S&P 500 Volatility: Is Downside Insurance Worth It?

Table of Contents

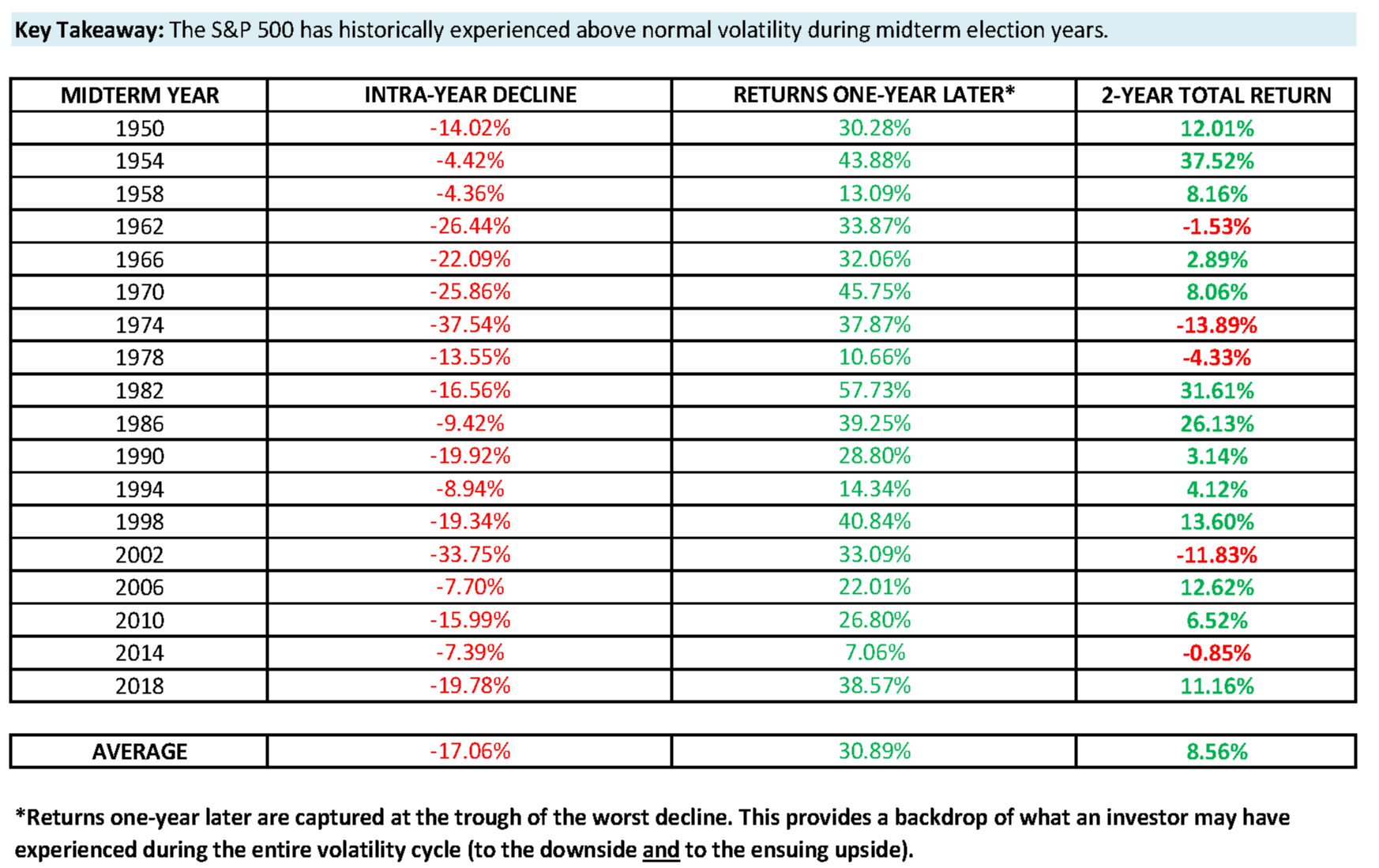

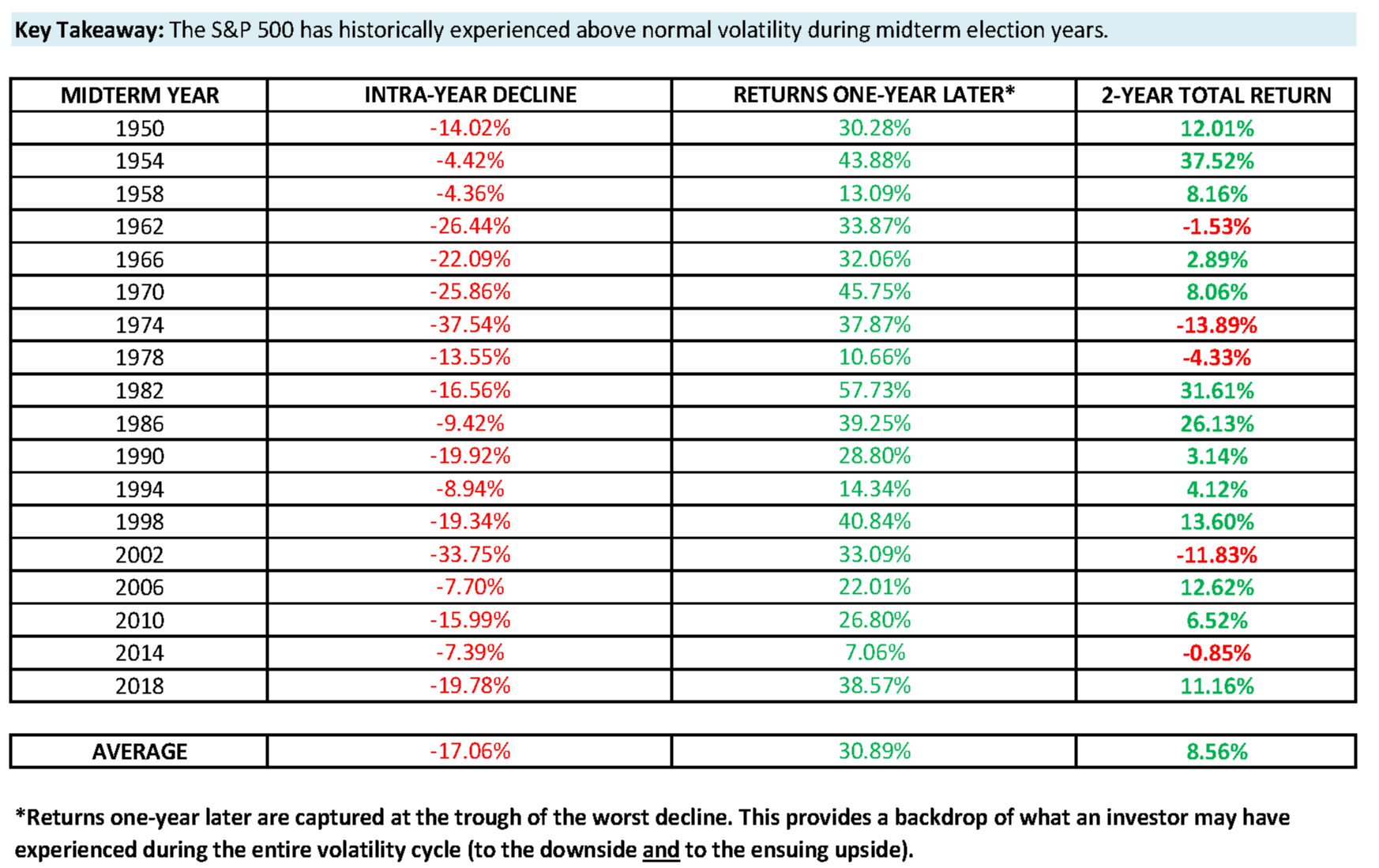

Understanding S&P 500 Volatility and its Impact

Defining Volatility and its Measurement

Market volatility refers to the rate and extent of price fluctuations in the S&P 500. It's often measured using standard deviation, which quantifies the dispersion of returns around the average. Beta, another key metric, compares the volatility of a specific asset (or index) to the overall market. A beta of 1 means the asset moves in line with the market; a beta greater than 1 indicates higher volatility than the market, and less than 1 indicates lower volatility. The VIX (Volatility Index), also known as the "fear gauge," provides a real-time measure of market expectation of volatility over the next 30 days.

- High VIX values: Reflect increased investor anxiety and expectations of significant market swings, often preceding market corrections or bear markets. The VIX surged dramatically during the 2008 financial crisis and the initial COVID-19 market crash.

- Low VIX values: Indicate a relatively calm market with lower expectations of volatility. Periods of low VIX often correspond to bull markets.

The Impact of Volatility on Portfolio Value

Volatility in the S&P 500 can lead to significant losses in a short period. Even seasoned investors can experience substantial portfolio drops during periods of heightened uncertainty.

- Hypothetical Scenario 1: A 10% drop in the S&P 500 could translate to a significant loss depending on your portfolio allocation. A $100,000 portfolio with 70% allocated to the S&P 500 could lose $7,000 in value.

- Hypothetical Scenario 2: A more severe 20% drop could result in a $14,000 loss in the same portfolio.

- Emotional Toll: Beyond the financial impact, market downturns can be emotionally draining, leading to impulsive investment decisions that may exacerbate losses.

Identifying Your Risk Tolerance

Before considering downside protection, it’s vital to understand your risk tolerance. Your risk profile influences your investment strategy and your comfort level with potential losses.

- Conservative: Investors with a low risk tolerance prefer stability and capital preservation, often prioritizing low-volatility investments.

- Moderate: These investors accept some risk for the potential of higher returns, balancing risk and reward.

- Aggressive: These investors have a higher tolerance for risk and seek significant returns, often investing in more volatile assets.

Strategies for Mitigating S&P 500 Downside Risk

Put Options

Put options are contracts that give the buyer the right, but not the obligation, to sell a specific asset (like an S&P 500 index fund) at a predetermined price (strike price) before a set expiration date. They act as insurance, limiting potential losses if the market falls below the strike price.

- Pros: Limited downside risk, potential for profit if the market declines significantly.

- Cons: Premiums (the cost of the option) can be substantial and represent an opportunity cost; the option expires worthless if the market remains above the strike price.

Inverse ETFs

Inverse exchange-traded funds (ETFs) aim to provide returns that are the opposite of the underlying index. For example, an inverse S&P 500 ETF would theoretically rise in value when the S&P 500 falls.

- Risks: Inverse ETFs are often leveraged, meaning small market movements can lead to magnified gains or losses. They are suitable only for sophisticated investors and are generally not recommended for long-term hedging. A rising market would lead to significant losses in an inverse ETF.

Diversification

Diversification reduces portfolio volatility by spreading investments across different asset classes. Over-reliance on the S&P 500 exposes your portfolio to its inherent volatility.

- Importance of diversification: Including bonds, real estate, international stocks, and other asset classes can cushion your portfolio against significant downturns in the S&P 500.

Hedging with Other Indices

Hedging your S&P 500 exposure involves using less volatile indices. For example, incorporating a bond index fund or a less volatile international index can reduce overall portfolio volatility.

- Examples: Government bond ETFs, or indices focused on developed markets with lower volatility than the U.S. market can create a more balanced portfolio.

Evaluating the Cost and Benefits of Downside Insurance

The Price of Protection

Each downside protection strategy comes with a cost. Put options have premiums, inverse ETFs have management fees, and diversification requires careful asset allocation.

- Cost Comparison: The cost-benefit analysis depends heavily on the market conditions and your chosen strategy. Put options can be cost-prohibitive for significant protection over a long time horizon.

Scenario Analysis

Analyzing different market scenarios helps to understand the effectiveness of each strategy.

- Bull Market: Downside protection strategies might underperform due to opportunity costs.

- Bear Market: These strategies can mitigate losses, protecting a significant portion of your initial investment.

- Sideways Market: The cost of protection might outweigh the benefits in a sideways trending market.

Long-Term Investment Perspective

Consider the long-term implications of downside protection. While it's valuable for mitigating losses, it might also limit potential gains.

- Opportunity Cost: The cost of insurance may prevent capturing the significant returns that occur during bull markets.

Conclusion

This article explored various strategies to manage S&P 500 volatility and whether downside insurance is the right choice for your investment strategy. While protecting against significant market declines is crucial, the cost of this protection must be carefully weighed against the potential opportunity cost. The optimal approach depends heavily on your individual risk tolerance, investment goals, and time horizon. Consider consulting a financial advisor to determine the best strategy for your portfolio. Remember, understanding S&P 500 volatility is key to making informed investment decisions. Start planning your S&P 500 risk management strategy today!

Featured Posts

-

Kamala Harris On Re Entering Politics A Timeline And Analysis

May 01, 2025

Kamala Harris On Re Entering Politics A Timeline And Analysis

May 01, 2025 -

Comparativo App De Ia Da Meta Vs Chat Gpt

May 01, 2025

Comparativo App De Ia Da Meta Vs Chat Gpt

May 01, 2025 -

Xrp Cryptocurrency A Deep Dive Into Its Functionality And Use Cases

May 01, 2025

Xrp Cryptocurrency A Deep Dive Into Its Functionality And Use Cases

May 01, 2025 -

Guardians Rally Past Yankees Bibees Resilience After Early Homer

May 01, 2025

Guardians Rally Past Yankees Bibees Resilience After Early Homer

May 01, 2025 -

Sheens Million Pound Giveaway Christopher Stevens Channel 4 Review

May 01, 2025

Sheens Million Pound Giveaway Christopher Stevens Channel 4 Review

May 01, 2025