Sensex & Nifty Close Higher: Detailed Stock Market Analysis & Updates

Table of Contents

Key Drivers Behind Sensex and Nifty's Rise

Several factors contributed to the impressive gains witnessed in the Sensex and Nifty today. Let's examine the key global and domestic influences that propelled the market higher.

Global Market Influences

Positive global cues played a significant role in boosting investor confidence and driving up the Indian indices. The performance of international markets, particularly the US, had a direct impact on the Indian stock market.

- US Inflation Data: Lower-than-expected US inflation figures eased concerns about aggressive interest rate hikes by the Federal Reserve, creating a positive ripple effect globally, including in India.

- Strong Performance of Global Indices: The positive performance of major global indices like the Dow Jones and Nasdaq instilled confidence among investors, encouraging them to invest in emerging markets such as India.

- FII/FPI Investments: Increased inflows from Foreign Institutional Investors (FII) and Foreign Portfolio Investors (FPI) fueled the market rally, indicating a positive outlook on the Indian economy. Positive global sentiment encouraged these investors to increase their holdings in Indian stocks.

Domestic Economic Factors

Simultaneously, positive developments within the Indian economy further contributed to the market's upbeat performance.

- RBI Policy: The recent Reserve Bank of India (RBI) monetary policy announcements, perceived as supportive of growth, boosted investor sentiment. This reinforced confidence in the Indian economy's stability.

- Positive GDP Growth Projections: Upbeat GDP growth projections for the current fiscal year signaled strong economic fundamentals, further attracting investor interest.

- Strong Corporate Earnings: Positive corporate earnings reports from several major companies indicated robust financial health within the Indian corporate sector, driving increased investor confidence and pushing stock prices higher.

Sector-Specific Performance

The market rally wasn't uniform across all sectors. While some sectors significantly outperformed others, we saw a generally positive trend.

- Top Performers: The Banking sector experienced significant gains, driven by positive sentiment regarding credit growth and loan disbursements. The IT sector also performed well, aided by strong global demand for tech services. Pharmaceutical stocks also saw robust gains. For example, Company X's stock price increased by Z%, while Company Y saw a W% increase.

- Underperformers: In contrast, the FMCG sector showed relatively muted performance, potentially due to [insert reason, e.g., concerns about slowing consumer demand].

Analysis of Trading Volume and Volatility

Analyzing trading volume and market volatility provides crucial insights into the market's overall health and investor sentiment.

Trading Volume

Today's trading volume on both the BSE and NSE was significantly higher than the average daily volume seen in recent weeks. This high trading volume indicates increased participation from investors, further confirming the strong market sentiment. This surge in activity reflects confident investor behavior.

- Implications: The high volume suggests strong conviction among investors regarding the market's upward trajectory. It signifies a robust and active market.

Market Volatility

Despite the significant price increases, market volatility remained relatively low. The VIX index, a measure of market volatility, remained within a comfortable range, indicating a degree of stability throughout the day. This low volatility points to a calm and confident market.

- Investor Sentiment: Low volatility suggests that investor sentiment was generally optimistic and risk appetite remained healthy.

Expert Opinions and Predictions

Market analysts and experts expressed largely positive views on today's market performance and its implications.

- Analyst Views: Many analysts attribute the market’s rise to a combination of factors, including positive global cues and the strengthening Indian economy. They believe that the current trend could continue, provided that global uncertainties remain contained.

- Future Outlook: While maintaining caution regarding potential global risks, several analysts predict sustained growth in the Indian stock market in the near term, citing strong domestic fundamentals and investor optimism. However, some analysts expressed reservations about the sustainability of the rally.

Conclusion

The Sensex and Nifty's positive closing today reflects a confluence of global and domestic factors. Positive global economic indicators, strong domestic economic performance, and upbeat corporate earnings all contributed to the impressive gains. High trading volume coupled with relatively low volatility showcased a robust and confident market. Expert opinions generally point towards a positive near-term outlook, though caution is always warranted.

Call to Action: Stay informed on the latest Sensex & Nifty movements! Follow our daily stock market analysis for informed investment decisions. Get real-time stock market updates on Sensex and Nifty by signing up for our newsletter today and receive timely alerts for crucial stock market analysis and updates!

Featured Posts

-

Largest Fentanyl Seizure In Us History Pam Bondis Announcement And Its Implications

May 09, 2025

Largest Fentanyl Seizure In Us History Pam Bondis Announcement And Its Implications

May 09, 2025 -

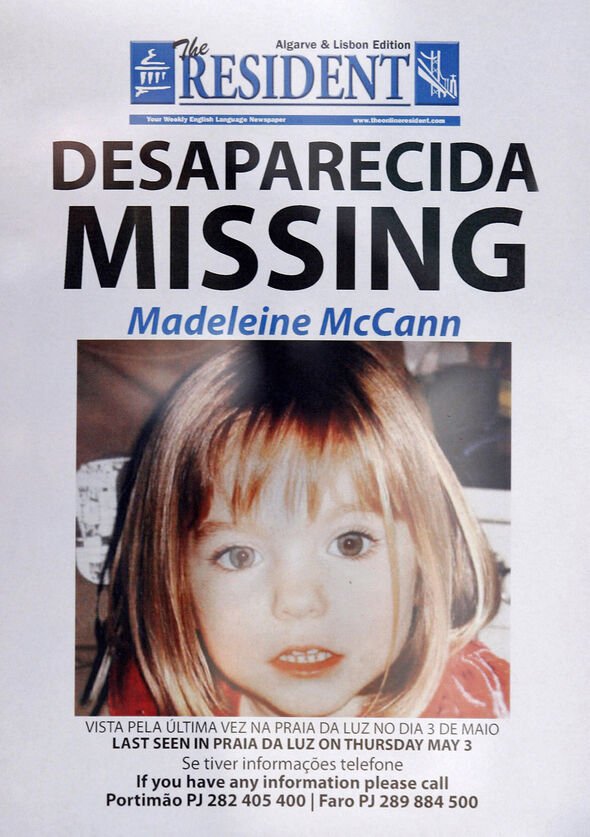

Madeleine Mc Cann Case Police Receive 108 000 For Investigation

May 09, 2025

Madeleine Mc Cann Case Police Receive 108 000 For Investigation

May 09, 2025 -

Maddie Mc Cann Autoridades Britanicas Detienen A Mujer Polaca

May 09, 2025

Maddie Mc Cann Autoridades Britanicas Detienen A Mujer Polaca

May 09, 2025 -

Apple Ai Navigating The Crossroads Of Technological Advancement

May 09, 2025

Apple Ai Navigating The Crossroads Of Technological Advancement

May 09, 2025 -

Frantsiya Polsha Novoe Soglashenie Detali Ot Unian

May 09, 2025

Frantsiya Polsha Novoe Soglashenie Detali Ot Unian

May 09, 2025