S&P 500 Downside Insurance: Is Now The Time To Buy?

Table of Contents

Understanding S&P 500 Downside Insurance Strategies

Protecting your portfolio from substantial losses in the S&P 500 requires a proactive approach. Several strategies can act as effective S&P 500 downside insurance, mitigating potential damage from a market downturn.

Put Options: A Classic Hedging Tool

Put options are contracts giving you the right, but not the obligation, to sell a specified number of S&P 500 index shares at a predetermined price (the strike price) before the option's expiration date. By purchasing put options, you essentially insure against a drop below your chosen strike price. The cost of this insurance is the option's premium.

- Protective Puts: Buying put options on the same number of shares you own in the S&P 500 provides a floor for your investment. If the market falls below the strike price, the put option limits your losses.

- Covered Puts: Writing (selling) a put option on shares you are willing to buy at the strike price. This generates income from the premium, but obligates you to purchase shares if the option is exercised.

Choosing the right strike price and expiration date is crucial. A lower strike price offers more protection but costs more in premiums. Shorter-term options are cheaper but offer less protection against prolonged declines. Understanding these aspects is key to effective S&P 500 put options hedging. Other market downside protection strategies exist, but this remains a common one.

Inverse ETFs: Betting on Market Declines

Inverse exchange-traded funds (ETFs) aim to profit from a decline in the underlying asset—in this case, the S&P 500. These bearish ETFs use various strategies, often involving derivatives, to achieve inverse performance. However, it's critical to understand their risks, particularly those associated with leveraged inverse ETFs, which amplify both gains and losses.

- Examples: Several inverse S&P 500 ETFs exist. It's crucial to research specific products, comparing expense ratios and leverage levels.

- Leverage Risk: While potentially lucrative during market declines, leveraged S&P 500 inverse ETFs magnify losses if the market unexpectedly rallies. They're generally not suitable for long-term, buy-and-hold investors.

Using inverse ETFs requires careful consideration and a thorough understanding of market dynamics. They are not a simple replacement for traditional S&P 500 downside insurance.

VIX and Volatility Strategies: Riding the Fear Gauge

The VIX (CBOE Volatility Index) measures market volatility, often referred to as the "fear gauge." A rising VIX signals increased market uncertainty and fear. Several strategies use VIX-related products to hedge against S&P 500 declines.

- VIX ETFs and Futures: Investing in VIX ETFs or futures allows you to profit from increased market volatility, offering a form of VIX hedging. However, it's important to remember that these are highly speculative and sensitive to market shifts.

- Volatility Trading: These strategies require a deep understanding of market dynamics and volatility forecasting. This type of market uncertainty hedging is not for the novice investor.

This approach, though potentially profitable during turbulent times, requires expertise and an understanding of volatility trading. It should be considered a sophisticated form of S&P 500 downside insurance.

Evaluating the Current Market Conditions for S&P 500 Downside Insurance

Determining whether to buy S&P 500 downside insurance requires a careful analysis of several factors.

Economic Indicators: Gauging the Macroeconomic Landscape

Several key economic indicators provide insights into the health of the economy and the potential for future S&P 500 performance.

- Inflation: High inflation erodes purchasing power and may lead to central bank interest rate hikes, impacting market performance. Current inflation levels should be carefully considered.

- Interest Rates: Rising interest rates can slow economic growth, negatively impacting stock valuations.

- GDP Growth: Slowing GDP growth is often correlated with lower stock market returns.

Monitoring these indicators helps to assess the economic outlook and potentially predict market volatility. An unfavorable S&P 500 forecast may increase the need for downside protection.

Geopolitical Factors: Assessing Global Risks

Geopolitical factors can significantly impact investor sentiment and market stability.

- International Conflicts: Wars, trade disputes, and political instability can trigger market declines.

- Global Economic Events: Unexpected economic shocks in major economies can have ripple effects globally.

These uncertainties contribute to market risk and necessitate a careful evaluation of geopolitical risk when considering S&P 500 downside insurance. The global economic outlook should be considered as well.

Analyzing Investor Sentiment: Reading the Tea Leaves

Investor sentiment reflects the collective mood of market participants. High optimism often precedes market highs, while pessimism often precedes lows.

- Market Breadth: Examining the performance of a broad range of stocks can provide insights into the overall market sentiment.

- Investor Surveys: Various surveys gauge investor confidence and expectations, offering valuable data for market sentiment analysis.

Understanding investor psychology and risk appetite is vital to assessing the potential for future market movements.

Costs and Benefits of S&P 500 Downside Insurance

Before implementing any S&P 500 downside insurance strategy, it's crucial to weigh the costs against the potential benefits.

Premium Costs vs. Potential Losses: A Cost-Benefit Analysis

The cost of downside protection, whether through options premiums or ETF fees, needs to be compared to the potential losses it could prevent.

- Scenario Analysis: Consider various market scenarios to assess the cost-effectiveness of your chosen strategy. A comprehensive risk management cost analysis is essential.

- Hedging Strategy Cost: The cost of hedging should be carefully weighed against the potential reduction in losses.

This cost-benefit analysis determines the efficacy of your downside protection cost.

Tax Implications: A Crucial Consideration

The tax implications of different downside insurance strategies vary considerably. It's essential to consult a financial advisor to understand the tax consequences of your chosen approach.

- Options Trading: Profits and losses from options trading are treated differently than those from other investments.

- ETF Investing: Tax implications of ETF investing depend on factors such as the ETF’s structure and holding period.

Conclusion

Several strategies offer S&P 500 downside insurance, including put options, inverse ETFs, and VIX-based products. The optimal approach depends on your risk tolerance, investment timeline, and understanding of market dynamics. Current economic indicators, geopolitical events, and investor sentiment should all inform your decision. Remember to weigh the costs of this protection against the potential losses it could prevent. Before implementing any strategy, consult a financial advisor to explore S&P 500 downside insurance options suited to your specific circumstances. Learn more about protecting your portfolio with S&P 500 downside insurance today!

Featured Posts

-

Il Cardinale Becciu Chat Segrete Processo Falsato E Accuse Di Infangamento

Apr 30, 2025

Il Cardinale Becciu Chat Segrete Processo Falsato E Accuse Di Infangamento

Apr 30, 2025 -

Alex Ovechkins Historic Goal Ties Wayne Gretzkys Nhl Record Cp News Alert

Apr 30, 2025

Alex Ovechkins Historic Goal Ties Wayne Gretzkys Nhl Record Cp News Alert

Apr 30, 2025 -

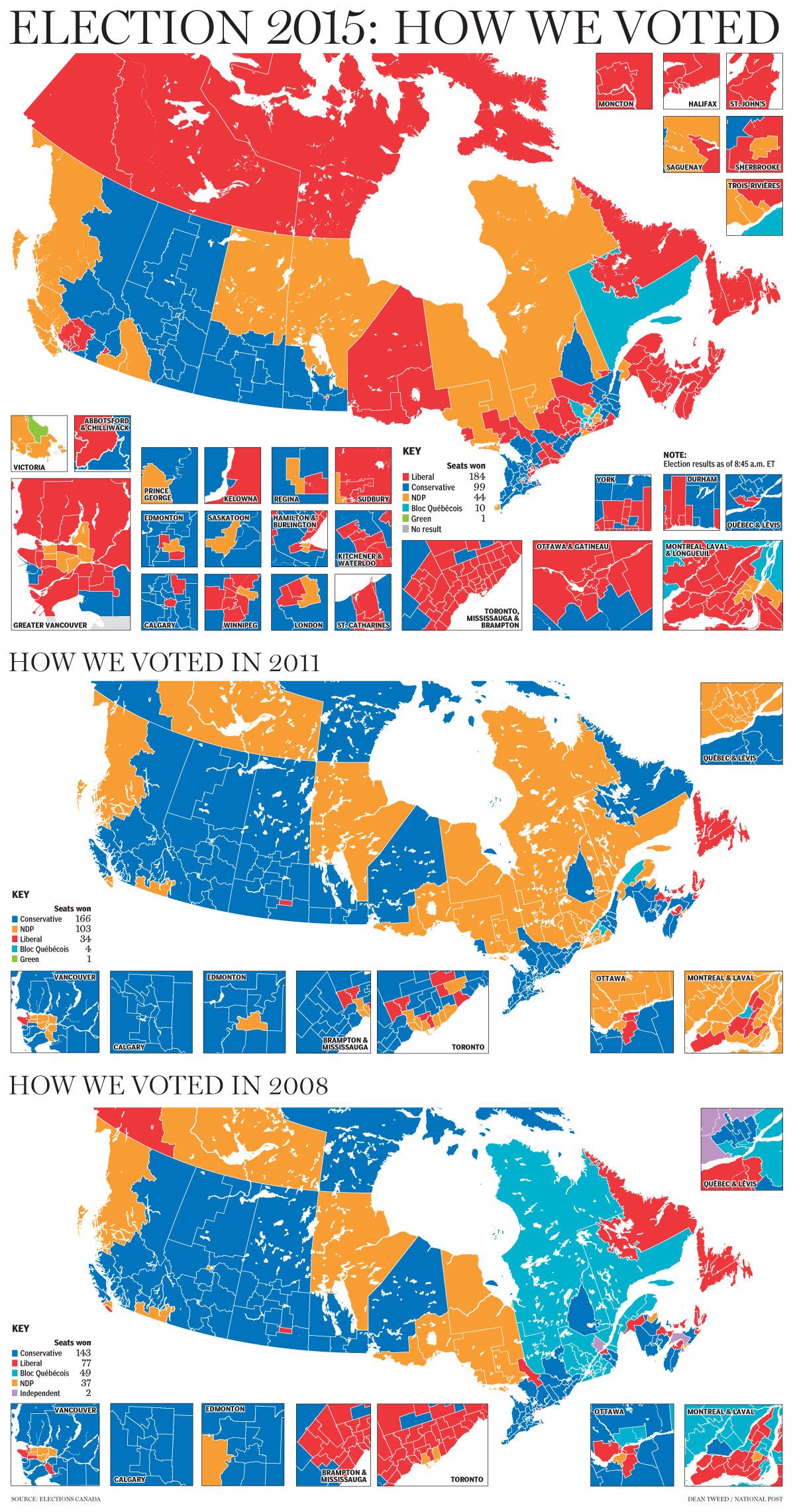

Canadian Election Results Poilievres Unexpected Defeat

Apr 30, 2025

Canadian Election Results Poilievres Unexpected Defeat

Apr 30, 2025 -

Tyazheliy Diagnoz Mat Beyonse Boretsya S Rakom

Apr 30, 2025

Tyazheliy Diagnoz Mat Beyonse Boretsya S Rakom

Apr 30, 2025 -

Eurovision 2024 Uks Remember Monday Channels Online Hate Into Music

Apr 30, 2025

Eurovision 2024 Uks Remember Monday Channels Online Hate Into Music

Apr 30, 2025