Should Investors Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

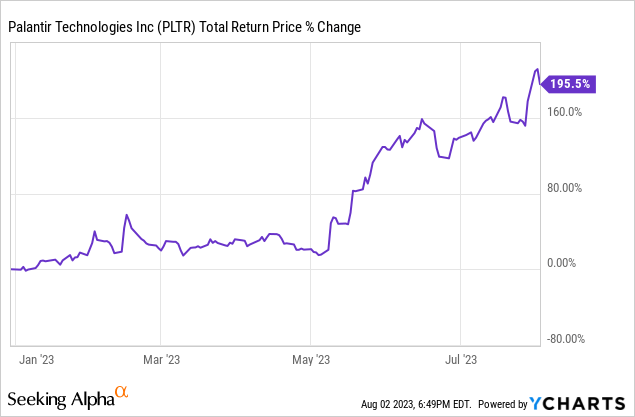

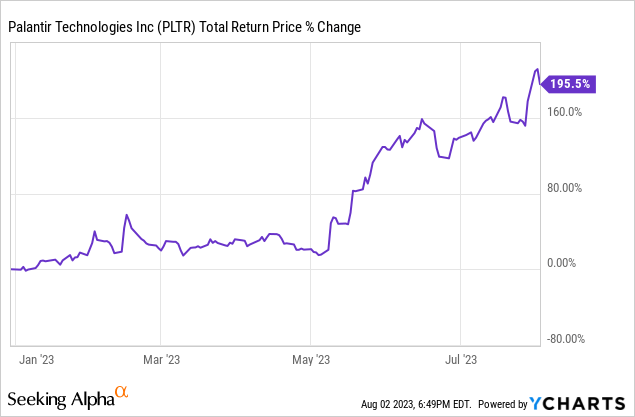

Palantir's Recent Performance and Growth Trajectory

Analyzing Q4 2023 Results

Palantir's Q4 2023 results provided a mixed bag for investors. While the company demonstrated continued revenue growth, profitability remained a key focus area. Understanding these nuances is crucial for assessing whether to buy Palantir stock.

- Revenue Growth: Palantir reported a [Insert actual percentage]% increase in revenue year-over-year, showcasing continued demand for its data analytics platforms. However, the rate of growth compared to previous quarters needs careful consideration.

- Net Income/Loss: The company reported a [Insert actual net income/loss], highlighting ongoing efforts to improve profitability. Investors should analyze the reasons behind this figure, considering factors such as increased operating expenses and investment in research and development.

- Customer Acquisition and Contract Wins: Key metrics such as the number of new customers acquired and significant contract wins, particularly in the government and commercial sectors, will influence future Palantir stock price predictions. Analyzing these provides insight into the sustainability of growth.

- Government Contracts and Partnerships: The extent to which Palantir secured new government contracts and the nature of any new partnerships are also key indicators of future performance and should be carefully reviewed.

Future Growth Projections and Market Opportunities

Analysts project continued growth for Palantir, driven by several key factors. Understanding these projections is vital for any investor considering buying Palantir stock.

- Projected Revenue Growth: Analysts predict a [Insert range of projected revenue growth percentages] for the coming quarters, reflecting a generally optimistic outlook, although the variability underscores the inherent uncertainty.

- Key Market Segments: Government contracts remain a significant revenue driver, but expanding commercial adoption of Palantir's platforms in healthcare, finance, and other sectors will be critical for long-term growth. This will impact the Palantir stock price prediction.

- Impact of New Technologies: Palantir's investments in artificial intelligence (AI) and its related product launches could significantly impact revenue streams. The success of these initiatives will be key to future growth and should inform any Palantir stock analysis.

Assessing the Risks Associated with Investing in Palantir

Volatility and Market Sentiment

Palantir's stock price is known for its volatility, making it susceptible to market fluctuations and overall investor sentiment. Understanding this risk is critical before buying Palantir stock.

- Historical Volatility: Analyzing Palantir's historical stock price volatility demonstrates the significant price swings it has experienced. This data provides context for the potential for both substantial gains and significant losses.

- Impact of News Events: News events, including earnings reports, geopolitical factors, and industry trends, can significantly affect Palantir's stock price. Being prepared for such volatility is vital for investing wisely.

- Comparison to Competitors: Comparing Palantir's performance and volatility to its competitors helps gauge its relative risk profile within the broader market landscape.

Competition and Market Saturation

The competitive landscape within the data analytics market is intense. Understanding Palantir's competitive position is essential for any Palantir stock analysis.

- Key Competitors: Palantir faces competition from established players and emerging startups offering similar data analytics solutions. Analyzing these competitors is crucial.

- Market Share Analysis: Evaluating Palantir's market share and its ability to maintain or expand it provides valuable insights into its future prospects and sustainability.

- Competitive Advantages and Disadvantages: Palantir's strengths lie in its deep government relationships and sophisticated technology. However, its high pricing and dependence on large contracts could be seen as disadvantages.

The Impact of the May 5th Earnings Report on Palantir Stock

Earnings Expectations and Analyst Forecasts

Wall Street analysts have varying expectations for Palantir's May 5th earnings report, resulting in a range of price targets for the Palantir stock price prediction.

- Average Price Target: The average price target among analysts is [Insert average price target]. However, this should not be taken as a guaranteed outcome.

- Range of Price Targets: The range of price targets reflects the uncertainty surrounding Palantir's future performance and the varying interpretations of its potential.

- Key Metrics: Analysts will scrutinize revenue growth, profitability, customer acquisition, and the outlook for future contracts. Monitoring these metrics is crucial for understanding the market reaction.

Potential Scenarios and Their Impact on the Stock Price

Several scenarios could unfold following the May 5th earnings announcement. Understanding these possibilities is crucial for formulating an investment strategy.

- Beating Expectations: If Palantir surpasses expectations, the stock price could see a significant increase, potentially leading to higher returns for investors who bought Palantir stock before the announcement.

- Meeting Expectations: Meeting expectations might result in a modest price movement, possibly a slight increase or a flat performance.

- Missing Expectations: If Palantir underperforms, the stock price could experience a substantial drop, highlighting the risk associated with investing in volatile stocks like Palantir.

Conclusion

Investing in Palantir stock before May 5th presents both significant opportunities and considerable risks. While Palantir demonstrates consistent revenue growth and holds promising potential in the rapidly expanding AI market, its inherent volatility and competitive landscape must be carefully considered. The upcoming earnings report will likely significantly impact the Palantir stock price, making informed decision-making crucial. This analysis provides insights, but remember to conduct thorough independent research before buying Palantir stock. Consider your risk tolerance and consult with a financial advisor before making any investment decisions. Ultimately, whether or not to buy Palantir stock rests on your individual assessment of the potential rewards versus the risks involved.

Featured Posts

-

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025 -

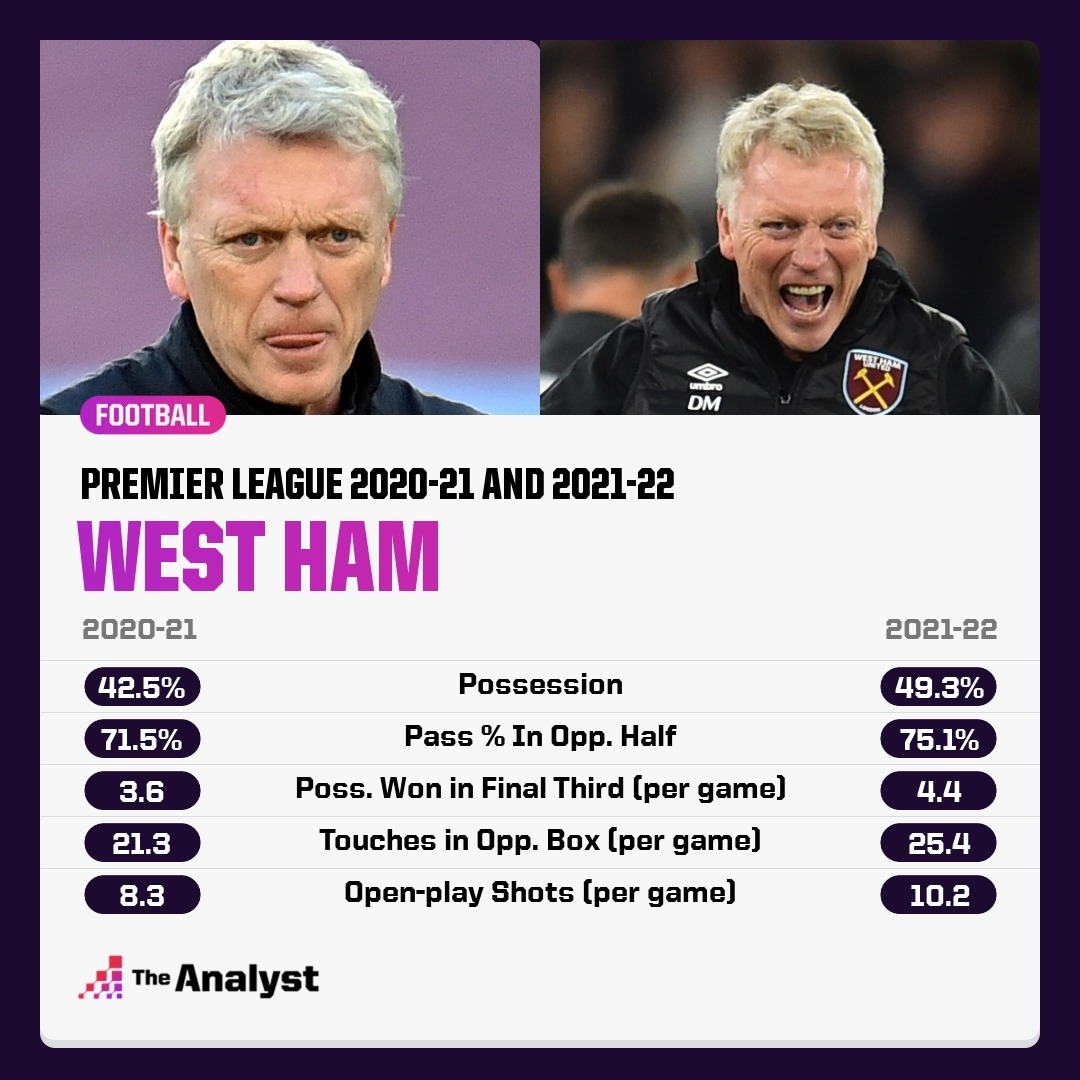

Analyzing West Hams Predicted 25m Financial Shortfall

May 09, 2025

Analyzing West Hams Predicted 25m Financial Shortfall

May 09, 2025 -

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025 -

Leon Draisaitl Injury Oilers Leading Scorer Exits Game

May 09, 2025

Leon Draisaitl Injury Oilers Leading Scorer Exits Game

May 09, 2025 -

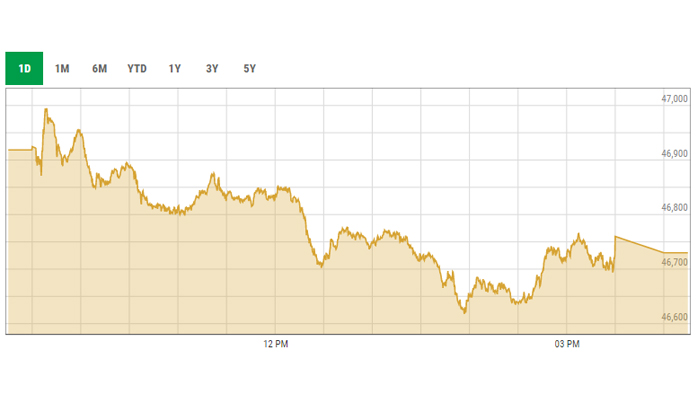

Sharp Decline In Kse 100 Operation Sindoors Effect On Pakistan Stock Market

May 09, 2025

Sharp Decline In Kse 100 Operation Sindoors Effect On Pakistan Stock Market

May 09, 2025