Sensex And Nifty LIVE Updates: Sharp Gains Today

Table of Contents

Sensex and Nifty's Sharp Rise: A Detailed Analysis

Opening Bell and Initial Reactions

The Sensex opened at 66,200, reflecting a 1.5% increase compared to yesterday's close of 65,200, while the Nifty mirrored this positive trend with an opening at 19,650. The initial market reaction was overwhelmingly positive, with significant buying activity observed across various sectors.

- Sensex Opening: 66,200 (+1.5%)

- Nifty Opening: 19,650 (+1.4%)

- Initial Sentiment: Strongly positive, high buying volume.

Intraday Highs and Lows

The Sensex reached an intraday high of 66,500 at approximately 1:30 PM, before consolidating around the 66,300 mark. The Nifty mirrored this trend, reaching a high of 19,720 before settling slightly lower.

- Sensex Intraday High: 66,500 (1:30 PM)

- Sensex Intraday Low: 66,100 (10:00 AM)

- Nifty Intraday High: 19,720 (1:45 PM)

- Nifty Intraday Low: 19,600 (10:15 AM)

Factors Contributing to the Surge

Positive global market sentiment, coupled with encouraging domestic inflation figures released earlier this week, played a pivotal role in driving up the Sensex and Nifty today. Strong quarterly earnings from several IT companies also boosted investor confidence.

- Positive Global Cues: Strong performance in US and European markets.

- Domestic Economic Data: Lower-than-expected inflation figures.

- Strong Sector Performance: Significant gains in IT, Banking, and FMCG sectors.

- Investor Sentiment: Increased optimism and risk appetite among investors.

Sector-Specific Performance: Winners and Losers

Top Performing Sectors

The IT sector led the charge, with a remarkable 2.5% increase, fueled by strong quarterly earnings and a positive outlook for the sector. The Banking and FMCG sectors also saw significant gains, reflecting positive investor sentiment in these key economic drivers.

- IT Sector: +2.5%

- Banking Sector: +1.8%

- FMCG Sector: +1.5%

Underperforming Sectors

Despite the overall positive market sentiment, the energy sector lagged behind, registering a 0.5% decline due to fluctuating global crude oil prices and concerns about future demand. The pharmaceutical sector also showed relatively weaker performance.

- Energy Sector: -0.5%

- Pharmaceutical Sector: +0.2%

- Reason for Underperformance: Global commodity price fluctuations, sector-specific headwinds.

Expert Opinions and Market Outlook

Analyst Comments

"[Analyst Name], a leading market expert, stated, 'The current surge suggests a positive outlook for the Indian market in the coming weeks, driven by strong fundamentals and improved investor confidence. However, global uncertainties remain a factor to consider.'" Another analyst highlighted the importance of upcoming macroeconomic data releases for shaping the near-term trend.

- Short-term outlook: Analysts largely predict continued positive momentum.

- Long-term outlook: Positive, but subject to global economic conditions.

Potential Risks and Concerns

While the market shows strong gains today, investors should remain cautious about potential global uncertainties, including geopolitical risks and the impact of rising interest rates in developed economies. Upcoming economic data releases could also influence market sentiment.

- Geopolitical Risks: Ongoing global tensions.

- Inflation Concerns: Potential impact of persistent inflation on corporate earnings.

- Upcoming Data Releases: Further economic data releases could trigger volatility.

Conclusion

Today's Sensex and Nifty LIVE Updates reveal a significant surge in market performance, driven by a confluence of positive factors, including strong global cues and positive domestic economic indicators. While specific sectors outperformed others, the overall trend points toward a positive market sentiment. However, it's crucial to remain informed about potential risks and to monitor market trends closely. For continuous updates and in-depth analysis on the Sensex and Nifty, bookmark this page and check back regularly for the latest Sensex and Nifty LIVE Updates. Stay tuned for tomorrow's market movements!

Featured Posts

-

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Community Heroes

May 10, 2025

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Community Heroes

May 10, 2025 -

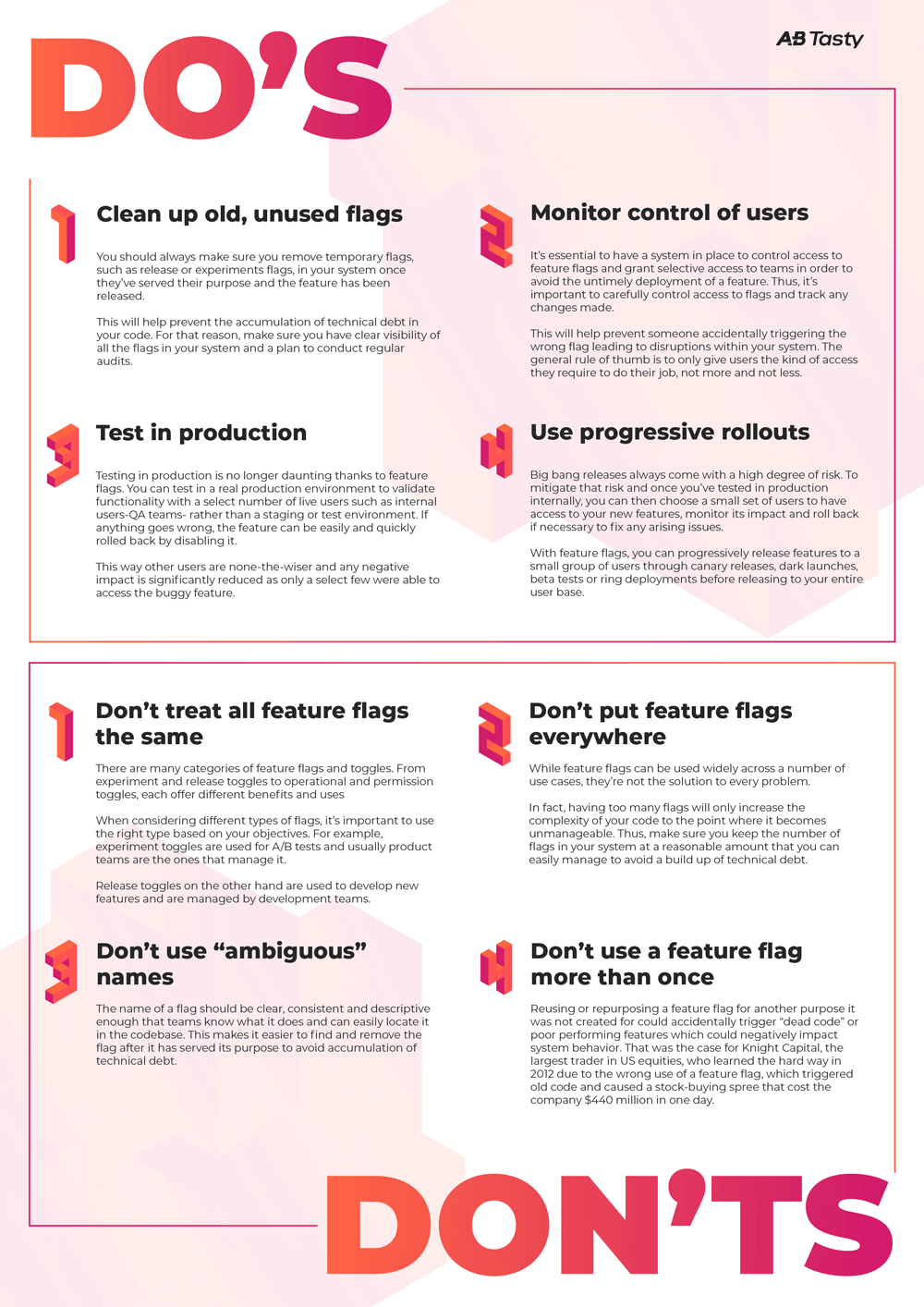

Land Your Dream Private Credit Job 5 Key Dos And Don Ts To Follow

May 10, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts To Follow

May 10, 2025 -

Apples Ai Ambitions A Realistic Assessment

May 10, 2025

Apples Ai Ambitions A Realistic Assessment

May 10, 2025 -

Japa New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025

Japa New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025 -

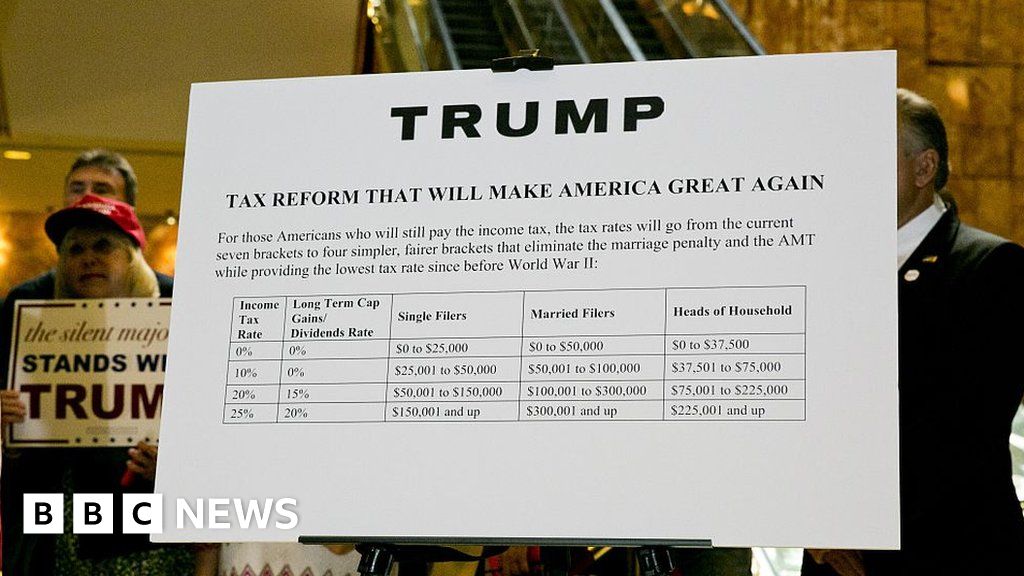

Are Tariffs Trumps Only Weapon Warner Weighs In

May 10, 2025

Are Tariffs Trumps Only Weapon Warner Weighs In

May 10, 2025