and other essential goods and services for the airline industry. Delays in procuring necessary components can lead to operational disruptions and increased costs for Ryanair.

H3: Reduced Passenger Demand:

Economic uncertainty stemming from tariff wars can dampen consumer confidence, leading to decreased demand for air travel. A potential global economic slowdown caused by trade tensions could significantly reduce passenger numbers, impacting Ryanair's revenue streams.

- Statistics: According to the IATA (International Air Transport Association), [Insert Statistics on the Impact of Tariff Wars or Economic Slowdowns on Air Travel Demand]. [Link to IATA report or relevant source]

Analyzing Ryanair's Strategy: Risk vs. Reward

H3: The Risks Associated with the Buyback:

Ryanair's share buyback program, while appearing strategically sound, carries inherent risks:

- Misallocation of Funds: Repurchasing shares might be viewed as a misallocation of funds if a more profitable investment opportunity arises, particularly given the economic uncertainty surrounding the tariff wars.

- Missed Acquisition Opportunities: The significant capital tied up in the buyback could limit Ryanair’s ability to pursue strategic acquisitions or expansion plans in the future.

- Negative Investor Sentiment: If the stock market performs poorly, the buyback could be perceived negatively by investors, potentially affecting Ryanair's stock price and overall market valuation.

H3: The Potential Rewards of the Buyback:

Despite the risks, the potential rewards of Ryanair's strategy are significant:

-

Increased Earnings Per Share (EPS): By reducing the number of outstanding shares, the buyback can increase earnings per share, potentially boosting investor confidence.

-

Improved Return on Equity (ROE): A higher ROE indicates better profitability relative to shareholder investment. The buyback can potentially improve this key metric.

-

Enhanced Shareholder Value: Ultimately, a successful buyback should increase shareholder value by driving up the share price over time.

-

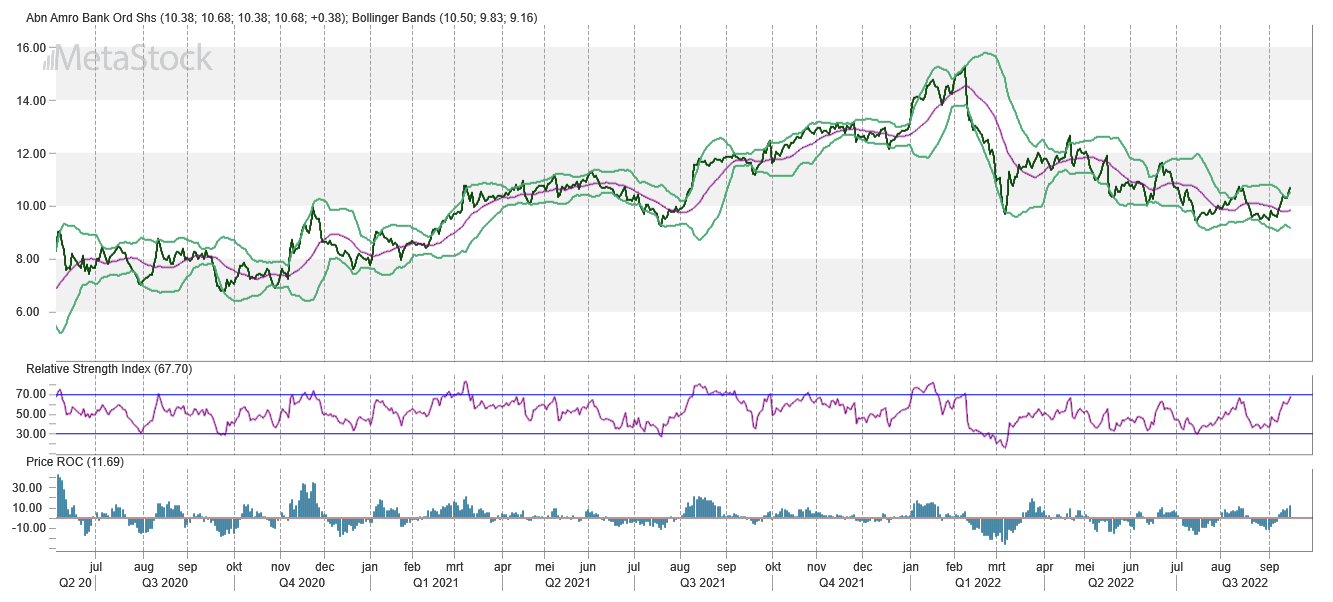

Data Comparison: [Insert Chart or Graph comparing Ryanair's performance indicators (EPS, ROE, etc.) to competitors and industry benchmarks].

Investor Sentiment and Market Reaction

H3: Initial Market Response to the Buyback:

The immediate market reaction to Ryanair's buyback announcement was [Describe the initial market response, including changes in stock price and analyst comments]. [Cite sources such as financial news articles].

H3: Long-Term Implications:

The long-term implications of Ryanair's share buyback depend heavily on several factors, including the overall economic climate, the impact of tariff wars on the airline industry, and Ryanair’s continued financial performance. A successful buyback could lead to a sustained increase in the share price, delivering significant returns for investors. Conversely, a downturn in the market could negatively impact the effectiveness of the buyback strategy.

- Examples: [Provide examples of successful and unsuccessful share buyback programs from similar companies in the airline industry, linking to relevant case studies].

Conclusion:

Ryanair's significant share buyback program is a bold strategic move, executed amidst the backdrop of escalating tariff wars and their potential impact on the airline industry. While the buyback presents several potential benefits, including increased EPS and ROE, it also carries inherent risks associated with misallocation of funds and negative market response. The ultimate success of this strategy will depend on a complex interplay of factors, including Ryanair's ability to navigate the challenges presented by the tariff wars and maintain its strong financial performance. To stay informed, continue monitoring Ryanair’s financial reports and keep abreast of the ongoing developments in global trade relations and their effect on the airline industry. Stay tuned for further updates on Ryanair's share buyback and its performance within this challenging global economic climate.

Featured Posts

-

Enjoy The Manhattan Sun A List Of Excellent Outdoor Dining Locations

May 21, 2025

Enjoy The Manhattan Sun A List Of Excellent Outdoor Dining Locations

May 21, 2025 -

5 Circuits A Velo Pour Decouvrir La Region Nantaise Loire Vignoble Et Estuaire

May 21, 2025

5 Circuits A Velo Pour Decouvrir La Region Nantaise Loire Vignoble Et Estuaire

May 21, 2025 -

Stijging Occasionverkopen Abn Amro Analyse Van De Groei

May 21, 2025

Stijging Occasionverkopen Abn Amro Analyse Van De Groei

May 21, 2025 -

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025 -

Michael Strahans Big Interview A Deep Dive Into The Ratings Battle

May 21, 2025

Michael Strahans Big Interview A Deep Dive Into The Ratings Battle

May 21, 2025

Latest Posts

-

Impact Of Collins Aerospace Layoffs On Cedar Rapids

May 21, 2025

Impact Of Collins Aerospace Layoffs On Cedar Rapids

May 21, 2025 -

Preparing For School Delays A Guide To Winter Weather Advisories

May 21, 2025

Preparing For School Delays A Guide To Winter Weather Advisories

May 21, 2025 -

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 21, 2025

Reddits Top Picks 12 Promising Ai Stocks For 2024

May 21, 2025 -

Confirmation Of Layoffs At Collins Aerospace Cedar Rapids Plant

May 21, 2025

Confirmation Of Layoffs At Collins Aerospace Cedar Rapids Plant

May 21, 2025 -

Urgent Weather Warning Prepare For High Winds And Severe Storms

May 21, 2025

Urgent Weather Warning Prepare For High Winds And Severe Storms

May 21, 2025