Sensex LIVE Updates: Market Rally, Adani Ports Gains, Eternal Losses

Table of Contents

Sensex LIVE: Overall Market Performance

The Sensex index displayed considerable volatility throughout today's trading session. Understanding the overall market performance is crucial for interpreting individual stock movements and assessing the broader market sentiment. Key performance indicators for today include:

- Opening Price and Time: The Sensex opened at [Insert Opening Price] at [Insert Opening Time].

- Intraday Highs and Lows: The index reached a high of [Insert High] and a low of [Insert Low] during the trading day, reflecting the market's fluctuating nature.

- Closing Price and Percentage Change: The Sensex closed at [Insert Closing Price], representing a [Insert Percentage Change] change compared to yesterday's closing price. This indicates a [bullish/bearish] market sentiment for the day.

- Trading Volume: Today's trading volume was [Insert Volume], which is [higher/lower/similar] compared to the average daily volume over the past week. High trading volume often suggests increased market activity and investor interest.

- Nifty 50 Performance: The Nifty 50, another key Indian market index, showed a [similar/divergent] performance, closing at [Insert Nifty 50 Closing Price] with a [Insert Percentage Change] change. The correlation (or lack thereof) between the Sensex and Nifty 50 indices provides further insights into the market's overall direction.

Adani Ports' Significant Gains

Adani Ports experienced a remarkable surge today, significantly contributing to the positive market sentiment. The share price showed a strong increase, prompting analysis into the underlying factors driving this performance.

- Percentage Increase: Adani Ports' share price increased by [Insert Percentage Increase] today.

- Contributing Factors: This substantial gain could be attributed to [Insert Reasons - e.g., positive quarterly earnings reports, successful infrastructure project announcements, increased investor confidence, favorable government policies relating to the port sector].

- Sectoral Comparison: Compared to other companies in the port and logistics sector, Adani Ports outperformed its competitors, indicating a strong position within its industry.

- Trading Volume: The trading volume for Adani Ports was exceptionally high, suggesting significant investor interest and activity in the stock.

Notable Losses and Sectoral Trends

While Adani Ports showcased impressive gains, several other companies and sectors experienced significant losses, highlighting the diverse nature of today's market movements.

- Companies with Notable Losses: [List companies and their percentage decline. Example: Company X (-5%), Company Y (-3%), etc.].

- Affected Sectors: The sectors most affected by today's losses include [List Sectors - e.g., IT, Pharma, Banking, etc.]. This sectoral analysis helps identify specific market vulnerabilities.

- Reasons for Losses: The decline in these sectors could be linked to [Insert Reasons - e.g., concerns about global economic slowdown, weaker-than-expected earnings reports, regulatory hurdles, geopolitical uncertainties].

- Impact on Market Sentiment: The combined impact of these losses created a sense of [Insert Market Sentiment - e.g., caution, uncertainty] among investors, partially offsetting the positive momentum generated by Adani Ports' strong performance.

Impact of Global Market Trends

The performance of the Sensex is not isolated from global market dynamics. International trade, foreign investment flows, and geopolitical events all play a significant role. Today's Sensex movements were [influenced/unaffected] by [mention specific global events or trends - e.g., fluctuations in the US stock market, changes in crude oil prices, geopolitical tensions in a specific region]. These external factors often have a ripple effect on emerging markets like India.

Conclusion

Today's Sensex LIVE updates revealed a mixed bag, with a significant rally driven largely by the impressive performance of Adani Ports, while other sectors experienced notable losses. Factors such as positive company news, sector-specific trends, and the influence of global market dynamics all contributed to the day's volatility. Understanding these intricacies is vital for navigating the complexities of the Indian stock market. Stay updated on the latest Sensex LIVE updates and market analysis by regularly visiting our website for insightful commentary and comprehensive coverage of the Indian stock market. Track the Sensex LIVE and make informed investment decisions with our continuous updates on market trends and individual stock performances.

Featured Posts

-

Aoc Condemns Fox News Hosts Trump Support

May 09, 2025

Aoc Condemns Fox News Hosts Trump Support

May 09, 2025 -

Deborah Taylor Former Judge To Head Nottingham Attacks Inquiry

May 09, 2025

Deborah Taylor Former Judge To Head Nottingham Attacks Inquiry

May 09, 2025 -

Rejected By Wolves Now A European Heartbeat His Inspiring Journey

May 09, 2025

Rejected By Wolves Now A European Heartbeat His Inspiring Journey

May 09, 2025 -

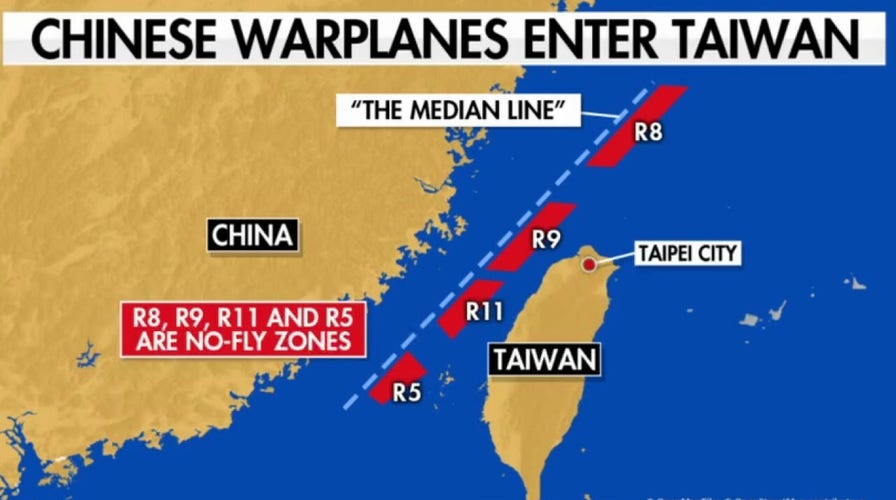

Ve Day Speech Taiwans Lai On The Rising Threat Of Totalitarianism

May 09, 2025

Ve Day Speech Taiwans Lai On The Rising Threat Of Totalitarianism

May 09, 2025 -

Choking Hazard Toddler Rescued By Police Video Shows

May 09, 2025

Choking Hazard Toddler Rescued By Police Video Shows

May 09, 2025