Shein's Stalled London IPO: The US Tariff Fallout

Table of Contents

Shein's Growth and the Planned London IPO

Shein's phenomenal success story is undeniable. Its ultra-fast fashion model, leveraging social media marketing and offering an incredibly wide range of trendy clothing at unbelievably low prices, disrupted the global apparel industry. This explosive growth fueled ambitions for a significant initial public offering (IPO), initially targeting London's financial markets. The planned IPO was expected to be one of the largest in recent years, potentially setting a new benchmark for valuations in the fast-fashion sector.

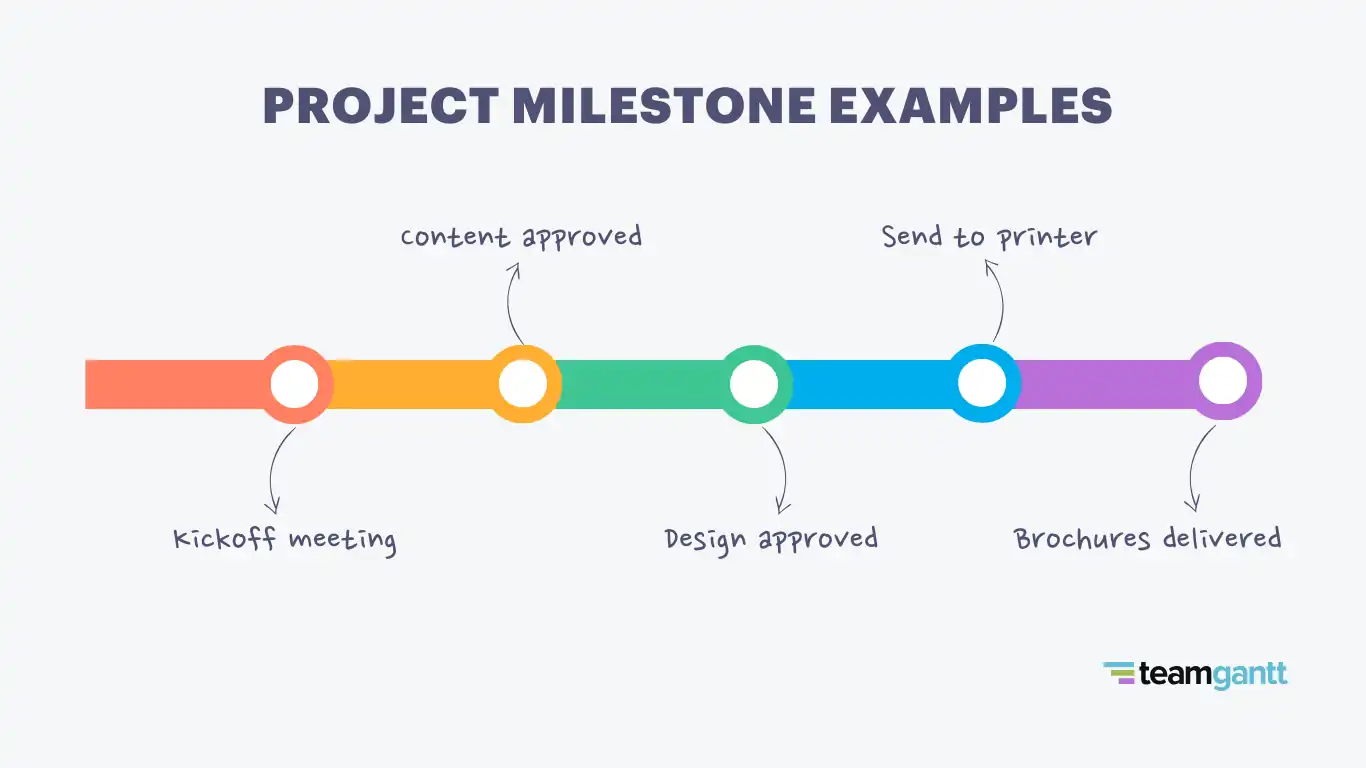

- Key milestones in Shein's growth: Launched in 2012, Shein quickly expanded its global reach, leveraging digital marketing and a vast supply chain. Key milestones include reaching millions of customers, establishing itself as a market leader, and consistently launching new collections.

- Reasons for choosing London as the IPO location: London, a major global financial hub, offered access to a diverse pool of international investors and a well-established regulatory framework for IPOs. Its reputation as a center for innovation and global trade made it an attractive option for Shein.

- Estimated valuation of the IPO: While the exact figures remained undisclosed, analysts predicted a valuation ranging from $50 billion to upwards of $100 billion, placing it among the world's most valuable privately held companies.

The Threat of US Tariffs on Shein's Business Model

The imposition of US tariffs on clothing and textiles imported from China significantly impacted Shein's business model. A large portion of Shein's manufacturing occurs in China, making the company particularly vulnerable to these trade barriers. The tariffs increased the cost of production, impacting Shein's already razor-thin profit margins and potentially affecting its competitive pricing strategy.

- Specific tariff rates affecting Shein's products: The exact tariff rates vary depending on the specific product, but they generally range from a few percentage points to upwards of 20%, significantly increasing the cost of goods sold (COGS).

- Shein's sourcing strategies and their vulnerability to tariffs: Shein's reliance on a predominantly Chinese manufacturing base leaves it highly exposed to trade tensions and tariff increases. The company's reliance on low-cost manufacturing in China is central to its business model, making diversification difficult.

- Potential impact on Shein's profit margins: The increased production costs directly eat into Shein's already tight profit margins, reducing profitability and potentially forcing price increases, which could impact its customer base.

Shein's Response to US Tariffs

Shein has attempted to mitigate the impact of these tariffs through various strategies, but the effectiveness of these remains questionable.

- Examples of Shein's mitigation strategies: The company has explored diversifying its sourcing to countries with less restrictive trade relationships with the US, but this involves significant logistical and infrastructural challenges.

- Successes and failures of these strategies: While Shein has likely seen some success in diversifying its production, it is challenging to completely offset the reliance on Chinese manufacturing given the scale of its operations.

The Impact of Tariffs on Investor Confidence

The uncertainty surrounding US tariffs has significantly dampened investor confidence in Shein's long-term prospects. The potential for continued tariff increases or trade disputes casts a shadow over the company's profitability and its ability to maintain its current growth trajectory. This uncertainty makes the IPO less attractive to investors.

- Analyst predictions on Shein's valuation considering tariffs: Analysts have revised downward their predictions for Shein's valuation, reflecting the negative impact of tariffs on profitability and future growth.

- Impact of tariffs on investor sentiment towards the fast fashion industry: The challenges faced by Shein highlight broader concerns about the sustainability and profitability of the fast-fashion industry in the face of global trade tensions.

- Comparison with other fast fashion brands facing similar challenges: Other fast-fashion brands have also faced similar challenges due to US tariffs, emphasizing the systemic nature of the problem.

Alternative Strategies for Shein's Future Growth

To achieve its growth objectives, Shein needs to consider alternative strategies that reduce its dependence on low-cost Chinese manufacturing and navigate the challenges posed by US tariffs.

- Potential expansion into new markets less affected by US tariffs: Focusing on markets outside of the US, where tariffs are less of a concern, can help reduce reliance on the US market.

- Exploring alternative business models to reduce reliance on low-cost manufacturing: This could include shifting towards more sustainable and ethically sourced materials, which might command higher prices but align with evolving consumer preferences.

- Alternative funding options beyond a traditional IPO: Shein could explore private equity funding or other forms of alternative financing to achieve its growth targets without relying on a public offering in the near future.

Conclusion: The Future of Shein's IPO and the US Tariff Challenge

The US tariffs present a significant hurdle for Shein's planned London IPO. The uncertainty surrounding tariffs has negatively impacted investor confidence, making a successful IPO challenging in the current climate. Shein must actively address these challenges by diversifying its sourcing, adapting its business model, and exploring alternative funding sources. Staying informed about the evolving situation regarding Shein's IPO and the broader impact of US tariffs on global trade and the fast fashion industry is crucial. The future of Shein's IPO, and indeed its future overall, remains tied to its ability to effectively navigate this complex landscape. The developments concerning Shein's IPO, the impact of US tariffs on Shein, and Shein's future will continue to shape the fast-fashion landscape.

Featured Posts

-

Zuckerbergs Meta In A Post Trump World

May 05, 2025

Zuckerbergs Meta In A Post Trump World

May 05, 2025 -

Anna Kendricks Upcoming Milestone A Look At Her Real Age And Career

May 05, 2025

Anna Kendricks Upcoming Milestone A Look At Her Real Age And Career

May 05, 2025 -

Opting Out Of Google Ai Training Does It Really Work

May 05, 2025

Opting Out Of Google Ai Training Does It Really Work

May 05, 2025 -

The Rock Band That Almost Was Lizzo Sza And A Mystery Musician

May 05, 2025

The Rock Band That Almost Was Lizzo Sza And A Mystery Musician

May 05, 2025 -

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 05, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 05, 2025

Latest Posts

-

A Look At Fleetwood Macs Best Selling Albums And Their Lasting Impact

May 05, 2025

A Look At Fleetwood Macs Best Selling Albums And Their Lasting Impact

May 05, 2025 -

Analyzing The Continued Success Of Fleetwood Macs Extensive Discography

May 05, 2025

Analyzing The Continued Success Of Fleetwood Macs Extensive Discography

May 05, 2025 -

Fleetwood Macs Hit Albums A Deep Dive Into Their Continued Popularity

May 05, 2025

Fleetwood Macs Hit Albums A Deep Dive Into Their Continued Popularity

May 05, 2025 -

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 05, 2025

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 05, 2025 -

Buckingham And Fleetwoods Reunion Future Of Fleetwood Mac Uncertain

May 05, 2025

Buckingham And Fleetwoods Reunion Future Of Fleetwood Mac Uncertain

May 05, 2025