Saudi ABS Market Transformation: Regulatory Change And Growth Potential

Table of Contents

The Saudi Arabian financial market is experiencing a period of rapid growth and evolution, transforming into a dynamic and increasingly sophisticated hub for investment. A key driver of this transformation is the burgeoning Asset-Backed Securities (ABS) market, which plays a crucial role in channeling capital towards economic development and infrastructure projects. This article will explore the transformative impact of recent regulatory changes on the Saudi ABS market and analyze its immense future growth potential, highlighting significant investment opportunities. We will delve into key aspects including regulatory reforms, growth projections, and the role of technology in shaping this exciting landscape. Keywords: Saudi Arabia, ABS market, regulatory changes, growth potential, investment opportunities, Saudi ABS, Asset-Backed Securities.

Regulatory Reforms Driving Saudi ABS Market Growth

Easing of Issuance Requirements: The Saudi Arabian Monetary Authority (SAMA) has implemented significant reforms to streamline the ABS issuance process. This simplification has significantly reduced bureaucratic hurdles and expedited approvals, making it easier for businesses of all sizes to access capital through the ABS market.

- Updated Legal Frameworks: New legal frameworks have clarified the regulatory landscape, providing greater certainty for issuers and investors.

- Reduced Capital Requirements: Lowered capital requirements have reduced the financial burden on businesses, particularly small and medium-sized enterprises (SMEs), thereby broadening market accessibility.

- Streamlined Approval Processes: Faster approval times have significantly reduced the time-to-market for ABS issuances, boosting efficiency.

These changes are already impacting the market; issuance volumes have increased by X% in the last year (Source: [Insert reputable source here]), demonstrating the positive effect of these regulatory reforms. This increased accessibility opens doors for SMEs to access crucial funding, stimulating economic growth and diversification.

Enhanced Investor Protection: To foster investor confidence, SAMA has introduced several measures aimed at enhancing transparency and protecting investor rights. These measures include:

- Strengthened Disclosure Requirements: More rigorous disclosure requirements ensure that investors have access to comprehensive and accurate information about ABS offerings.

- Credit Rating Requirements: Mandatory credit ratings provide investors with independent assessments of the risk associated with each ABS issuance.

- Independent Trustee Oversight: The appointment of independent trustees provides an additional layer of protection, ensuring that the interests of investors are safeguarded.

These measures are vital in attracting both domestic and international investment. By building trust and confidence, they pave the way for increased participation in the Saudi ABS market. Furthermore, initiatives focused on educating investors about ABS are improving market understanding and participation.

Focus on Specific Asset Classes: Regulatory support is being directed towards specific asset classes to drive growth in targeted sectors. This includes:

- Mortgage-Backed Securities (MBS): Government initiatives promoting affordable housing are fueling growth in the MBS segment.

- Auto Loan ABS: The expanding automotive sector is driving demand for auto loan-backed ABS.

- Receivables ABS: Regulatory support for factoring and receivables financing is boosting the growth of this segment.

The current market share is approximately [Insert Data on Market Share for each Asset Class], indicating substantial opportunities for growth. The integration of technology, such as digital platforms for ABS trading, is further accelerating this growth.

Growth Potential and Investment Opportunities in the Saudi ABS Market

Expanding Market Size and Depth: The Saudi ABS market is poised for significant expansion. Based on current trends and regulatory changes, market size is projected to reach [Insert Market Size Projection with Source] by [Year].

- Increased Diversification of Issuers: A wider range of issuers, including SMEs and corporations, are expected to participate in the market.

- Infrastructure Development: Ongoing infrastructure projects will continue to drive demand for ABS financing.

The deepening of the market will result in greater liquidity and increased investor participation, fostering sustainable growth.

Attracting Foreign Investment: The Saudi ABS market presents compelling opportunities for international investors.

- Higher Returns: Compared to other markets, the Saudi ABS market offers potentially higher returns.

- Diversification Benefits: Investing in the Saudi ABS market allows for diversification beyond traditional asset classes.

- Supportive Government Policies: Government initiatives to promote the ABS market create a favorable investment climate.

Joint ventures and collaborations between international and domestic players are likely to become increasingly common. Government incentives for attracting foreign capital further enhance the attractiveness of the market.

Technological Disruption and Fintech: Technological advancements are transforming the Saudi ABS market.

- Blockchain Technology: Blockchain's potential to enhance transparency and efficiency in ABS transactions is being explored.

- AI and Big Data: AI and big data are improving risk assessment and pricing models, leading to more accurate valuations and reduced risk.

- Digital Platforms: Digital platforms are improving market efficiency by streamlining trading processes.

Conclusion: Investing in the Future of Saudi ABS

The Saudi ABS market is undergoing a significant transformation, driven by comprehensive regulatory reforms, substantial growth potential, and attractive investment opportunities. The easing of issuance requirements, enhanced investor protection, and a focus on specific asset classes are creating a more dynamic and accessible market. This, coupled with technological advancements and supportive government policies, points towards a future of significant expansion and lucrative returns. Unlock the potential of the Saudi ABS market – contact us today to explore investment strategies and learn more about the opportunities available in this rapidly evolving sector.

Featured Posts

-

Government Funded Mental Health Courses A Comprehensive Guide

May 03, 2025

Government Funded Mental Health Courses A Comprehensive Guide

May 03, 2025 -

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy I Mid Rossii

May 03, 2025

Situatsiya Vokrug Makronov Reaktsiya Zakharovoy I Mid Rossii

May 03, 2025 -

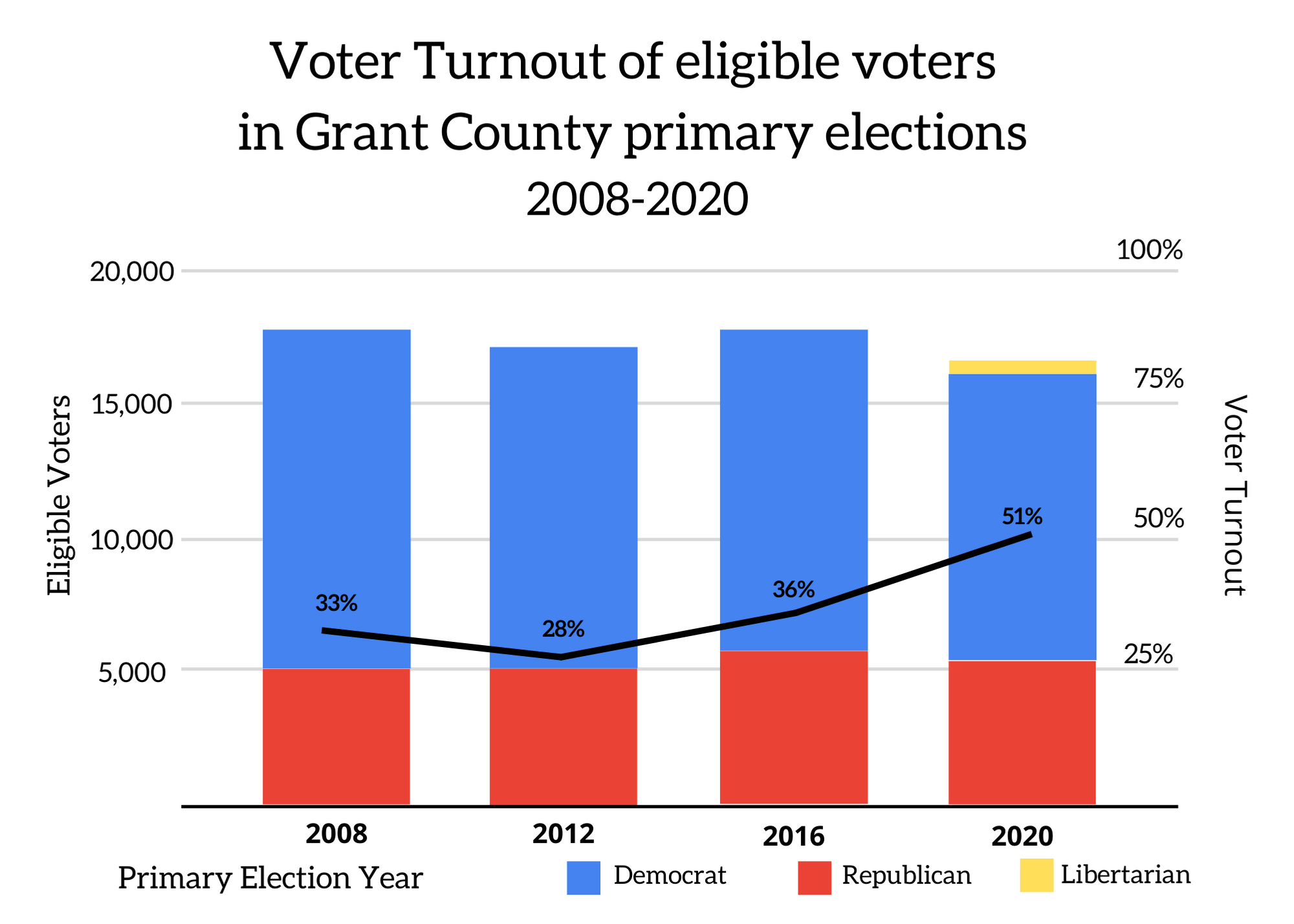

Understanding The Political Climate Key Insights From Florida And Wisconsins Election Turnout

May 03, 2025

Understanding The Political Climate Key Insights From Florida And Wisconsins Election Turnout

May 03, 2025 -

Family Pays Tribute To Tragically Lost Manchester United Fan Poppy

May 03, 2025

Family Pays Tribute To Tragically Lost Manchester United Fan Poppy

May 03, 2025 -

Blay Styshn 6 Thlyl Shaml Llmyzat Waltqnyat Almtwqet

May 03, 2025

Blay Styshn 6 Thlyl Shaml Llmyzat Waltqnyat Almtwqet

May 03, 2025

Latest Posts

-

Analyzing The Final Destination Film Series Worldwide Box Office Performance And Bloodline Trailer

May 04, 2025

Analyzing The Final Destination Film Series Worldwide Box Office Performance And Bloodline Trailer

May 04, 2025 -

Final Destination Franchise Box Office Success Ranking All Films Including Bloodline

May 04, 2025

Final Destination Franchise Box Office Success Ranking All Films Including Bloodline

May 04, 2025 -

The End Of An Era Tony Todds Final On Screen Appearance And A 25 Year Mystery

May 04, 2025

The End Of An Era Tony Todds Final On Screen Appearance And A 25 Year Mystery

May 04, 2025 -

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025 -

Competing For Horror Fans Franchise Reboot Vs Stephen King Movie

May 04, 2025

Competing For Horror Fans Franchise Reboot Vs Stephen King Movie

May 04, 2025