Should You Buy BigBear.ai Stock? Investing Insights

Table of Contents

Recent headlines highlight the surging interest in artificial intelligence (AI) and its transformative potential across various sectors. This naturally leads many investors to explore opportunities in this rapidly evolving field. One company attracting attention is BigBear.ai, a leading provider of AI-powered data analytics and solutions for both government and commercial clients. This article aims to provide you with insightful information to help you determine if BigBear.ai stock is a suitable addition to your investment portfolio. We'll delve into the company's business model, financial performance, associated risks, and compare it to alternative investments.

H2: Understanding BigBear.ai's Business Model and Market Position

BigBear.ai's core business revolves around providing advanced data analytics and AI-powered solutions to solve complex challenges. Their offerings cater to two primary target markets: the government sector (national security, defense, intelligence) and the commercial sector (various industries requiring data-driven insights). They leverage cutting-edge technologies like machine learning and artificial intelligence to deliver solutions tailored to specific client needs.

- Key products and services: BigBear.ai offers a range of products and services including predictive analytics, AI-driven decision support systems, and cybersecurity solutions.

- Target customer segments: Their customer base includes government agencies, defense contractors, and commercial organizations across various sectors like finance, healthcare, and energy.

- Competitive advantages: BigBear.ai possesses several competitive advantages, including its strong presence in the government sector secured through significant contracts, its proprietary AI algorithms, and its team of highly skilled data scientists and engineers. However, disadvantages could include competition from larger, more established tech companies.

- Market share analysis: While precise market share data for BigBear.ai can be difficult to obtain, their strong presence in specific government and commercial niches suggests a considerable market influence within their specialized areas.

H2: Analyzing BigBear.ai's Financial Performance and Growth Prospects

Analyzing BigBear.ai's financial health requires a careful review of their financial statements. Investors should examine their revenue growth trajectory, profitability margins, debt levels, and cash flow to understand the company's financial stability. Past stock performance, accessible through financial charting websites, provides valuable historical context (Disclaimer: Past performance is not indicative of future results).

- Revenue and earnings growth: Examine the company's financial reports to assess the trends in revenue and earnings growth over time. Look for consistent growth and identify any potential factors influencing these trends.

- Profitability margins: Analyze the company's gross and net profit margins to gauge its efficiency and pricing strategies. Healthy margins suggest profitability and sustainable growth.

- Debt-to-equity ratio: This crucial ratio indicates the company's financial leverage and risk. A high ratio suggests higher financial risk.

- Future growth projections and estimations: Industry analysis, new product development announcements, and expansion plans provide clues about the company's future growth potential. However, these are projections and may not materialize.

H2: Evaluating the Risks Associated with Investing in BigBear.ai Stock

Investing in BigBear.ai stock, like any investment, involves several inherent risks. Understanding and acknowledging these risks is crucial for informed decision-making.

- Market risk: The overall market's performance significantly impacts BigBear.ai's stock price. Economic downturns or sector-specific corrections can lead to price volatility.

- Competition risk: The AI and data analytics sector is competitive. New entrants and existing players could pose a threat to BigBear.ai's market share.

- Regulatory risk: Changes in government regulations related to data privacy, cybersecurity, or national security could impact BigBear.ai's operations and profitability.

- Technological risk: Rapid technological advancements in AI could render some of BigBear.ai's technologies obsolete, necessitating continuous innovation and investment.

- Financial risk: The company's financial health, including its debt levels and cash flow, presents a risk to investors. Financial instability can negatively impact the stock price.

H2: Considering Alternative Investments

Before investing in BigBear.ai stock, it's prudent to compare it to other investment options within the AI and data analytics sector. Several publicly traded companies offer similar products and services. A comparative analysis of their risk profiles, growth prospects, and valuations is essential. This requires careful evaluation of factors such as market capitalization, price-to-earnings ratio (P/E), and revenue growth rates.

- Competitor stock comparisons: Analyze the financial performance and market position of BigBear.ai's competitors to identify potential alternatives.

- Alternative investment strategies: Consider diversifying your portfolio to mitigate risk. Investing in other asset classes, like bonds or real estate, can reduce your dependence on individual stocks.

- Risk tolerance assessment: Determine your own risk tolerance before investing in any stock. BigBear.ai, being a growth stock in a rapidly changing sector, carries inherent risks.

Conclusion: Should You Buy BigBear.ai Stock? A Final Verdict

Deciding whether to invest in BigBear.ai stock requires careful consideration of its business model, financial performance, growth potential, and inherent risks. While the company operates in a high-growth sector with significant potential, the competitive landscape and inherent market volatility necessitate thorough due diligence. This analysis highlights the importance of considering various factors, from competitive advantages to financial stability and regulatory risks. Remember that any investment decision should be aligned with your individual risk tolerance and overall investment strategy. Before investing in BigBear.ai stock, remember to conduct thorough research and consult with a financial advisor. Understanding BigBear.ai investment opportunities requires a comprehensive BigBear.ai stock analysis and close monitoring of the BigBear.ai stock price. Ultimately, the decision to buy BigBear.ai stock rests solely on your individual assessment and investment goals.

Featured Posts

-

Bauprojekt Update Architektin Legt Endgueltige Form Fest

May 20, 2025

Bauprojekt Update Architektin Legt Endgueltige Form Fest

May 20, 2025 -

Smrt Andelke Milivojevic Tadic Tugovanje Milice Milse I Oprostaj Od Voljene Koleginice

May 20, 2025

Smrt Andelke Milivojevic Tadic Tugovanje Milice Milse I Oprostaj Od Voljene Koleginice

May 20, 2025 -

Meurtre D Aramburu La Traque Des Suspects D Extreme Droite Continue

May 20, 2025

Meurtre D Aramburu La Traque Des Suspects D Extreme Droite Continue

May 20, 2025 -

Nyt Mini Crossword Puzzle Answers March 22

May 20, 2025

Nyt Mini Crossword Puzzle Answers March 22

May 20, 2025 -

Sofrep Evening Brief Israel Yemen Missile Intercept Russia Bans Amnesty International

May 20, 2025

Sofrep Evening Brief Israel Yemen Missile Intercept Russia Bans Amnesty International

May 20, 2025

Latest Posts

-

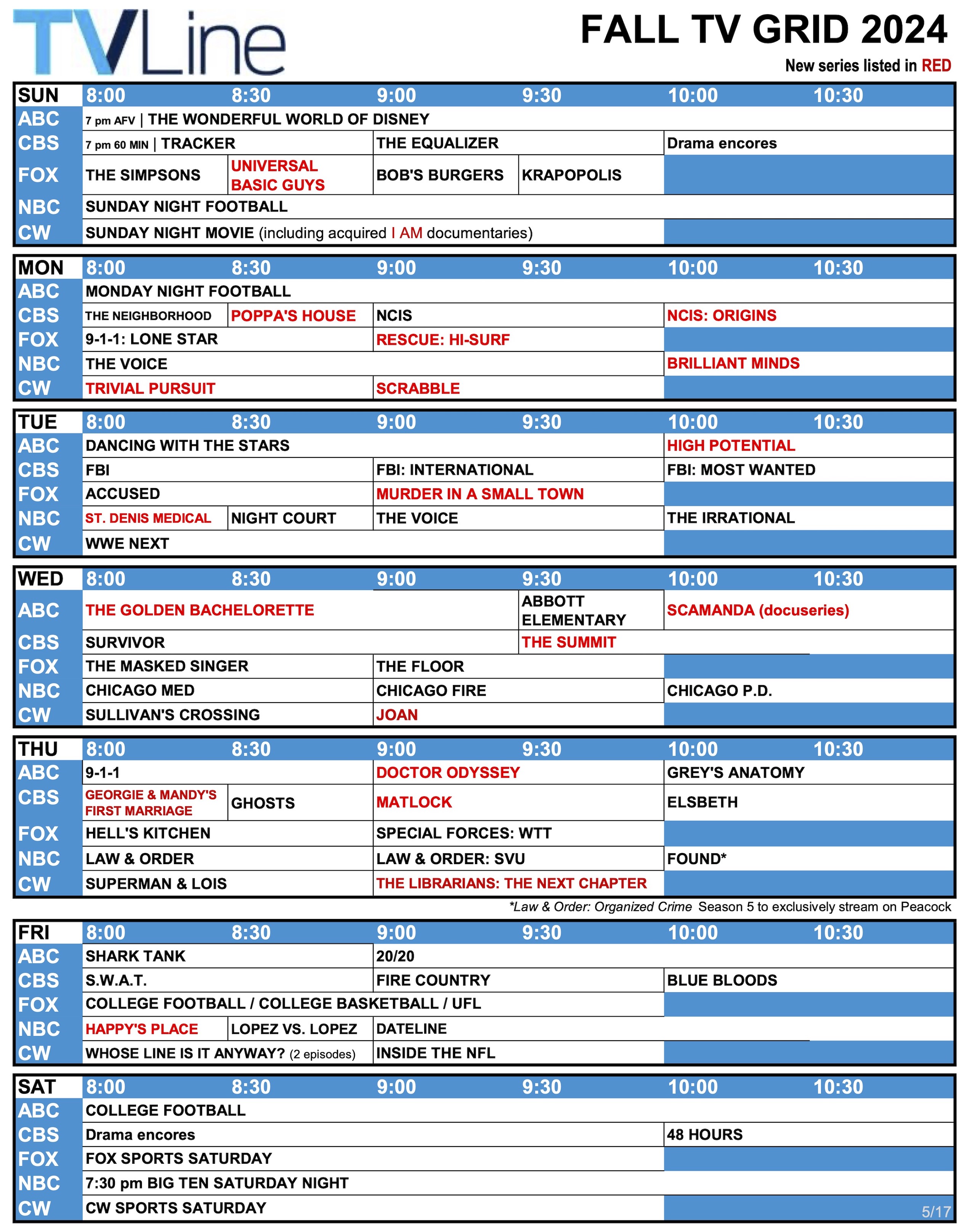

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025 -

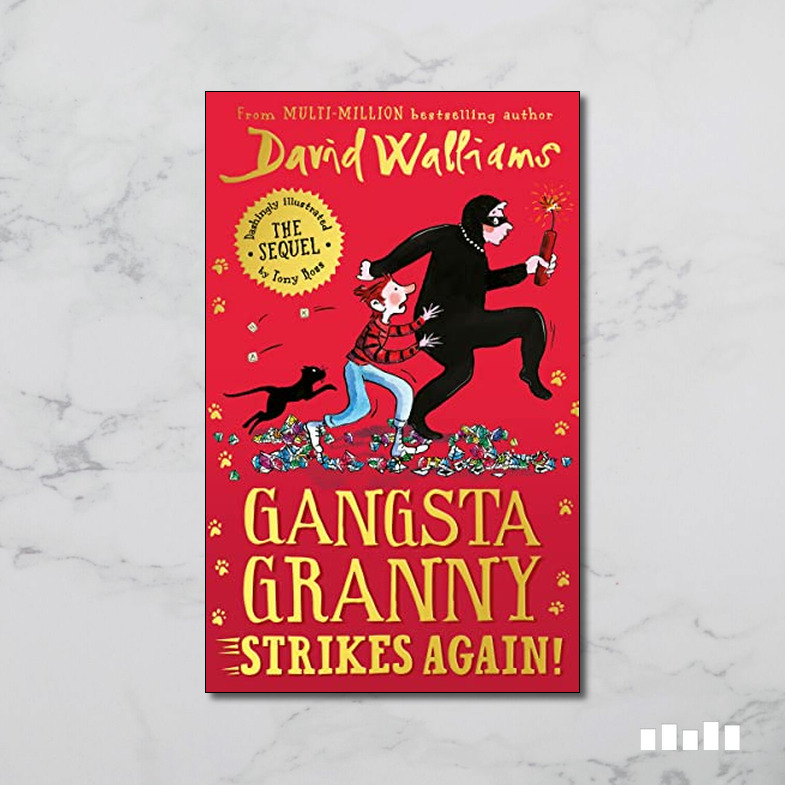

The Enduring Appeal Of Gangsta Granny

May 20, 2025

The Enduring Appeal Of Gangsta Granny

May 20, 2025 -

Your Guide To Sandylands U Tv Show Listings

May 20, 2025

Your Guide To Sandylands U Tv Show Listings

May 20, 2025 -

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025 -

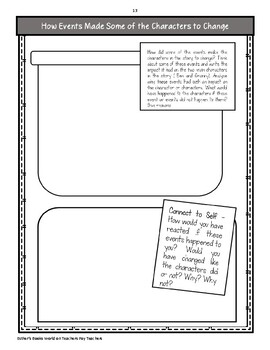

Gangsta Granny Activities And Resources For Kids

May 20, 2025

Gangsta Granny Activities And Resources For Kids

May 20, 2025