Sensex Today: 100-Point Gain, Nifty Above 17,950 - Market Analysis

Table of Contents

Sensex and Nifty's Performance: A Detailed Look

Sensex's 100-Point Jump

The BSE Sensex today witnessed a remarkable 100-point jump, closing at [Insert Closing Value] after opening at [Insert Opening Value]. This represents a [Insert Percentage Change]% increase, demonstrating strong bullish momentum in the Indian stock market.

Nifty's Crossing of 17,950

Equally impressive was the NSE Nifty's performance, surpassing the crucial 17,950 level. It closed at [Insert Closing Value], having opened at [Insert Opening Value], marking a [Insert Percentage Change]% rise. This significant milestone underscores the overall positive sentiment among investors.

- High/Low: The Sensex reached a high of [Insert High Value] and a low of [Insert Low Value] during the trading session. Similarly, the Nifty touched a high of [Insert High Value] and a low of [Insert Low Value].

- Yesterday's Close: Compared to yesterday's closing values of [Insert Yesterday's Sensex Closing Value] and [Insert Yesterday's Nifty Closing Value], today's gains are substantial.

- Volume: Trading volume showed a [Increase/Decrease] in activity, indicating [Interpretation of volume change - e.g., increased investor participation/ cautious trading].

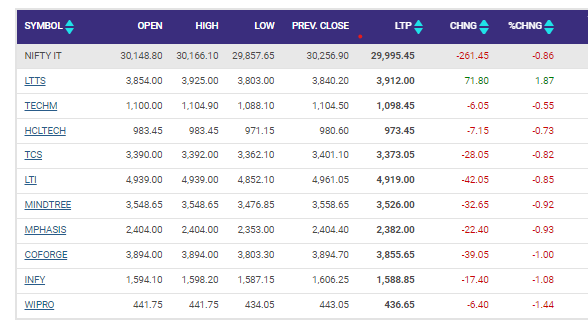

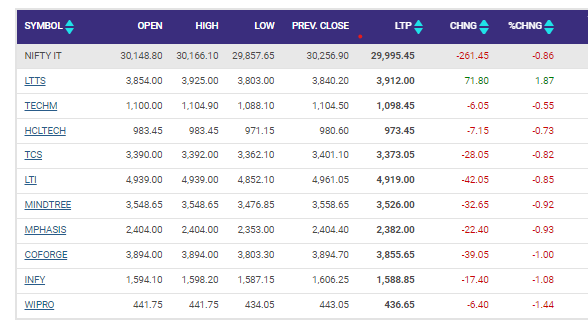

Sectoral Performance and Key Gainers/Losers

Top Performing Sectors

Several sectors significantly contributed to today's market rally. The IT sector experienced a robust performance, driven by [mention specific reasons, e.g., positive global tech outlook, strong quarterly results]. The Banking sector also performed strongly, boosted by [mention reasons, e.g., positive credit growth, easing inflation concerns]. The Pharma sector also saw significant gains due to [mention reasons, e.g., positive regulatory updates, strong demand].

Key Gainers

Among the top gainers were:

- [Stock 1] (+[Percentage Increase]%)

- [Stock 2] (+[Percentage Increase]%)

- [Stock 3] (+[Percentage Increase]%)

- [Stock 4] (+[Percentage Increase]%)

- [Stock 5] (+[Percentage Increase]%)

(Note: Links to relevant stock information would be inserted here)

Key Losers

Conversely, some stocks experienced losses:

- [Stock 1] (-[Percentage Decrease]%)

- [Stock 2] (-[Percentage Decrease]%)

- [Stock 3] (-[Percentage Decrease]%)

- [Stock 4] (-[Percentage Decrease]%)

- [Stock 5] (-[Percentage Decrease]%)

(Note: Potential reasons for losses would be mentioned here, e.g., profit booking, negative news, sector-specific challenges.)

Factors Driving Today's Market Movement

Global Market Influence

Positive global cues played a significant role. [Mention specific global events, e.g., positive US economic data, easing geopolitical tensions]. These developments infused confidence in the international markets, positively impacting the Indian stock market.

Domestic Economic Indicators

Recent positive domestic economic data, such as [Mention specific data, e.g., better-than-expected inflation figures, robust industrial production], also contributed to the bullish sentiment. [Link to source of economic data].

Investor Sentiment and Trading Activity

Investor sentiment today was predominantly bullish, with increased buying activity across various sectors. Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) showed [Increased/Decreased] participation, further fueling the market's upward trajectory. High trading volumes suggest robust investor confidence.

Expert Opinion and Future Market Outlook

Analyst Predictions

Market analysts remain cautiously optimistic. [Insert quote from a reputable market analyst]. Others suggest that [Insert another analyst's prediction/opinion].

Potential Risks and Opportunities

While the market outlook appears positive, potential risks remain, including [Mention risks, e.g., global economic slowdown, geopolitical uncertainties, inflation]. However, opportunities exist in sectors like [Mention sectors, e.g., renewable energy, technology], driven by [Mention drivers, e.g., government policies, technological advancements].

- Upcoming Events: [Mention any upcoming events that may impact the market, e.g., RBI policy meetings, budget announcements].

Conclusion: Sensex Today's Performance and What it Means for Investors

Today's market performance, marked by the Sensex's 100-point gain and Nifty's crossing of 17,950, reflects a positive confluence of global and domestic factors. Strong performance in sectors like IT and Banking, coupled with improved investor sentiment, drove the market higher. While opportunities exist, investors should remain aware of potential risks. To stay informed about the ever-evolving dynamics of the "Sensex today" and future market trends, regularly check for updates and engage with detailed market analyses. Subscribe to our newsletter or follow us on social media for continued insights into the Indian stock market.

Featured Posts

-

Salvage Operation Tragedy Diver Death During Tech Tycoons Yacht Recovery

May 10, 2025

Salvage Operation Tragedy Diver Death During Tech Tycoons Yacht Recovery

May 10, 2025 -

Impact Of Uks Stricter Visa Policies On Pakistani Students

May 10, 2025

Impact Of Uks Stricter Visa Policies On Pakistani Students

May 10, 2025 -

Jared Kushners Low Profile Advising For Trumps Middle East Trip

May 10, 2025

Jared Kushners Low Profile Advising For Trumps Middle East Trip

May 10, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025 -

Ligne 3 De Tram Dijon Le Projet Entre En Concertation

May 10, 2025

Ligne 3 De Tram Dijon Le Projet Entre En Concertation

May 10, 2025