Shein's London IPO Delay: The Impact Of US Tariffs

Table of Contents

The Rising Tide of US Tariffs on Fast Fashion

Understanding the Current Tariff Landscape

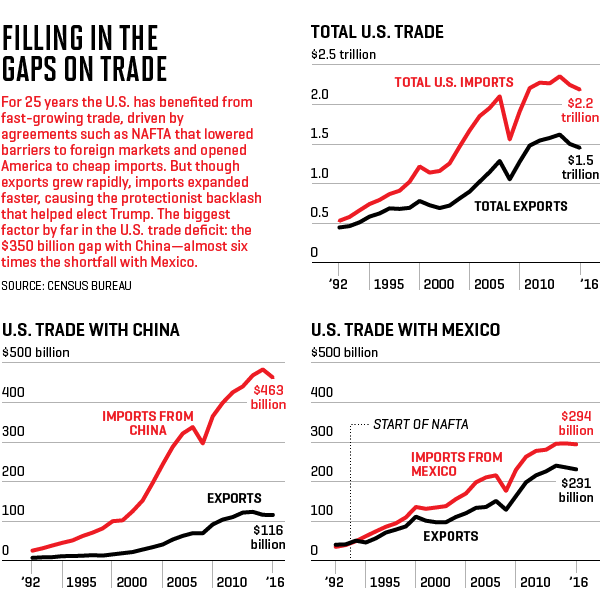

The US imposes various tariffs on imported goods, and fast fashion, particularly from China (Shein's primary manufacturing base), has been significantly impacted. These tariffs, often levied as percentages of the goods' value, increase the cost of imported clothing. For example, certain textile categories might face tariffs ranging from 15% to 30%, significantly impacting Shein's bottom line. These tariffs are not new, but their potential increase and the current economic climate are adding to the pressure.

- Impact on Shein's Production Costs: Increased tariffs directly translate into higher production costs for Shein, eating into its already slim profit margins.

- Potential increase in Shein's retail prices: To maintain profitability, Shein might be forced to increase its retail prices, potentially impacting its competitive advantage of offering ultra-low prices.

- Effect on Shein's competitive advantage (low prices): Higher prices could diminish Shein's key competitive edge—its affordability—making it less attractive to price-sensitive consumers.

- Mention other fast fashion brands facing similar challenges: Shein isn't alone; many other fast-fashion brands heavily reliant on Chinese manufacturing are facing similar challenges with increased US tariffs.

Shein's Financial Vulnerability and the IPO Delay

Analyzing Shein's Financial Position

Shein's financial performance, while impressive in terms of revenue growth, has also raised concerns among analysts. While specific financial details remain largely private, reports suggest that profit margins are thin, and the company carries a significant amount of debt. The escalating US tariffs exacerbate these pre-existing vulnerabilities.

- Increased production costs impacting profitability margins: The higher costs associated with US tariffs directly impact Shein's already tight profit margins, making it harder to demonstrate strong profitability to potential investors.

- Investor concerns regarding tariff-related risks: The uncertainty surrounding future tariff increases creates considerable risk for investors, potentially discouraging participation in the IPO.

- The role of these financial factors in the IPO postponement: The combination of thin margins and increased tariff-related risks likely contributed to the decision to postpone the London IPO.

- Shein's potential strategies for mitigating these risks: Shein may be exploring strategies like diversifying its manufacturing base to reduce its reliance on China or lobbying for tariff reductions.

Alternative Explanations for the IPO Delay

Beyond Tariffs

While US tariffs present a significant challenge, other factors might have contributed to Shein's IPO delay. A comprehensive assessment requires considering these broader economic and geopolitical realities.

- Global economic uncertainty: The current global economic climate, characterized by inflation and recessionary fears, could have influenced Shein's decision to postpone its IPO.

- Geopolitical instability: Global political instability and tensions could also play a role in investor hesitancy and market uncertainty.

- Internal company restructuring or strategic decisions: Shein might be undertaking internal restructuring or strategic shifts that necessitate a delay in its IPO plans.

- Regulatory hurdles in the UK market: Navigating the regulatory landscape in the UK for a large-scale IPO can be complex and time-consuming.

The Future of Shein and the London IPO

Potential Scenarios

The future remains uncertain. Shein might revise its IPO timeline once market conditions improve and tariff-related risks are better managed. Alternatively, they could explore alternative funding strategies or even potentially abandon the London IPO altogether.

- Shein's potential strategies to navigate US tariffs (e.g., diversification of sourcing): Shifting some manufacturing to countries with more favorable trade relations with the US could be a key strategy.

- The likely impact on investors and the wider fast-fashion industry: The delay sends ripples through the fast-fashion industry, impacting investor confidence and influencing other brands' IPO plans.

- Predictions about the future of Shein's growth and market position: Shein's ability to navigate these challenges will determine its long-term success and market dominance.

Conclusion: Shein's London IPO Delay – A Case Study in Tariff Impacts

Shein's London IPO delay highlights the complex interplay between global trade policies, a company's financial health, and market dynamics. The rising tide of US tariffs on fast fashion, coupled with Shein's existing financial vulnerabilities, likely contributed significantly to this decision. However, other factors, such as global economic uncertainty and internal company strategies, also played a role. The situation underscores the challenges faced by fast-fashion brands navigating the intricacies of global trade and the volatile international economic landscape.

What are your predictions for Shein's future? Will they successfully navigate the challenges posed by US tariffs and eventually complete their London IPO? Stay tuned for further analysis on Shein's response to US tariffs and the impact on the broader fast-fashion industry. Share your thoughts on the impact of US tariffs on the fast fashion industry and continue reading our coverage on Shein's London IPO and the implications of US tariffs. The interplay between Shein, its London IPO, and US tariffs will continue to be a fascinating case study in the years to come.

Featured Posts

-

Leon Thomas And Halle Bailey Exploring Their Rather Be Alone Collaboration

May 06, 2025

Leon Thomas And Halle Bailey Exploring Their Rather Be Alone Collaboration

May 06, 2025 -

Analyzing Trumps Trade Policy Economic Concerns And Deal Making

May 06, 2025

Analyzing Trumps Trade Policy Economic Concerns And Deal Making

May 06, 2025 -

Romania Election Far Right Leader Heads To Runoff Against Centrist

May 06, 2025

Romania Election Far Right Leader Heads To Runoff Against Centrist

May 06, 2025 -

2025 Met Gala Livestream Accessing The Event From Latin America Mexico And The U S

May 06, 2025

2025 Met Gala Livestream Accessing The Event From Latin America Mexico And The U S

May 06, 2025 -

Dostawa Trotylu Z Polski Do Usa Dla Wojska

May 06, 2025

Dostawa Trotylu Z Polski Do Usa Dla Wojska

May 06, 2025

Latest Posts

-

Met Gala 2024 Rachel Zegler Lizzo Doechii And More

May 06, 2025

Met Gala 2024 Rachel Zegler Lizzo Doechii And More

May 06, 2025 -

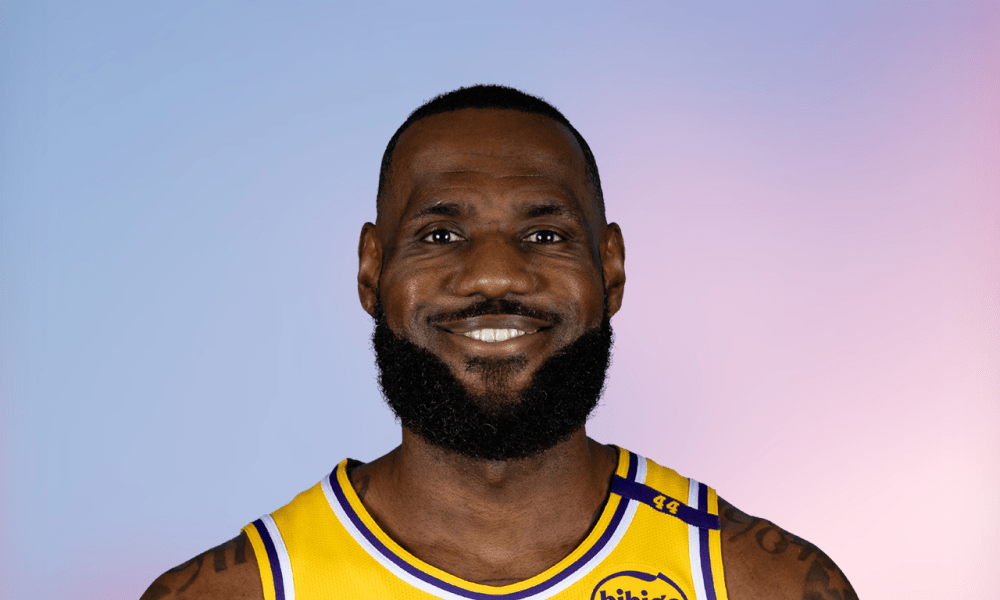

Knee Injury Prevents Le Bron James From Chairing 2025 Met Gala

May 06, 2025

Knee Injury Prevents Le Bron James From Chairing 2025 Met Gala

May 06, 2025 -

Le Bron James Absence At 2025 Met Gala Confirmed Knee Injury

May 06, 2025

Le Bron James Absence At 2025 Met Gala Confirmed Knee Injury

May 06, 2025 -

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025 -

2025 Met Gala Le Bron James Out Due To Knee Problem

May 06, 2025

2025 Met Gala Le Bron James Out Due To Knee Problem

May 06, 2025