SEC Crypto Broker Rules: Chairman Atkins Hints At Overhaul

Table of Contents

Gensler's Stance on Crypto Broker Regulation

Chairman Gensler has consistently expressed concerns about the lack of robust regulation within the cryptocurrency market. He views many crypto assets as unregistered securities, highlighting significant gaps in investor protection and a high potential for market manipulation. His stance emphasizes the need for clearer rules and stronger enforcement to protect investors and maintain market integrity.

Specific concerns raised by Gensler include:

- Unregistered Securities Offerings: Many crypto projects, in Gensler's view, conduct unregistered securities offerings, violating existing securities laws. This includes Initial Coin Offerings (ICOs) and other fundraising methods where tokens are sold to investors with the expectation of future profits.

- Inadequate Investor Protection: The current regulatory framework lacks robust mechanisms to safeguard investors from fraud, scams, and market manipulation within the crypto space.

- Market Manipulation: The decentralized nature of cryptocurrencies, while touted as a benefit, also presents challenges in monitoring and preventing market manipulation.

Examples of crypto assets considered securities by the SEC include:

- Certain tokens offering profit-sharing or revenue-sharing arrangements.

- Tokens issued by projects offering a return on investment.

- Tokens with governance rights that provide significant influence over the project.

The SEC also expresses regulatory concerns surrounding:

- Staking: The practice of staking cryptocurrencies to secure a blockchain network and earn rewards.

- Lending: Platforms that allow users to lend their crypto assets and earn interest.

- DeFi (Decentralized Finance) Platforms: Decentralized applications offering various financial services, often operating outside traditional regulatory frameworks.

Past enforcement actions against crypto companies underscore the SEC's commitment to strengthening its regulatory oversight.

Potential Overhaul of SEC Crypto Broker Rules

While specific proposals haven't been fully released, Chairman Gensler’s statements strongly suggest a significant overhaul of SEC Crypto Broker Rules is imminent. This potential overhaul could involve:

- Increased Registration Requirements: Crypto brokers may face stricter registration requirements, potentially necessitating registration as broker-dealers or investment advisors under existing securities laws.

- Stricter AML/KYC Compliance: Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations will likely be significantly tightened, forcing brokers to implement more robust compliance programs to prevent illicit activities.

- Enhanced Investor Protection Measures: Increased disclosure requirements, stricter custody rules, and potentially mandatory investor education initiatives could become standard.

- Limitations on Certain Crypto Activities: The SEC might introduce restrictions on activities such as staking and lending, particularly if deemed to be securities offerings. This could significantly impact the business models of many crypto platforms.

Impact on the Cryptocurrency Industry

The potential changes to SEC crypto broker rules will have a profound impact on the cryptocurrency market. These regulatory shifts could:

- Decrease Market Liquidity: Increased regulation could deter some investors and reduce trading volume.

- Increase Compliance Costs: Crypto businesses will face higher compliance costs associated with implementing stricter AML/KYC procedures, enhanced reporting requirements, and legal counsel.

- Shift the Competitive Landscape: Smaller, less established players might find it challenging to comply with the new regulations, potentially leading to consolidation within the market.

- Impact Innovation: Overly stringent regulations could stifle innovation within the crypto space, slowing down the development of new technologies and applications.

Legal and Compliance Challenges for Crypto Brokers

Navigating the evolving regulatory landscape presents numerous challenges for crypto brokers:

- Defining "Security": The classification of crypto assets as securities remains a complex legal issue, with varying interpretations impacting regulatory compliance.

- Robust Compliance Programs: Implementing comprehensive compliance programs that meet the stringent requirements of the SEC will require significant investment in technology, personnel, and expertise.

- Legal Risks of Non-Compliance: Non-compliance with SEC regulations can result in hefty fines, legal battles, and reputational damage.

- Specialized Expertise: Crypto brokers will need to engage specialized legal and compliance professionals experienced in cryptocurrency regulation to navigate these complex issues.

Conclusion

Chairman Gensler's focus on strengthening SEC crypto broker rules signifies a pivotal moment for the cryptocurrency industry. The potential overhaul, encompassing stricter registration requirements, enhanced compliance measures, and increased investor protection, will fundamentally reshape the operating landscape for crypto brokers. Understanding these evolving regulations is critical for survival and success in this dynamic market. Stay updated on the latest developments regarding SEC crypto broker rules and ensure your business is prepared for potential regulatory changes. Subscribe to reputable financial news sources, follow regulatory updates from the SEC, and consult with legal professionals specializing in crypto regulation to navigate this complex environment.

Featured Posts

-

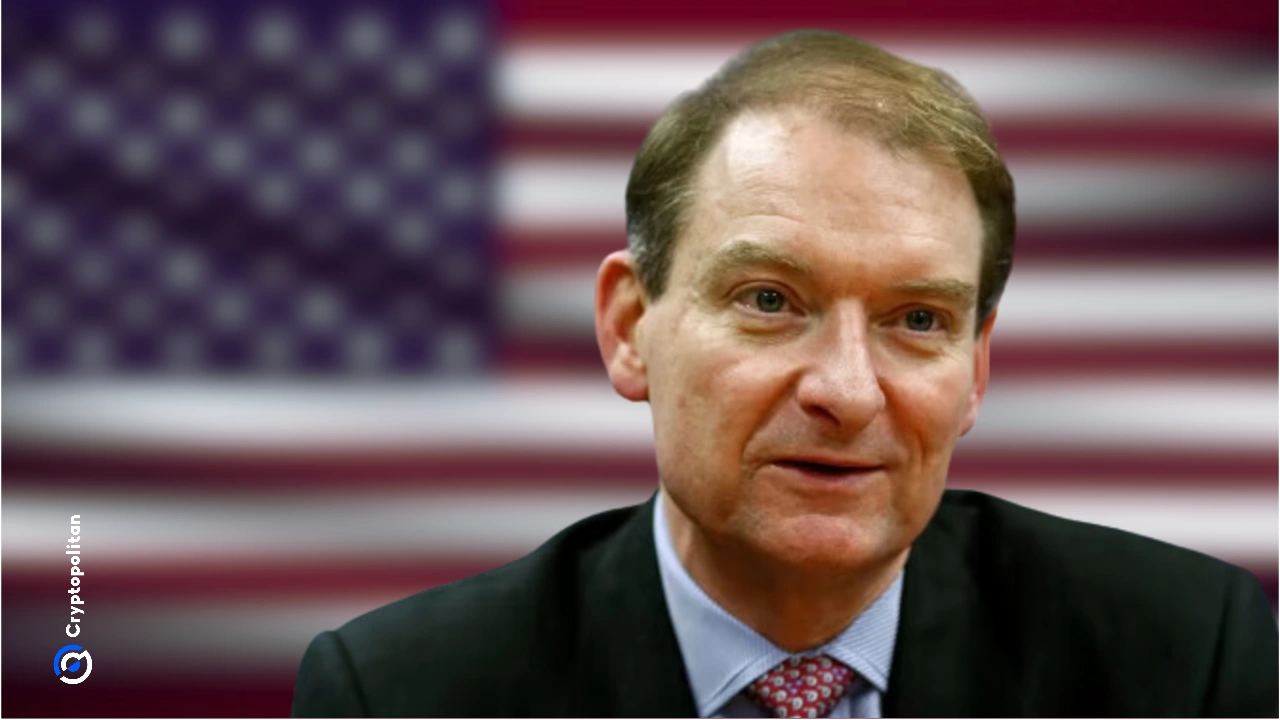

523 Million Franchise Den Of Thieves 2 And Gerard Butlers Highly Anticipated Return

May 13, 2025

523 Million Franchise Den Of Thieves 2 And Gerard Butlers Highly Anticipated Return

May 13, 2025 -

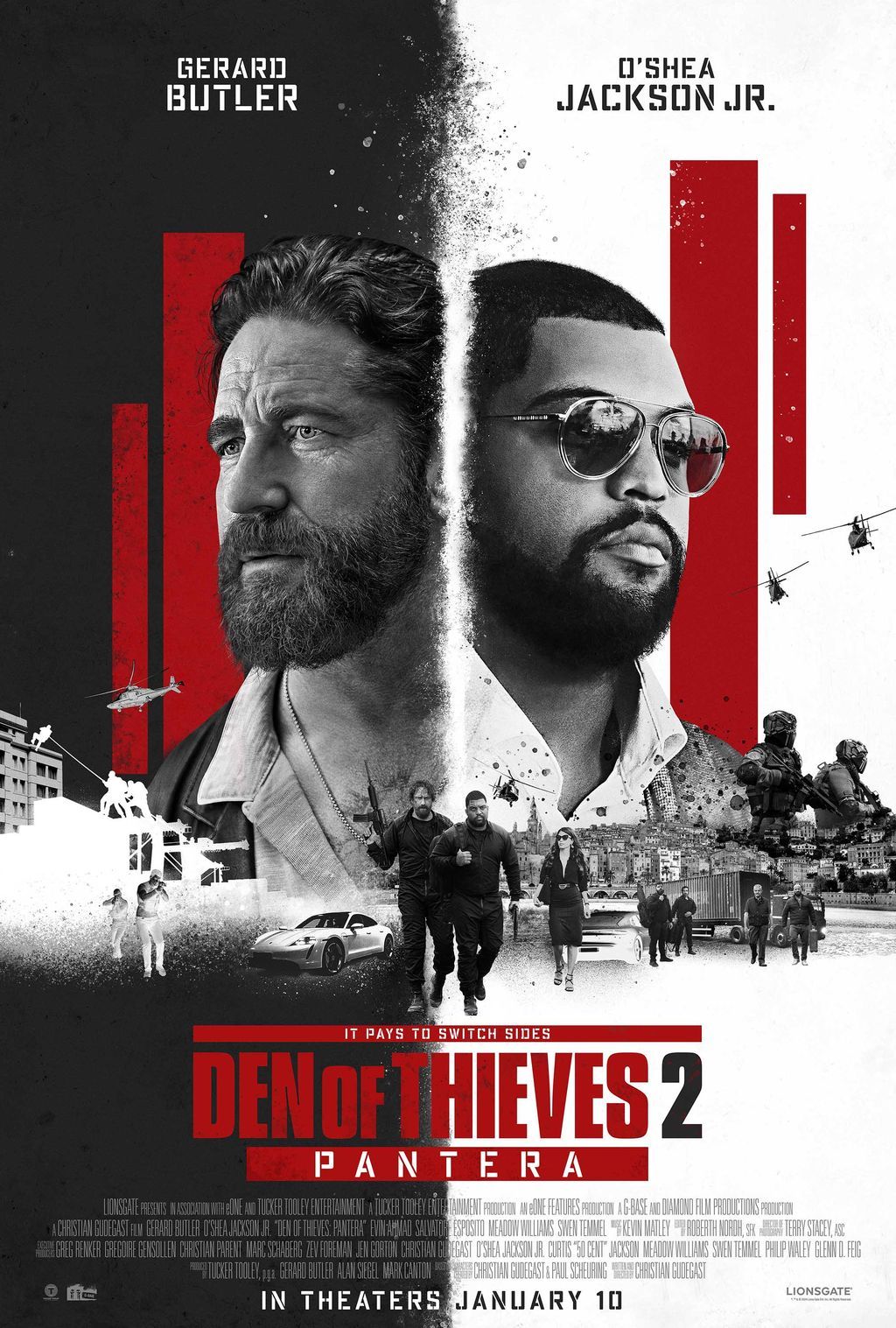

A Deeper Dive Into Earth Series 1 Infernos Storyline

May 13, 2025

A Deeper Dive Into Earth Series 1 Infernos Storyline

May 13, 2025 -

Best Senior Trips Activities And Events Calendar

May 13, 2025

Best Senior Trips Activities And Events Calendar

May 13, 2025 -

Whats App And Instagram The Ftcs Antitrust Claims Against Meta

May 13, 2025

Whats App And Instagram The Ftcs Antitrust Claims Against Meta

May 13, 2025 -

40 Million Series B Investment Fuels Pliants B2 B Payment Solutions Growth

May 13, 2025

40 Million Series B Investment Fuels Pliants B2 B Payment Solutions Growth

May 13, 2025

Latest Posts

-

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

See Scotty Mc Creerys Sons Moving George Strait Tribute

May 14, 2025

See Scotty Mc Creerys Sons Moving George Strait Tribute

May 14, 2025 -

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025 -

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025