Should Investors Worry About Current Stock Market Valuations? BofA's View

Table of Contents

BofA generally expresses a cautious but not overly pessimistic outlook on current market valuations, suggesting a need for careful consideration rather than outright panic. This article will explore their analysis in detail.

BofA's Assessment of Current Market Valuations

BofA employs a multi-faceted approach to evaluating market valuations, utilizing a combination of traditional and more sophisticated metrics. Their methodology incorporates both absolute and relative valuation techniques to provide a comprehensive picture.

-

Methodology: BofA analysts utilize various valuation models, including:

- Price-to-Earnings Ratio (P/E): A fundamental valuation metric comparing a company's stock price to its earnings per share. BofA analyzes both trailing and forward P/E ratios across different sectors.

- Shiller P/E Ratio (CAPE): This cyclically adjusted P/E ratio smooths out earnings fluctuations over a longer period (typically 10 years), offering a more stable valuation benchmark.

- Discounted Cash Flow (DCF) Analysis: A more complex model that projects future cash flows and discounts them back to their present value to estimate intrinsic value.

-

Key Findings: BofA's recent findings suggest that while some sectors appear overvalued based on historical averages, the overall market isn't drastically inflated. However, the current environment requires careful consideration of various macroeconomic factors.

-

Specific Metrics and Comparisons:

- BofA might find the current overall market P/E ratio slightly above its long-term average, signaling a potentially higher risk.

- The Shiller P/E ratio might paint a more nuanced picture, potentially suggesting less overvaluation than a simple P/E ratio.

- Specific sectors, such as technology or certain consumer discretionary stocks, might be flagged as relatively overvalued compared to others.

Macroeconomic Factors Influencing BofA's View

BofA's valuation assessment is deeply intertwined with its macroeconomic outlook. Several factors significantly influence their perspective:

-

Interest Rate Hikes: The Federal Reserve's interest rate increases directly impact stock valuations by increasing the discount rate used in DCF models and making bonds a more attractive alternative investment. This can lead to lower stock prices.

-

Inflationary Pressures: High inflation erodes corporate earnings and can negatively affect investor sentiment, leading to lower valuations. BofA closely monitors inflation data and its impact on corporate profit margins.

-

Geopolitical Risks: Global uncertainties, such as geopolitical tensions or supply chain disruptions, can create market volatility and influence investor confidence, impacting valuations. BofA considers these factors in its overall assessment.

-

Economic Growth Forecasts: BofA's economic growth projections directly influence their valuation estimates. Stronger growth generally supports higher valuations, while weaker growth forecasts suggest lower valuations.

BofA's Recommendations for Investors

Based on their valuation analysis and macroeconomic outlook, BofA generally recommends a cautious and diversified approach:

-

Investment Strategies: BofA might suggest a balanced approach, incorporating both value and growth stocks, depending on the specific market conditions and risk tolerance of the investor.

-

Sector Allocation: They may advise investors to favor sectors less sensitive to interest rate changes and inflation, while potentially reducing exposure to sectors perceived as overvalued.

-

Risk Management: Given the current market environment, BofA likely stresses the importance of risk management strategies, such as diversification, stop-loss orders, and regular portfolio rebalancing.

Alternative Perspectives on Stock Market Valuations

It's crucial to acknowledge that not all analysts share BofA's perspective. Other financial institutions and analysts may hold differing viewpoints on current market valuations.

-

Contrasting Views: Some analysts might argue that current valuations are justified by strong corporate earnings growth or technological advancements. Others may hold more pessimistic views, predicting a significant market correction.

-

Reasons for Discrepancies: These differing perspectives often stem from variations in methodological approaches, macroeconomic forecasts, and assumptions about future growth.

Conclusion: Should You Worry About Current Stock Market Valuations? BofA's Insights and Your Next Steps

BofA's analysis suggests that while some sectors might be overvalued, the overall market isn't necessarily in a bubble. However, the current macroeconomic environment necessitates a cautious approach. Their recommendations emphasize diversification, risk management, and a thorough understanding of individual investment choices.

Key Takeaways: Understanding current stock market valuations is crucial for informed investing. BofA's cautious but not overly bearish stance underscores the need for careful monitoring of macroeconomic factors and a well-diversified portfolio.

Call to Action: Conduct your own thorough research, consult with a qualified financial advisor, and develop an investment strategy aligned with your risk tolerance and financial objectives. Stay informed about BofA's ongoing analysis of stock market valuations and other reputable sources to make the best decisions for your financial future.

The dynamic nature of stock market valuations requires continuous monitoring and adaptation of investment strategies. Don't hesitate to adjust your approach based on evolving market conditions and expert analysis.

Featured Posts

-

Istoriki Synantisi Nea Epoxi Synergasias Ierosolymon Kai Antioxeias

May 19, 2025

Istoriki Synantisi Nea Epoxi Synergasias Ierosolymon Kai Antioxeias

May 19, 2025 -

The Impact Of Music Festivals On London Parks Rylances Strong Condemnation

May 19, 2025

The Impact Of Music Festivals On London Parks Rylances Strong Condemnation

May 19, 2025 -

Mairon Santos Concedes Francis Marshall Won Ufc 313

May 19, 2025

Mairon Santos Concedes Francis Marshall Won Ufc 313

May 19, 2025 -

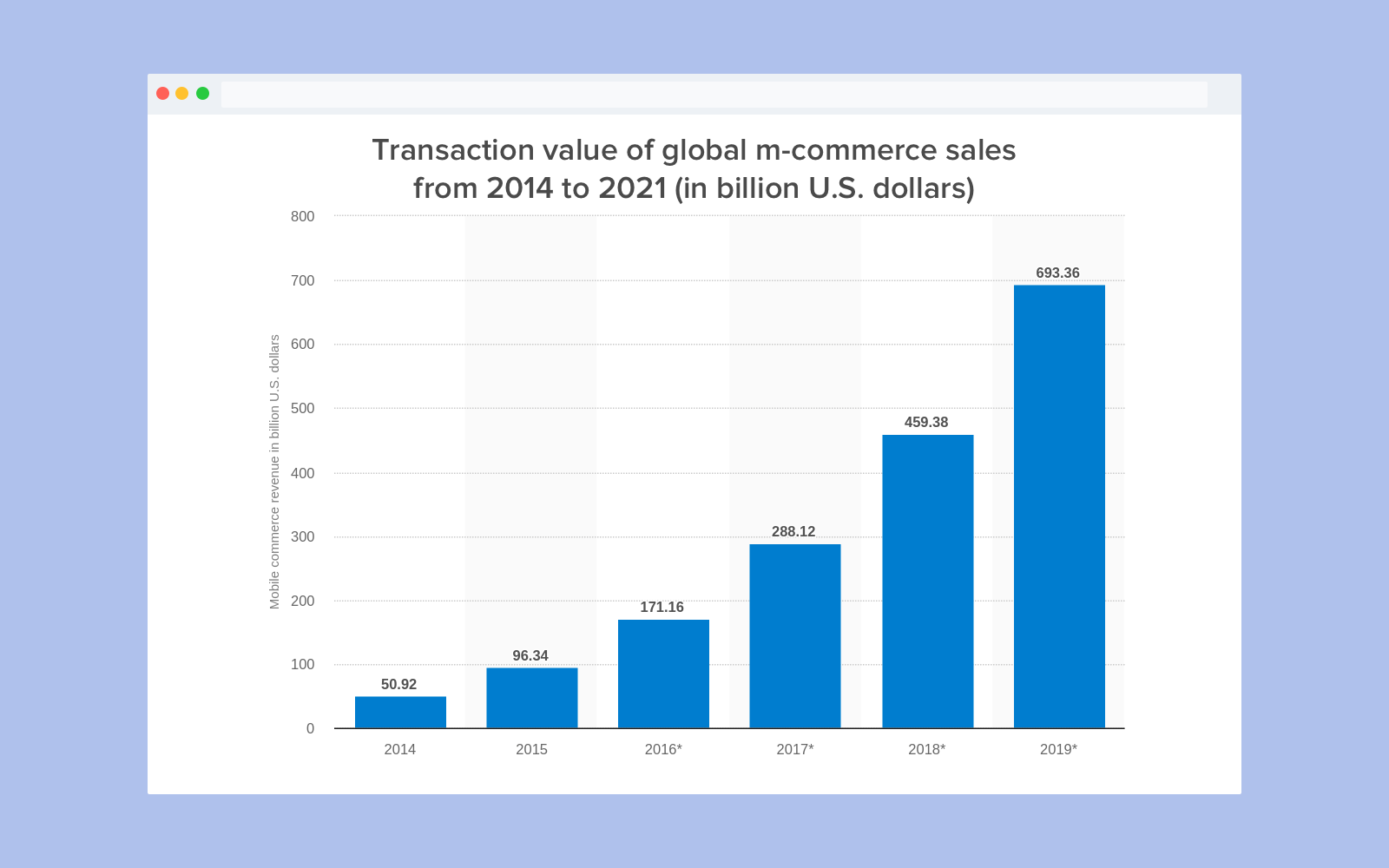

Is Mobile Marketing The Future Of E Commerce A Comprehensive Analysis

May 19, 2025

Is Mobile Marketing The Future Of E Commerce A Comprehensive Analysis

May 19, 2025 -

Srimandir Visit Footage Of Youtuber Jyoti Malhotra Puri Investigated For Espionage

May 19, 2025

Srimandir Visit Footage Of Youtuber Jyoti Malhotra Puri Investigated For Espionage

May 19, 2025