Secure Your Investments: S&P 500 Downside Insurance Analysis

Table of Contents

Understanding S&P 500 Volatility and Risk

The S&P 500, while historically a strong performer, is susceptible to significant price swings. Understanding this volatility is crucial for effective risk management and choosing the right S&P 500 downside insurance.

Historical Volatility of the S&P 500

History is replete with examples of market corrections and crashes that significantly impacted S&P 500 investments. These events underscore the importance of having a robust risk mitigation strategy in place.

- The Dot-com Bubble (2000): The S&P 500 experienced a substantial decline, impacting technology-heavy portfolios.

- The Global Financial Crisis (2008): A severe market downturn caused significant losses across various asset classes, including the S&P 500.

- The COVID-19 Pandemic Crash (2020): The pandemic triggered a sharp and rapid market correction, demonstrating the unpredictable nature of market events.

[Insert chart or graph visualizing historical S&P 500 volatility here]

Understanding statistical measures like standard deviation and beta is also vital. Standard deviation measures the dispersion of returns around the average, indicating the level of price fluctuation. Beta measures the volatility of an investment relative to the overall market; a beta of 1 means the investment moves in line with the market, while a beta greater than 1 indicates higher volatility.

Identifying Your Risk Tolerance

Before selecting an S&P 500 downside protection strategy, it's essential to assess your risk tolerance. Different investor profiles require different approaches to risk management.

- Conservative Investors: These investors prioritize capital preservation and are comfortable with lower potential returns in exchange for reduced risk. They often favor strategies with minimal downside exposure.

- Moderate Investors: These investors seek a balance between risk and return, accepting some volatility for the potential of higher gains.

- Aggressive Investors: These investors are willing to accept higher levels of risk in pursuit of potentially higher returns.

Risk assessment questionnaires can help determine your risk profile, guiding your choice of investment strategies and downside protection.

Strategies for S&P 500 Downside Insurance

Several strategies can help protect your S&P 500 investments from market downturns. These range from options strategies to diversification techniques.

Put Options

Put options give the buyer the right, but not the obligation, to sell an underlying asset (in this case, an S&P 500 index fund or ETF) at a specific price (the strike price) before a certain date (the expiration date). If the market falls below the strike price, the put option becomes valuable, offsetting some of the losses.

- Strike Price: The price at which you can sell the underlying asset.

- Expiration Date: The date when the option expires.

- Premium: The cost of purchasing the put option.

- Cost-Benefit Analysis: Weighing the cost of the premium against the potential protection from market declines is crucial.

A covered put involves owning the underlying asset and selling a put option, generating income while hedging against a potential decline.

Protective Collar

A protective collar uses both put and call options to create a range-bound strategy. It limits both upside and downside risk.

- Put Option: Protects against losses if the market falls.

- Call Option: Limits potential gains, but protects from significant upside losses.

While offering comprehensive protection, a protective collar is generally more expensive than just using put options. Understanding break-even points is crucial to evaluating its cost-effectiveness.

Inverse ETFs

Inverse exchange-traded funds (ETFs) aim to deliver returns that are the opposite of the underlying index. An inverse S&P 500 ETF would profit from a decline in the S&P 500. However, these ETFs often use leverage, amplifying both gains and losses. This makes them suitable only for sophisticated investors comfortable with higher risk.

- Leverage: Amplifies returns, but also increases risk.

- Suitable Investor Profiles: Only experienced investors with a high risk tolerance should consider inverse ETFs.

Examples include ETFs like ProShares Short S&P 500 (SH). Remember to thoroughly understand the risks associated with leveraged inverse ETFs.

Diversification

Diversification is a fundamental risk management strategy. Don't put all your eggs in one basket! Investing in a variety of asset classes reduces your overall portfolio volatility.

- Bonds: Offer lower returns but typically provide stability during market downturns.

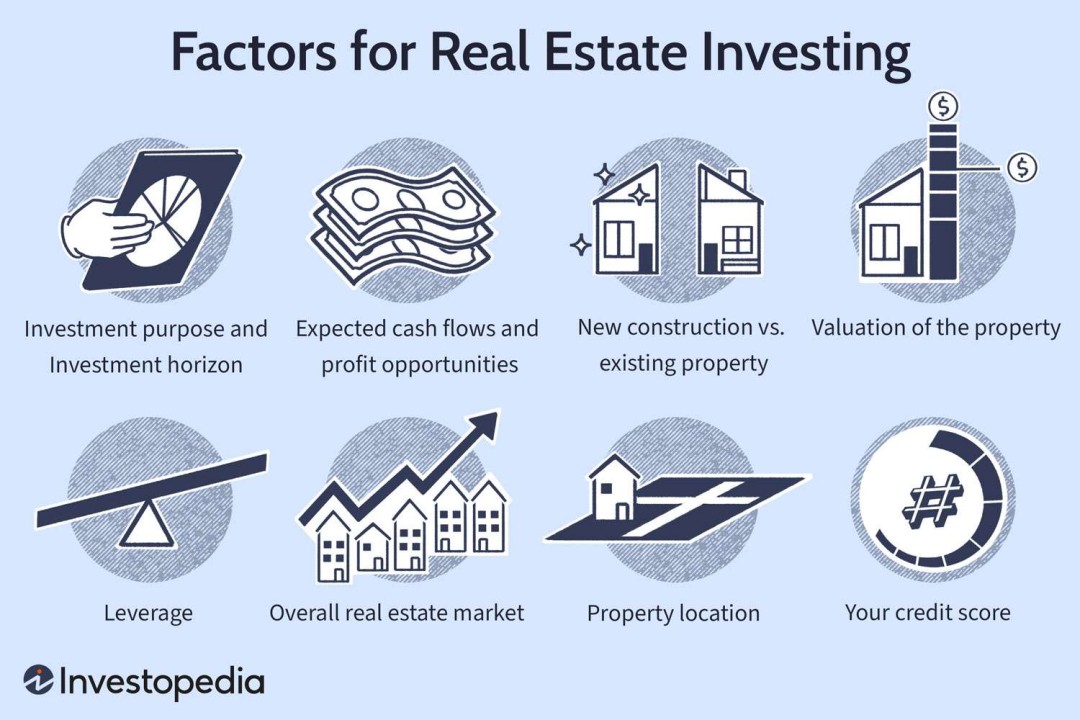

- Real Estate: Can act as a hedge against inflation and offer diversification benefits.

- International Stocks: Exposure to international markets reduces dependence on the US economy.

Regular portfolio rebalancing ensures your asset allocation stays aligned with your risk tolerance and investment goals.

Factors to Consider When Choosing Downside Protection

Selecting the right S&P 500 downside insurance requires careful consideration of several factors.

Time Horizon

Your investment time horizon significantly influences the appropriate downside protection strategy. Long-term investors may be more tolerant of short-term market fluctuations, while short-term investors may need more immediate protection.

Cost vs. Benefit

The cost of downside protection (e.g., put option premiums) must be weighed against the potential benefits of avoiding significant losses. A thorough cost-benefit analysis is crucial.

Your Financial Goals

The choice of downside protection should align with your overall financial objectives. If capital preservation is paramount, a more conservative approach is warranted.

Conclusion

Protecting your S&P 500 investments from market downturns is crucial for long-term financial success. This article has explored various strategies for S&P 500 downside insurance, including put options, protective collars, inverse ETFs, and the importance of diversification. By carefully evaluating your risk tolerance, investment time horizon, and financial goals, you can select the approach that best suits your needs. Explore the options discussed here and begin building a more resilient portfolio today! Learn more about securing your investments and achieving long-term financial stability.

Featured Posts

-

Acces Au Document Amf Mercialys 2025 E1022016 Du 25 Fevrier 2025

Apr 30, 2025

Acces Au Document Amf Mercialys 2025 E1022016 Du 25 Fevrier 2025

Apr 30, 2025 -

Leo Carlssons Two Goals Not Enough Ducks Lose To Stars In Overtime

Apr 30, 2025

Leo Carlssons Two Goals Not Enough Ducks Lose To Stars In Overtime

Apr 30, 2025 -

Our Yorkshire Farm Star Amanda Owen Shares Update Following Personal Loss

Apr 30, 2025

Our Yorkshire Farm Star Amanda Owen Shares Update Following Personal Loss

Apr 30, 2025 -

Inka Williams Channing Tatums Aussie Model Girlfriend Spotted In Melbourne

Apr 30, 2025

Inka Williams Channing Tatums Aussie Model Girlfriend Spotted In Melbourne

Apr 30, 2025 -

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 30, 2025

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 30, 2025