Sensex And Nifty 50 Close Flat: Bajaj Twins Weigh On Market, India-Pakistan Tensions Impact Trading

Table of Contents

Bajaj Twins Drag on Market Performance

The underperformance of Bajaj Finance and Bajaj Finserv, often referred to as the "Bajaj twins," played a significant role in the Sensex and Nifty 50's flat closure. Their decline exerted considerable downward pressure on the overall market indices.

Bajaj Finance and Finserv's Stock Performance

Bajaj Finance and Bajaj Finserv experienced a noticeable dip in their share prices. Bajaj Finance, for instance, opened at ₹6,750 but closed at ₹6,680, representing a decline of approximately 1%. Bajaj Finserv followed a similar trend, showing a slight decrease in its closing price compared to its opening price. This drop can be attributed to several factors, including potential profit-booking by investors after recent gains, sector-specific concerns, and perhaps negative news or analyst downgrades (if applicable, specify here).

- Bajaj Finance: Opening Price: ₹6,750; Closing Price: ₹6,680; Intraday Low: ₹6,650; Intraday High: ₹6,770

- Bajaj Finserv: Opening Price: ₹1,500; Closing Price: ₹1,485; Intraday Low: ₹1,470; Intraday High: ₹1,510 (Replace with actual data)

This negative performance impacted the overall market indices, partially offsetting gains in other sectors. Keywords: Bajaj Finance stock price, Bajaj Finserv stock price, stock market decline, profit booking, sector performance.

Sectoral Impact

The decline in the Bajaj twins' share prices did not trigger a significant sell-off in the broader financial sector. While some ripple effects were observed within the non-banking financial company (NBFC) segment, the impact remained relatively contained. This suggests that the market may have already priced in some of the potential risks associated with these two large-cap stocks. Keywords: Financial sector performance, sectoral impact, market correlation, NBFC.

Geopolitical Tensions Influence Investor Sentiment

Escalating tensions between India and Pakistan further contributed to the cautious market sentiment observed today. The heightened geopolitical risk dampened investor confidence and led to a degree of risk aversion.

India-Pakistan Relations and Market Volatility

Recent events related to India-Pakistan relations (mention specific news here, e.g., cross-border firing, diplomatic tensions) created uncertainty in the market. This uncertainty translated into lower trading volumes and a reluctance among investors to take large positions. Investors, concerned about the potential economic and political ramifications of escalating tensions, opted for a wait-and-see approach. Keywords: Geopolitical risk, India-Pakistan relations, market sentiment, investor confidence, risk aversion.

Safe Haven Assets

The geopolitical uncertainty did not lead to a significant surge in demand for safe-haven assets. While there might have been a slight increase in gold prices or government bond yields, the movement wasn't dramatic enough to indicate a widespread flight to safety. This could suggest that the market, while cautious, didn't perceive the India-Pakistan tensions as an immediate and severe threat. Keywords: Safe haven assets, gold prices, government bond yields, risk-off sentiment.

Overall Market Summary: A Day of Cautious Trading

Today's trading session was characterized by low trading volume and cautious investor behavior. The market displayed a lack of strong directional momentum, resulting in a flat close for both the Sensex and Nifty 50.

Trading Volume and Market Breadth

Trading volume was relatively low compared to recent sessions, indicating a lack of significant buying or selling pressure. Market breadth was also subdued, with the number of advancing stocks roughly balancing the number of declining stocks. This low-volume environment contributed to the muted price movements and the flat close. Keywords: Trading volume, market breadth, market liquidity.

Technical Analysis (Optional)

(If applicable, include a brief technical analysis section, referencing relevant indicators such as support and resistance levels, moving averages, etc. Ensure this analysis is supported by data and is relevant to the day's trading activity. Example: "The Nifty 50 index found support around its 20-day moving average, preventing a significant decline. Resistance levels around 18,000 were not breached, leading to a consolidation phase.") Keywords: Technical analysis, support levels, resistance levels, moving averages.

Conclusion: Sensex and Nifty 50's Flat Close – A Cautious Outlook

The flat close of the Sensex and Nifty 50 today reflects a cautious market sentiment shaped by the underperformance of Bajaj Finance and Bajaj Finserv, and the lingering geopolitical uncertainties surrounding India-Pakistan relations. Low trading volume and muted market breadth further highlighted the lack of strong directional momentum. The upcoming trading sessions are likely to remain influenced by these factors, along with any further developments on the geopolitical front. Stay updated on the latest news and market analysis to make informed investment decisions. Keywords: Sensex outlook, Nifty 50 predictions, market analysis, stock market trends, Indian stock market updates, Sensex and Nifty 50. For continuous updates on Sensex and Nifty 50 performance, bookmark this page and follow our market analysis.

Featured Posts

-

Trump Announces Landmark Trade Agreement With Britain

May 09, 2025

Trump Announces Landmark Trade Agreement With Britain

May 09, 2025 -

Dakota Johnson Channels Spring Style With Mom Melanie Griffith

May 09, 2025

Dakota Johnson Channels Spring Style With Mom Melanie Griffith

May 09, 2025 -

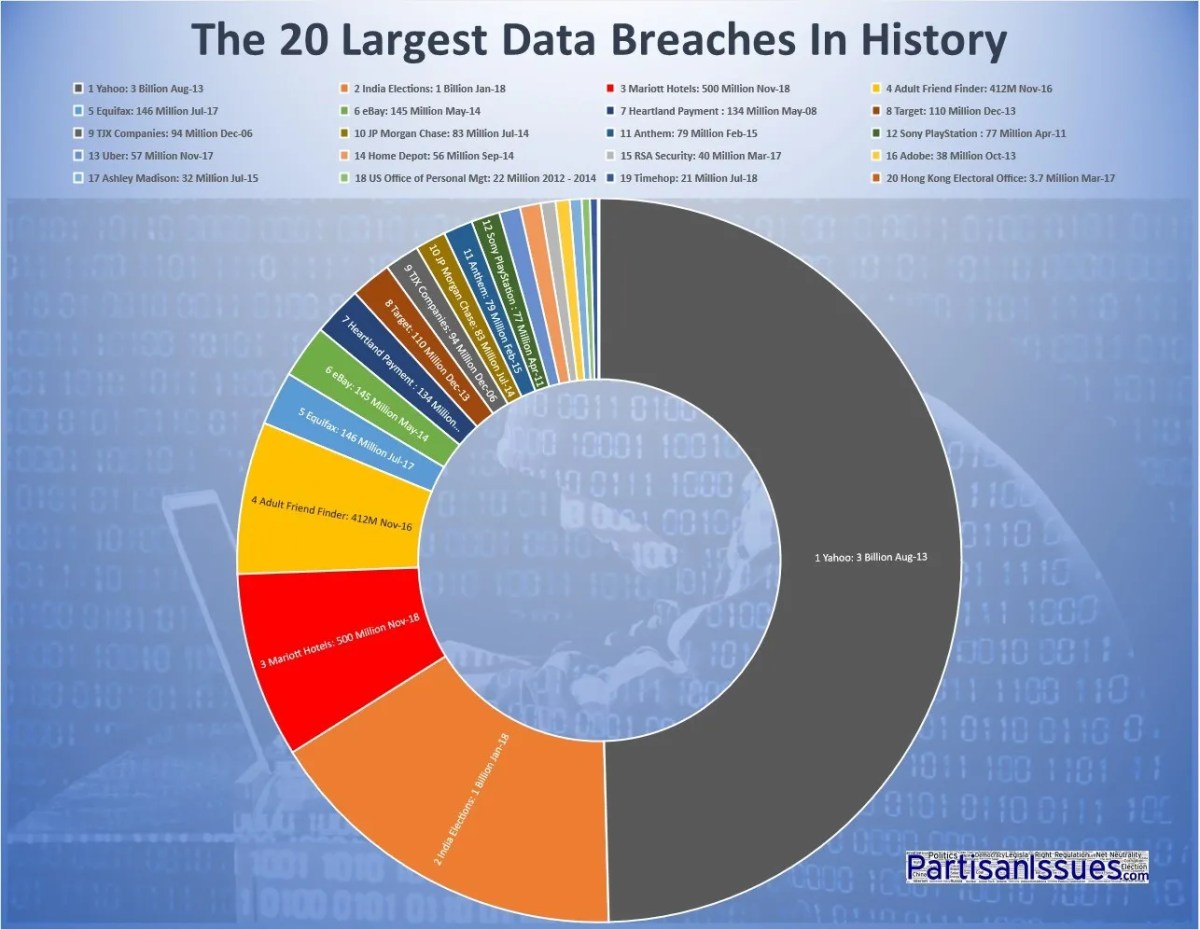

T Mobile Penalty 16 Million For Years Of Data Breaches

May 09, 2025

T Mobile Penalty 16 Million For Years Of Data Breaches

May 09, 2025 -

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025 -

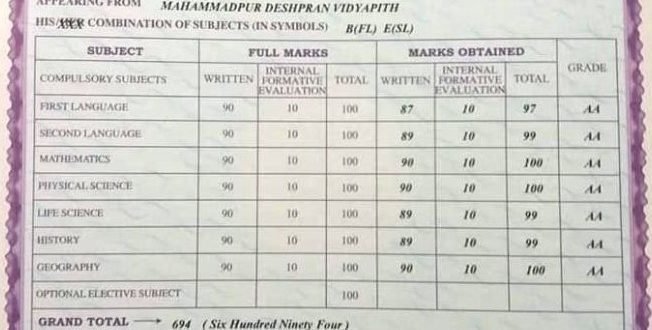

Madhyamik Result 2025 Merit List And Toppers

May 09, 2025

Madhyamik Result 2025 Merit List And Toppers

May 09, 2025