Should I Invest In XRP (Ripple) At Its Current Price?

Table of Contents

Understanding XRP and Ripple's Technology

XRP is a cryptocurrency designed to function within Ripple's payment network, a platform intended to facilitate fast and low-cost international money transfers. Unlike cryptocurrencies like Bitcoin that rely on blockchain technology, Ripple uses a unique consensus mechanism that allows for significantly faster transaction speeds. This technology aims to solve the inherent inefficiencies of traditional cross-border payments, offering a quicker, cheaper, and more secure alternative.

- Speed and Efficiency: XRP transactions are processed within seconds, drastically outpacing many other cryptocurrencies and traditional banking systems.

- Low Transaction Costs: The fees associated with sending XRP are significantly lower than those charged by banks and other payment providers.

- Scalability Potential: Ripple's network is designed to handle a high volume of transactions, making it potentially more scalable than some other cryptocurrencies.

- International Money Transfers: XRP's primary use case is facilitating seamless and cost-effective international money transfers for businesses and individuals.

Analyzing the Current Market Conditions for XRP

The current price of XRP is subject to constant change, reflecting the overall cryptocurrency market sentiment and the ongoing legal proceedings. Analyzing its recent price history, market capitalization, and trading volume is crucial for understanding its current position. Several factors influence XRP's price, including:

- Regulatory News: The SEC lawsuit significantly impacts investor confidence and, consequently, XRP's price. Positive developments in the case could lead to a price surge, while negative news could cause a sharp decline.

- Market Sentiment: The overall sentiment towards cryptocurrencies in general significantly influences XRP's performance. Broader market trends, such as Bitcoin's price movements, can have a ripple effect on other cryptocurrencies like XRP.

- Partnerships and Developments: Ripple's partnerships with financial institutions and any technological advancements they announce can positively influence XRP's price and adoption.

[Insert a chart showing XRP's price fluctuations here]

The SEC Lawsuit and its Impact on XRP Investment

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, a claim that Ripple strongly contests. The outcome of this legal battle will significantly impact XRP's future.

- SEC's Arguments: The SEC argues that Ripple sold XRP as an unregistered security, violating federal securities laws.

- Ripple's Defense: Ripple maintains that XRP is a currency and not a security, arguing it's used for facilitating payments on their network.

- Potential Outcomes: The lawsuit could result in a settlement, a court ruling in favor of the SEC, or a court ruling in favor of Ripple. Each outcome carries drastically different implications for XRP's price and future.

- Uncertainty: The uncertainty surrounding the legal outcome poses a significant risk for investors considering an XRP investment.

Risk Assessment and Diversification Strategies

Investing in cryptocurrencies, including XRP, is inherently risky. The market is highly volatile, and prices can fluctuate dramatically in short periods.

- Volatility: XRP's price is subject to significant swings, potentially leading to substantial losses for investors.

- Only Invest What You Can Afford to Lose: It's crucial to only invest funds you can afford to lose entirely.

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk.

- Alternative Investments: Consider diversifying into other cryptocurrencies or traditional investments to balance your portfolio and reduce reliance on a single, high-risk asset like XRP.

Conclusion: Should You Invest in XRP (Ripple)? A Final Verdict

Investing in XRP at its current price presents a complex decision. While XRP's underlying technology offers potential advantages in cross-border payments, the ongoing SEC lawsuit introduces significant uncertainty and risk. The volatility of the cryptocurrency market adds another layer of complexity. Therefore, a balanced approach is crucial.

Based on the analysis, investing in XRP requires careful consideration of your risk tolerance and a thorough understanding of the potential outcomes of the SEC lawsuit. While the technology behind XRP is promising, the legal uncertainties significantly impact the investment's viability.

Call to Action: Before making any investment decisions regarding XRP, conduct thorough independent research, assess your risk tolerance, and consider seeking advice from a qualified financial advisor. Invest wisely in XRP, making informed decisions about XRP investments and carefully weighing the risks of XRP investment.

Featured Posts

-

Nigeria Railway Corporation Warri Itakpe Train Service Back In Operation

May 01, 2025

Nigeria Railway Corporation Warri Itakpe Train Service Back In Operation

May 01, 2025 -

Royal Initiative Prince William And Kate Secure New Partnership

May 01, 2025

Royal Initiative Prince William And Kate Secure New Partnership

May 01, 2025 -

Is Age Just A Number Redefining Aging And Its Impact

May 01, 2025

Is Age Just A Number Redefining Aging And Its Impact

May 01, 2025 -

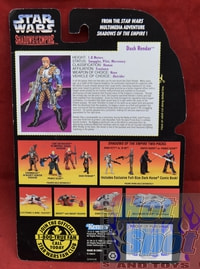

Star Wars Shadow Of The Empire Hasbro Unveils Dash Rendar Collectible

May 01, 2025

Star Wars Shadow Of The Empire Hasbro Unveils Dash Rendar Collectible

May 01, 2025 -

Bbc Dragons Den Confusion Old Episode Shown During New Season

May 01, 2025

Bbc Dragons Den Confusion Old Episode Shown During New Season

May 01, 2025