Shopify Stock Jumps After Nasdaq 100 Listing

Table of Contents

Nasdaq 100 Inclusion: A Catalyst for Growth?

The Nasdaq 100 is a market-capitalization-weighted index of 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Inclusion in this index is a significant achievement, signaling to investors a company's size, stability, and growth potential. For Shopify, this listing represents a major milestone, potentially acting as a powerful catalyst for future growth.

The benefits of being included in the Nasdaq 100 are multifaceted:

- Increased Investor Visibility and Interest: Inclusion instantly boosts Shopify's visibility among a broader range of investors, both domestic and international, attracting significant attention from institutional investors and attracting increased trading volume.

- Potential Inclusion in Various Passively Managed Index Funds: Many index funds track the Nasdaq 100, meaning Shopify's inclusion automatically adds it to the portfolios of countless investors who may not have previously considered the company.

- Enhanced Credibility and Market Trust: Being part of such a prestigious index lends an air of legitimacy and credibility, reinforcing investor confidence in Shopify's long-term prospects.

- Increased Trading Volume: Listing on the Nasdaq 100 often translates to increased trading volume, enhancing liquidity and potentially reducing price volatility over time.

Analyzing Shopify's Stock Performance Post-Listing

Since the announcement and subsequent listing on the Nasdaq 100, Shopify's stock price has experienced a notable increase. While precise figures vary depending on the timeframe considered, reports suggest a significant percentage jump – for example, a [Insert Specific Percentage]% increase within [Insert Timeframe] following the announcement. This surge wasn't solely attributed to the Nasdaq 100 inclusion; other factors played a crucial role.

- Specific Percentage Increase in Shopify Stock Price: [Insert Data and Source]

- Trading Volume Data Before and After the Nasdaq 100 Inclusion: [Insert Data and Source with comparison chart or graph]

- Comparison to Other Similar Companies Listed on the Nasdaq 100: A comparison with other e-commerce companies or software-as-a-service (SaaS) businesses listed on the Nasdaq 100 can provide valuable context for Shopify's performance. [Include comparison data and analysis if available]

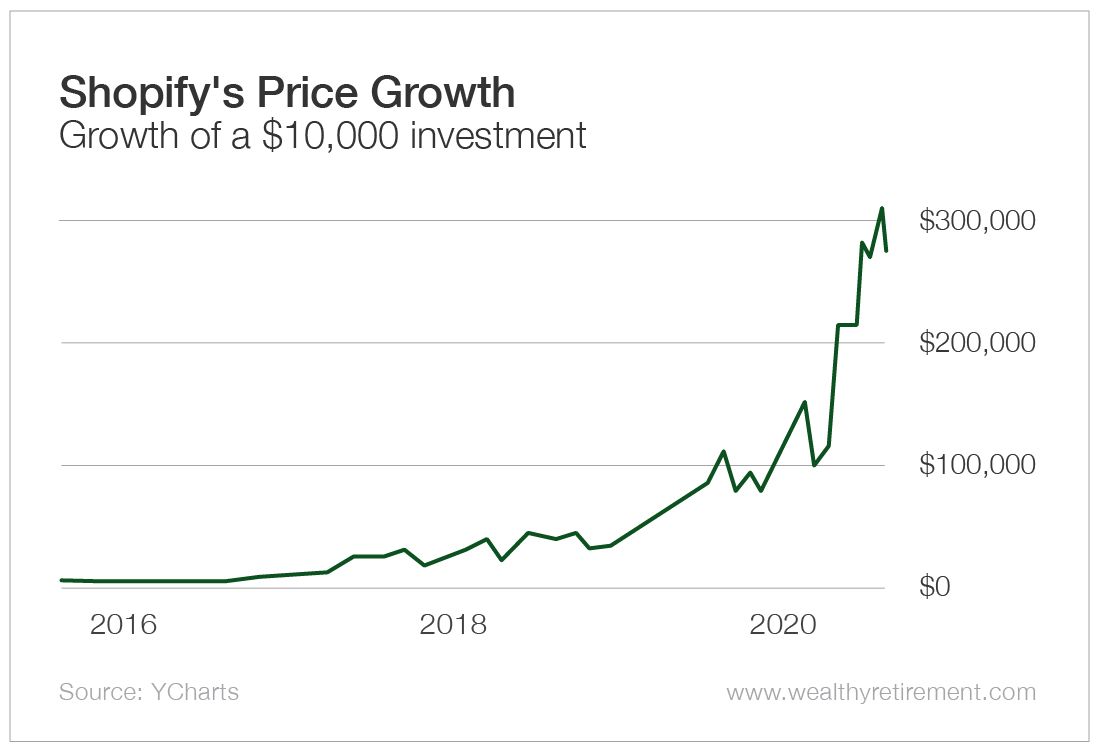

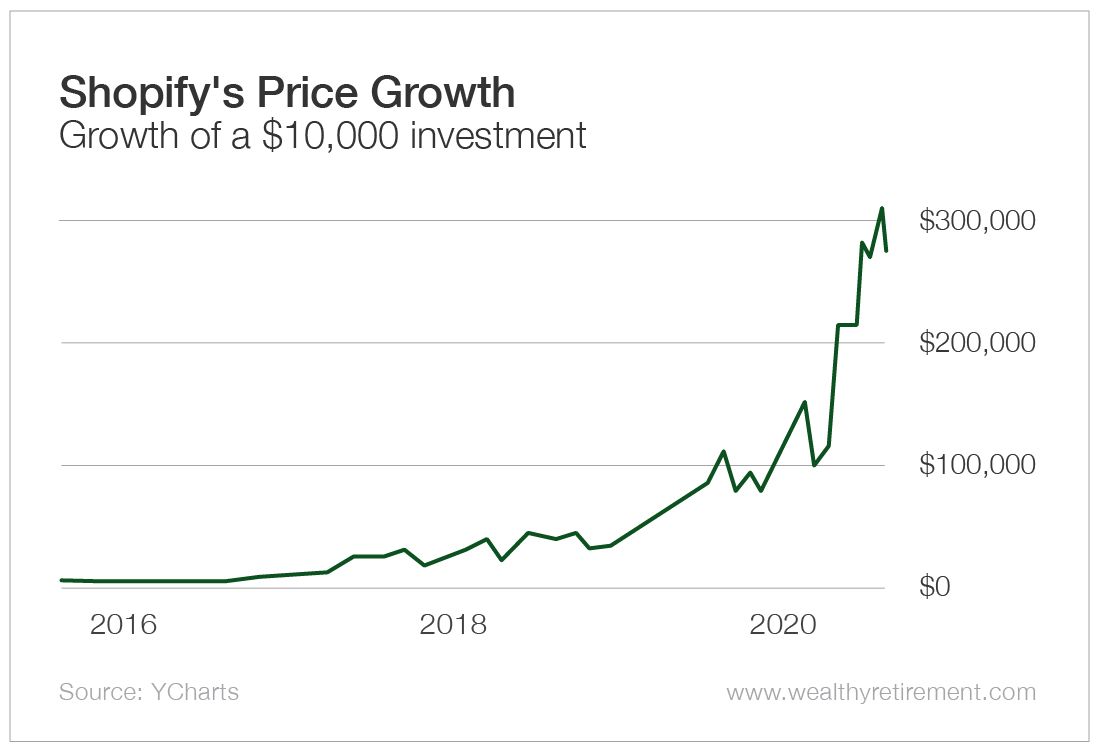

Strong Q[Insert Quarter] earnings, positive market sentiment toward the tech sector, and a generally bullish outlook for the e-commerce industry all contributed to the upward momentum. A visual representation of the stock price movement through charts and graphs would further enhance understanding.

Investor Sentiment and Future Outlook for Shopify Stock

Following the Nasdaq 100 listing, investor sentiment towards Shopify has been largely positive. Many analysts have issued buy or hold ratings, reflecting confidence in the company's long-term growth potential. However, it's important to acknowledge potential headwinds.

- Summary of Analyst Ratings (buy, hold, sell): [Insert data and source. Mention the range of ratings and any dissenting opinions.]

- Discussion of Potential Future Growth Drivers for Shopify: This could include expansion into new markets, the launch of innovative features, strategic acquisitions, and increasing adoption of its platform by larger businesses.

- Mention Any Potential Headwinds Facing Shopify: This could encompass increased competition from established players and new entrants, economic slowdowns impacting consumer spending, and potential regulatory changes.

Shopify's Position in the E-commerce Market

Shopify maintains a leading position in the e-commerce platform market. Its user-friendly interface, comprehensive feature set, and robust app ecosystem attract merchants of all sizes. This strong market position fuels investor confidence.

- Market Share Data and Comparison to Competitors: [Insert data and source. Compare Shopify's market share to competitors like Wix, Squarespace, etc.]

- Key Features of the Shopify Platform That Attract Merchants: Highlight features such as ease of use, scalability, marketing tools, and 24/7 support.

- Examples of Successful Shopify Businesses: Showcase examples of businesses that have successfully leveraged the Shopify platform to achieve significant growth.

Conclusion: Investing in Shopify Stock After the Nasdaq 100 Boost

The inclusion of Shopify in the Nasdaq 100 has undeniably had a significant positive impact on its stock price. This surge reflects both the prestige associated with the index and Shopify's inherent strength as a leading e-commerce platform. While the future holds both opportunities and challenges, the positive investor sentiment and the company's strong market position suggest a promising outlook. However, potential investors should always conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. Learn more about investing in Shopify stock and explore Shopify's investment potential by researching the company's financial reports and consulting with a financial advisor. Stay updated on Shopify's stock performance to make informed investment choices.

Featured Posts

-

Sabalenka Dominates Ending Paolinis Dubai Run

May 14, 2025

Sabalenka Dominates Ending Paolinis Dubai Run

May 14, 2025 -

Pokemon Tcg Pocket Charizard Ex A2b 010 Comprehensive Deckbuilding And Counter Strategy Guide

May 14, 2025

Pokemon Tcg Pocket Charizard Ex A2b 010 Comprehensive Deckbuilding And Counter Strategy Guide

May 14, 2025 -

Central London Welcomes Lindts New Chocolate Haven

May 14, 2025

Central London Welcomes Lindts New Chocolate Haven

May 14, 2025 -

Pokemon Go Sweet Discoveries Event Everything You Need To Know

May 14, 2025

Pokemon Go Sweet Discoveries Event Everything You Need To Know

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025