Shein Faces London IPO Setback Due To US Tariffs

Table of Contents

The Magnitude of US Tariffs on Shein's Business Model

US tariffs have dealt a significant blow to Shein's business model. These import duties directly increase the cost of goods sold, squeezing profit margins and potentially impacting its competitive edge in the vast US market. While precise figures remain confidential, the sheer volume of Shein's US imports means even a small percentage increase in tariffs translates to substantial financial losses. The impact is felt most acutely in clothing categories like apparel and accessories, which form the core of Shein's product offerings. Specific product lines, such as trendy dresses and inexpensive tops, are particularly vulnerable due to their price sensitivity.

- Increased production costs leading to higher prices: The added tariff costs are ultimately passed on to consumers, leading to higher prices and potentially reducing demand.

- Reduced competitiveness in the US market against domestic brands: Higher prices make it harder for Shein to compete with established US brands that don't face the same import tariff burden.

- Potential loss of market share in the US: If Shein fails to adapt, it risks losing market share to competitors who can offer comparable products at lower prices. This is particularly true given the high price sensitivity in the fast fashion market. The impact of these Shein tariffs on the company's supply chain disruption is also noteworthy.

Investor Concerns and the Impact on IPO Valuation

The US tariff situation casts a significant shadow over investor sentiment regarding Shein's long-term profitability. The uncertainty surrounding future earnings, directly linked to the unpredictable nature of US trade policy, makes it a risky investment for many. This uncertainty is likely to translate into a lower IPO valuation than initially anticipated. Analysts are already expressing concerns, with some predicting a potentially significant downward revision of Shein's valuation. The increased risk associated with US import tariffs on clothing and fast fashion is a key factor contributing to market volatility and investor hesitation.

- Reduced investor interest leading to lower demand for Shein's shares: Investors may be hesitant to commit capital to a company facing such significant and unpredictable headwinds.

- Increased uncertainty surrounding future earnings: The fluctuating nature of tariffs makes it difficult to predict Shein's future profitability accurately.

- Potential delays or cancellation of the IPO: In a worst-case scenario, Shein might be forced to postpone or even cancel its London IPO until the tariff situation stabilizes.

Shein's Potential Strategies to Mitigate the Impact of US Tariffs

Shein isn't without options. The company could implement several strategies to mitigate the impact of US tariffs. These include diversifying its sourcing, strategically adjusting prices, and engaging in political lobbying. Shifting production to countries with preferential trade agreements with the US, like Vietnam or Bangladesh, could significantly reduce tariff burdens. However, this requires substantial investment and time.

- Shifting production to countries with preferential trade agreements: This would require significant investment in new factories and supply chains.

- Negotiating with US authorities for tariff exemptions: This is a long shot, but Shein could attempt to lobby for exemptions based on specific product categories or circumstances.

- Absorbing some of the tariff costs to maintain competitiveness: This would hurt profit margins in the short term, but it might be necessary to maintain market share.

Alternatives to a London IPO for Shein

If the London IPO proves unfeasible due to the ongoing tariff challenges, Shein has several alternative funding options. Private equity funding and debt financing are both viable alternatives. While these routes could provide the necessary capital for expansion, they come with their own set of considerations. Private equity funding might entail some dilution of ownership, while debt financing increases the company's financial leverage.

- Maintaining financial flexibility and control: While private equity might dilute ownership, it can provide significant capital infusion.

- Potential dilution of ownership: Private equity investors often require a substantial stake in the company.

- Impact on future expansion plans: The chosen funding route will significantly affect Shein's ability to pursue its aggressive growth strategy.

Conclusion: The Future of Shein and its London IPO Amidst US Tariff Challenges

Shein's planned London IPO faces significant headwinds due to the substantial impact of US tariffs on its profitability and investor sentiment. The magnitude of these tariffs, their effect on Shein's valuation, and the company’s response will shape its future trajectory. Shein's strategic decisions regarding tariff mitigation and alternative funding options will be crucial in navigating this complex situation. Stay updated on the Shein IPO update, the US tariff impact on Shein, and Shein's future prospects—this situation is constantly evolving, and the future of this fast-fashion giant remains uncertain. Understanding the evolving impact of US tariffs on the fast fashion industry is key to predicting Shein’s future.

Featured Posts

-

Betting On Los Angeles Wildfires A Reflection Of Our Times

May 04, 2025

Betting On Los Angeles Wildfires A Reflection Of Our Times

May 04, 2025 -

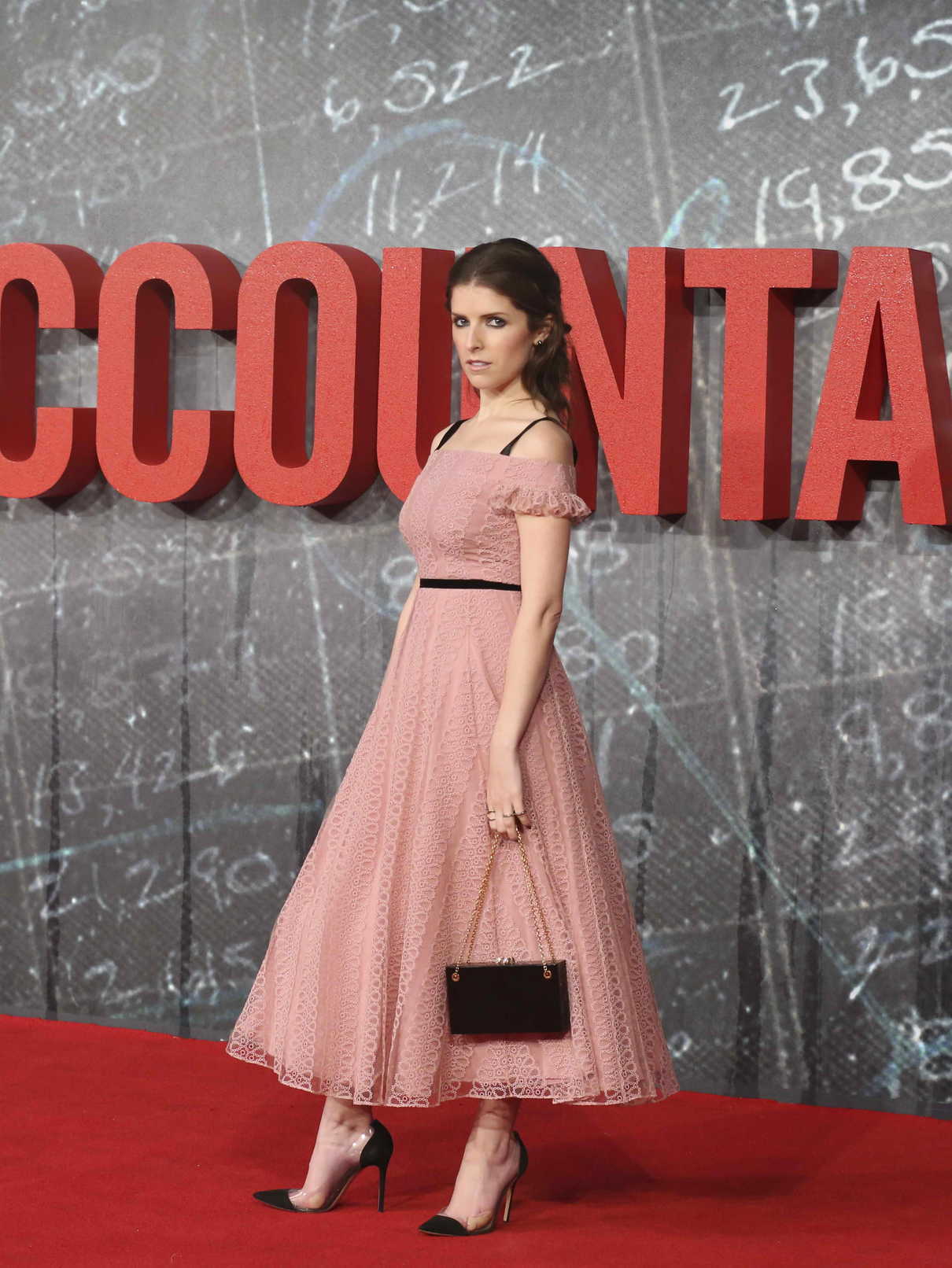

The Accountant 2 And The Case For Anna Kendrick In The Accountant 3

May 04, 2025

The Accountant 2 And The Case For Anna Kendrick In The Accountant 3

May 04, 2025 -

Oscars 2024 Lizzos Stunning Weight Loss Transformation

May 04, 2025

Oscars 2024 Lizzos Stunning Weight Loss Transformation

May 04, 2025 -

Is Darjeeling Teas Production In Jeopardy A Look At Current Issues

May 04, 2025

Is Darjeeling Teas Production In Jeopardy A Look At Current Issues

May 04, 2025 -

Tri State Area Snow Forecast Timing And Accumulation

May 04, 2025

Tri State Area Snow Forecast Timing And Accumulation

May 04, 2025

Latest Posts

-

Analyst Chris Fallica On Trump And Putin A Strong Rebuke

May 04, 2025

Analyst Chris Fallica On Trump And Putin A Strong Rebuke

May 04, 2025 -

Charissa Thompson On Her Exit From Fox The Full Story

May 04, 2025

Charissa Thompson On Her Exit From Fox The Full Story

May 04, 2025 -

Fox News And Charissa Thompson Addressing Departure Rumors

May 04, 2025

Fox News And Charissa Thompson Addressing Departure Rumors

May 04, 2025 -

Mlb Tokyo Series Chicago Cubs Vs La Dodgers Live Stream Options

May 04, 2025

Mlb Tokyo Series Chicago Cubs Vs La Dodgers Live Stream Options

May 04, 2025 -

How To Live Stream The Chicago Cubs Vs La Dodgers Mlb Game In Tokyo

May 04, 2025

How To Live Stream The Chicago Cubs Vs La Dodgers Mlb Game In Tokyo

May 04, 2025