S&P/TSX Composite Index: Record High And Market Outlook For Canada

Table of Contents

The S&P/TSX Composite Index Hits Record Highs: A Deep Dive

The S&P/TSX Composite Index has consistently climbed in recent months, reaching unprecedented peaks. For instance, on [Insert Date], the index reached a new high of [Insert Value], representing a [Insert Percentage]% increase from [Insert Previous Benchmark Date and Value]. This remarkable growth is attributable to several key factors:

-

Strong performance of key sectors: The energy sector, fueled by robust oil and gas prices, has been a significant driver. Companies like Suncor Energy and Canadian Natural Resources have seen substantial gains. The materials sector, boosted by high commodity prices (e.g., gold, copper), also contributed significantly, with companies like Barrick Gold and Teck Resources experiencing strong performance. The financials sector, benefiting from rising interest rates, has also shown considerable strength.

-

Increased investor confidence: Positive economic indicators, such as [mention specific indicators, e.g., strong employment numbers, rising consumer confidence], have fueled increased investor confidence in the Canadian economy. Government policies supporting key sectors and infrastructure projects have further boosted sentiment.

-

Global economic factors: Favorable global economic conditions, particularly sustained demand for Canadian commodities, have had a positive ripple effect on the Canadian stock market. Although global inflation remains a concern, the resilience of the Canadian economy has helped mitigate some of the negative impacts.

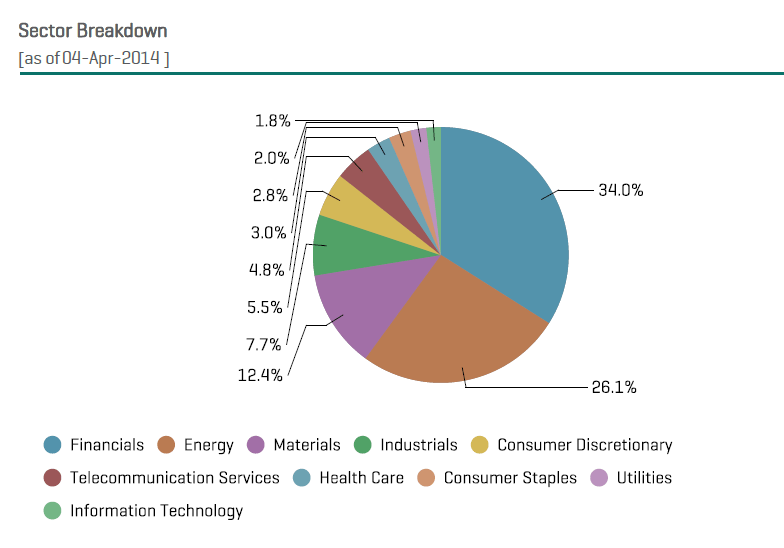

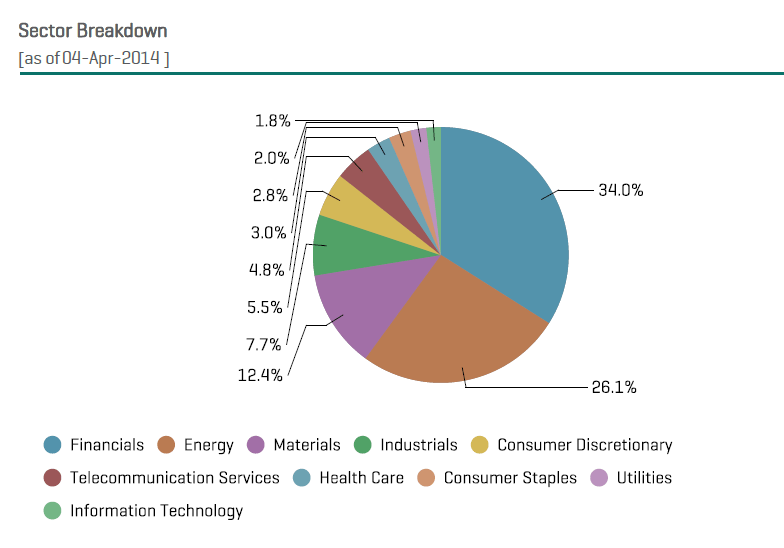

Sector-Specific Performance within the TSX Index

Analyzing the performance of individual sectors provides a nuanced understanding of the TSX Index's overall trajectory.

-

Energy Sector: The surge in oil and gas prices globally has dramatically impacted the energy sector's performance on the TSX. This sector's growth is directly correlated to global energy demand and geopolitical stability.

-

Materials Sector: The performance of this sector, encompassing mining and other materials companies, closely tracks commodity prices and global demand. Fluctuations in metal prices and global economic growth significantly influence the performance of companies in this sector.

-

Financials Sector: Canadian banks and financial institutions have shown resilience despite global economic uncertainties. Interest rate hikes, while presenting challenges, have also boosted profitability for some financial institutions.

-

Technology Sector: The Canadian technology sector exhibits both growth and challenges. While certain segments experience robust growth, others face competition from larger international players.

Market Outlook and Forecast for the Canadian Stock Market

Predicting the future of the S&P/TSX Composite Index requires careful consideration of various factors. Short-term forecasts suggest continued growth, albeit with potential volatility, driven by global economic conditions and interest rate policies. Long-term prospects remain positive, driven by Canada's strong fundamentals and diversified economy. However, several challenges need consideration:

-

Interest rate hikes: Further interest rate hikes by the Bank of Canada could impact economic growth and potentially cool down the market.

-

Global economic uncertainty: Global economic slowdowns or unexpected geopolitical events could negatively affect Canadian equities.

-

Geopolitical factors: International conflicts and trade tensions can create volatility and uncertainty in the Canadian market.

Despite these potential risks, growth opportunities exist in sectors such as renewable energy, technology, and healthcare. Investment strategies should be tailored to individual risk tolerance and long-term goals.

Investing in the Canadian Market: Strategies and Considerations

Investors can approach the Canadian market through various strategies:

-

Index funds: Investing in index funds tracking the S&P/TSX Composite Index provides broad market exposure and diversification.

-

Sector-specific ETFs: Focusing on specific sectors like energy or technology through ETFs allows for targeted investment based on market expectations.

-

Individual stock picking: Selecting individual stocks requires thorough research and understanding of the specific company's performance and future prospects.

Diversification is crucial to mitigating risk. Thoroughly researching potential investments and understanding one's risk tolerance are essential before committing capital. Seeking professional financial advice is strongly recommended.

Conclusion

The S&P/TSX Composite Index's recent record highs reflect a positive outlook for the Canadian economy, driven by strong sector performance and increased investor confidence. However, global uncertainties and interest rate hikes present potential challenges. Investors should carefully consider their risk tolerance and diversification strategies before investing in the Canadian stock market. Stay informed about the S&P/TSX Composite Index and navigate the Canadian stock market effectively by consulting financial professionals and conducting your own thorough research. Remember to consult with a financial advisor before making any investment decisions related to the S&P/TSX Composite Index and Canadian equities.

Featured Posts

-

Crook Accused Of Millions In Gains From Executive Office365 Intrusions

May 17, 2025

Crook Accused Of Millions In Gains From Executive Office365 Intrusions

May 17, 2025 -

Giants Vs Mariners Injury Concerns Ahead Of April 4 6 Series On Fox Sports 550

May 17, 2025

Giants Vs Mariners Injury Concerns Ahead Of April 4 6 Series On Fox Sports 550

May 17, 2025 -

Atlantic Canadas Lobster Fishers Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025

Atlantic Canadas Lobster Fishers Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025 -

Floridas Generation Z And Active Shooter Response Evaluating School Lockdown Effectiveness

May 17, 2025

Floridas Generation Z And Active Shooter Response Evaluating School Lockdown Effectiveness

May 17, 2025 -

Crockett Accuses Trump Of Driving Up Grocery Prices And Threatening Wages

May 17, 2025

Crockett Accuses Trump Of Driving Up Grocery Prices And Threatening Wages

May 17, 2025

Latest Posts

-

Best Online Casinos Ontario Mirax Casino Top Payouts In 2025

May 17, 2025

Best Online Casinos Ontario Mirax Casino Top Payouts In 2025

May 17, 2025 -

Top Australian Crypto Casinos For 2025 Games Bonuses And Security

May 17, 2025

Top Australian Crypto Casinos For 2025 Games Bonuses And Security

May 17, 2025 -

Bitcoin And Crypto Casino Comparison Top Choices For 2025

May 17, 2025

Bitcoin And Crypto Casino Comparison Top Choices For 2025

May 17, 2025 -

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 17, 2025

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 17, 2025 -

Reliable Bitcoin And Crypto Casinos Your 2025 Selection Guide

May 17, 2025

Reliable Bitcoin And Crypto Casinos Your 2025 Selection Guide

May 17, 2025