Sabic Weighs IPO For Gas Unit: A Strategic Move For Saudi Arabia

Table of Contents

Why Sabic is Considering an IPO for its Gas Unit

The decision to pursue an IPO for Sabic's gas unit is driven by several strategic objectives aimed at enhancing the company's financial position and competitiveness in the global market. Key drivers include:

-

Generating Significant Capital: An IPO would unlock significant capital, providing substantial funding for crucial investments in research and development (R&D). This will allow Sabic to explore and develop innovative technologies and expand into promising new markets, strengthening its position in the global petrochemicals landscape.

-

Enhanced Financial Flexibility: Securing capital through an IPO would greatly increase Sabic's financial flexibility. It reduces reliance on traditional funding methods, providing greater freedom to pursue strategic acquisitions and expansion projects without being constrained by debt levels.

-

Improved Transparency and Governance: Going public necessitates greater transparency and adherence to robust corporate governance standards. This increased accountability can attract more foreign investment and build investor confidence in Sabic's long-term sustainability.

-

Attracting Foreign Investment: The IPO is expected to attract significant foreign direct investment (FDI) into Saudi Arabia, boosting investor confidence in the Kingdom's economy and its commitment to diversification. This influx of capital can contribute to overall economic growth and development.

-

Focusing on Core Competencies: By separating its gas unit, Sabic can better focus its resources and expertise on its core petrochemical businesses, allowing for greater efficiency and specialization. This strategic move allows for optimized resource allocation and enhanced competitiveness within the core business.

Strategic Implications for Saudi Arabia

The potential IPO aligns perfectly with Saudi Arabia's Vision 2030, a transformative national plan aiming to diversify the economy and reduce dependence on oil revenue. The implications for the Kingdom are significant:

-

Economic Diversification: The IPO directly supports Vision 2030's goal of diversifying the Saudi Arabian economy. It demonstrates a commitment to reducing reliance on oil and creating new avenues for economic growth within the energy sector and beyond.

-

Attracting Foreign Direct Investment (FDI): The IPO is anticipated to attract significant FDI, bolstering the Kingdom's global economic standing and reputation as an attractive investment destination. This increased foreign investment will contribute to job creation and economic growth.

-

Promoting Sector Competition and Efficiency: Introducing a more competitive environment within the Saudi energy sector can stimulate innovation, efficiency improvements, and enhanced service delivery to consumers. The IPO could act as a catalyst for this needed transformation.

-

Privatization Drive: The move is a significant step in the ongoing privatization of state-owned enterprises within Saudi Arabia, fostering a more dynamic and efficient private sector. This aligns with broader government efforts to modernize the economy.

-

Job Creation: The gas sector's expansion following the IPO can potentially create new employment opportunities, contributing to reducing unemployment rates and strengthening the Kingdom's human capital.

Potential Challenges and Risks

While the Sabic gas unit IPO offers significant advantages, several challenges and risks warrant consideration:

-

Market Volatility: Global economic uncertainty and volatile energy prices pose significant risks to the IPO's success. Fluctuations in investor sentiment and market conditions can directly impact the valuation and overall success of the offering.

-

Regulatory Hurdles: Navigating regulatory complexities and obtaining necessary approvals can cause delays and even derail the IPO process. The regulatory landscape in both domestic and international markets needs careful consideration.

-

Valuation Uncertainties: Accurately determining a fair market valuation for the gas unit is crucial for a successful IPO. Misjudging the valuation can lead to either undervaluing the asset or pricing it too high, impacting investor response.

-

Investor Sentiment: Negative investor sentiment towards Saudi Arabian assets, influenced by geopolitical factors or other economic concerns, can significantly impact the reception of the IPO. Building investor confidence is crucial for a successful offering.

-

Competition: The increased competition from other global gas companies will require the separated gas unit to maintain operational excellence and innovation to compete effectively in the marketplace.

The Role of Aramco

Saudi Aramco, the world's largest oil company, plays a crucial role in this development. Aramco's existing relationship with Sabic and its significant influence on the Saudi energy sector will strongly impact the IPO's success. Synergies between Aramco and the gas unit could be explored, potentially leading to improved gas supply integration within the Saudi energy infrastructure. Aramco's involvement could offer strategic advantages, guaranteeing a stable gas supply for the separated unit and potentially attracting investors through its reputation and financial strength.

Conclusion

Sabic's consideration of an IPO for its gas unit is a momentous strategic move, strongly aligned with Saudi Arabia's Vision 2030 and its broader efforts to diversify its economy and enhance global competitiveness. While challenges and risks undoubtedly exist, the potential benefits – including substantial capital generation, increased financial flexibility, and the attraction of significant foreign investment – make this a crucial development for both Sabic and the Kingdom. The strategic implications extend far beyond Sabic itself, affecting the broader Saudi energy landscape and the nation's ongoing economic transformation.

Call to Action: Stay informed on the unfolding Sabic IPO and its substantial impact on the Saudi Arabian energy market. Follow our updates for insightful analyses of this landmark event in the development of the Saudi petrochemical and gas sectors. Learn more about the multifaceted implications of this pivotal Sabic IPO and its contribution to the Kingdom's ambitious Vision 2030 goals.

Featured Posts

-

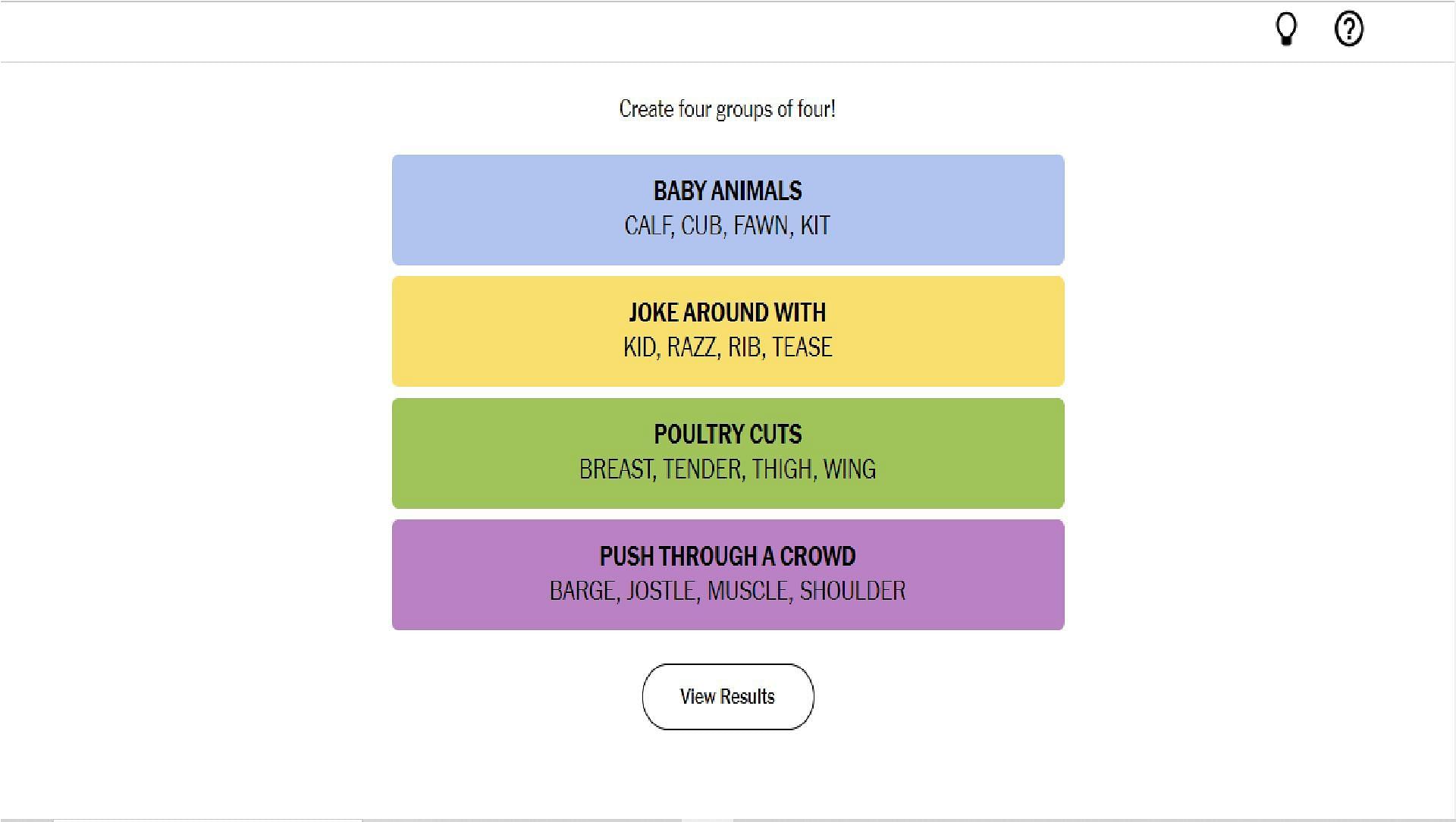

Complete Guide To Nyt Connections Puzzle 697 May 8 2024

May 19, 2025

Complete Guide To Nyt Connections Puzzle 697 May 8 2024

May 19, 2025 -

The Jersey Battle Of Flowers A Fight For Its Survival

May 19, 2025

The Jersey Battle Of Flowers A Fight For Its Survival

May 19, 2025 -

First Class Stamp Price Hike 1 70 Blow To Consumers

May 19, 2025

First Class Stamp Price Hike 1 70 Blow To Consumers

May 19, 2025 -

April 7th Royal Mail Stamp Price Increases The Full Breakdown

May 19, 2025

April 7th Royal Mail Stamp Price Increases The Full Breakdown

May 19, 2025 -

Series Opener Cavaliers Offensive Attack Overwhelms Georgia Tech

May 19, 2025

Series Opener Cavaliers Offensive Attack Overwhelms Georgia Tech

May 19, 2025