Sensex And Nifty Surge: 5 Reasons Behind Today's Market Rally

Table of Contents

Positive Global Cues and Foreign Institutional Investor (FII) Inflow

Positive global market trends played a crucial role in today's Sensex and Nifty rally. Easing inflation concerns in the US, coupled with a robust performance of the US markets, instilled confidence among global investors. This positive sentiment directly translated into increased Foreign Institutional Investor (FII) inflows into the Indian market.

- Increased FII investment in specific sectors: FIIs significantly invested in sectors like IT, banking, and pharmaceuticals, boosting these indices substantially.

- Positive global economic indicators influencing investor sentiment: Positive economic data releases from major global economies signaled improved economic health, encouraging risk appetite among investors.

- Reduction in global uncertainties leading to increased risk appetite: A decrease in geopolitical uncertainties and concerns about a global recession boosted investor confidence, leading them to invest more aggressively in emerging markets like India.

Data on FII inflows will further solidify the impact of these global cues. A strong inflow generally signifies a positive outlook for the Indian economy and its potential for growth.

Strong Corporate Earnings and Positive Business Outlook

Strong Q[Insert Quarter - e.g., 2] earnings reports from several major companies listed on the Sensex and Nifty significantly contributed to the market rally. These impressive results, coupled with positive future growth projections by leading businesses, instilled confidence among investors. Specific sectors demonstrating exceptional growth further fueled the positive market sentiment.

- Examples of companies with strong earnings reports and their impact on market sentiment: [Mention specific company examples and their performance]. These strong results boosted investor confidence and encouraged further investment.

- Positive business forecasts for key sectors driving market confidence: Positive outlooks across various sectors, including [mention specific sectors], projected strong growth prospects, creating a positive feedback loop within the market.

- Mention any significant industry-specific news that contributed positively: [Mention any relevant industry news, like successful product launches or regulatory approvals].

Government Policies and Economic Reforms

Recent positive government policies and economic reforms have played a significant role in bolstering investor confidence and contributing to today's market rally. These supportive measures have created a favorable environment for business growth and investment.

- Specific government policies or initiatives supporting market growth (e.g., infrastructure spending): Government initiatives focused on infrastructure development and easing regulatory burdens have positively impacted investor sentiment.

- Impact of regulatory changes on investor confidence: Clear and consistent regulatory policies have helped to improve investor confidence and attract further foreign investment.

- Positive economic indicators released by the government: Positive economic indicators, such as [mention specific indicators], further strengthened the positive market sentiment.

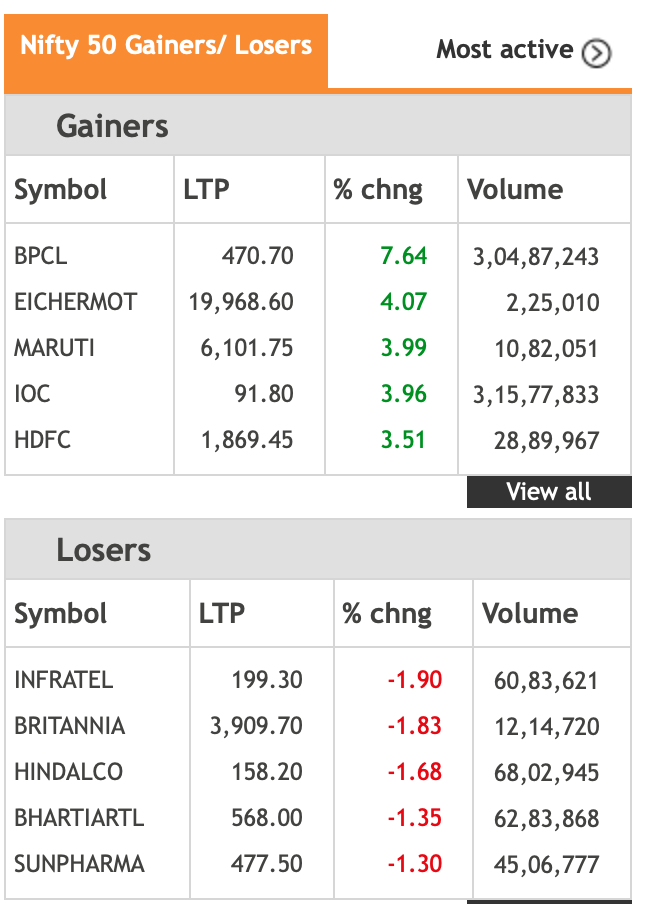

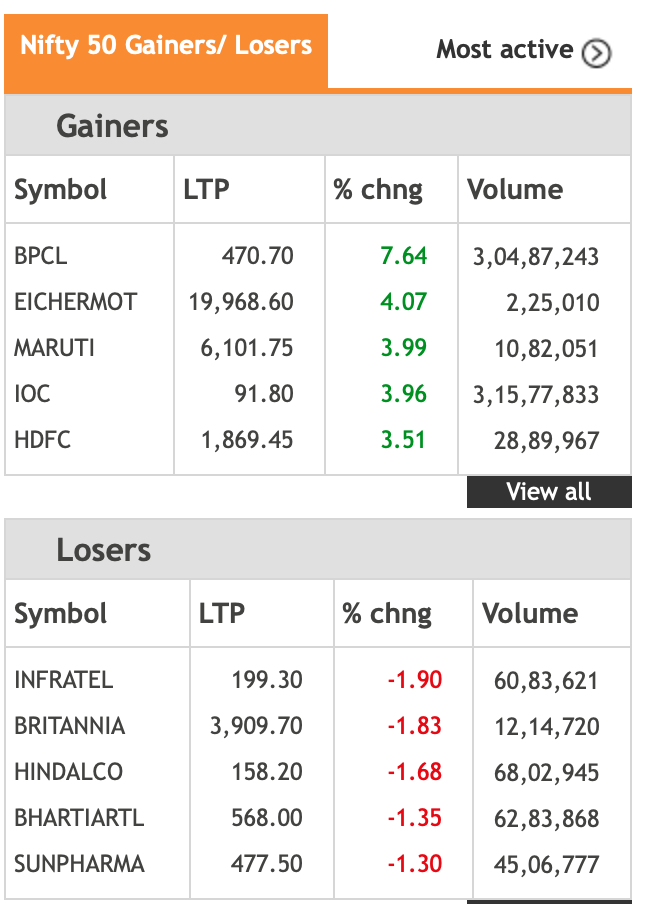

Sector-Specific Growth Drivers

The market rally wasn't uniform; certain sectors experienced disproportionately significant growth. This sector-specific growth acted as a major catalyst for the overall market surge.

- Highlighting the top-performing sectors (e.g., IT, Banking, Pharma): The IT sector, in particular, saw remarkable growth, driven by [mention specific reasons]. The Banking and Pharma sectors also contributed significantly.

- Reasons for the growth within each sector: [Detail the reasons behind the growth in each sector – e.g., technological advancements, increased demand, successful product launches, etc.]

- Key events driving the sector’s growth: [Mention specific events or news impacting each sector, contributing to their positive performance.]

Short Covering and Speculative Trading

While positive fundamentals drove the majority of the rally, short covering and speculative trading also contributed to the rapid price increases. Short covering, where investors buy back securities to close out short positions, can create a sharp upward price movement. Speculative trading, driven by anticipating future price increases, further amplified the effect.

- Explanation of short covering and its market impact: A significant amount of short covering contributed to the upward momentum, particularly in certain sectors.

- Role of speculative trading and its contribution to price increases: Speculative traders, anticipating further growth, added to the buying pressure, exacerbating the rally.

- Potential risks associated with short covering and speculative trading: It's crucial to acknowledge that such activities can also lead to increased market volatility.

Conclusion: Analyzing the Sensex and Nifty Surge – What's Next?

Today's remarkable Sensex and Nifty surge is attributable to a confluence of factors: positive global cues and FII inflows, strong corporate earnings, supportive government policies, sector-specific growth drivers, and the influence of short covering and speculative trading. The magnitude of this increase underscores the positive outlook for the Indian economy. While the market's future trajectory remains uncertain, the current indicators suggest a cautiously optimistic outlook. To stay informed and capitalize on future opportunities, continue researching the Sensex and Nifty, staying abreast of market trends and developing a robust investment strategy. Understanding the nuances of the Sensex and Nifty movements is crucial for informed decision-making in the Indian stock market.

Featured Posts

-

Hyatt Hotel Project Historic Broad Street Diner To Be Demolished

May 10, 2025

Hyatt Hotel Project Historic Broad Street Diner To Be Demolished

May 10, 2025 -

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 10, 2025

Adin Hills 27 Saves Lead Golden Knights To Victory Over Blue Jackets

May 10, 2025 -

Is Palantir Stock A Smart Investment For Your Portfolio

May 10, 2025

Is Palantir Stock A Smart Investment For Your Portfolio

May 10, 2025 -

Ice Detains Tufts Student Judge Orders Release Of Rumeysa Ozturk

May 10, 2025

Ice Detains Tufts Student Judge Orders Release Of Rumeysa Ozturk

May 10, 2025 -

Attorney Generals Dire Warning To Trumps Opponents

May 10, 2025

Attorney Generals Dire Warning To Trumps Opponents

May 10, 2025