Sasol (SOL) 2023 Strategy Update: What Investors Need To Know

Table of Contents

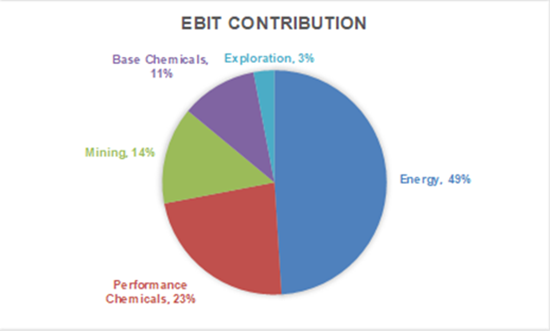

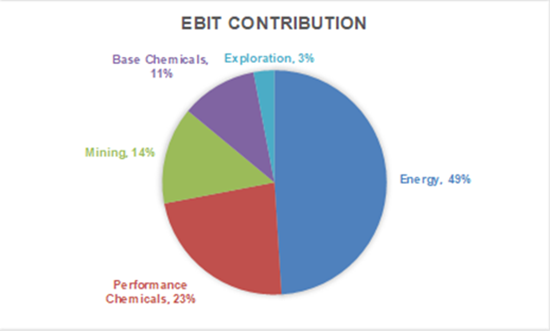

Sasol's 2023 Financial Performance and Key Metrics

Sasol's 2023 financial performance reflects the challenges and opportunities within the global energy market. Analyzing key metrics provides valuable insights for investors considering a position in SOL.

Revenue and Profitability

Sasol's revenue streams are diverse, encompassing chemicals, energy, and mining. Profitability margins in 2023 were impacted by several factors, including fluctuating commodity prices (especially oil and gas) and global economic uncertainty. However, strategic cost-cutting measures and operational improvements helped mitigate some of these pressures.

- Revenue: While precise figures require consulting official Sasol reports, analysts projected [Insert projected revenue figures and percentage change compared to previous year]. This change can be attributed to [mention specific factors like changes in commodity prices or sales volume].

- Profitability: [Insert data on net income, operating income margins, and EBITDA]. A key ratio to watch is Return on Equity (ROE), which indicates the company’s efficiency in generating profits from shareholder investments. [Insert ROE data and compare to previous years and industry benchmarks].

- Key Financial Ratios: Beyond ROE, investors should monitor the Debt-to-Equity ratio to assess Sasol's financial leverage. [Insert data and analysis of debt-to-equity ratio]. Other important ratios include Gross Profit Margin and Operating Profit Margin, offering further insights into operational efficiency and profitability.

Debt Reduction and Capital Allocation

Sasol has actively pursued debt reduction strategies, aiming to strengthen its balance sheet and enhance financial flexibility. This involves a combination of deleveraging initiatives and careful capital allocation.

- Debt Reduction: Sasol has successfully reduced its debt by [Insert amount and percentage reduction]. The target debt levels for [Insert timeframe] are [Insert target levels]. This successful debt reduction improves the company's creditworthiness and reduces financial risk.

- Capital Allocation: Sasol's capital allocation strategy prioritizes investments in projects that align with its long-term growth strategy, including [mention specific examples like renewable energy projects, operational improvements, and strategic acquisitions]. Share buybacks and dividend payments also play a role, reflecting the company's commitment to returning value to shareholders. The balance between these competing demands will be a key factor influencing future performance.

Key Strategic Initiatives and Future Outlook

Sasol's future outlook hinges on its ability to execute its strategic initiatives effectively, navigating a changing energy landscape and adapting to evolving market dynamics.

Energy Transition and Sustainability

Sasol is actively pursuing an energy transition strategy, focusing on decarbonization and expanding its renewable energy portfolio.

- Renewable Energy Investments: Sasol is investing in [mention specific renewable energy projects, such as solar, wind, or biofuels]. These projects aim to reduce the company’s carbon footprint and diversify its energy sources.

- Carbon Reduction Targets: Sasol has set ambitious carbon reduction targets for [mention timeframe] aiming to reduce emissions by [mention percentage] . The company is pursuing various strategies to achieve these targets, including carbon capture technologies and operational efficiency improvements.

- Partnerships and Collaborations: To accelerate the transition, Sasol is forming strategic partnerships and collaborations with other companies and organizations in the renewable energy sector.

Operational Efficiency and Cost Optimization

Improving operational efficiency and reducing costs are central to Sasol's strategy for enhancing profitability and competitiveness.

- Efficiency Improvements: Sasol is implementing various initiatives to streamline operations and improve productivity across its value chain, including [mention specific examples, such as process optimization, automation, and waste reduction].

- Cost-Cutting Measures: The company is pursuing a range of cost-cutting measures, targeting [mention specific areas like operational expenses, administrative costs, and procurement]. These measures are expected to significantly impact profitability.

- Quantifiable Impact: The expected impact of these efficiency improvements and cost reductions on profitability is [Insert projected figures or percentage improvement]. This data should be obtained from official Sasol releases or analyst reports.

Growth Strategies and Market Expansion

Sasol's growth strategy involves expanding into new markets, developing innovative technologies, and potentially pursuing strategic acquisitions.

- Target Markets: Sasol is targeting growth in [mention specific geographic regions or market segments] to diversify its revenue streams and reduce reliance on any single market.

- New Technologies: The company is investing in research and development of new technologies to enhance its competitiveness and create new growth opportunities, such as [mention specific technologies under development].

- Potential Acquisitions: Strategic acquisitions could play a role in accelerating growth and expanding into new markets or technologies. However, any such acquisitions would need to align with Sasol's overall strategic goals and financial capacity.

Risk Factors and Potential Challenges

While Sasol's strategy holds promise, investors must consider potential risks and challenges that could impact its performance.

Commodity Price Volatility

Fluctuations in commodity prices, particularly oil and gas, present a significant risk to Sasol's profitability.

- Hedging Strategies: Sasol employs various hedging strategies to mitigate the impact of price volatility, including [mention specific hedging instruments or techniques]. However, hedging cannot entirely eliminate the risk associated with price fluctuations.

- Impact on Business Segments: Different business segments within Sasol are exposed to varying degrees of price risk. For example, [mention how different segments, like chemicals or energy, are affected differently by commodity price changes].

Geopolitical and Regulatory Risks

Geopolitical instability and regulatory changes pose potential challenges to Sasol's operations.

- Geopolitical Risks: Political instability in regions where Sasol operates, or changes in global trade policies, could disrupt operations or impact supply chains.

- Regulatory Changes: Changes in environmental regulations or tax policies could increase operational costs or limit expansion opportunities. Compliance with evolving regulations is a key concern.

Competition and Market Dynamics

The energy sector is highly competitive, and Sasol faces competition from established players and new entrants.

- Key Competitors: Sasol's key competitors include [list major competitors in the energy and chemicals sectors].

- Competitive Advantages: Sasol's competitive advantages include [mention key strengths, such as technological expertise, established market position, or access to resources].

- Market Share and Growth Prospects: Sasol's market share and growth prospects will depend on its ability to execute its strategic initiatives effectively and adapt to changing market conditions.

Conclusion

Sasol's (SOL) 2023 strategy update reveals a company navigating a dynamic energy market with a focus on financial stability, operational efficiency, and a strategic shift towards sustainability. While challenges remain, particularly concerning commodity price volatility and geopolitical uncertainty, the company's proactive approach to debt reduction and its investment in renewable energy projects offer a positive outlook for long-term investors. Understanding these key elements is vital for making informed investment decisions regarding Sasol (SOL). Stay updated on further developments and consider consulting with a financial advisor before making any investment choices related to Sasol (SOL) or other energy sector stocks. Remember to always conduct thorough due diligence before investing in Sasol (SOL) or any other stock.

Featured Posts

-

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025 -

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025

China Urges Philippines To Remove Typhon Missile System For Regional Stability

May 20, 2025 -

Parcours De Femmes A Biarritz Colloques Et Debats Pour La Journee Internationale Des Droits Des Femmes

May 20, 2025

Parcours De Femmes A Biarritz Colloques Et Debats Pour La Journee Internationale Des Droits Des Femmes

May 20, 2025 -

Todays Nyt Mini Crossword Answers For March 27

May 20, 2025

Todays Nyt Mini Crossword Answers For March 27

May 20, 2025 -

Jutarnji List Tko Je Sve Bio Na Premijeri Redatelji Glumci I Voditelji

May 20, 2025

Jutarnji List Tko Je Sve Bio Na Premijeri Redatelji Glumci I Voditelji

May 20, 2025

Latest Posts

-

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025 -

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025 -

Corruption In The Us Navy The Case Of The Convicted Four Star Admiral

May 20, 2025

Corruption In The Us Navy The Case Of The Convicted Four Star Admiral

May 20, 2025 -

High Ranking Admiral Sentenced Details Of The Corruption Case

May 20, 2025

High Ranking Admiral Sentenced Details Of The Corruption Case

May 20, 2025 -

Us Navy Admirals Fall From Grace Corruption Charges And Conviction

May 20, 2025

Us Navy Admirals Fall From Grace Corruption Charges And Conviction

May 20, 2025