Securing Funding For A 270MWh Battery Energy Storage System (BESS) In Belgium

Table of Contents

Understanding Belgian Government Incentives and Subsidies for BESS

The Belgian government actively promotes renewable energy and energy storage through various policies and financial incentives. These initiatives aim to accelerate the country's transition to a sustainable energy future and support large-scale projects like the proposed 270MWh BESS. Understanding and leveraging these incentives is crucial for securing funding.

- Renewable energy investment incentives: Belgium offers various tax breaks and subsidies for investments in renewable energy projects, many of which extend to energy storage systems paired with renewable generation. Check the latest regulations on the website of the Federal Public Service Economy, SMEs, Self-Employed and Energy.

- Grid services support programs: The Belgian grid operator Elia offers programs that compensate BESS owners for providing grid stabilization services. This recurring revenue stream significantly enhances the project's financial attractiveness to investors.

- Regional or local government initiatives: Some regions in Belgium offer additional subsidies or tax benefits for renewable energy and energy storage projects. Research local incentives specific to your chosen location.

- Potential tax benefits for BESS investments: Accelerated depreciation, tax credits, and reduced corporate tax rates are among the potential tax advantages available for BESS investments in Belgium. Consult with a tax advisor to optimize your tax position.

To find the most up-to-date information, refer to the official websites of the relevant ministries and agencies, including the Federal Public Service Economy, SMEs, Self-Employed and Energy.

Exploring Private Investment Options for a 270MWh BESS Project

Private investment is a significant funding source for large-scale infrastructure projects. For a 270MWh BESS, attracting private investors requires a compelling business plan demonstrating strong financial returns and mitigating potential risks.

- Developing a compelling investment proposal: A comprehensive business plan should include detailed technical specifications, market analysis, financial projections (including revenue streams from energy arbitrage, grid services, and potential ancillary services), and a robust risk assessment.

- Highlighting the project’s financial viability and ROI: Clearly demonstrate the project's expected profitability and return on investment (ROI) to attract private investors. Sensitivity analysis showcasing the resilience to market fluctuations is highly valuable.

- Understanding investor due diligence processes: Be prepared for thorough scrutiny from potential investors. This includes providing detailed financial information, technical documentation, and legal compliance evidence.

- Negotiating favorable investment terms: Seek legal and financial advice during negotiations to ensure favorable terms for your project. This includes equity stakes, debt financing options, and preferred return structures. Potential investors include venture capital firms, private equity funds, and institutional investors specializing in renewable energy infrastructure.

Securing Project Financing through Banks and Financial Institutions

Banks and financial institutions play a crucial role in providing project financing for large-scale infrastructure projects, including BESS. Securing project finance requires a strong financial model, a detailed project plan, and a healthy credit rating.

- Types of financing available (loans, bonds, etc.): Various financing options exist, including direct loans, syndicated loans, green bonds, and other structured finance products designed for infrastructure projects.

- Requirements for securing project finance: Banks will assess your project's financial viability, technical feasibility, environmental impact, and regulatory compliance. A strong credit rating and sufficient collateral are often prerequisites.

- Navigating the due diligence process with financial institutions: Cooperate fully with the bank's due diligence process, providing all necessary documentation and addressing any concerns promptly.

- Understanding loan terms and conditions: Carefully review loan agreements, focusing on interest rates, repayment schedules, covenants, and other crucial terms.

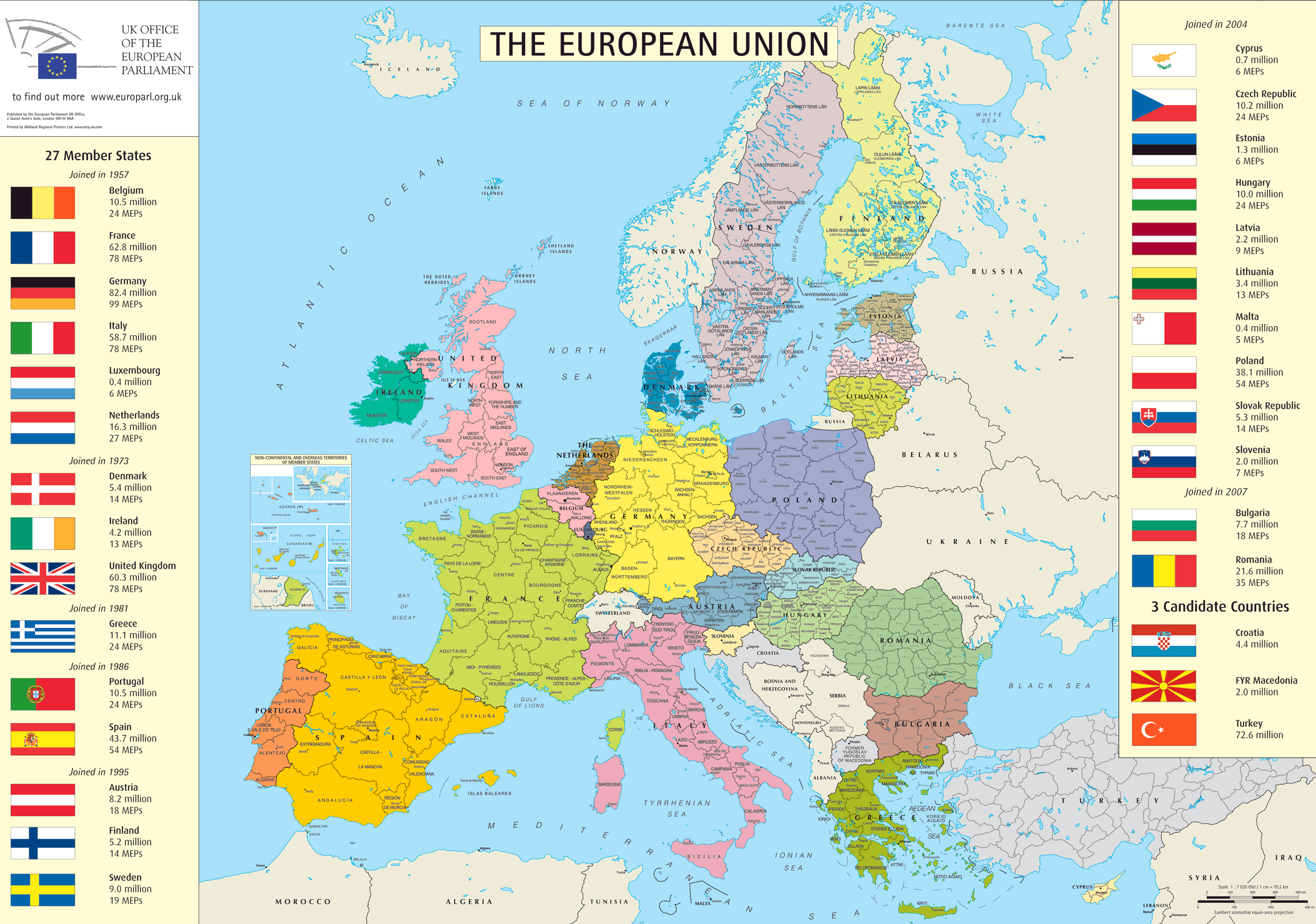

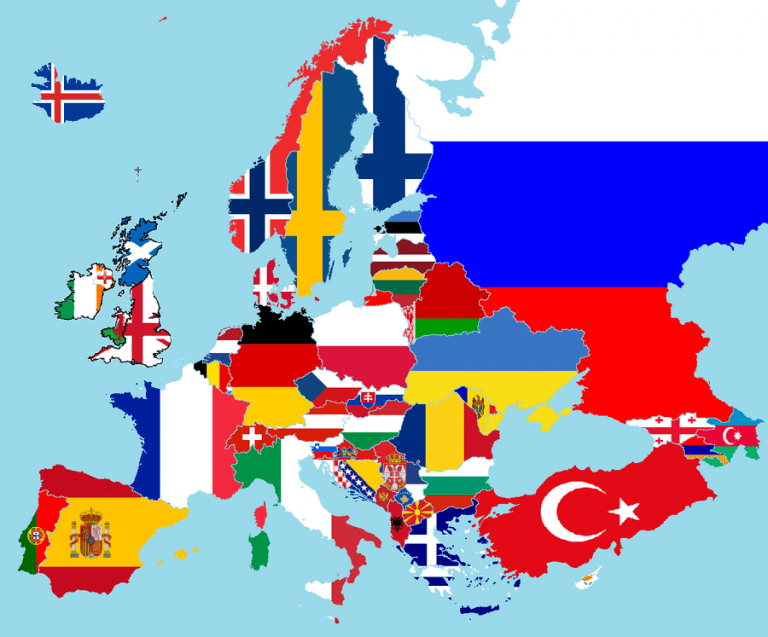

Leveraging EU Funding Opportunities for Energy Storage Projects

The European Union offers various funding programs supporting renewable energy and energy storage projects. These programs aim to accelerate the energy transition across member states and provide grants and loans for eligible projects.

- Horizon Europe funding opportunities: Horizon Europe is the EU's key funding program for research and innovation, including projects related to energy storage technologies and grid integration.

- Connecting Europe Facility (CEF) programs: CEF supports infrastructure projects of European importance, including energy infrastructure projects that enhance the integration of renewable energy sources and energy storage.

- Other relevant EU initiatives: Explore other EU initiatives and programs related to energy, climate, and sustainable development, which might offer funding opportunities for your BESS project.

- Navigating the complexities of EU grant applications: EU grant applications are often complex and require detailed proposals. Seek assistance from experienced consultants if necessary.

Risk Mitigation and Due Diligence for BESS Investment

Investing in a large-scale BESS project involves various risks. Thorough due diligence and proactive risk mitigation strategies are crucial for project success.

- Technological risks and mitigation strategies: Address potential risks related to battery technology, performance degradation, and system failures through careful selection of equipment, robust design, and comprehensive maintenance plans.

- Regulatory risks and compliance: Ensure full compliance with all relevant Belgian and EU regulations related to energy storage, grid connection, safety, and environmental protection.

- Market risks and hedging techniques: Analyze potential market risks (e.g., price volatility of electricity, changes in grid tariffs) and implement appropriate hedging strategies to mitigate financial exposure.

- Environmental and social risk assessments: Conduct thorough environmental and social impact assessments to identify and address potential negative consequences and ensure responsible development.

Conclusion: Securing Your Funding for a Successful 270MWh BESS Project in Belgium

Securing funding for a 270MWh BESS project in Belgium requires a multifaceted approach, leveraging government incentives, private investment, project finance, and EU funding opportunities. A well-structured business plan, comprehensive due diligence, and proactive risk mitigation are essential for attracting investors and securing financing. The potential benefits of BESS for Belgium's energy future are immense, making it a compelling investment opportunity. Begin securing funding for your Battery Energy Storage System (BESS) project in Belgium today! Learn more about securing investment for your Belgian BESS project by researching the resources and contacts mentioned throughout this article.

Featured Posts

-

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025 -

Nigel Farage Press Conference An Insiders Account

May 03, 2025

Nigel Farage Press Conference An Insiders Account

May 03, 2025 -

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025 -

A List Celebrity Wants In Melissa Gorgas Exclusive Nj Beach House

May 03, 2025

A List Celebrity Wants In Melissa Gorgas Exclusive Nj Beach House

May 03, 2025 -

Zakharova Prokommentirovala Otnosheniya Makronov Podrobnosti Zayavleniya

May 03, 2025

Zakharova Prokommentirovala Otnosheniya Makronov Podrobnosti Zayavleniya

May 03, 2025

Latest Posts

-

Stratejik Avrupa Is Birligi Oenemli Adimlar

May 03, 2025

Stratejik Avrupa Is Birligi Oenemli Adimlar

May 03, 2025 -

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025

Avrupa Ile Is Birliginin Gelecegi

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Detajet E Ngjarjes

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Detajet E Ngjarjes

May 03, 2025 -

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025

10 Year Old Girl Too Good For This World Dies On Rugby Pitch A Communitys Grief

May 03, 2025 -

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025

Gueclendirilen Avrupa Is Birligi Son Gelismeler Ve Analizler

May 03, 2025