Sharp Rise In Gas Prices: Up Almost 20 Cents A Gallon

Table of Contents

Factors Contributing to the Sharp Increase in Gas Prices

Several interconnected factors have contributed to this sudden and substantial increase in gasoline prices. Understanding these factors is crucial to grasping the current situation and anticipating future trends.

Increased Global Demand

The post-pandemic global economic recovery has fueled a significant surge in global energy demand. Countries like China, experiencing robust economic growth, have seen a dramatic increase in their energy consumption. This increased demand is directly impacting crude oil prices, which in turn affect gasoline prices at the pump.

- Increased travel: As international and domestic travel rebounds, the demand for gasoline has skyrocketed.

- Industrial activity: Manufacturing and industrial production are booming, requiring vast quantities of energy.

- Economic recovery: The overall economic recovery in many parts of the world is directly linked to increased energy consumption.

- Specific Statistics: [Insert relevant statistics about increased global oil demand and consumption, if available, citing reputable sources]. For example: "The International Energy Agency (IEA) projects a [percentage]% increase in global oil demand for [year]."

Related keywords: gasoline prices, crude oil prices, global energy demand.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical events, particularly the ongoing war in Ukraine, have severely impacted the global oil supply. Sanctions imposed on Russia, a major oil producer, have disrupted the flow of oil to international markets. Further complicating matters are supply chain disruptions impacting the transportation and distribution of oil.

- Sanctions on Russian oil exports have reduced global supply.

- Export restrictions from other oil-producing nations have exacerbated the shortage.

- Disruptions to supply routes due to geopolitical tensions have increased transportation costs.

Related keywords: oil supply, geopolitical risks, energy security.

OPEC+ Production Decisions

The Organization of the Petroleum Exporting Countries (OPEC+), a group of major oil-producing nations, plays a significant role in influencing global oil supply and prices. Their production quotas and decisions regarding oil output directly impact the availability of crude oil and consequently gasoline prices.

- Recent production quotas set by OPEC+ have fallen short of meeting global demand.

- Potential future adjustments to production quotas could further influence gasoline prices.

- The influence of OPEC+ on the global oil market is a key factor in price volatility.

Related keywords: OPEC oil production, crude oil supply, oil cartel.

Refinery Capacity Constraints

Limitations in refinery capacity also contribute to higher gasoline prices. Maintenance issues, plant closures, and the time lag involved in expanding refining capacity can restrict the amount of crude oil that can be processed into gasoline, creating supply bottlenecks.

- Planned and unplanned refinery maintenance can temporarily reduce output.

- Plant closures due to various reasons can further constrain refining capacity.

- Expanding refinery capacity is a long-term project and doesn't provide immediate relief.

Related keywords: gasoline refining, refinery output, fuel processing.

Impact of the Price Hike on Consumers and the Economy

The sharp increase in gas prices has far-reaching consequences for consumers and the broader economy.

Increased Transportation Costs

Higher gas prices directly translate into increased transportation costs for individuals and businesses. This impacts commuting costs, shipping costs for goods, and overall inflationary pressures.

- Higher commuting costs reduce disposable income for households.

- Increased shipping costs for businesses lead to higher prices for consumers.

- Inflationary pressures driven by higher transportation costs affect the overall economy.

Related keywords: fuel costs, inflation, consumer spending.

Potential Economic Slowdown

The persistent rise in gas prices could contribute to a slowdown in economic growth. Reduced consumer spending due to higher fuel costs, coupled with the impact on businesses, can have a ripple effect throughout the economy, potentially leading to a recession or stagflation.

- Reduced consumer spending due to higher fuel costs dampens economic activity.

- Businesses face higher transportation costs, impacting profitability and potentially leading to job losses.

- The potential for stagflation (high inflation and slow economic growth) is a significant concern.

Related keywords: economic growth, recession, stagflation.

Potential Solutions and Future Outlook for Gas Prices

Addressing the sharp rise in gas prices requires a multifaceted approach.

Government Policies and Interventions

Governments can play a significant role in mitigating the impact of high gas prices through various policy interventions.

- Tax cuts on gasoline could provide temporary relief to consumers.

- Releasing oil from strategic reserves can temporarily increase supply.

- Investing in domestic oil production could reduce reliance on foreign sources.

Related keywords: government regulation, energy policy, fuel subsidies.

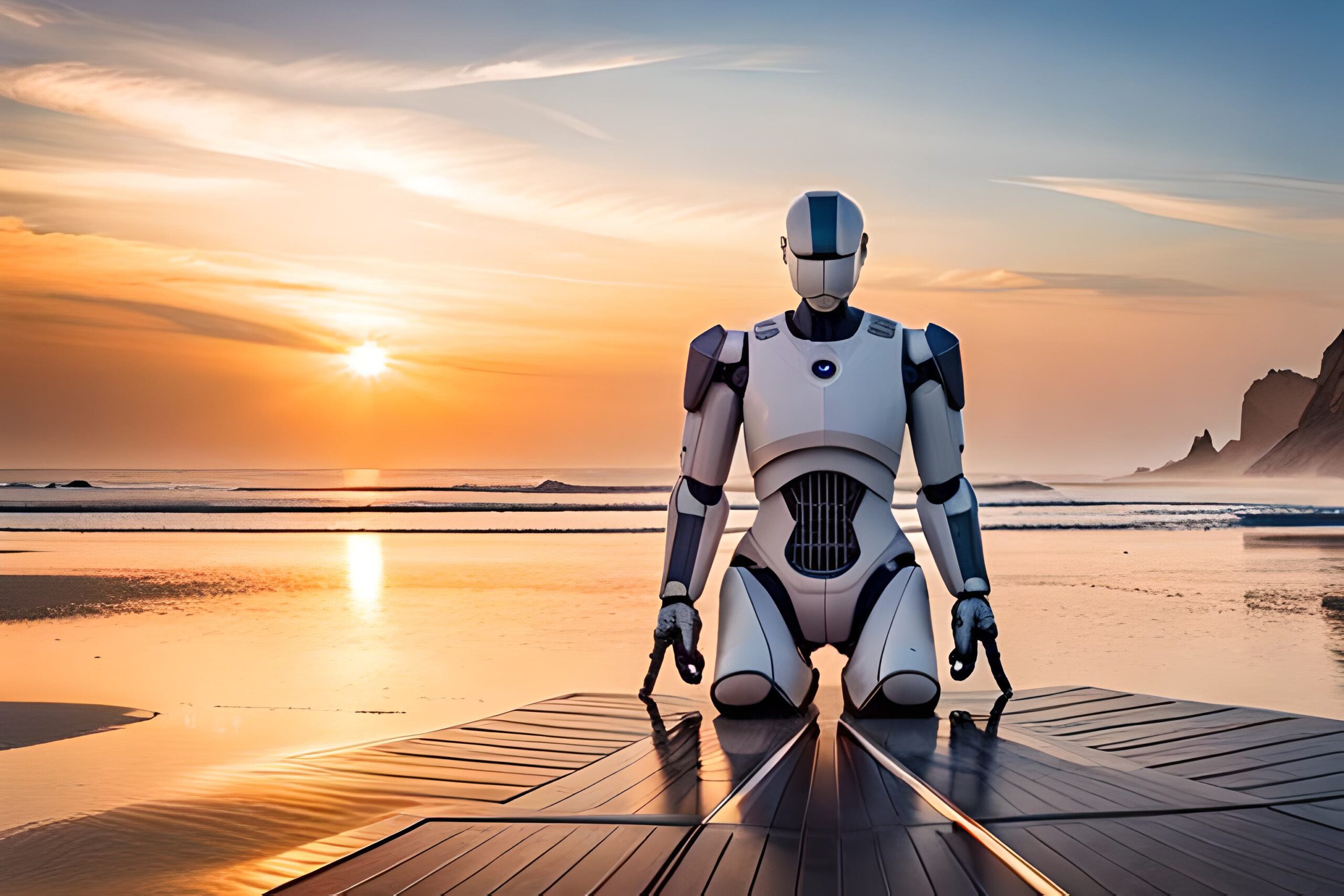

Investment in Renewable Energy

Transitioning to cleaner and more sustainable energy sources is crucial for long-term energy security and reducing dependence on volatile fossil fuel markets.

- Investing in renewable energy sources like solar and wind power can reduce reliance on oil.

- Long-term cost savings associated with renewable energy can offset initial investment costs.

- Environmental benefits of renewable energy contribute to a sustainable future.

Related keywords: renewable energy, solar power, wind energy, alternative fuels.

Sharp Rise in Gas Prices: What You Need to Know

The sharp rise in gas prices is a complex issue with multiple contributing factors, including increased global demand, geopolitical instability, OPEC+ production decisions, and refinery capacity constraints. The impact on consumers and the economy is significant, leading to increased transportation costs and the potential for an economic slowdown. While governments can implement short-term measures like tax cuts and releasing oil from strategic reserves, the long-term solution lies in investing in renewable energy sources to reduce our dependence on fossil fuels. Stay informed about gas price fluctuations and consider strategies to manage your fuel expenses. For further reading on gasoline price trends and energy market analysis, explore resources from the EIA and IEA. Understanding these factors is key to navigating this challenging period and preparing for the future of energy.

Featured Posts

-

Chi Varto Ukrayini Vstupati Do Nato Poperedzhennya Vid Yevrokomisara

May 22, 2025

Chi Varto Ukrayini Vstupati Do Nato Poperedzhennya Vid Yevrokomisara

May 22, 2025 -

Australian Trans Influencer Shatters Record Addressing Doubts And Scrutiny

May 22, 2025

Australian Trans Influencer Shatters Record Addressing Doubts And Scrutiny

May 22, 2025 -

Major Fire At Franklin County Pa Chicken Farm Extensive Damage Reported

May 22, 2025

Major Fire At Franklin County Pa Chicken Farm Extensive Damage Reported

May 22, 2025 -

Gas Price Hike In Southeast Wisconsin Factors Contributing To The Increase

May 22, 2025

Gas Price Hike In Southeast Wisconsin Factors Contributing To The Increase

May 22, 2025 -

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 22, 2025

Plouzane Et Clisson Selectionnes Pour La Mission Patrimoine 2025

May 22, 2025

Latest Posts

-

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025

Decoding The Big Rig Rock Report 3 12 97 1 Double Q

May 23, 2025 -

Analyzing The Big Rig Rock Report 3 12 And The Big 100

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 And The Big 100

May 23, 2025 -

Advanced Brief Writing Techniques Mastering Nuance And Persuasion

May 23, 2025

Advanced Brief Writing Techniques Mastering Nuance And Persuasion

May 23, 2025 -

Analyzing The Big Rig Rock Report 3 12 97 1 Double Q Metrics

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 97 1 Double Q Metrics

May 23, 2025 -

Big Rig Rock Report 3 12 Big 100 Ranking And Industry Insights

May 23, 2025

Big Rig Rock Report 3 12 Big 100 Ranking And Industry Insights

May 23, 2025