Shein's London IPO: Delayed Due To US Tariff Concerns

Table of Contents

The US Tariff Threat Looms Large

The looming threat of US tariffs is the primary reason behind the Shein London IPO delay. Shein, known for its incredibly low prices and vast product range, sources much of its production from China. The ongoing trade tensions between the US and China have resulted in a complex web of import tariffs, impacting numerous industries, and Shein is now squarely in the crosshairs. These Shein US tariffs, specifically targeting clothing and textiles, threaten to significantly increase the company's production costs.

- Increased Production Costs: The potential imposition of China tariffs on Shein's products could dramatically increase the cost of importing goods into the US, potentially impacting the company's already razor-thin profit margins.

- Trade War Ramifications: The ongoing trade war between the US and China creates significant uncertainty for businesses like Shein, making it difficult to predict future costs and plan long-term strategies. This uncertainty is a major factor in the Shein IPO delay.

- Pricing Strategy Impacts: To absorb the increased costs associated with the clothing tariffs, Shein may be forced to raise prices, potentially impacting its competitive advantage and customer base. This could also negatively impact the Shein stock market valuation.

- Official Statements: While neither Shein nor US government officials have made definitive statements directly linking the IPO delay to the tariff threat, the timing and context strongly suggest a direct correlation.

Impact on Shein's Valuation and Investor Confidence

The delay of the Shein London IPO has undoubtedly impacted its valuation and investor confidence. The uncertainty surrounding the potential US tariffs on Shein creates a significant risk factor for potential investors. This uncertainty makes it difficult to accurately assess the company's future profitability and growth potential. A delayed IPO also means a delay in the much needed capital injection Shein may have been hoping for.

- Fundraising Goals: The delay directly impacts Shein's planned fundraising goals, potentially forcing the company to explore alternative funding options or postpone expansion plans.

- Lower Valuation Potential: If the IPO proceeds at a later date, the valuation might be lower than initially anticipated, given the increased uncertainty in the market. The fast fashion valuation landscape is particularly volatile right now.

- Expert Analysis: Financial experts are already expressing concerns about the long-term consequences for Shein’s stock, particularly if the tariff issue remains unresolved. The Shein stock market performance, upon eventual listing, will be closely watched.

Alternative IPO Locations and Strategies

In light of the Shein IPO delay, the company is likely exploring alternative options. Shifting the IPO location away from London is a possibility, particularly to regions less impacted by US trade policies. Furthermore, Shein may need to adjust its business strategy to mitigate future tariff risks.

- Hong Kong or Other Locations: An IPO in Hong Kong or another Asian financial center could provide a more stable environment, less vulnerable to US trade policies. This is a key factor impacting Shein's IPO strategy.

- Restructuring Supply Chains: To reduce dependence on Chinese manufacturing and lessen the impact of tariffs, Shein might explore diversifying its supply chains by sourcing materials and manufacturing in other countries.

The Broader Implications for the Fast Fashion Industry

The Shein IPO delay carries significant implications for the entire fast-fashion industry. The challenges faced by Shein – namely, the threat of US tariffs and subsequent supply chain disruptions – are not unique. Other fast-fashion brands relying on similar sourcing models face comparable risks.

- Ripple Effect on Competitors: The delay and uncertainty surrounding the Shein IPO serves as a cautionary tale for other fast-fashion companies considering an IPO, highlighting the complexities of navigating global trade relations.

- Supply Chain Restructuring: Shein's potential supply chain restructuring could set a precedent for the industry, prompting other brands to diversify their sourcing to mitigate geopolitical risks.

- Future of Fast Fashion IPOs: The Shein case could impact the timing and strategies of other fast-fashion companies planning public listings. This could lead to a more cautious and strategic approach to IPOs within the sector.

Conclusion

The delay of Shein's London IPO due to US tariff concerns highlights the significant challenges faced by global fast-fashion companies navigating complex international trade relations. The uncertainty surrounding tariffs has impacted investor confidence and necessitates a reassessment of Shein's strategic trajectory. The ripple effects are felt throughout the fast fashion industry, underscoring the need for adaptability and diversification.

Call to Action: Stay informed about the evolving situation surrounding the Shein IPO and the impact of US tariffs on the fast-fashion industry. Keep an eye on further developments regarding the Shein London IPO and its eventual listing. Follow reputable financial news sources for updates on the Shein IPO and its future.

Featured Posts

-

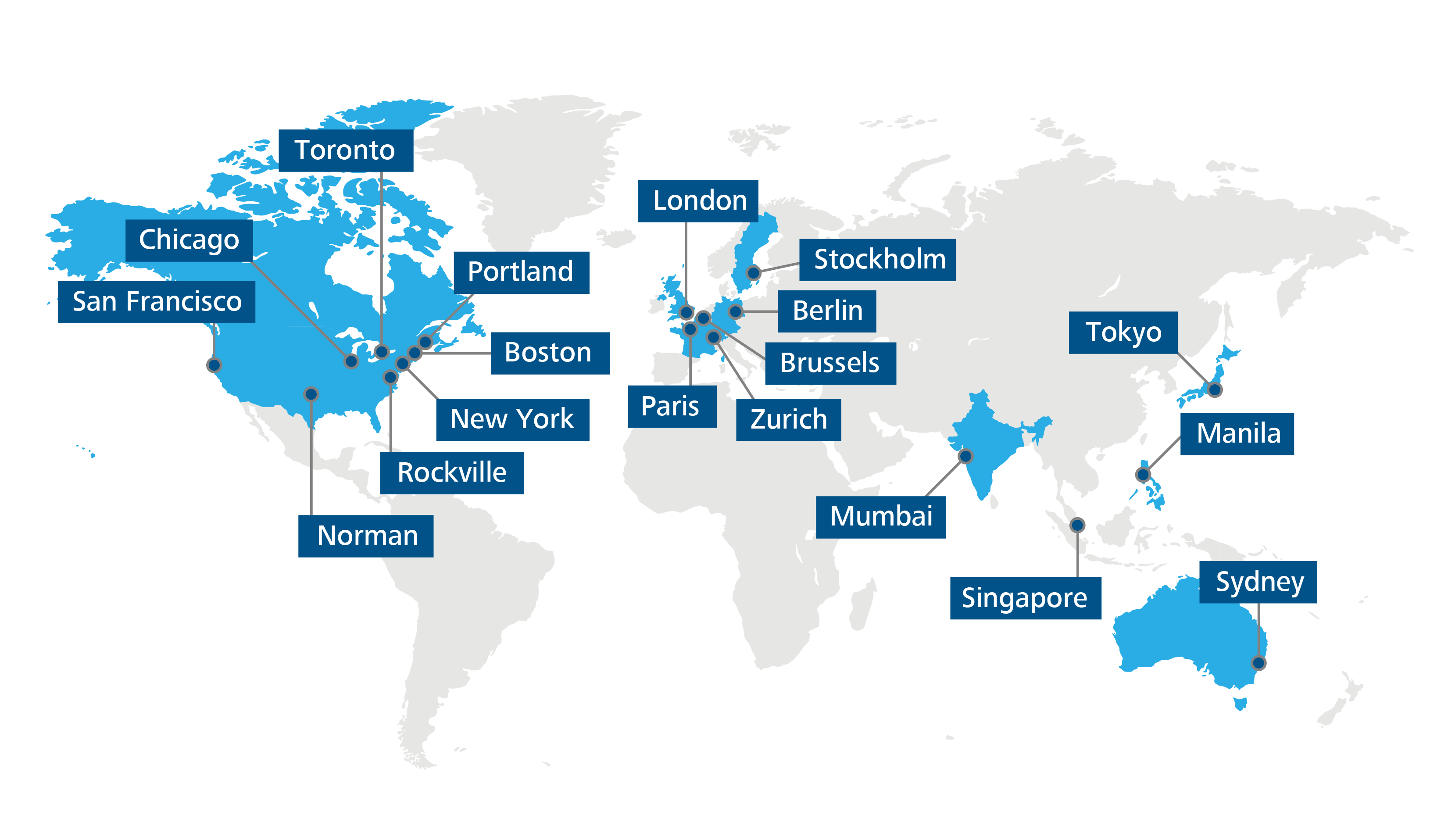

Discover The Countrys Top Business Locations A Detailed Guide

May 05, 2025

Discover The Countrys Top Business Locations A Detailed Guide

May 05, 2025 -

U S Antitrust Suit Could Googles Ad Dominance Be Broken Up

May 05, 2025

U S Antitrust Suit Could Googles Ad Dominance Be Broken Up

May 05, 2025 -

Zuckerbergs Meta In A Post Trump World

May 05, 2025

Zuckerbergs Meta In A Post Trump World

May 05, 2025 -

Australia Votes Labor Leads In Early Election Results

May 05, 2025

Australia Votes Labor Leads In Early Election Results

May 05, 2025 -

South Bengal Heatwave Five Districts Face Extreme Heat

May 05, 2025

South Bengal Heatwave Five Districts Face Extreme Heat

May 05, 2025

Latest Posts

-

Seventh Wonder Performs Fleetwood Mac Perth Mandurah Albany Tour Dates

May 05, 2025

Seventh Wonder Performs Fleetwood Mac Perth Mandurah Albany Tour Dates

May 05, 2025 -

Ranking Fleetwood Macs Top Songs From Rhiannon To Landslide

May 05, 2025

Ranking Fleetwood Macs Top Songs From Rhiannon To Landslide

May 05, 2025 -

Dope Girls Movie Review A Unique Wwi Perspective

May 05, 2025

Dope Girls Movie Review A Unique Wwi Perspective

May 05, 2025 -

Fleetwood Mac Tribute Concert Seventh Wonder In Perth Mandurah Albany

May 05, 2025

Fleetwood Mac Tribute Concert Seventh Wonder In Perth Mandurah Albany

May 05, 2025 -

The Most Popular Fleetwood Mac Songs Of All Time

May 05, 2025

The Most Popular Fleetwood Mac Songs Of All Time

May 05, 2025