S&P 500 Insurance: Strategies For Volatility Management

Table of Contents

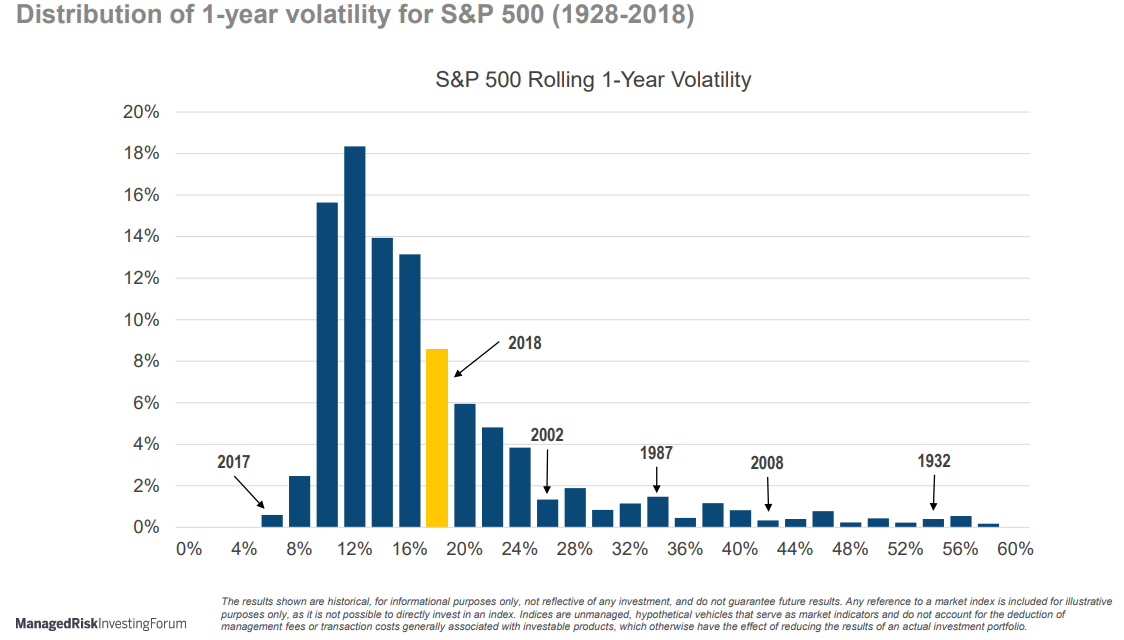

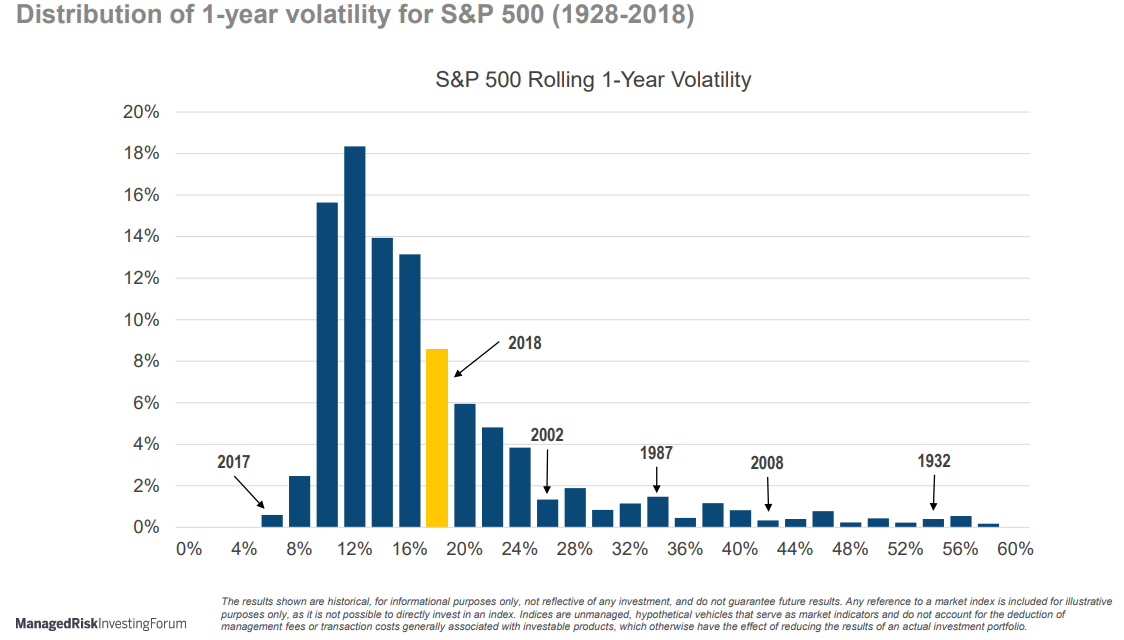

Understanding S&P 500 Volatility and its Impact on Investments

The S&P 500 index tracks the performance of 500 large-cap US companies, offering a broad representation of the American economy. However, its historical performance reveals periods of significant volatility. Sharp market corrections and bear markets are not uncommon, impacting investment portfolios dramatically. Several factors contribute to this volatility:

-

Economic Indicators: Data releases such as GDP growth, inflation rates, and employment figures can trigger significant market reactions, influencing the S&P 500's trajectory.

-

Geopolitical Events: Global political instability, international conflicts, and unexpected policy changes often introduce uncertainty, affecting investor sentiment and market prices.

-

Interest Rate Changes: Decisions by central banks regarding interest rates directly impact borrowing costs for businesses and consumers, influencing corporate profitability and overall market valuation.

-

Impact of market corrections and bear markets on investment portfolios: Market downturns can lead to substantial losses, eroding investment capital and delaying long-term financial goals.

-

The importance of diversification in reducing S&P 500 related risk: Diversification across asset classes can help mitigate the impact of S&P 500 downturns by reducing overall portfolio volatility.

-

Long-term vs. short-term investment horizons and their impact on volatility: Longer investment horizons generally allow investors to ride out market fluctuations, while short-term investors are more exposed to the risks of volatility.

Types of S&P 500 Insurance Strategies

Several strategies can help protect against S&P 500 volatility. These strategies can be broadly categorized into index-based insurance and portfolio insurance.

Index-Based Insurance

These strategies directly address S&P 500 fluctuations. Options include:

- Options strategies (puts, calls) for hedging against downside risk: Buying put options provides the right, but not the obligation, to sell the index at a specific price, acting as a safety net during market declines.

- Variance swaps and other derivative instruments: These more complex instruments allow investors to bet on the level of volatility in the S&P 500, providing potential protection against unexpected market swings.

- Index funds and ETFs with built-in risk mitigation strategies: Some index funds employ strategies to reduce volatility, such as hedging or employing alternative weighting methodologies.

Portfolio Insurance Strategies

These strategies adopt a broader approach, considering the S&P 500 as part of a diversified portfolio. They include:

- Dynamic asset allocation strategies that adjust exposure based on market conditions: These strategies automatically shift asset allocation based on market signals, reducing exposure to equities during periods of high volatility.

- Stop-loss orders to limit potential losses: Stop-loss orders automatically sell assets when they reach a predetermined price, preventing further losses in a downturn.

- Hedging with other asset classes (e.g., bonds, gold) to reduce correlation risk: Investing in assets that tend to perform differently from equities can reduce overall portfolio volatility and provide a buffer during market downturns.

Factors to Consider When Choosing an S&P 500 Insurance Strategy

Selecting the right S&P 500 insurance strategy requires careful consideration of several factors:

Risk Tolerance and Investment Goals

Your risk tolerance and investment objectives are paramount.

- Assessing your risk tolerance questionnaire: Honest self-assessment of your comfort level with market fluctuations is critical in choosing the right strategy.

- Defining your investment goals (e.g., retirement planning, wealth preservation): Your time horizon and financial goals will shape your approach to risk management.

- Understanding the trade-offs between risk and return: Higher returns typically come with higher risks; the chosen strategy should align with your acceptable risk level.

Cost and Fees

Different strategies involve varying costs.

- Premium costs for options and other derivatives: Options and other derivatives have associated premium costs that need to be factored into the overall strategy.

- Management fees for actively managed portfolios: Actively managed portfolios that incorporate risk mitigation strategies often charge higher management fees.

- Transaction costs for buying and selling assets: Frequent trading to adjust portfolio allocations will incur transaction costs.

Regulatory Compliance and Due Diligence

Thorough research is essential.

- Understanding the terms and conditions of insurance contracts: Carefully review the contract before committing to any S&P 500 insurance product.

- Verifying the legitimacy and reputation of insurance providers: Ensure the provider is reputable and adheres to all relevant regulatory standards.

- Seeking professional financial advice before making investment decisions: Consulting a financial advisor can provide personalized guidance and ensure your strategy aligns with your financial situation and goals.

Conclusion

Managing S&P 500 volatility is crucial for protecting investment portfolios. Various S&P 500 insurance strategies exist, ranging from simple options strategies to complex portfolio insurance approaches. The optimal choice depends heavily on individual risk tolerance, investment goals, and a thorough understanding of associated costs and regulatory requirements. Invest wisely with effective S&P 500 insurance by carefully evaluating your risk profile and seeking professional financial advice to create a comprehensive risk management plan tailored to your specific needs. Secure your S&P 500 investments and mitigate S&P 500 risk with the right insurance strategy.

Featured Posts

-

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025 -

Thunder Over Louisville 2024 Fireworks Show Cancelled Due To Flooding

May 01, 2025

Thunder Over Louisville 2024 Fireworks Show Cancelled Due To Flooding

May 01, 2025 -

Witt And Garcia Lead Royals To Victory Over Guardians

May 01, 2025

Witt And Garcia Lead Royals To Victory Over Guardians

May 01, 2025 -

Cincinnati Edges Lady Raiders In Close Home Game 59 56

May 01, 2025

Cincinnati Edges Lady Raiders In Close Home Game 59 56

May 01, 2025 -

Eurovision 2024 Uks Unexpected Revelation

May 01, 2025

Eurovision 2024 Uks Unexpected Revelation

May 01, 2025