Sabic's Gas Business IPO: Exploring Saudi Arabia's Energy Future

Table of Contents

Understanding Sabic's Gas Business and its Significance

Sabic's Role in Saudi Arabia's Petrochemical Industry

Saudi Basic Industries Corporation (Sabic) is a global leader in the petrochemical industry, playing a crucial role in Saudi Arabia's economy. For decades, Sabic has been a cornerstone of the Kingdom's industrial sector, contributing significantly to GDP and employment. Its operations are heavily reliant on natural gas, making the gas business segment a vital component of its overall operations. This segment is poised for significant growth, given the global demand for petrochemicals and the Kingdom's substantial natural gas reserves.

The Scale and Scope of the Gas Business IPO

The Sabic gas business IPO is expected to be one of the largest in Saudi Arabia's history. The sheer scale of the assets involved and the potential valuation draw significant attention from both domestic and international investors.

- Estimated Valuation: While precise figures remain confidential until closer to the IPO date, industry analysts predict a multi-billion dollar valuation.

- Targeted Investors: The IPO is likely to attract a diverse range of investors, including Saudi Arabian sovereign wealth funds, large institutional investors from across the globe, and high-net-worth individuals.

- Potential Market Share Gains Post-IPO: A successful IPO could provide Sabic with the capital to expand its gas operations, potentially increasing its market share and strengthening its competitive position in the global petrochemical market.

Strategic Rationale Behind the IPO

The Saudi government's decision to initiate the IPO is driven by several strategic objectives directly aligned with Vision 2030:

- Generating Revenue for Vision 2030 Initiatives: Proceeds from the IPO will contribute to funding various national development projects outlined in Vision 2030, encompassing infrastructure development, education, and healthcare.

- Attracting Foreign Investment: The IPO is intended to attract substantial foreign direct investment (FDI) into Saudi Arabia's energy sector, boosting economic growth and international collaboration.

- Improving Market Transparency and Corporate Governance: Listing Sabic's gas business on the stock exchange will increase transparency and accountability, enhancing corporate governance standards.

Impact on Saudi Arabia's Energy Future

Implications for Energy Security

The Sabic gas business IPO has significant implications for Saudi Arabia's energy security:

- Increased Investment in Gas Infrastructure: The influx of capital from the IPO can be reinvested in upgrading and expanding the Kingdom's gas infrastructure, enhancing its reliability and resilience.

- Potential for Technological Advancements: The IPO could attract investment in research and development (R&D), leading to technological advancements in gas exploration, production, and utilization.

- Improved Efficiency and Sustainability in the Gas Sector: New technologies and increased investment will likely improve the efficiency and sustainability of gas operations, reducing environmental impact.

Contribution to Economic Diversification (Vision 2030)

The IPO is a pivotal step towards achieving the diversification goals of Vision 2030:

- Reducing Reliance on Oil Revenue: By generating substantial revenue from the gas sector, Saudi Arabia can reduce its dependence on oil price fluctuations for economic stability.

- Creating New Jobs and Investment Opportunities: The expanded gas sector will create numerous direct and indirect job opportunities across various industries, fostering economic growth and reducing unemployment.

- Developing a More Robust and Sustainable Economy: A diversified economy, less reliant on volatile commodities, is better equipped to withstand global economic shocks.

Environmental Considerations and Sustainability

While the gas sector has an environmental footprint, Saudi Arabia is actively addressing sustainability concerns:

- Potential for Carbon Capture and Storage (CCS): Investment from the IPO could facilitate the adoption of CCS technologies to mitigate greenhouse gas emissions.

- Investment in Renewable Energy Sources: The proceeds could also support investments in renewable energy sources, accelerating the Kingdom's energy transition.

- Environmental, Social, and Governance (ESG) Factors Influencing the IPO: ESG considerations are increasingly important to investors, and Sabic is likely to highlight its sustainability initiatives to attract investment.

Challenges and Opportunities

Potential Market Risks and Volatility

The IPO faces potential challenges:

- Potential Market Risks and Volatility: Global economic downturns or fluctuations in the energy market could impact investor confidence and the IPO's success.

Regulatory and Geopolitical Factors

- Regulatory and Geopolitical Factors: Government regulations and regional geopolitical stability will play a crucial role in shaping the IPO's outcome.

Opportunities for Growth and Innovation

- Opportunities for Growth and Innovation: The IPO presents significant opportunities for growth and innovation within Sabic's gas business, potentially leading to the development of new technologies and market expansion.

Conclusion: The Sabic Gas Business IPO: Shaping Saudi Arabia's Energy Tomorrow

The Sabic gas business IPO is a significant event with far-reaching consequences for Saudi Arabia's energy future. It represents a bold step towards economic diversification, energy security enhancement, and the integration of sustainability initiatives. While challenges exist, the potential benefits – increased investment, job creation, and a more resilient economy – are substantial. This IPO is a crucial component of Saudi Arabia’s strategic shift, paving the way for a more sustainable and prosperous energy sector. To learn more about investing in Sabic's gas business and Saudi Arabia's energy future, explore resources on the Sabic website and official government publications.

Featured Posts

-

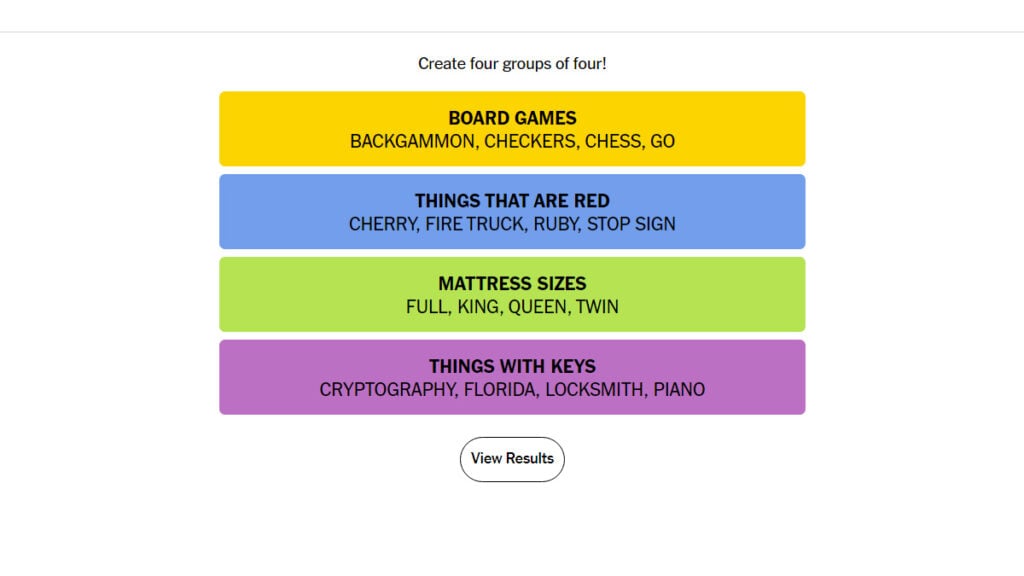

Nyt Connections Hints And Solutions April 11 670

May 19, 2025

Nyt Connections Hints And Solutions April 11 670

May 19, 2025 -

19th Place For The Uk At Eurovision 2025 Reasons And Reactions

May 19, 2025

19th Place For The Uk At Eurovision 2025 Reasons And Reactions

May 19, 2025 -

New Mexico Governor Race Deb Haalands Candidacy Announcement

May 19, 2025

New Mexico Governor Race Deb Haalands Candidacy Announcement

May 19, 2025 -

I Anastasi Toy Lazaroy Istoria Simasia And Topothesia Sta Ierosolyma

May 19, 2025

I Anastasi Toy Lazaroy Istoria Simasia And Topothesia Sta Ierosolyma

May 19, 2025 -

Youtuber Jyoti Malhotra Puris Srimandir Visit Footage Emerges Amid Espionage Probe

May 19, 2025

Youtuber Jyoti Malhotra Puris Srimandir Visit Footage Emerges Amid Espionage Probe

May 19, 2025