Should Investors Worry About Elevated Stock Market Valuations? BofA's Take

Table of Contents

The anxieties surrounding high stock valuations are understandable. High price-to-earnings ratios (P/E ratios) and other valuation metrics often precede market corrections or even crashes. Understanding whether current valuations are justified, and how to navigate this environment, is critical for investors aiming to protect and grow their wealth. This article will explore BofA's assessment and offer practical advice.

BofA's Assessment of Current Market Valuations

BofA employs a range of valuation metrics to assess the current market, including traditional P/E ratios, the cyclically adjusted price-to-earnings ratio (Shiller P/E), and other forward-looking indicators. Their analysis considers historical averages, comparing current valuations to previous market peaks and troughs, as well as considering sector-specific variations.

- BofA's Overall Assessment: While BofA acknowledges that certain market segments exhibit elevated valuations, their assessment is nuanced. They typically don't declare a blanket "overvalued" or "undervalued" statement, instead offering a more granular analysis. Their reports often highlight specific sectors exhibiting particularly high or low valuations relative to their growth prospects.

- Data Points: BofA's research frequently references specific data points, such as the current Shiller P/E ratio compared to its historical average, highlighting discrepancies and offering context. They might also point to variations in valuation across different market capitalization ranges (large-cap, mid-cap, small-cap).

- Historical Comparisons: BofA's reports often include charts and graphs comparing current valuation metrics to historical data, allowing investors to gauge the current situation within a broader historical context. This helps determine whether current valuations are unusually high or fall within a typical range.

- Sector-Specific Analysis: BofA's analysts frequently analyze valuations on a sector-by-sector basis, recognizing that valuations vary significantly across different industries. For example, technology stocks might be deemed highly valued while certain cyclical sectors might appear relatively undervalued.

Factors Contributing to Elevated Stock Market Valuations

Several factors contribute to the current environment of elevated stock market valuations. These include both macroeconomic and microeconomic influences, as well as shifts in investor sentiment.

- Macroeconomic Factors:

- Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and investors, pushing up asset prices across the board, including stocks.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the financial system, stimulating demand for assets and increasing prices.

- Inflation: While inflation can sometimes dampen valuations, moderate inflation can, in some circumstances, support higher stock prices if corporate earnings keep pace.

- Economic Growth: Periods of robust economic growth usually drive higher corporate profits, supporting elevated stock valuations.

- Company-Specific Factors:

- Strong Corporate Earnings: Consistent and increasing corporate earnings justify higher stock prices based on fundamental valuation metrics.

- Technological Innovation: Rapid technological advancements can create significant growth opportunities for companies in innovative sectors.

- Mergers and Acquisitions: Consolidation within industries can lead to increased market share and profitability, boosting stock valuations.

- Investor Sentiment:

- Market Optimism: Periods of sustained market growth can fuel investor optimism, leading to increased buying and pushing up prices.

- Fear of Missing Out (FOMO): The fear of missing out on potential gains can drive investors to buy even at higher valuations.

BofA's Recommendations for Investors

Given the current environment of elevated stock market valuations, BofA typically advises investors to adopt a cautious yet opportunistic approach.

- Risk Management Strategies: BofA often recommends diversification to mitigate risk across various asset classes. Defensive investing strategies, focusing on companies with stable earnings and lower volatility, are also suggested. Value investing, focusing on undervalued companies, may be another consideration.

- Portfolio Adjustments: BofA might suggest rebalancing portfolios to align with individual risk tolerances. This could involve increasing cash positions to capitalize on potential market dips or reallocating investments to less volatile assets.

- Alternative Investments: BofA may recommend exploring alternative investment options, such as real estate, bonds, or commodities, to diversify portfolios and reduce reliance on potentially overvalued equity markets.

Long-Term Outlook and Potential Risks

BofA's long-term outlook on stock market valuations is usually cautious, acknowledging the potential for future corrections or even a bear market.

- Market Corrections: The bank often highlights the likelihood of periodic market corrections, emphasizing the importance of managing risk during periods of high valuations.

- Potential Bubbles: Specific sectors or asset classes might be susceptible to bubble formation, requiring careful analysis before investment.

- Interest Rate Hikes: Increases in interest rates can negatively impact stock valuations by increasing borrowing costs for companies and making bonds a more attractive investment.

- Opportunities: Even in a potentially volatile market, BofA might point to potential opportunities for savvy investors. For example, identifying undervalued sectors or companies that can withstand market downturns could offer attractive entry points.

Conclusion: Navigating Elevated Stock Market Valuations – BofA's Guidance

BofA's perspective on elevated stock market valuations is nuanced, emphasizing the need for a cautious yet opportunistic approach. The bank acknowledges that certain sectors exhibit high valuations, driven by factors such as low interest rates, strong corporate earnings, and investor optimism. However, they also highlight the potential risks associated with maintaining these high valuations, including the possibility of market corrections and the impact of rising interest rates. BofA typically recommends investors focus on diversification, risk management strategies, and a thorough understanding of individual company valuations before making investment decisions. To stay informed and develop a robust investment strategy addressing concerns about elevated stock market valuations, consult with a financial professional and refer to reputable financial resources such as BofA's research publications. [Link to BofA Research]

Featured Posts

-

Warner Bros Discoverys Grand Slam Tennis Broadcast Plans Unveiled

May 12, 2025

Warner Bros Discoverys Grand Slam Tennis Broadcast Plans Unveiled

May 12, 2025 -

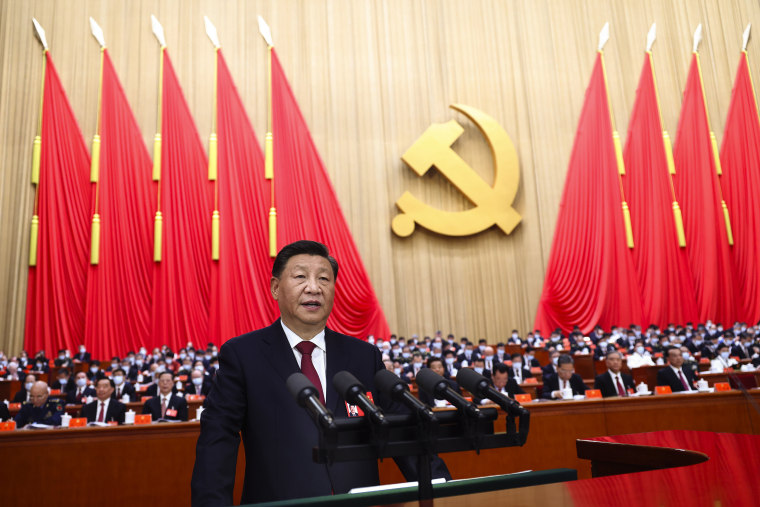

El Regalo De Uruguay A Xi Jinping Tres Toros En Camino A China

May 12, 2025

El Regalo De Uruguay A Xi Jinping Tres Toros En Camino A China

May 12, 2025 -

Martinelli Encuentra Refugio En Colombia Detalles Del Asilo

May 12, 2025

Martinelli Encuentra Refugio En Colombia Detalles Del Asilo

May 12, 2025 -

Prince Andrew And Underage Girl Explosive Claims In New Undercover Footage

May 12, 2025

Prince Andrew And Underage Girl Explosive Claims In New Undercover Footage

May 12, 2025 -

India Pakistan Conflict Five Indian Soldiers Killed Despite Ceasefire

May 12, 2025

India Pakistan Conflict Five Indian Soldiers Killed Despite Ceasefire

May 12, 2025

Latest Posts

-

Discover Cp Music Productions A Father Son Musical Collaboration

May 13, 2025

Discover Cp Music Productions A Father Son Musical Collaboration

May 13, 2025 -

Cp Music Productions Father And Son Delivering Exceptional Music

May 13, 2025

Cp Music Productions Father And Son Delivering Exceptional Music

May 13, 2025 -

Oregon Ducks Womens Basketball Season Ends With Duke Defeat In Ncaa Tournament

May 13, 2025

Oregon Ducks Womens Basketball Season Ends With Duke Defeat In Ncaa Tournament

May 13, 2025 -

Fans React To Kelly Ripa And Mark Consuelos Temporary Studio Setup

May 13, 2025

Fans React To Kelly Ripa And Mark Consuelos Temporary Studio Setup

May 13, 2025 -

A Father Son Musical Journey Cp Music Productions

May 13, 2025

A Father Son Musical Journey Cp Music Productions

May 13, 2025