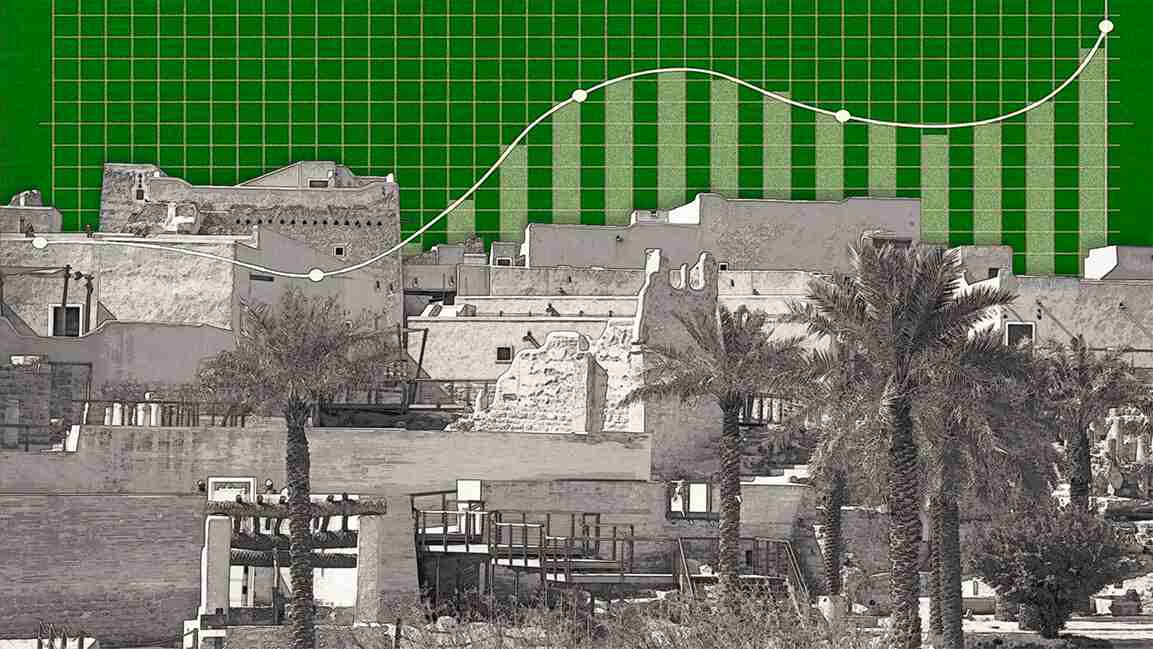

Saudi Arabia Investment Drive: Deutsche Bank's Global Outreach

Table of Contents

Deutsche Bank's Strategic Partnerships in Saudi Arabia

Deutsche Bank's success in the Saudi Arabian market is deeply rooted in its strategic partnerships with both governmental entities and private sector companies. These collaborations are instrumental in driving investment and fostering economic growth aligned with Vision 2030.

-

Examples of Collaborations: Deutsche Bank's involvement spans diverse sectors. They've played advisory roles in significant privatization initiatives, assisting in the restructuring and sale of state-owned assets. Furthermore, they are actively participating in the financing of mega-projects, contributing expertise in project finance and structuring complex deals.

-

Key Saudi Arabian Partners: While specific details of all partnerships are often confidential, the bank’s collaborations likely include prominent Saudi Arabian governmental bodies such as the Public Investment Fund (PIF) and various ministries, along with major private sector players across diverse sectors including energy, infrastructure, and technology.

-

Financial Instruments: Deutsche Bank employs a range of financial instruments to support its partnerships, including equity investments, syndicated loans, and the issuance of bonds, offering flexible solutions tailored to the specific needs of each project and partner. These instruments are key to unlocking the capital necessary for large-scale development initiatives and the realization of Vision 2030 goals. The bank’s expertise in structuring and executing these financial transactions is a critical component of its contribution to the Saudi Arabia investment drive.

Facilitating Foreign Direct Investment (FDI) into Saudi Arabia

Deutsche Bank acts as a vital bridge, connecting international investors with the promising landscape of Saudi Arabia. The bank provides comprehensive support to foreign companies looking to enter the Saudi Arabian market, navigating the complexities of regulatory compliance and market entry strategies.

-

Due Diligence and Regulatory Support: Deutsche Bank offers robust due diligence services, ensuring that international investors have access to thorough market analysis, risk assessments, and regulatory compliance support. This assists investors in making informed decisions and mitigating potential risks.

-

Successful FDI Case Studies: While specific details of confidential client engagements are naturally protected, Deutsche Bank's success stories in facilitating FDI in sectors such as renewable energy, tourism, and technology showcase its effectiveness in attracting international capital. These case studies underline the bank's comprehensive understanding of the Saudi Arabian market.

-

Attractive Sectors for FDI: Saudi Arabia’s Vision 2030 strategy is driving significant investment in several key sectors. These include renewable energy, where the country is making massive investments in solar and wind power; tourism, with ambitious plans to develop world-class resorts and destinations; and technology, fueled by the Kingdom's digital transformation initiatives. Deutsche Bank is actively supporting FDI in each of these areas.

Deutsche Bank's Role in Financing Saudi Arabian Mega-Projects

Deutsche Bank plays a crucial role in financing the ambitious infrastructure and development projects integral to Vision 2030. This involvement is driving economic diversification and creating significant opportunities for both domestic and international investors.

-

Significant Projects: Deutsche Bank’s contribution to the Saudi Arabia investment drive is evident in its participation in financing landmark projects such as NEOM, the ambitious futuristic city, and the Red Sea Project, a luxury tourism development.

-

Financing Mechanisms: The bank provides a diverse range of financing options, including project finance, where the financing is directly tied to the cash flows of the project, and syndicated loans, where multiple lenders contribute to a large financing package. This flexibility enables the bank to cater to the unique requirements of each mega-project.

-

Contribution to Economic Diversification: By supporting these mega-projects, Deutsche Bank is actively contributing to the economic diversification goals set forth in Vision 2030. This diversification reduces reliance on oil revenue, fostering a more sustainable and robust economy.

Deutsche Bank's Commitment to Sustainable Investments in Saudi Arabia

Deutsche Bank is actively promoting Environmental, Social, and Governance (ESG) principles within its investments in Saudi Arabia, aligning its activities with the Kingdom's growing focus on sustainability.

-

ESG-Focused Investments: The bank is increasingly directing investment towards renewable energy projects, sustainable tourism initiatives, and other ventures that demonstrate a strong commitment to environmental responsibility and social impact.

-

Commitment to ESG Principles: Deutsche Bank’s integration of ESG considerations into its investment decisions reflects a wider trend within the global financial sector, showcasing a commitment to responsible and sustainable investment practices.

-

Alignment with Saudi Arabia's Sustainability Goals: This focus on sustainable investments directly supports Saudi Arabia's own ambitions for a more sustainable future, reinforcing the country's commitment to environmentally conscious development.

Conclusion

Deutsche Bank’s profound engagement in the Saudi Arabia investment drive underscores its dedication to supporting the Kingdom's remarkable economic transformation. By facilitating Foreign Direct Investment (FDI), financing major projects, and championing sustainable investments, Deutsche Bank plays a vital role in the success of Vision 2030. To learn more about the diverse investment opportunities in Saudi Arabia and Deutsche Bank's comprehensive services, explore their resources and connect with their investment specialists. The future of the Saudi Arabia investment drive is undeniably bright, and Deutsche Bank is strategically positioned at its forefront.

Featured Posts

-

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025

The Cut White Tiger Scene In Daredevil Born Again Episode 4 Analysis And Speculation

May 30, 2025 -

Ticketmaster Alert Significant Losses Reported Due To Counterfeit Ticket Scams

May 30, 2025

Ticketmaster Alert Significant Losses Reported Due To Counterfeit Ticket Scams

May 30, 2025 -

Citizen Scientists And The Mysteries Of Whidbey Clams

May 30, 2025

Citizen Scientists And The Mysteries Of Whidbey Clams

May 30, 2025 -

Announcing The Launch Of The Joy Smith Foundation A Media Advisory

May 30, 2025

Announcing The Launch Of The Joy Smith Foundation A Media Advisory

May 30, 2025 -

Revisiting The Reviews A Rediscovery Of A Key Golden Age Hollywood Film Critic

May 30, 2025

Revisiting The Reviews A Rediscovery Of A Key Golden Age Hollywood Film Critic

May 30, 2025