Sensex Today: 800+ Point Surge, Nifty Above 17,500

Table of Contents

Factors Driving Today's Sensex Surge

Several interconnected factors contributed to the impressive gains witnessed in the Sensex today. Analyzing these contributing elements helps paint a clearer picture of the current market dynamics.

Global Market Influences

Positive global cues played a significant role in today's market rally. Improved economic data from major economies, coupled with a positive sentiment in international indices, infused optimism into the Indian stock market. Stronger-than-expected earnings reports from leading multinational corporations further boosted investor confidence.

- Improved US Economic Indicators: Positive employment data and signs of easing inflation in the US contributed to a global risk-on sentiment.

- European Market Stability: Stable growth projections from major European economies strengthened investor confidence in global markets.

- Positive Global Indices: The upward trend in major global indices like the Dow Jones and Nasdaq provided a positive spillover effect on the Indian markets.

Domestic Economic News

Positive domestic economic news further fueled the Sensex surge. Encouraging GDP growth figures, coupled with signs of easing inflation, bolstered investor confidence in the Indian economy. Furthermore, proactive government policies aimed at stimulating economic growth also played a part.

- Robust GDP Growth: Better-than-anticipated GDP growth for the current quarter indicates a healthy economic trajectory.

- Easing Inflationary Pressures: Signs of cooling inflation, primarily driven by lower food and fuel prices, provided relief to investors concerned about rising prices.

- Supportive Government Initiatives: Recent government announcements focused on infrastructure development and ease of doing business positively impacted market sentiment.

Sector-Specific Performances

The strong performance of several key sectors significantly boosted the Sensex. The IT sector, driven by strong Q2 earnings and positive outlook for the future, led the charge. The FMCG sector also demonstrated resilience despite inflationary pressures. This sector-specific strength showcases the diverse drivers behind today's market rally.

- IT Sector Boosts Sensex: Strong Q2 earnings and robust order books propelled IT stocks, contributing significantly to the Sensex surge.

- FMCG Sector Shows Resilience: Despite inflationary pressures, FMCG companies demonstrated resilience, indicating strong consumer demand.

- Financial Sector Gains: Positive banking sector performance further added to the overall market optimism.

Foreign Institutional Investment (FII) Flows

Significant FII inflows also played a crucial role in driving today's Sensex rally. Positive global sentiment and expectations of continued economic growth in India attracted substantial foreign investment, leading to increased buying pressure.

- Increased FII Inflows: A significant surge in FII investments injected substantial liquidity into the market.

- Positive Outlook for Indian Economy: Foreign investors seem optimistic about the long-term growth prospects of the Indian economy.

Nifty's Performance Above 17,500

The Nifty 50 index also performed exceptionally well, surpassing the 17,500 mark, a significant milestone. This reflects the broader market strength and positive investor sentiment.

- Top Gainers: Several large-cap stocks from IT, banking, and FMCG sectors were among the top gainers in the Nifty 50 index.

- Top Losers: While the overall market sentiment was positive, some sectors experienced minor corrections, resulting in a few stocks among the top losers.

- Investor Sentiment: The Nifty's performance above 17,500 significantly boosted investor confidence, signaling a positive outlook for the Indian stock market.

Expert Opinions and Market Analysis

Market experts attribute today's Sensex surge to a combination of global and domestic factors, highlighting the positive economic indicators and improved investor sentiment. However, they also caution against excessive optimism, emphasizing the need to carefully analyze potential risks.

- Analyst Predictions: Many analysts predict sustained growth, but also advise caution, urging investors to diversify their portfolios.

- Market Risks: Geopolitical uncertainties and global inflation remain potential risks that could impact future market trends.

Conclusion: Understanding Today's Sensex Movement and Future Outlook

The significant Sensex rally and Nifty's crossing of 17,500 are driven by a confluence of factors, including positive global cues, robust domestic economic data, strong sectoral performances, and substantial FII inflows. Understanding the "Sensex Today" movements is paramount for making informed investment decisions. Staying updated on daily Sensex updates and market trends, and consulting with a financial advisor for personalized investment strategies, is crucial for successful investment in the dynamic Indian stock market. The dynamic nature of the Sensex today requires continuous monitoring and a strategic approach to investment.

Featured Posts

-

Office365 Security Failure Millions Lost In Sophisticated Data Breach

May 09, 2025

Office365 Security Failure Millions Lost In Sophisticated Data Breach

May 09, 2025 -

Strictly Scandal Leads To Wynne Evans Go Compare Departure

May 09, 2025

Strictly Scandal Leads To Wynne Evans Go Compare Departure

May 09, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 09, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 09, 2025 -

Vremennoe Zakrytie Aeroporta Permi Chto Nuzhno Znat Passazhiram

May 09, 2025

Vremennoe Zakrytie Aeroporta Permi Chto Nuzhno Znat Passazhiram

May 09, 2025 -

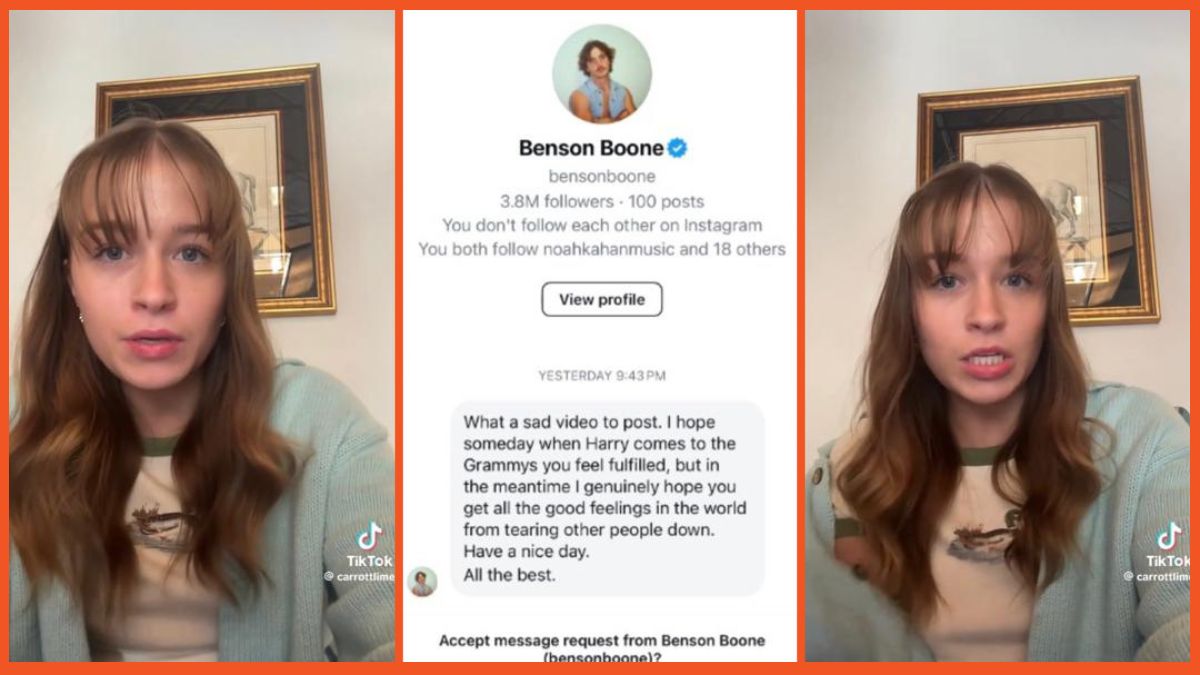

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025